Score

RaiseFX

South Africa|2-5 years|

South Africa|2-5 years| https://raisefx.com

Website

Rating Index

MT4/5 Identification

MT4/5 Identification

Full License

United States

United StatesContact

Licenses

Single Core

1G

40G

Disclosure

More

Danger

Warning

Contact number

+44 20 45 79 80 75

Other ways of contact

Broker Information

More

Raise Global SA (Pty) Ltd

RaiseFX

South Africa

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- This broker exceeds the business scope regulated by South Africa FSCA(license number: 50506)National Futures Association-UNFX Non-Forex License. Please be aware of the risk!

- The South AfricaFSCA regulation (license number: 50455) claimed by this broker is suspected to be clone. Please be aware of the risk!

WikiFX Verification

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed RaiseFX also viewed..

XM

GTC

MultiBank Group

Ec Markets

RaiseFX · Company Summary

| Aspect | Information |

| Registered Country/Area | Kazakhstanan |

| Founded Year | 2017 |

| Company Name | RaiseFX |

| Regulation | No Regulation |

| Minimum Deposit | €/$/£ 200 |

| Maximum Leverage | 1:400 |

| Spreads | From 0.0 pips |

| Trading Platforms | MetaTrader 5 |

| Tradable Assets | Forex, commodities, indices, shares, cryptocurrencies |

| Account Types | Standard, MAM |

| Demo Account | Available |

| Islamic Account | Available |

| Customer Support | Phone, email, live chat |

| Deposit Methods | Bank transfer, credit/debit cards, e-wallets, cryptocurrencies |

| Withdrawal Methods | Bank transfer, credit/debit cards, e-wallets, cryptocurrencies |

| Swaps | Fixed swaps, no interest rates, Islamic swap available |

General Information

RaiseFX, operated by RaiseGroup LLP in Kazakhstan and licensed by the Financial Supervision Committee, offers over 400 financial instruments across various asset classes including forex, indices, cryptocurrencies, commodities, and share CFDs. The broker provides accounts with leverage ranging from 1:20 to 1:400 and features variable spreads starting at 0.0 pips. Payments can be made through Visa, MasterCard, and wire transfers with no commission fees, and the minimum required deposit is €200.

The platform supports MetaTrader5 for both desktop and mobile, offering access to over 10,000 trading apps. Customer support is available on weekdays via phone and email. Notably, RaiseFX does not serve residents of the EU, US, Singapore, Australia, and other regions where its services would contravene local laws.

Pros and Cons

Furthermore, it is important to examine the pros and cons of RaiseFX. On the positive side, RaiseFX provides a wide range of trading instruments and offers flexible leverage options. Additionally, the availability of MetaTrader 4 enhances the trading experience. RaiseFX also stands out by not charging any deposit or withdrawal fees and by offering competitive spreads starting from 0.0 pips. However, it is worth noting that RaiseFX is registered in Kazakhstan, which entails limited regulatory oversight. Moreover, there is no available information on the minimum deposit requirement. Additionally, there is limited transparency regarding trading conditions and fees. It is also important to highlight that RaiseFX is not regulated in major financial jurisdictions. While customer support is available during weekdays, RaiseFX provides limited educational resources and research tools.

| Pros | Cons |

| Wide range of trading instruments | Registered in Kazakhstan with limited regulatory oversight |

| Flexible leverage options | No information on minimum deposit requirement |

| Availability of MetaTrader 4 | Limited information on trading conditions and fees |

| No deposit or withdrawal fees | Not regulated in major financial jurisdictions |

| Competitive spreads starting from 0.0 pips | Limited educational resources and research tools |

| Customer support available during weekdays |

Is RaiseFX Legit or a Scam?

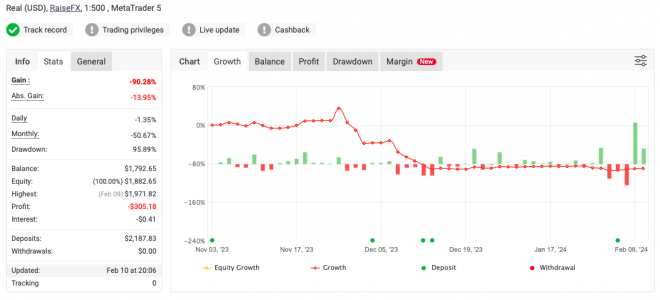

RaiseFX is not regulated and does not hold any licenses from reputable financial authorities. RaiseFX has been flagged as a suspicious clone by the financial authorities. This means that there is a high likelihood of fraudulent activities associated with the company.

It is also significant to note that RaiseFX was also be licensed as exceeded by FSCA.

Market Instruments

RaiseFX offers a variety of market instruments for traders to trade over 500 different assets across five different classes of assets, including Forex, Indices, Crypto, Commodities, and Stocks.

Forex: RaiseFX provides traders with access to over 60 currency pairs to trade on the largest financial market with a leverage of up to 1:500, allowing traders to optimize their potential with some of the tightest spreads in the industry.

Indices: Traders can explore Indices CFDs with RaiseFX and trade on the world's most liquid exchange, including popular indices such as Dow Jones, S&P, Nasdaq, DAX, and CAC. With fast execution speeds, traders can take advantage of rising or falling prices and position themselves from $0.10 per point with micro-lots.

Crypto: Trading Crypto CFDs with RaiseFX provides traders with the opportunity to trade a large amount of cryptocurrencies without any crypto wallet, with a leverage of up to 1:33, the highest in the industry. The market is available for trading 24/7, and traders can take advantage of rising or falling prices.

Commodities: Traders can trade precious metals and commodities with a leverage of up to 1:500, including gold, silver, and other commodities. Precious metals are considered safe havens in the investor's mind, and commodities are considered a good risk hedge against inflation.

Stocks CFDs: Traders can trade Stocks CFDs in both ways with a leverage of up to 1:10 and profit from the rise or fall of top companies around the world, including Netflix, Amazon, Google, and Apple.

Overall, RaiseFX offers traders a wide range of market instruments to trade with professional trading conditions, high liquidity, and no commissions on any trading account opened with them.

Account Types

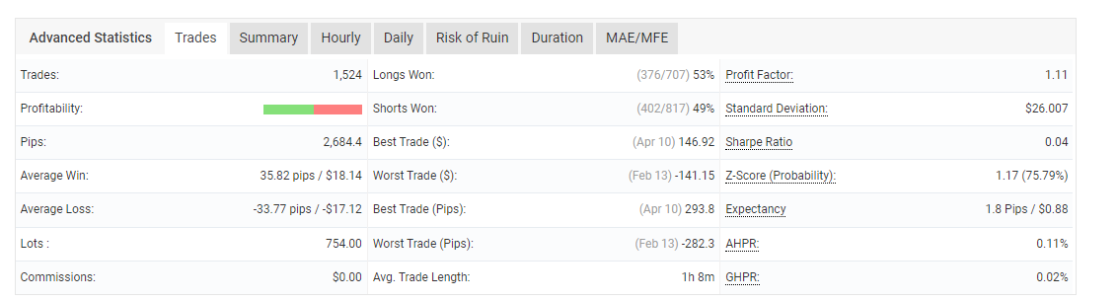

RaiseFX offers two types of accounts: Real accounts and MAM accounts. eal Accounts: Real accounts are individual trading accounts designed for traders who want to trade on their own. RaiseFX offers real accounts with various features and benefits, including variable spreads, leverage of up to 1:500, hedging and scalping allowed, access to a wide range of trading instruments, and 24/5 customer support.

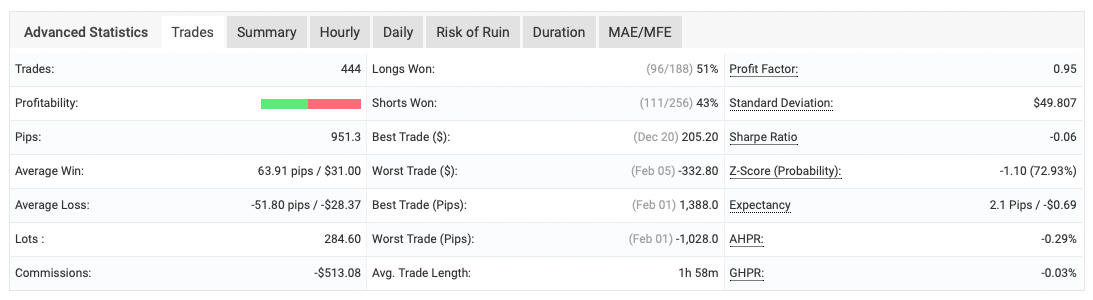

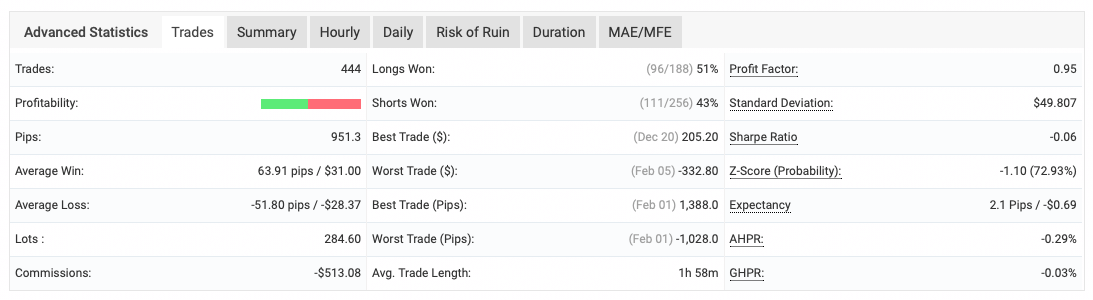

MAM Accounts: MAM accounts (Multi-Account Manager) are designed for professional traders who manage multiple trading accounts at once. MAM accounts allow traders to manage multiple accounts with a single master account. This is particularly useful for traders who manage funds on behalf of clients or who trade with multiple strategies simultaneously. RaiseFX offers MAM accounts with flexible allocation methods, including lot size, percentage, and equity.

Leverage

RaiseFX offers leverage for trading in various financial instruments such as Forex, Indices, Crypto, Commodities, and CFD Shares. The maximum leverage that can be offered by RaiseFX is 1:500 for approved accounts. However, the default leverage for RaiseFX accounts is 1:100. The leverage varies depending on the type of financial instrument being traded. For Forex, the maximum leverage offered is 1:500, for Indices it is 1:200, for Crypto it is 1:33, for Commodities it ranges from 1:20 to 1:500, and for CFD Shares it is 1:10.

It's important to note that while leverage can increase potential profits, it can also amplify losses. Traders should use leverage with caution and ensure they have a proper risk management strategy in place.

Spreads & Commissions

RaiseFX advertises tight spreads and no commissions on trading accounts, highlighting spreads as low as 0.0 pips and specific rates for major currency pairs like EUR/USD at 0.5 pips. Despite claiming no commissions on trades, they do charge a fixed commission per lot on certain accounts, such as €2.5 in EUR or $3 in USD, applied to both opening and closing trades. This means the total commission for a complete transaction is double the per-lot rate.

While offering competitive conditions with potentially lower spreads on commission-based accounts, traders must also consider other costs like rollover fees and swap rates which vary by instrument. Additionally, RaiseFX provides a range of trading instruments, each with different cost structures, making it crucial for traders to assess all fees and choose options that align with their strategies to optimize overall trading costs.

Swaps

RaiseFX offers a distinctive swap policy that aligns with the needs of traders from various faiths or beliefs, ensuring compliance without the influence of interest rates. This approach addresses the requirements of Islamic finance by providing “Islamic Swaps” which are free from any hidden commissions and are among the lowest in the industry.

The swap charges at RaiseFX are transparent and straightforward, allowing traders to easily calculate their swap costs. The swaps for each asset are fixed and clearly displayed in a table format, making it simple for traders to understand the costs associated with holding positions overnight. For example:

EUR/USD: 10 EUR per lot

GBP/USD: 6 GBP per lot

USD/JPY: 8 USD per lot

Bitcoin: 10.65755 points per lot

Ethereum: 0.7825 points per lot

Gold: 18 USD per lot

Oil WTI: 50 USD per lot

Dow Jones 30: 5 USD per lot

Nasdaq 100: 5 USD per lot

Trading Platform Available

Platforms available for trading at RaiseFX are the MT4 Desktop version and Mobile & Tablet App. In any case, we recommend using MT4 or MT5 for your trading platform. Forex traders praise MetaTrader's stability and trustworthiness as the most popular forex trading platform. Expert Advisors, Algo trading, Complex indicators, and Strategy testers are some of the sophisticated trading tools available on this platform. There are currently 10,000+ trading apps available on the Metatrader marketplace that traders can use to improve their performance. By using the right mobile terminals, including iOS and Android devices, you can trade from anywhere and at any time through MT4 and MT5.

Deposit & Withdrawal

RaiseFX offers a variety of payment methods to accommodate different preferences and needs, ensuring efficient and secure transactions for its clients:

Credit Cards (VISA and MasterCard):

Transaction Time: Instant

Supported Currencies: EUR, USD, AUD, GBP, JPY, SGD, NZD, CAD

These widely accepted credit cards provide a quick and easy way for traders to fund their accounts.

Wire Transfer:

Transaction Time: 2-3 business days

Supported Currencies: EUR, USD, AUD, GBP, JPY, SGD, NZD, CAD

Ideal for larger transfers, wire transfers are secure though they take longer to process compared to instant payment methods.

Cryptocurrencies (Bitcoin, Ethereum, Tether):

Transaction Time: Instant

Supports transactions in over 80 cryptocurrencies.

This method offers an instant and secure way to deposit funds using digital currencies.

Apple Pay and Google Pay (G Pay):

Transaction Time: Instant

Supported Currencies: EUR, USD, AUD, GBP, JPY, SGD, NZD, CAD

These mobile payment technologies provide a fast and secure way to make payments directly from smartphones.

OZOW and SwiffyEft:

Transaction Time: Instant

Supported Currencies: EUR, USD, GBP, JPY, SGD, NZD, CAD, ZAR

These are instant electronic funds transfer services that facilitate quick online payments directly from bank accounts.

Withdrawing funds from your RaiseFX trading account is a straightforward process that can be completed in just three steps, whether you choose to withdraw in fiat currencies or cryptocurrencies:

Initiate Withdrawal: Start by requesting a withdrawal from your trader room on the RaiseFX platform.

Confirmation Email: Within the next 24 hours, you will receive a confirmation email acknowledging your withdrawal request.

Receive Funds: After the confirmation, your funds will be transferred to your designated bank account within 2-3 business days.

Customer Support

RaiseFXs customer support can be reached from Monday to Friday from 9:00 a.m. to 7:00 p.m. (GMT+1) by telephone: +442045798075, email: support@raisefx.com. Company address: Timiryazev street, building 71, office 17, Almaty, 050060, Republic of Kazakhstan.

Conclusion

RaiseFX offers customer support through multiple channels, including telephone and email. The customer support team can be reached from Monday to Friday, between 9:00 a.m. to 7:00 p.m. (GMT+1). Their telephone number is +442045798075, and their email address is support@raisefx.com.

In addition to these channels, RaiseFX also provides a physical address for their company in Kazakhstan. This suggests a level of transparency and accountability that customers may appreciate. However, it is unclear from the information provided whether RaiseFX offers additional customer support options, such as live chat or a help center on their website.

FAQs

What types of accounts are available on RaiseFX?

RaiseFX offers three types of accounts: Standard, Gold, and Platinum. Each account type comes with its own set of features and benefits.

What is the minimum deposit required to open an account on RaiseFX?

The minimum deposit required to open an account on RaiseFX is €200.

What are the trading hours on RaiseFX?

The trading hours on RaiseFX depend on the financial instrument you are trading. For example, the forex market is open 24 hours a day, five days a week, while the stock market is only open during regular business hours.

What are the deposit and withdrawal methods available on RaiseFX?

RaiseFX offers a variety of deposit and withdrawal methods, including bank wire transfer, credit/debit cards, and e-wallets like Skrill and Neteller.

Review 14

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now