Company Summary

| Company Name | Capital One FX |

| Registered In | Japan |

| Regulation Status | Unauthorized by NFA |

| Years of Establishment | Within 1 year |

| Trading Instruments | Forex, CFDs |

| Account Types | Various |

| Maximum Leverage | Up to 1:200 (Account-dependent) |

| Minimum Spread | Starts from 1.5 pips |

| Trading Platform | iOS, Android, Mac |

| Customer Service | 24/5 support |

Overview of Capital One FX

Capital One FX, a relatively new player in the trading arena, operates from Japan and is currently marked as “Unauthorized” by the US financial regulator NFA. Established within the past year, the platform offers trading opportunities in Forex and potentially CFDs, with various account types catering to diverse trading preferences.

Depending on the chosen account, traders can access leverage of up to 1:200, while spreads start from 1.5 pips. The user-friendly trading platform is compatible with iOS, Android, and Mac devices, ensuring accessibility. Capital One FX also provides 24/5 customer support, bolstering assistance for traders navigating the forex markets. However, the unauthorized status raises concerns about regulatory compliance, making independent due diligence essential for potential users.

Is Capital One FX legit or a scam?

Capital One FX's connection to Capital One Financial Corp., a renowned financial entity, would typically provide an aura of trustworthiness.

However, it is currently important to highlight that this broker's regulatory status is labeled as unauthorized by the US financial regulator, the NFA (license number: 0557316). This essentially means that they do not have the official nod for some of their operations. While affiliations exist with notable financial entities, traders should proceed with caution. It's paramount for potential users to perform independent scrutiny and due diligence before associating with the platform.

Pros and Cons

| Pros | Cons |

| Affiliated with Capital One Financial Corp | Lack of valid regulatory approval |

| Comprehensive trading solutions | Potential risk with unauthorized status |

| Strong focus on the Asia-Pacific market | Transparency concerns |

Pros:

Affiliated with Capital One Financial Corp: Capital One FX's association with Capital One Financial Corp, a well-established financial institution, can instill trust in potential traders.

Comprehensive Trading Solutions: The platform offers a wide range of trading solutions tailored to accommodate the diverse needs of traders, from beginners to experienced professionals.

Strong Focus on the Asia-Pacific Market: With a concentration on the Asia-Pacific region, Capital One FX aims to cater to the unique demands and opportunities in this geographical area.

Cons:

Lack of Valid Regulatory Approval: The absence of valid regulatory approval, especially from the US financial regulator NFA, raises concerns about the legitimacy and compliance of Capital One FX's operations.

Potential Risk with Unauthorized Status: Operating without proper authorization can pose a risk to traders, as it may indicate a lack of oversight and accountability.

Transparency Concerns: The regulatory status of being unauthorized can lead to concerns regarding the transparency of Capital One FX's operations and its commitment to adhering to industry standards.

Market Instruments

Capital One FX provides an array of market instruments to cater to diverse traders' preferences. In the forex domain, they offer all major currency pairs like EUR/USD, GBP/USD, and USD/JPY, along with several minor and exotic pairs. Given their Asia-Pacific centric focus, they emphasize pairs linked to this geographical region. Beyond forex, they might offer a selection of CFDs related to commodities, stocks, and indices, although the exact range would need a deeper dive into their offerings. Traders seeking diverse portfolios would be interested in the range provided, but it's pivotal to be aware of the platform's current regulatory challenges.

Account Types

Capital One FX caters to a variety of traders, offering different account types based on trading habits, risk appetite, and investment capital. Each account type provides distinct features to accommodate specific needs:

| Account Type | Minimum Deposit | Leverage | Spreads | Features |

| Basic | $100 | 1:50 | 1.5 pips | Basic tools, suited for beginners |

| Silver | $1,000 | 1:100 | 1.0 pips | Advanced analysis tools |

| Gold | $5,000 | 1:150 | 0.7 pips | VIP webinars, personal manager |

| Platinum | $10,000 | 1:200 | 0.5 pips | Exclusive access to events |

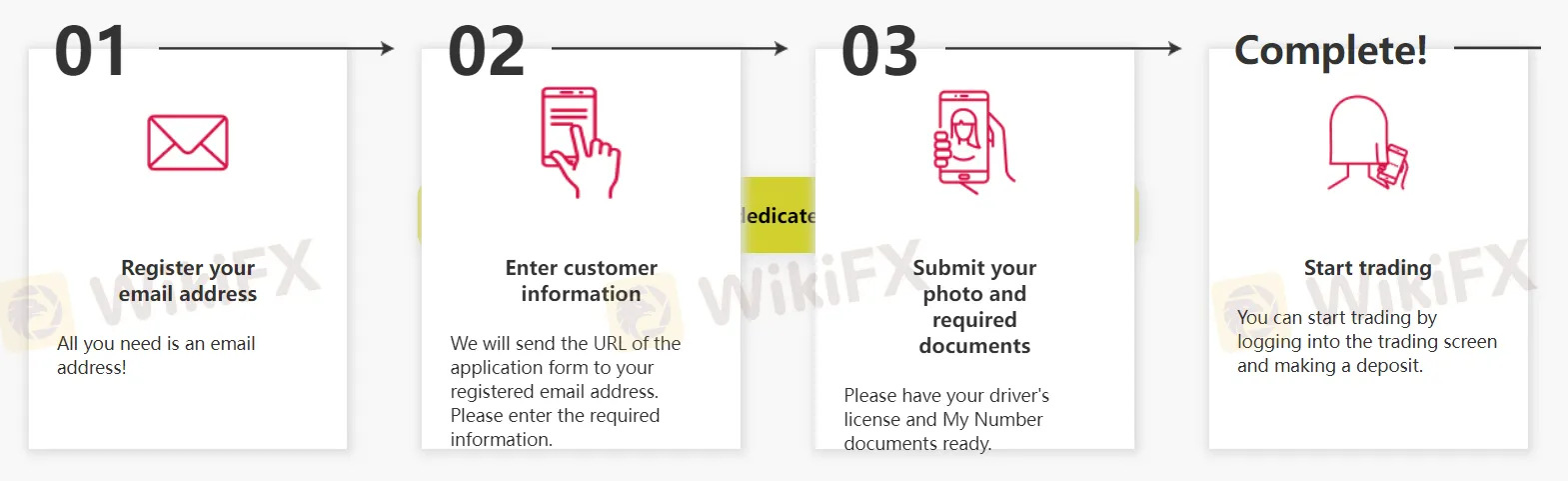

How to Open an Account?

Capital One FX offers a streamlined process for opening an account, allowing traders to get started in as little as 1 hour when using “Smartphone Identity Authentication.” Here's a step-by-step guide on how to open an account:

Step 1: Register Your Email AddressBegin by visiting Capital One FX's official website. On the homepage or designated registration page, you'll be prompted to register your email address. This is a straightforward process that requires you to provide a valid email address. Ensure that the email address you use is accessible to you as you'll receive important account-related information and updates through it.

Step 2: Enter Customer InformationOnce you've registered your email address, Capital One FX will send you a URL link to the application form. Access your email and click on the provided link. This will take you to the application form where you'll need to enter the required customer information. The information typically includes your personal details such as name, address, date of birth, and contact information. It's essential to provide accurate and up-to-date information to complete this step successfully.

Step 3: Submit Your Photo and Required DocumentsAfter completing the customer information section, the next step is to submit your photo and the necessary identification documents. You'll likely be asked to provide a clear copy of your driver's license and My Number documents. Ensure that these documents are readily available and comply with the platform's requirements. High-quality, legible copies are typically preferred.

Complete! Start TradingOnce you've submitted all the required information and documents, Capital One FX will review your application. If everything is in order and your application is approved, you'll receive confirmation. At this point, you can proceed to start trading. You'll gain access to the trading platform by logging in with the provided credentials. Additionally, you'll need to make an initial deposit into your trading account to fund your trading activities.

Leverage

Leverage in forex trading refers to borrowing funds to amplify trading positions. Capital One FX offers different leverage levels based on the account type. For instance, the basic account might provide 1:50, while platinum traders can access up to 1:200. Leverage can enhance profits but also magnifies potential losses. Hence, it's vital for traders to understand its implications and employ it judiciously.

Spreads & Commissions

Spreads are the differences between the buying and selling prices of currency pairs. Capital One FX's spread starts from 1.5 pips for basic accounts, narrowing down with advanced account types. In terms of commissions, a deeper insight into the broker's policy would be required. Often, brokers might not charge direct commissions but earn through the spread or other platform-related fees.

Trading Platform

Capital One FX offers a feature-rich and user-friendly trading platform, catering to traders' needs and preferences. This award-winning platform has earned popularity among customers for its intuitive interface and automation capabilities. It has evolved into an international community and continues to innovate through advanced technology. The platform is compatible with iOS, Android, and Mac, ensuring accessibility for traders across various devices.

The Android version, in particular, stands out with its impressive trading speed and customizability, featuring one-touch trading, customizable screen layouts, access to historical data, advanced drawing tools, and a wide range of indicators for comprehensive account management and market analysis. With an offline mode for price and chart viewing, this platform offers convenience and versatility to traders, making it a valuable tool for both beginners and experienced investors, ultimately enhancing their trading experience.

Deposit & Withdrawal

Depositing and withdrawing funds is a crucial aspect for traders. Capital One FX, similar to other online brokers, would most likely provide a variety of methods to ensure that clients can efficiently manage their funds. Traditional bank transfers, credit/debit card transactions, and e-wallet solutions like PayPal, Skrill, and Neteller might be among the offerings. When selecting a broker, it's essential to gauge the speed and reliability of their transactions. While instant deposits are a common feature, withdrawal timelines can vary based on the chosen method.

Additionally, traders should be cognizant of any associated fees with transactions. Some brokers might offer free deposits but charge for withdrawals. It's equally important to determine the broker's transparency concerning any hidden costs. With the regulatory concerns surrounding Capital One FX, potential clients should proceed with caution, ensuring their funds can be withdrawn with ease and without unforeseen complications.

Customer Support

Customer support often sets the tone for a trader's overall experience with a brokerage. Capital One FX offers support team available 24/5, given the nature of forex markets. Multiple channels, such as live chat, email, and direct phone lines: 0368-233-486, provideded to address varied client needs. A broker's support efficacy isn't just about solving issues but also about proactive communication. Updates about system maintenance, market anomalies, or platform enhancements should be communicated timely. With the backdrop of regulatory concerns, one would expect Capital One FX's support to be even more agile, addressing queries and assuaging any client apprehensions effectively.

Educational Resources

Educational content plays a significant role, especially for beginner traders. Capital One FX offers an array of resources, ranging from basic forex tutorials to advanced strategies. Webinars, eBooks, video tutorials, and periodic market analyses can be valuable tools. Brokers invested in the long-term success of their clients often emphasize education, understanding that an informed trader is a successful one.

Conclusion

While Capital One FX offers a suite of trading instruments and features, the regulatory concerns cast a significant shadow over its services. It's crucial for traders, especially novices, to be wary of platforms with questionable regulatory standings. The safety of funds and the integrity of trades hinge on broker transparency and adherence to industry standards. Given the myriad of options available in the market, traders are advised to conduct in-depth research and possibly consider more reputed, regulated brokers.

FAQs

Q: Is Capital One FX a regulated broker?

A: No, Capital One FX is currently marked as “Unauthorized” by the US financial regulator NFA.

Q: What trading instruments are available on Capital One FX?

A: Capital One FX offers Forex trading and potentially CFDs, catering to a range of trading preferences.

Q: What is the maximum leverage offered by Capital One FX?

A: Depending on the chosen account type, traders can access leverage of up to 1:200 on Capital One FX.

Q: What is the minimum spread on Capital One FX?

A: Spreads on Capital One FX start from 1.5 pips.

Q: Can I use Capital One FX on my mobile device?

A: Yes, Capital One FX provides a user-friendly trading platform compatible with iOS, Android, and Mac devices.

Q: What types of accounts are available on Capital One FX?

A: Capital One FX offers various account types tailored to different trading preferences, although specific details are not provided.

Q: How can I contact customer support on Capital One FX?

A: Capital One FX offers 24/5 customer support through multiple channels, including live chat, email, and direct phone lines, ensuring assistance for traders.