Score

Phillip Securities

Japan|15-20 years|

Japan|15-20 years| https://www.phillip.co.jp/en/

Website

Rating Index

Capital Ratio

Capital Ratio

Good

Capital

Influence

B

Influence index NO.1

Japan 7.26

Japan 7.26Capital Ratio

Capital Ratio

Good

Capital

Influence

Influence

B

Influence index NO.1

Japan 7.26

Japan 7.26Surpassed 97.61% brokers

Contact

Licenses

Single Core

1G

40G

Disclosure

Warning

Contact number

+81 3-4589-3303

+81 0120-883-308

Other ways of contact

Broker Information

More

Phillip Securities Japan, Ltd.

Phillip Securities

Japan

Number of employees

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- The current information shows that this broker does not have a trading software. Please be aware!

A Visit to Phillip Securities in Japan -- Office Confirmed Existed

The investigators went to visit the dealer Phillip Securities in Tokyo, Japan as planned. The dealer’s logo can be found on the publicly displayed address, indicating that the dealer has a real business place. Unfortunately, the investigators failed to enter the company for internal visit and were only able to take pictures at the entrance of the building for confirmation, so the specific scale of

Japan

JapanA Visit to Phillip Securities in Japan -- Office Confirmed Existed

The investigators went to visit the dealer Phillip Securities in Tokyo, Japan as planned. The dealer’s logo can be found on the publicly displayed address, indicating that the dealer has a real business place. Unfortunately, the investigators failed to enter the company for internal visit and were only able to take pictures at the entrance of the building for confirmation, so the specific scale of

Japan

JapanWikiFX Verification

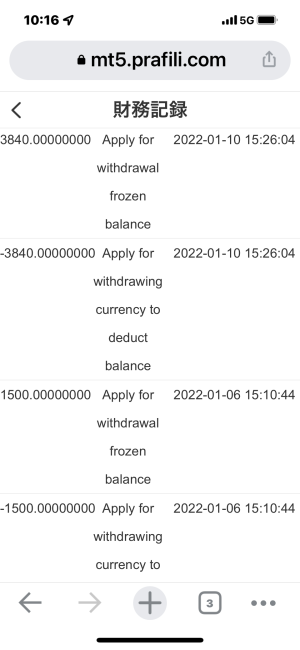

- Fundamental Item(A) $48,922,481

- Total Supplementary Items(B) $48,922,481

- Debt Amount(C) $22,224,806

- Non-Fixed Capital(A)+(B)-(C)=(D) $75,620,155

- Relative amount of risk(E) $36,046,512

- Market Risk $29,689,922

- Transaction Risk $2,674,419

- Underlying Risk $3,674,419

Capital

Higher than 92% Japanese brokers $7,365,504(USD)

- Business status announcement document

Risk Management

Average margin deposit rate

Proportion of unsold orders

Hedging Trading

- Date

- Institution

- Percentage

- Rating

Users who viewed Phillip Securities also viewed..

XM

ATFX

AUS GLOBAL

FBS

Sources

Language

Mkt. Analysis

Creatives

Phillip Securities · Company Summary

| Company Name | Phillip Securities |

| Registered Country/Area | Japan |

| Founded Year | 2002 |

| Regulation | Regulated by Financial Services Agency(FSA) |

| Minimum Deposit | 50,000 JPY |

| Maximum Leverage | 1:100 |

| Spreads | From 0.2 pips |

| Trading Platforms | POEMS, MT4 |

| Tradable Assets | Forex, CFDs, Stocks, Futures |

| Account Types | Standard, Premium, Islamic |

| Demo Account | Yes |

| Customer Support | Phone, Contact form |

| Deposit & Withdrawal | Bank Transfer, Credit/Debit Cards, Local Banks |

| Educational Resources | Trading guides, webinars, market analysis |

Overview of Phillip Securities

Phillip Securities Japan, operating under the umbrella of the Phillip Capital Group, has a rich history that dates back to 1920. The securities brokerage house became a part of the Phillip Capital Group in 2002. Over the past century, Phillip Japan has fostered enduring relationships with a myriad of financial organizations across Japan. The firm is strategically headquartered in Tokyo's historic Nihonbashi district, the birthplace of Japan's first modern bank founded by Shibusawa Eiichi, often referred to as the “father of Japanese Capitalism.” It is regulated by the Japan Financial Services Agency (FSA).

The company supports some of the most prominent proprietary trading houses and leading internet securities firms in Japan. Their clientele also comprises some of the world's largest banks and hedge funds. Their product offerings allow clients to trade on three domestic exchanges: TSE, OSE, and TOCOM. The range of services includes Electronic Trading, Margin Trading, ETF Creation and Redemption, Investment Consultation, Custodian Proxy Services, Outside Connectivity Options, Low Latency Options, and Settlement Options.

Additionally, they provide FX Brokerage and Dealing, Corporate Finance, and Investment Banking services. The firm has a global footprint, with over 5000 employees worldwide, managing assets exceeding $35B and operating in over 16 countries.

Regulatory Information

Phillip Securities Japan holds a recognized Retail Forex License. The firm is regulated in Japan and has been granted the license number 関東財務局長(金商)第127号 by the regulatory authorities. This license came into effect on September 30, 2007. It's important to note that the license type specifies “No Sharing,” ensuring exclusive rights to the license..The firm's regulatory status underscores its commitment to adhering to the financial standards and practices set by the Japanese regulatory bodies.

Pros and Cons

| Pros | Cons |

| Established Reputation | Limited Digital Presence |

| Regulated | No Promotions |

| Diverse Services | Complex Account Setup |

| Global Presence | Potential Language Barrier |

| Strong Capital Base | Limited Product Offerings |

Pros:

Established Reputation: With a history dating back to 1920 and being part of the Phillip Capital Group since 2002, Phillip Securities has a long-standing reputation in the financial industry.

Regulated: The firm is regulated by the Financial Services Agency, ensuring adherence to strict financial standards.

Diverse Services: They offer a wide range of services, including Electronic Trading, Margin Trading, ETF Creation & Redemption, and more.

Global Presence: Operating in over 16 countries, they have a significant global footprint, catering to various markets and clientele.

Strong Capital Base: Managing assets exceeding $35B indicates a robust financial position.

Cons:

Limited Digital Presence: Their website had accessibility issues, which might deter some tech-savvy traders.

No Promotions: Unlike some brokers that offer deposit bonuses or promotional rates, Phillip Securities might not have such incentives for new or existing clients.

Complex Account Setup: The process to open an account, especially for international clients, might be more cumbersome compared to other brokers that have streamlined digital onboarding processes.

Potential Language Barrier: Their primary operations being in Japan might pose a language barrier for international clients.

Limited Product Offerings: While they offer a range of services, they might not provide a comprehensive list of financial instruments or global markets compared to other global brokers.

Market Instruments

Phillip Securities Japan, a financial institution, offers a comprehensive suite of trading products tailored to meet the diverse needs of its clientele. Here's a detailed breakdown of the trading products they provide:

Trading Products Offered by Phillip Securities Japan:

Electronic Trading: Efficient electronic trade execution.

Margin Trading: Trading with borrowed funds for amplified potential.

ETF Creation & Redemption: Flexibility in managing exchange-traded funds.

FX Brokerage & Dealing: Trading services for various currency pairs.

Corporate Finance: Services related to IPOs on the Tokyo Pro Market and TOB Administration.

Investment Banking Services: Catering to financial advisory and capital raising needs.

Clients also have access to three domestic exchanges: TSE, OSE, and TOCOM. This range ensures Phillip Securities Japan's capability to serve both individual traders and institutional investors.

Account Types

Phillip Securities Japan offers three main accounts - Standard, Premium, and Islamic - with minimum deposits of 50,000 JPY. Spreads start from 0.4 pips for standard accounts. The maximum leverage offered is 1:100.

| Account Type | Minimum Deposit | Spreads From | Leverage | Products |

| Standard | 50,000 JPY | 0.4 pips | 1:30 | Forex, CFDs, Stocks, Futures, Options |

| Premium | 10,000,000 JPY | 0.2 pips | 1:100 | Forex, CFDs, Stocks, Futures, Options |

| Islamic | 50,000 JPY | 0.9 pips | 1:30 | Forex, CFDs, Stocks, Futures, Options |

How to Open an Account?

Opening an account with Phillip Securities Japan is a straightforward endeavor, designed to cater to both domestic and international clients. Here's a quick guide to get you started:

Account Opening Process for Phillip Securities Japan:

Eligibility: They welcome applications from various global jurisdictions, including places like Singapore, Hong Kong, and the United States.

Required Documents: Specific documents are essential for the process. For those registered in Japan, there's a dedicated page detailing the requirements.

Reach Out: For any clarifications or additional information, their Corporate Sales Department is readily available to assist.

By following these steps, you'll be well on your way to becoming a client of Phillip Securities Japan.

Leverage

Phillip Securities Japan provides leverage up to 1:100 on some type of account types, allowing traders to control larger positions than the capital in their accounts. For forex, the maximum leverage is 1:100. For trading CFDs and futures, 1:30 leverage is available. Equities and options trading is capped at 1:10 leverage. These adjustable leverage levels give traders flexibility in managing risk and optimizing their capital efficiency on a range of assets. Regardless of account type, all clients can benefit from the broker's high-leverage capabilities to amplify potential gains while responsibly managing their risk exposure.

| Product | Maximum Leverage |

| Forex | 1:100 |

| CFDs | 1:30 |

| Futures | 1:30 |

| Equities | 1:10 |

| Options | 1:10 |

Spreads and Commissions

Phillip Securities Japan offers competitive variable spreads starting from 0.4 pips on Standard accounts across all asset classes. Tighter spreads from 0.2 pips are available for Premium accounts with higher minimum deposits. The broker does not charge any additional commissions on forex and CFD trading.

However, there are commissions charged for equity and options trading based on account type. Commissions start from 0.1% of trade value on Standard accounts. Overall, Phillip Securities Japan provides transparent pricing with competitive spreads and caps on commissions to ensure cost-efficient trading.

| Account Type | Spreads From | Commissions |

| Standard | 0.4 pips | 0.1% trade value |

| Premium | 0.2 pips | 0.05% trade value |

More experienced traders can benefit from the lower spreads and commissions offered on Premium accounts at Phillip Securities Japan.

Trading Platform

Phillip Securities Japan provides traders with access to both POEMS, its proprietary trading platform, as well as the popular MT4 platform.

The POEMS desktop and mobile platform is comprehensive, offering robust charting capabilities, options strategy builders, and customizable trading screens to analyze and trade a wide range of products including forex, CFDs, futures, equities, and options.

For forex and CFDs specifically, Phillip Securities also integrates the MT4 platform which is an industry standard known for advanced charting, expert advisors, and backtesting functionalities optimized for currency and contract trading.

Between the two platforms, traders can enjoy technological tools tailored for different markets and trading approaches. The availability of POEMS and MT4 gives clients the flexibility to choose the right platform for their needs and trading style.

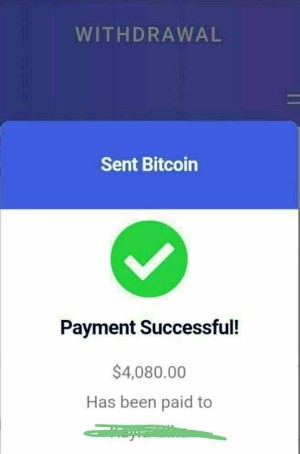

Deposit and Withdrawal

Phillip Securities Japan offers convenient deposit and withdrawal methods through Japanese banks and major credit cards. There are no fees charged for deposits or withdrawals. Deposits are credited quickly within 1 business day, while withdrawals take slightly longer at 3 business days for security reasons. The minimum amount per deposit/withdrawal is 50,000 JPY in keeping with the minimum account balance requirements.

| Deposits | Withdrawals | |

| Method | Bank Transfer Credit/Debit Cards (VISA, MasterCard, JCB) | Bank Transfer |

| Fees | No Deposit Fees | No Withdrawal Fees |

| Minimum Amount | 50,000 JPY | 50,000 JPY |

| Processing Time | 1 Business Day | 3 Business Days |

Customer Support

Phillip Securities Japan offers dedicated customer support to cater to the needs of its clients. Here's a detailed breakdown of their customer support availability:

Phone Support: +81-3-4589-3303

Contact Form: The website provides a contact form for inquiries.

Educational Resources

Phillip Securities Japan is committed to enhancing the financial knowledge of its clients and potential investors. Their Education Center serves as a testament to this commitment. The Phillip Institute of Financial Learning is a member of the Phillip Securities Group. They offer a range of educational resources, including:

Preparatory Course of Licensing Examination: This course prepares individuals for Licensing Examinations, specifically papers 1, 7, & 8, which are entry-level qualifications for the financial industry in Hong Kong.

Video Tutorials: While the specifics are not detailed, the mention of video tutorials suggests multimedia resources for learners.

Courses & Seminars: They organize various courses and seminars, with details available on their platform.

Speakers: Specific speakers or experts might be invited for their courses or seminars to provide in-depth insights.

User Experience and Additional Features

Phillip Securities Japan receives positive feedback for its stable, easy-to-use trading platforms, competitive spreads, and responsive customer service. Investors find the POEMS and MT4 platforms suitable for beginners. Some note needed improvements in the mobile apps. Phillip's knowledgeable support team stands out for quickly resolving issues. Overall, investors are satisfied with their trading experience.

Phillip Securities provides auto-trading via MT4 expert advisors, daily analysis to guide traders, contests for demo traders, and a cash rebate loyalty program. While social trading is not offered, other services include margin financing, IPO underwriting, and free educational seminars. With its technology, pricing, and added services, Phillip Securities caters to both new and experienced active traders in Japan.

Comparison with Similar Brokers

Phillip Securities Japan competes with leading Japanese brokers Rakuten and SBI Securities. All offer MT4 for trading forex and CFDs. For equities, Phillip provides POEMS while Rakuten and SBI use proprietary platforms. Phillip has tighter average spreads from 0.4 pips like SBI, compared to Rakuten's 1 pip spreads. Rakuten does not charge equity commissions, unlike Phillip and SBI. For research and tools, Phillip and Rakuten offer more resources like auto-trading, analysis, and seminars.

Overall, Phillip stands out for its combination of competitive spreads, advanced platforms and value-added trading tools.

| Broker | Average Spreads | Trading Platforms | Commissions (Equities) | Research/Tools |

| Phillip Securities | From 0.2 pips | MT4, POEMS | From 0.1% trade value | Auto-trading, Analysis, Seminars |

| Rakuten Securities | From 1 pip | MT4, Rakuten | No commissions | Limited tools and analysis |

| SBI Securities | From 0.4 pips | MT4, Proprietary | From 0.1% trade value | Basic research only |

Conclusion

Phillip Securities Japan stands as a testament to the fusion of tradition and innovation in the financial trading realm. With its roots in the esteemed Phillip Capital Group, the broker has consistently showcased a commitment to empowering traders through cutting-edge tools and platforms. Their forward-thinking approach, evident in their adoption of AI-driven insights and integration with renowned platforms like TradingView, positions them as a broker attuned to the evolving needs of the modern trader.

While their offerings might resonate more with the experienced trading community, their dedication to financial literacy ensures that traders of all levels can navigate the financial markets with confidence. In essence, Phillip Securities Japan embodies a blend of reliability, innovation, and trader-centric services.

FAQs

Q: What is margin trading?

A: Margin trading allows you to open larger positions using borrowed funds from your broker.

Q: How do I qualify for a premium account?

A: Premium accounts require a minimum deposit of 10,000,000 JPY.

Q: Does Phillip Securities offer portfolio margining?

A: Yes, portfolio margining can lower margin requirements for certain options strategies.

Q: What trading contests are available?

A: Phillip runs monthly contests for demo traders with cash prizes.

Q: Can I automate my trading strategies?

A: Yes, MT4 supports auto-trading via customizable expert advisors.

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now