Company Summary

| Aspect | Information |

| Company Name | Argosy Securities |

| Registered Country/Area | Canada |

| Founded Year | 2021 |

| Regulation | IIROC |

| Minimum Deposit | $5,000 |

| Spreads | as low as 0 pips |

| Trading Platforms | MT4 |

| Tradable Assets | Wealth management,investment products |

| Account Types | Client account |

| Demo Account | Available |

| Customer Support | Phone:+1-886-709-7066,email:info@argosynet.ca |

| Deposit & Withdrawal | Bank transfer,credit card,debit card |

Overview of Argosy Securities

Argosy Securities, established in 2021 and based in Canada, is a regulated financial services firm overseen by the IIROC. Specializing in wealth management and investment products, it offers a client account with the option of a demo account for beginners.

The company requires a minimum deposit of $5,000 and boasts competitive spreads that can be as low as 0 pips, using the MT4 trading platform.

Customer support is accessible via phone and email, and for deposit and withdrawal options, Argosy Securities accommodates bank transfers as well as credit and debit card transactions.

Is Argosy Securities Legit or a Scam?

Argosy Securities Inc. is a regulated entity under the Investment Industry Regulatory Organization of Canada (IIROC), holding a Market Making (MM) license.

Although the specific license number is not disclosed, this Canadian-based firm operates with a policy of 'No Sharing' in terms of its license type. The effective and expiry dates of the license, as well as the email address, are not provided.

Pros and Cons

Pros:

Regulated by IIROC:This ensures that Argosy Securities adheres to strict industry standards and regulations, providing a level of security and trustworthiness for clients.

Market Making License:This type of license suggests that Argosy Securities is actively involved in providing liquidity to the market, which can be beneficial for traders looking for stable and reliable trading environments.

Physical Presence in Canada:Having a physical address in Richmond Hill, Ontario, provides a tangible location for clients who prefer dealing with a company that has a local presence.

Use of MT4 Trading Platform:MT4 is widely recognized for its user-friendly interface and advanced trading features, which can be advantageous for both new and experienced traders.

Diverse Payment Options:Offering multiple methods for deposit and withdrawal, including bank transfers and credit/debit cards, makes it convenient for clients to manage their funds.

Cons:

High Minimum Deposit:A minimum deposit of $5,000 may be prohibitive for small-scale traders or those just starting out.

Limited License Information:The absence of detailed information about the license number and specific regulations could be a concern for those seeking transparency.

Lack of Information on License Validity:Without knowing the effective and expiry dates of the license, it's hard to determine the current regulatory status.

Limited Contact Information:The lack of an email address might limit options for clients who prefer digital communication.

Focused on Wealth Management:This focus might limit the options for clients interested in a broader range of trading activities or financial services.

| Pros | Cons |

| Regulated by IIROC | High Minimum Deposit |

| Market Making License | Limited License Information |

| Physical Presence in Canada | Lack of Information on License Validity |

| Use of MT4 Trading Platform | Limited Contact Information |

| Diverse Payment Options | Focused on Wealth Management |

Market Instruments

Argosy Securities offers a range of market instruments that cater to diverse investment needs and strategies, allowing clients to build and manage a well-rounded financial portfolio. Here's an overview of the market instruments they provide:

Wealth Management:

Personalized Approach: Argosy's wealth management services are tailored to individual client needs, focusing on wealth creation to enhance personal freedom and lifestyle choices. This approach might involve a variety of investment vehicles depending on the clients personal goals and circumstances.

Investment Products:

Broad Access: Clients have access to a wide array of investment products. This broad range ensures that clients can diversify their investments in line with their financial objectives, potentially including stocks, bonds, mutual funds, ETFs, and other investment vehicles.

Alternative Strategies:

Enhanced Diversification: Argosy integrates alternative investment strategies with traditional investments. This approach aims to provide less volatility and improved risk-adjusted returns, potentially involving investments in private equity, hedge funds, real estate, commodities, and other non-traditional assets.

Portfolio Construction:

Customized Portfolios: Investment portfolios at Argosy are customized based on individual investment goals, time horizons, and financial situations. This personalized portfolio construction might involve a mix of different asset classes, continuously adjusted to capture market opportunities and trends.

Investment Strategies:

Strategic Guidance: Argosy offers solid investment strategies, akin to a detailed roadmap, ensuring a successful investment journey. This might include strategic asset allocation, tactical investment moves, or specific advice on individual securities, tailored to navigate financial market complexities effectively.

Argosy Securities, thus, provides a comprehensive array of market instruments and strategies, equipping clients with the resources to explore and invest across various financial arenas, fostering an environment conducive to achieving diverse financial goals and aspirations.

Account Types

The account type offered by Argosy Securities, as per the provided information, is Client Account.This type of account is typically designed to cater to individual investor needs, offering services and features aligned with wealth management and investment products.

The client account structure usually allows for personalized investment strategies and portfolio management, reflecting the individual financial goals, risk tolerance, and time horizons of the client.

How to Open an Account?

Opening an account with Argosy Securities can be streamlined into the following four steps:

Visit the Website:

Start by navigating to the official Argosy Securities website. This will be your primary resource for information and the starting point for opening an account.

Review Account Options and Requirements:

Take time to review the details of the Client Account, including any minimum deposit requirements, fees, and services offered. Ensure that the account type aligns with your investment goals and financial situation.

Complete the Application Form:

Locate and fill out the account application form on the website. This form typically requires personal information, financial details, and investment experience. Be prepared to provide identification documents and other necessary verification as part of the compliance process.

Submit Application and Await Approval:

After completing the application, submit it for review. You may need to wait for the application to be processed and approved. During this time, the company might contact you for additional information or verification. Once approved, you will receive instructions on how to fund your account and start trading or investing.

Spreads & Commissions

Argosy Securities advertises spreads as low as 0 pips, indicating highly competitive pricing for its trading services. However, specific details about their spreads for various investment products and commissions are not provided in the available information.

Potential clients should be aware that, while the advertised spreads are attractive, actual trading costs might vary based on market conditions, the type of tradable assets, and account activity. Additionally, it is important for users to inquire about any additional fees or commissions that may apply to their trades or account management.

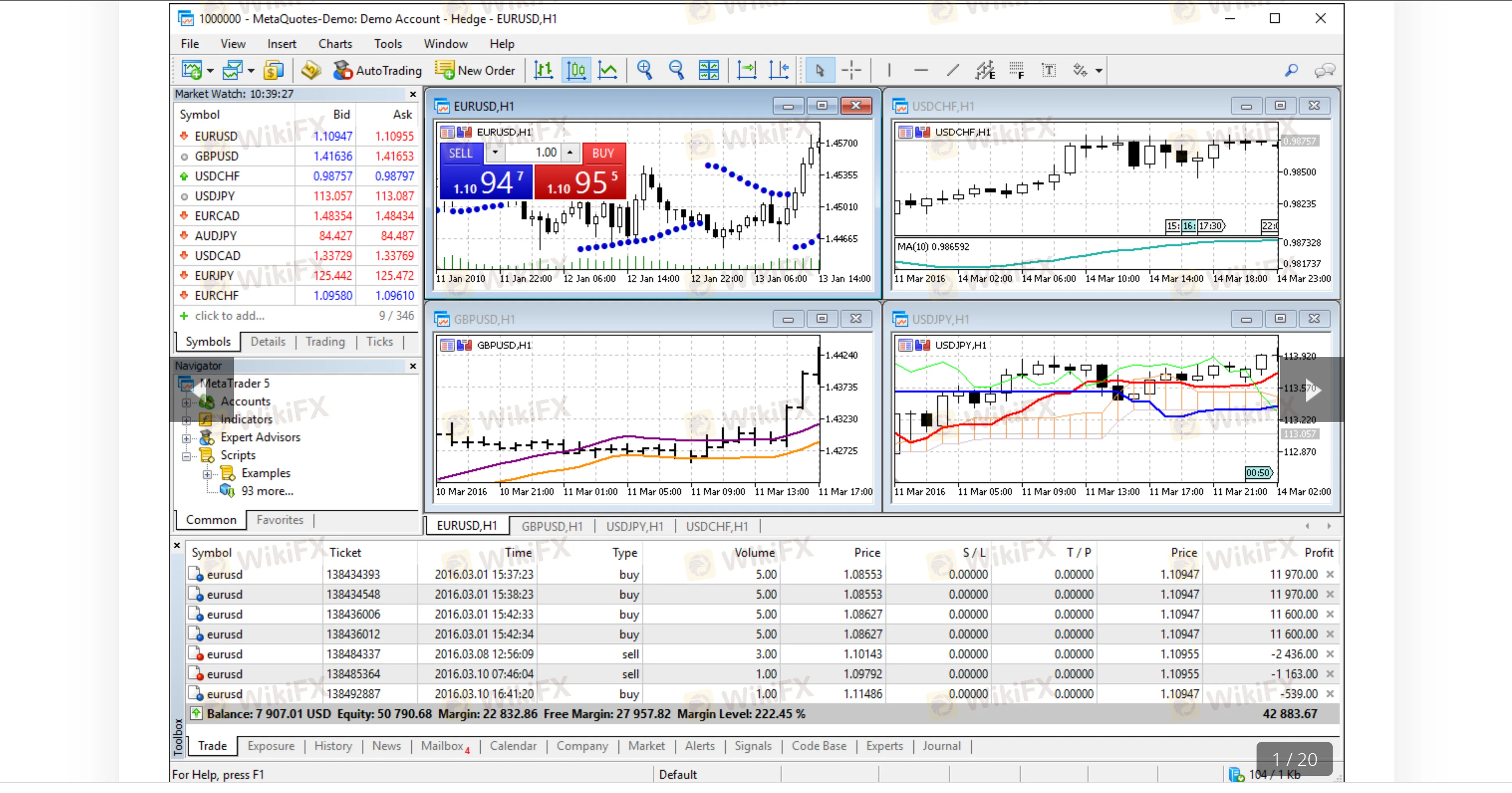

Trading Platform

Argosy Securities utilizes the MT4 (MetaTrader 4) trading platform, renowned in the industry for its user-friendly interface, advanced trading tools, and robust functionality. MT4 is favored by both novice and experienced traders for its comprehensive charting capabilities, automated trading options through Expert Advisors (EAs), and extensive back-testing environment.

The platform offers real-time access to market prices and technical analysis tools, making it a versatile choice for trading a wide range of financial instruments. Its popularity also stems from the vast community support and the plethora of custom indicators and scripts available, which can enhance the trading experience.

This choice of platform by Argosy Securities reflects their commitment to providing reliable and advanced trading technology to their clients.

Deposit & Withdrawal

Argosy Securities offers a range of options for deposit and withdrawal to accommodate their clients' needs. Clients can fund their accounts and make withdrawals using traditional bank transfers, as well as through credit and debit cards.

This variety of choices provides flexibility and convenience, catering to different preferences and banking requirements. However, it's important for clients to be aware of any potential processing times, fees, or limits associated with each method.

Bank transfers might take longer to process but are generally considered secure, while credit and debit card transactions can be faster but might incur additional fees. Clients should also check for any specific terms or conditions that Argosy Securities may have regarding minimum and maximum transaction limits, currency conversion charges, or security procedures for financial transactions.

It is advisable for clients to consult with the companys customer service or review their account agreement for detailed information on deposit and withdrawal processes.

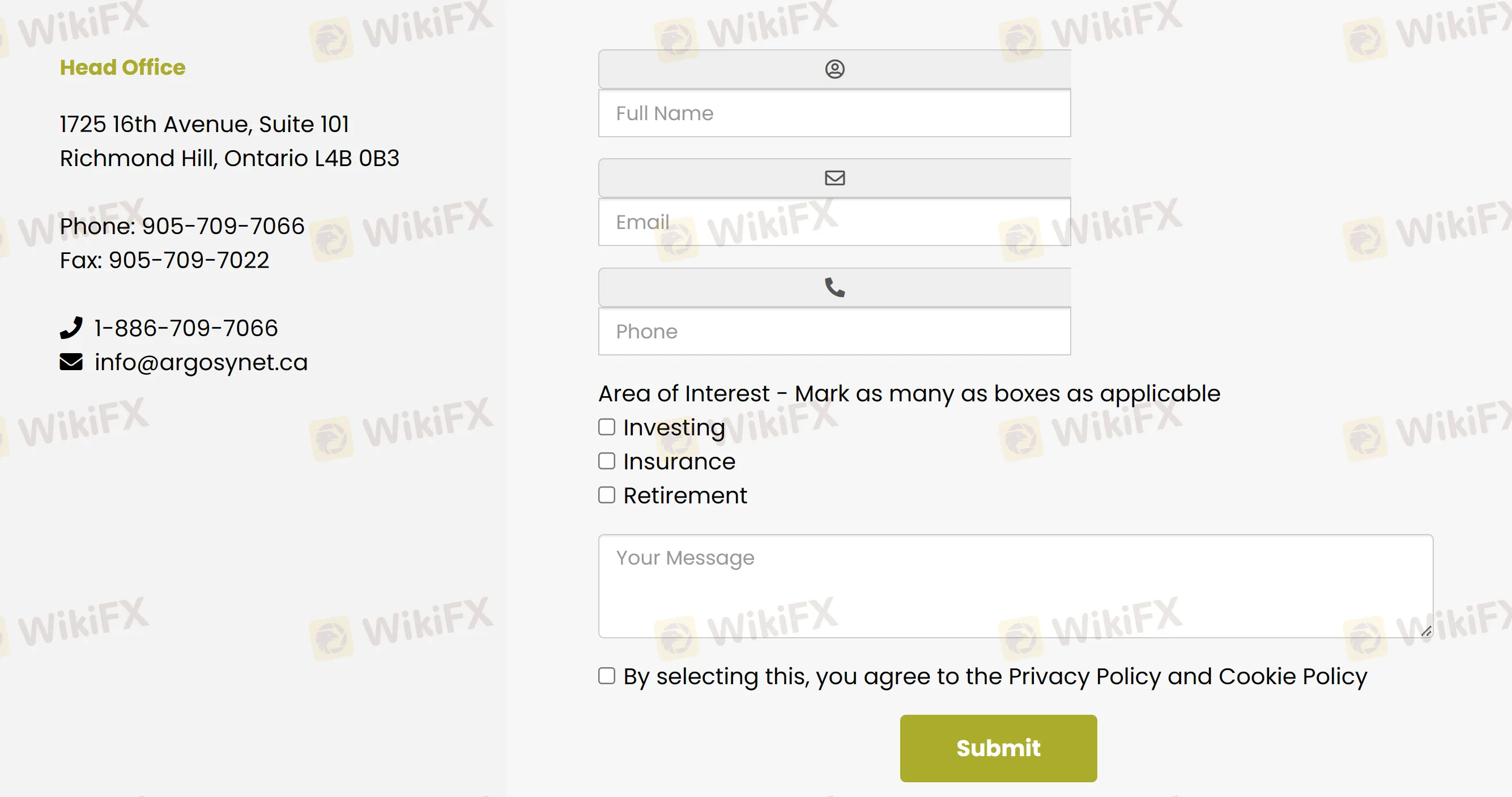

Customer Support

Argosy Securities provides comprehensive customer support to address client inquiries and concerns. Clients can reach out to their team via several channels.

For direct communication, clients can call their office at 905-709-7066 or use the toll-free number 1-886-709-7066, which is particularly useful for clients who are not in the local area.

Additionally, Argosy Securities offers support through email at info@argosynet.ca, allowing for detailed queries and the submission of necessary documents. For clients who prefer or require fax communications, they can use the fax number 905-709-7022.

The physical address of their office, located at 1725 16th Avenue, Suite 101, Richmond Hill, Ontario L4B 0B3, is also available for clients who might need to visit the office or send physical mail. This range of contact options reflects Argosy Securities commitment to accessibility and client service.

Conclusion

Argosy Securities, a Canadian firm established in 2021, offers client-focused investment experience with a range of services including wealth management and diverse investment products.

Operating with a Market Making license under IIROC, it provides the MT4 trading platform and requires a minimum deposit of $5,000.

Clients benefit from various deposit and withdrawal methods and comprehensive customer support. Argosys approach is characterized by a blend of advanced trading technology and personalized financial strategies, catering to both novice and experienced investors.

FAQs

Is Argosy Securities regulated?

Yes, Argosy Securities is regulated by the Investment Industry Regulatory Organization of Canada (IIROC) and holds a Market Making (MM) license.

What trading platform does Argosy Securities use?

Argosy Securities utilizes the MetaTrader 4 (MT4) platform, known for its user-friendly interface and comprehensive trading tools.

What is the minimum deposit required to open an account with Argosy Securities?

The minimum deposit required to open an account with Argosy Securities is $5,000.

Does Argosy Securities offer a demo account?

Yes, Argosy Securities provides the option of a demo account for clients to practice and get familiar with trading strategies before investing real money.

What types of assets can I trade with Argosy Securities?

Argosy Securities offers a variety of investment products, including options in wealth management and other investment vehicles, although specific details should be confirmed directly with the firm.

How can I contact Argosy Securities for support?

Argosy Securities can be contacted via phone at 905-709-7066 or toll-free at 1-886-709-7066. They also offer support through email at info@argosynet.ca, and have a fax number, 905-709-7022.