User Reviews

Sort by content

- Sort by content

- Sort by time

User comment

2

CommentsWrite a review

2024-01-09 18:24

2024-01-09 18:24

2023-07-13 10:28

2023-07-13 10:28

Seychelles|1-2 years|

Seychelles|1-2 years| https://princemarkets.com/#

Website

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

+41 (44)26-242115

More

Prince Markets International LTD

Prince Markets

Seychelles

Pyramid scheme complaint

Expose

| Aspect | Information |

| Registered Country/Area | Seychelles |

| Founded Year | 2023 |

| Company Name | Prince Markets |

| Regulation | Unregulated |

| Minimum Deposit | Silver: $100 Gold: $500 Platinum: $5,000 Palladium: $100 |

| Maximum Leverage | Up to 1:500 |

| Spreads | Varies by account type and market instrument |

| Trading Platforms | Proprietary Trading Platform (PTP) |

| Tradable Assets | Forex, Gold, Silver, Oil, CFDs |

| Account Types | Silver, Gold, Platinum, Palladium |

| Demo Account | Available with $10,000 virtual balance |

| Islamic Account | Available upon request |

| Customer Support | Email support for various inquiries |

| Payment Methods | Mastercard, Visa, Skrill, Neteller, Bank Transfer, Fasapay, Nganluong.vn, Dragonpay, ZOTAPAY, Paytrust88 |

| Educational Tools | Educational resources available on the website |

Prince Markets is an unregulated brokerage operating out of Seychelles since its establishment in 2023. Offering a variety of account types with minimum deposits ranging from $100 to $5,000, and leverage of up to 1:500, the broker caters to traders with different risk appetites. While they provide a proprietary trading platform, spreads vary depending on the account type and trading instrument. Traders can access Forex, Gold, Silver, Oil, and CFDs, and a demo account with a $10,000 virtual balance is available for practice. Prince Markets also accommodates Islamic accounts upon request and offers customer support through email. They accept several payment methods and provide educational resources on their website. However, it's important to note that Prince Markets operates without regulatory oversight, warranting caution and thorough research before trading with them.

Prince Markets is an unregulated broker, which means that it operates without oversight or regulation from any official financial authority. While unregulated brokers may offer certain benefits such as greater flexibility and fewer restrictions, they also come with significant risks. Investors who choose to trade with unregulated brokers are often exposed to a higher likelihood of fraudulent activities, lack of investor protection, and potential financial loss. It is crucial for individuals considering trading or investing through Prince Markets or any unregulated broker to exercise caution, conduct thorough research, and seek advice from reputable financial professionals to mitigate the associated risks and ensure the safety of their investments.

Prince Markets presents traders with a range of pros and cons to consider when evaluating the broker. While it offers diverse market instruments, competitive leverage, and multiple account types to cater to different traders, its lack of regulation raises concerns about investor protection. The absence of deposit fees is a positive aspect, but traders should be mindful of potential fees associated with payment methods. The Proprietary Trading Platform and educational resources enhance the trading experience, yet the unregulated status may deter some traders.

| Pros | Cons |

| Diverse market instruments | Unregulated broker |

| Competitive leverage | Lack of investor protection |

| Multiple account types | Potential for fraudulent activities |

| No deposit fees | Lack of regulatory oversight |

| Proprietary Trading Platform | Fees may apply with payment methods |

| Educational resources | Limited transparency |

Prince Markets offers a variety of market instruments for trading, including Forex, Gold, Silver, and Oil. Here's a brief description of each:

Forex (Foreign Exchange): Prince Markets provides access to the Forex market, allowing traders to trade currency pairs. Forex trading involves the buying and selling of one currency in exchange for another, and it is one of the largest financial markets globally, with high liquidity and opportunities for profit due to fluctuations in exchange rates.

Gold and Silver: Prince Markets offers trading opportunities in precious metals like gold and silver. These commodities are popular among investors as they are seen as a hedge against inflation and economic uncertainty. Traders can speculate on the price movements of gold and silver through various trading instruments such as contracts for difference (CFDs).

Oil: Prince Markets also provides access to the oil market, allowing traders to speculate on the price of crude oil. Crude oil is a critical commodity in the global economy, and its price can be influenced by factors such as supply and demand dynamics, geopolitical events, and economic data.

Trading these instruments with Prince Markets allows traders to diversify their portfolios and potentially profit from price fluctuations in these markets. However, it's important to note that trading in these markets carries inherent risks, including volatility and potential losses, and it's advisable for traders to have a good understanding of the markets and risk management strategies before participating. Additionally, as Prince Markets is an unregulated broker, traders should exercise caution and conduct thorough due diligence before engaging in any trading activities with the platform.

Prince Markets offers multiple account types tailored to meet the needs of different traders, based on their experience, trading preferences, and the size of their businesses. Here's a description of the various account types they offer:

Silver Account:

Minimum Deposit: $100

Leverage: 1:500

Market Execution

Instruments: FX, Commodities, Metals, and CFDs

Decimal: 5

Swap Free: No

Commission: No

Platform: MetaTrader 5

Standard Lot: 65

Margin Call: 50%/30%

Gold Account:

Minimum Deposit: $500

Leverage: 1:400

Market Execution

Instruments: FX, Commodities, Metals, and CFDs

Decimal: 5

Swap Free: No

Commission: No

Platform: MetaTrader 5

Standard Lot: 65

Margin Call: 50%/30%

Platinum Account:

Minimum Deposit: $5,000

Leverage: 1:300

Market Execution

Instruments: FX, Commodities, Metals, and CFDs

Decimal: 5

Swap Free: No

Commission: No

Platform: MetaTrader 5

Standard Lot: 100

Margin Call: 50%/30%

Palladium Account:

Minimum Deposit: $100

Leverage: 1:100

Market Execution

Instruments: FX, Commodities, Metals, and CFDs

Decimal: 5

Swap Free: No

Commission: No

Platform: MetaTrader 5

Standard Lot: 100

Margin Call: 50%/30%

These account types offer varying levels of leverage, minimum deposit requirements, and lot sizes, allowing traders to choose the one that aligns with their trading goals and risk tolerance. Additionally, Prince Markets provides a demo account with a virtual balance of $10,000 for traders to practice and develop their trading skills before using real funds. It's important to note that traders should carefully consider their trading objectives and the associated risks before selecting an account type and engaging in trading activities with Prince Markets.

Prince Markets offers a maximum trading leverage of up to 1:500, allowing traders to control a larger position in the market with a smaller amount of capital. However, high leverage increases the risk of substantial losses, so traders should use it cautiously and with a solid risk management strategy.

At Prince Markets, the structure of spreads and commissions is carefully designed to accommodate the diverse needs of traders across various account types. This approach ensures that traders from small startups to large corporations can find an account that aligns with their trading strategy and financial capacity.

Silver Account: Aimed at small startups with fewer than 10 team members, the Silver Account offers market execution without any commission charges. This account type is particularly attractive for its cost-effective trading environment, allowing traders to engage in FX, Commodities, Metals, and CFDs trading without worrying about additional commission fees.

Gold Account: Tailored for medium-sized businesses with up to 30 employees, the Gold Account mirrors the Silver Account in terms of commission structure. It offers commission-free market execution, providing a cost-efficient trading solution for businesses looking to expand their trading activities in a variety of financial instruments.

Platinum Account: Designed for large corporations with an unlimited number of members, the Platinum Account maintains the no-commission policy seen in the Silver and Gold accounts. This consistency in the commission structure across different account sizes underlines Prince Markets International LTD's commitment to providing a uniform and fair trading environment for all its clients.

Palladium Account: Serving large corporations with unlimited membership, the Palladium Account also features market execution with no commission fees. This account type offers the same advantages as the Platinum Account, ensuring large-scale traders can execute high-volume trades without the burden of additional commission costs.

Depositing Funds:

To deposit funds into a trading account with Prince Markets, traders can choose from various payment methods. These methods include Mastercard, Visa, Skrill, Neteller, Bank Transfer, Fasapay, Nganluong.vn, Dragonpay, ZOTAPAY, and Paytrust88. Each of these methods supports various currencies and offers different funding times.

Prince Markets does not impose any deposit fees.

It's important to note that while Prince Markets does not apply deposit fees, fees may be associated with the chosen payment method or intermediary banks, which should be taken into consideration.

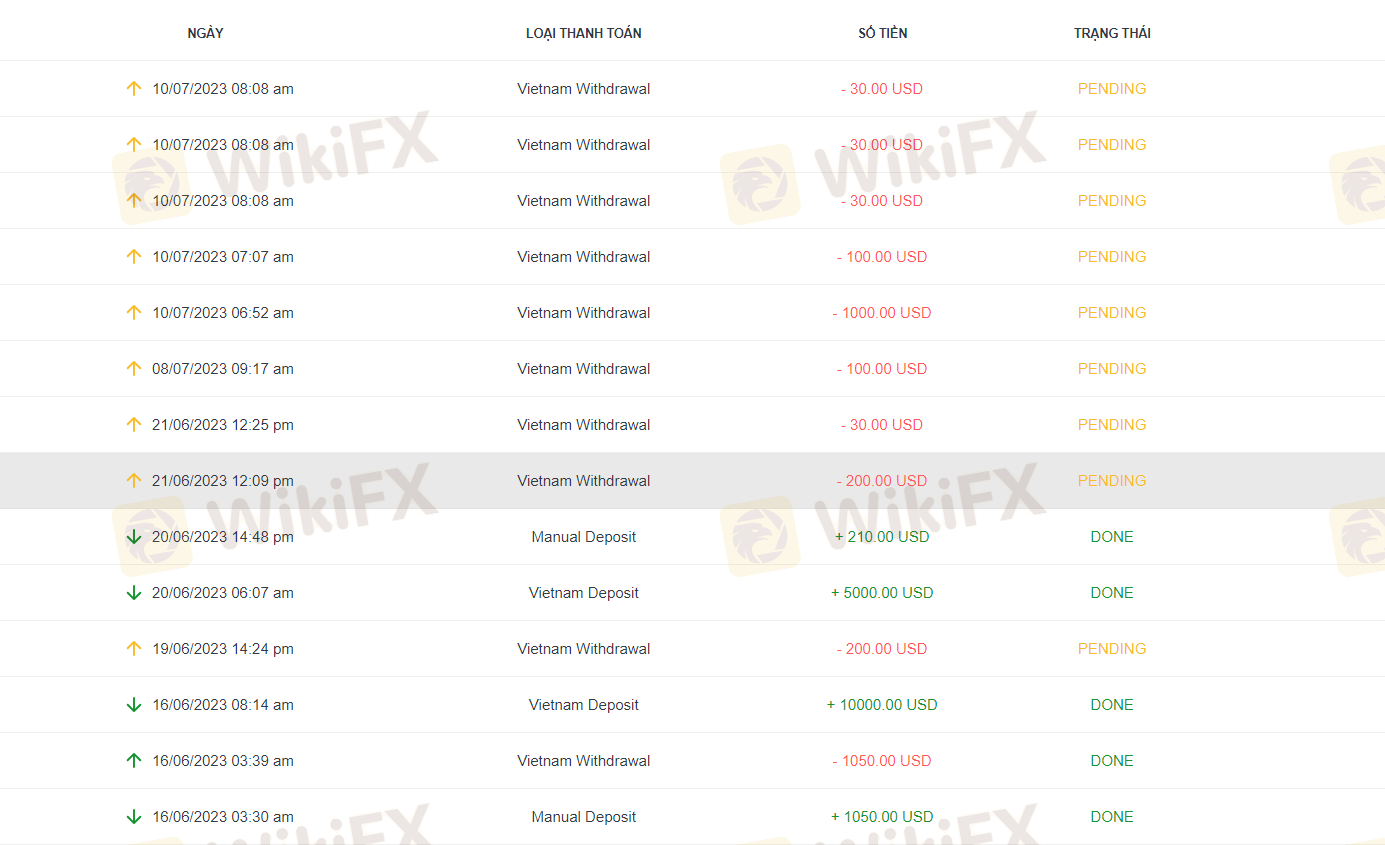

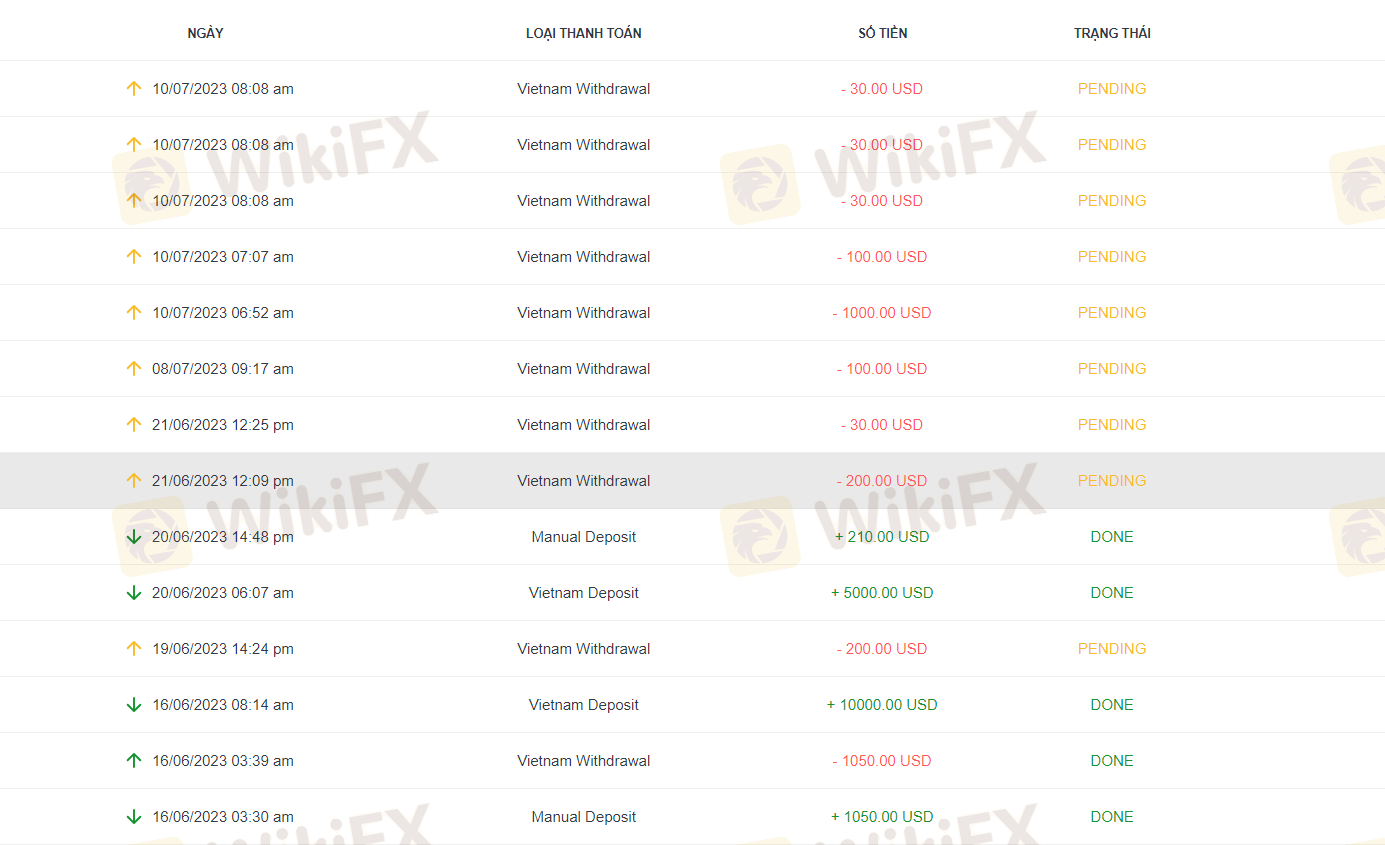

Withdrawing Funds:

To initiate a withdrawal from a trading account with Prince Markets, specific requirements and procedures must be followed:

Validation: Prior to initiating a withdrawal, the trading account must undergo validation. This involves uploading certain documents in the Members Area, including Proof of Identity (ID, passport, driving license) and Proof of Residency (utility bill, telephone/Internet/TV bill, or bank statement) that include the name and address and are not older than 6 months.

Withdrawal Request: Once the trading account is validated, a withdrawal can be requested by accessing the Members Area, selecting the Withdrawal tab, and submitting a withdrawal request.

Original Source of Deposit: Withdrawals can only be made to the original source of the deposit.

Free Margin: Withdrawals are permissible if the free margin at the time of the withdrawal request exceeds the specified amount, inclusive of all payment charges. Free margin is calculated as equity minus the necessary margin required to maintain any open positions.

Processing Time: All withdrawals are processed by Prince Markets' Finance Desk within 24 hours on business days.

Bank Wire Processing Time: Depending on the country where the funds are sent, bank wires may take up to 5 working days.

Deposit/Withdrawal Fees: Prince Markets does not levy any fees for deposit or withdrawal options. For example, if funds are deposited via Neteller and subsequently withdrawn, the full amount of the withdrawal, such as USD 100, will be received in the Neteller account as Prince Markets covers all transaction fees both ways.

Transferring Funds:

Certainly, there is an option to transfer funds between various trading accounts or even to/from one's trading account within Prince Markets. This facilitates efficient fund management based on trading strategies and preferences.

Adhering to these processes and conditions when depositing, withdrawing, or transferring funds with Prince Markets ensures a smooth and secure financial transaction experience.

The Proprietary Trading Platform (PTP) by Prince Markets is a powerful multi-asset trading terminal that offers more than 200 trading instruments across six asset classes, making it a versatile choice for traders of all levels. With a variety of features, including advanced charting tools, a hedging system for multiple positions, real-time price monitoring across 21 timeframes, and 38 built-in indicators, the PTP is designed to enhance the trading experience. It also provides fundamental analysis tools, such as an Economic Calendar, to keep traders informed about market events. Additionally, the platform supports mobile trading on iOS and Android devices, making it accessible and convenient for traders on the go. Overall, the Proprietary Trading Platform is a comprehensive solution that caters to the diverse needs of online foreign exchange traders and brokerage services worldwide, offering a wide range of tools and functionalities for effective trading.

Prince Markets offers a comprehensive customer support system to assist traders with their inquiries and concerns. Traders can contact the support team through various email addresses, each dedicated to specific types of inquiries, including general questions, product-related queries, partnership programs, financial transactions, technical support, and document-related matters. The support team operates during regular business hours from Monday to Friday, ensuring timely assistance to traders. Additionally, a feedback form is available on the website for traders to provide input and suggestions. Overall, Prince Markets strives to provide accessible and specialized customer support to cater to a range of trading needs and inquiries in a professional manner.

Prince Markets offers an “Education” section where traders can access a wealth of educational resources to enhance their trading knowledge and skills. This section provides a valuable collection of articles and materials designed to help traders learn how to navigate the financial markets effectively. From trading strategies and market analysis to risk management and trading psychology, the educational resources are tailored to support traders at various experience levels. Prince Markets' commitment to education underscores its dedication to empowering traders with the tools and insights needed to make informed trading decisions and succeed in their trading endeavors.

Prince Markets is an unregulated broker, offering a range of market instruments such as Forex, Gold, Silver, and Oil for trading. They provide various account types to cater to traders of different sizes and preferences, along with a maximum trading leverage of 1:500. The broker offers competitive spreads and commissions depending on the chosen account type, with a no-commission option for many accounts. They also support multiple deposit and withdrawal methods, including popular e-wallets and bank transfers, with no deposit fees and quick processing times. Prince Markets provides a proprietary trading platform with advanced features and a comprehensive set of educational resources. However, it's essential to exercise caution due to the lack of regulatory oversight. Traders can access customer support during business hours, and the broker emphasizes trader education through its dedicated section.

Q1: Is Prince Markets a regulated broker?

A1: No, Prince Markets is an unregulated broker, which means it operates without oversight from official financial authorities.

Q2: What market instruments can I trade with Prince Markets?

A2: Prince Markets offers trading in Forex, Gold, Silver, and Oil.

Q3: What is the maximum trading leverage offered by Prince Markets?

A3: Prince Markets offers a maximum trading leverage of up to 1:500.

Q4: Are there deposit fees when funding my trading account with Prince Markets?

A4: No, Prince Markets does not charge deposit fees. However, fees associated with payment methods or intermediary banks may apply.

Q5: How quickly are withdrawal requests processed by Prince Markets?

A5: Prince Markets processes withdrawal requests within 24 hours on business days, with bank wire withdrawals potentially taking up to 5 working days depending on the destination country.

Sort by content

User comment

2

CommentsWrite a review

2024-01-09 18:24

2024-01-09 18:24

2023-07-13 10:28

2023-07-13 10:28