Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

INGOT BROKERS, a trading name of INGOT Global Ltd, is a multi-asset brokerage firm founded in 2006 and registered in Seychelles, while further, the company diversified its portfolio to Asia, MENA and International trading regions through their offices in New Zealand, Switzerland and Bahrain.

The broker offers a diverse range of market instruments, including agriculture, energies, metals, stocks, indices, ETFs, currencies, and cryptocurrencies. This provides traders with opportunities for diversification and access to global markets. However, regional restrictions may apply, and there are potential risks associated with commodity price fluctuations and higher volatility in certain markets.

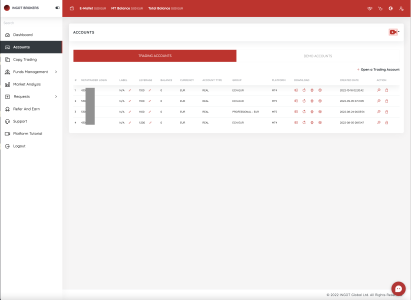

INGOT BROKERS offers different account types, such as the Professional Raw Account and the Professional Account, catering to the needs of Wholesale clients and Sophisticated investors. These accounts provide access to various asset classes, different leverage options, and low spreads. Traders are advised to consider the potential limitations and convenience of each account type.

To open an account with INGOT BROKERS, interested individuals can visit the broker's website and follow the account opening process, which involves providing personal information, selecting an account type and currency, reviewing terms and conditions, submitting an application, undergoing a verification process, funding the account, and starting trading.

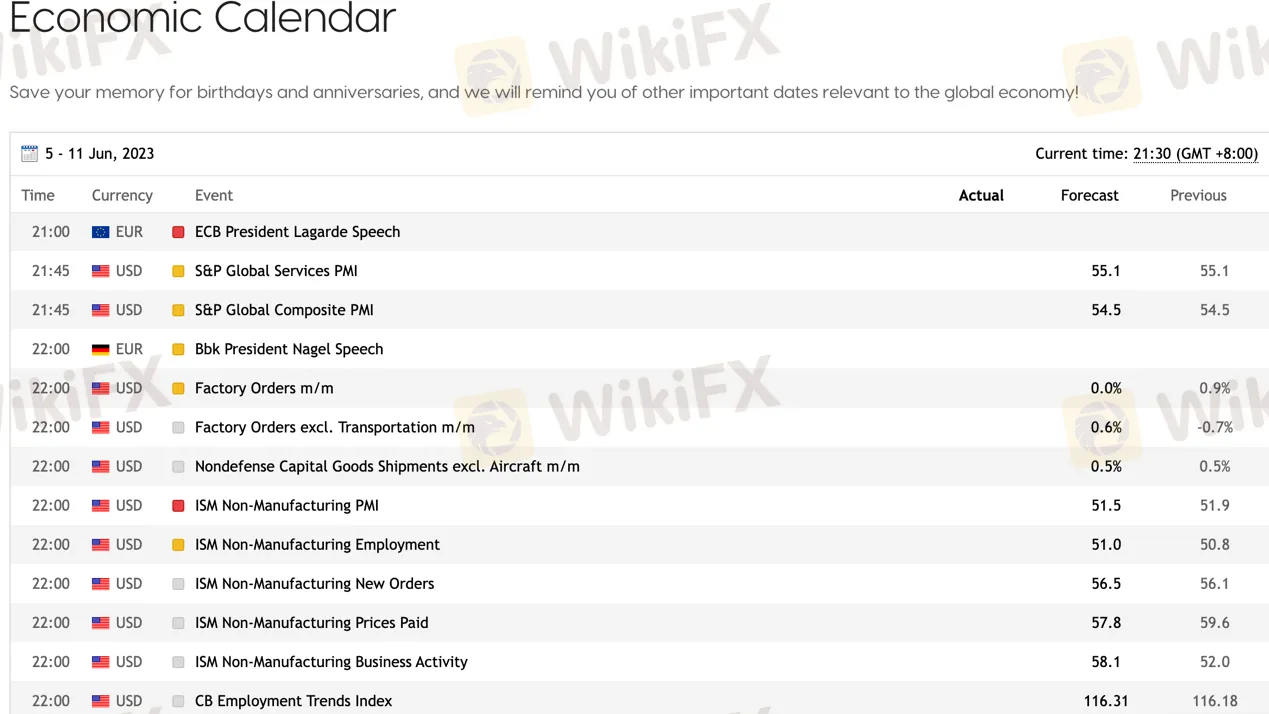

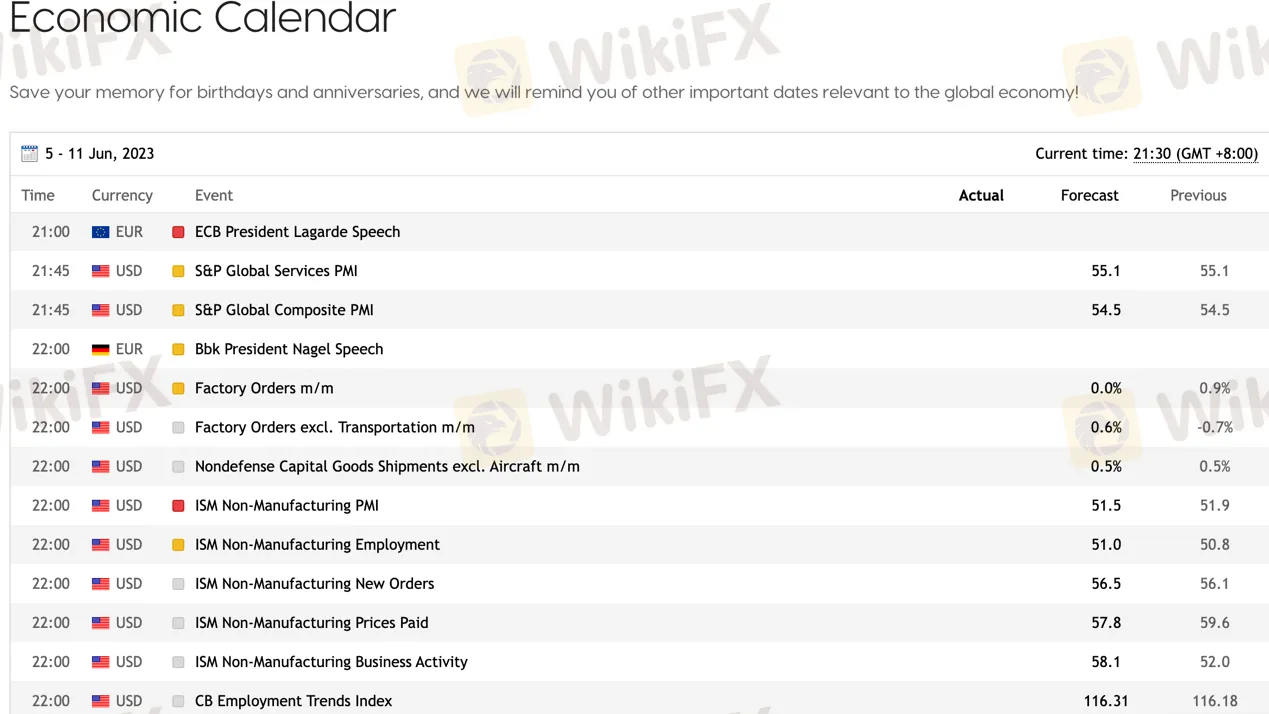

INGOT BROKERS offers leverage options up to 1:500, spreads starting from 0 pips, and a variety of deposit and withdrawal methods, including wire transfers, cryptocurrencies, and credit/debit cards. However, withdrawal fees may apply, and additional fees imposed by the concerned bank should be taken into account. The broker supports the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, which provide access to global financial markets and advanced trading features. Traders can also utilize trading tools such as the Trader's Calculator and the Economic Calendar to assist in their trading decisions.

Educational resources offered by INGOT BROKERS include videos, articles, seminars, webinars, and one-to-one training sessions, covering topics such as chart patterns, commodities, and technical analysis. However, there are no upcoming webinars at the moment. Traders should consider these resources as supplementary to comprehensive market analysis and risk management strategies.

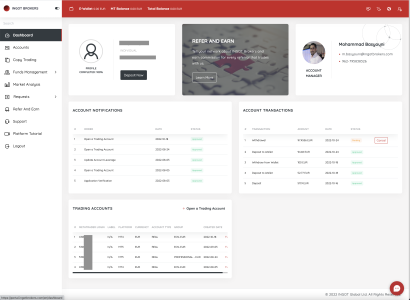

Here is the home page of this brokers official site:

Pros and Cons

kers is a reputable brokerage firm that offers a range of financial services. One notable advantage of INGOT Brokers is its user-friendly platform, which makes it easy for both experienced and novice traders to navigate. The company provides a wide selection of tradable assets, including stocks, currencies, and commodities, allowing investors to diversify their portfolios. Additionally, INGOT Brokers offers low pricing and low fees, enabling clients to execute trades at affordable costs. On the downside, customer support can be slow at times, and there have been occasional reports of technical glitches on the platform.

Is INGOT BROKERS Legit?

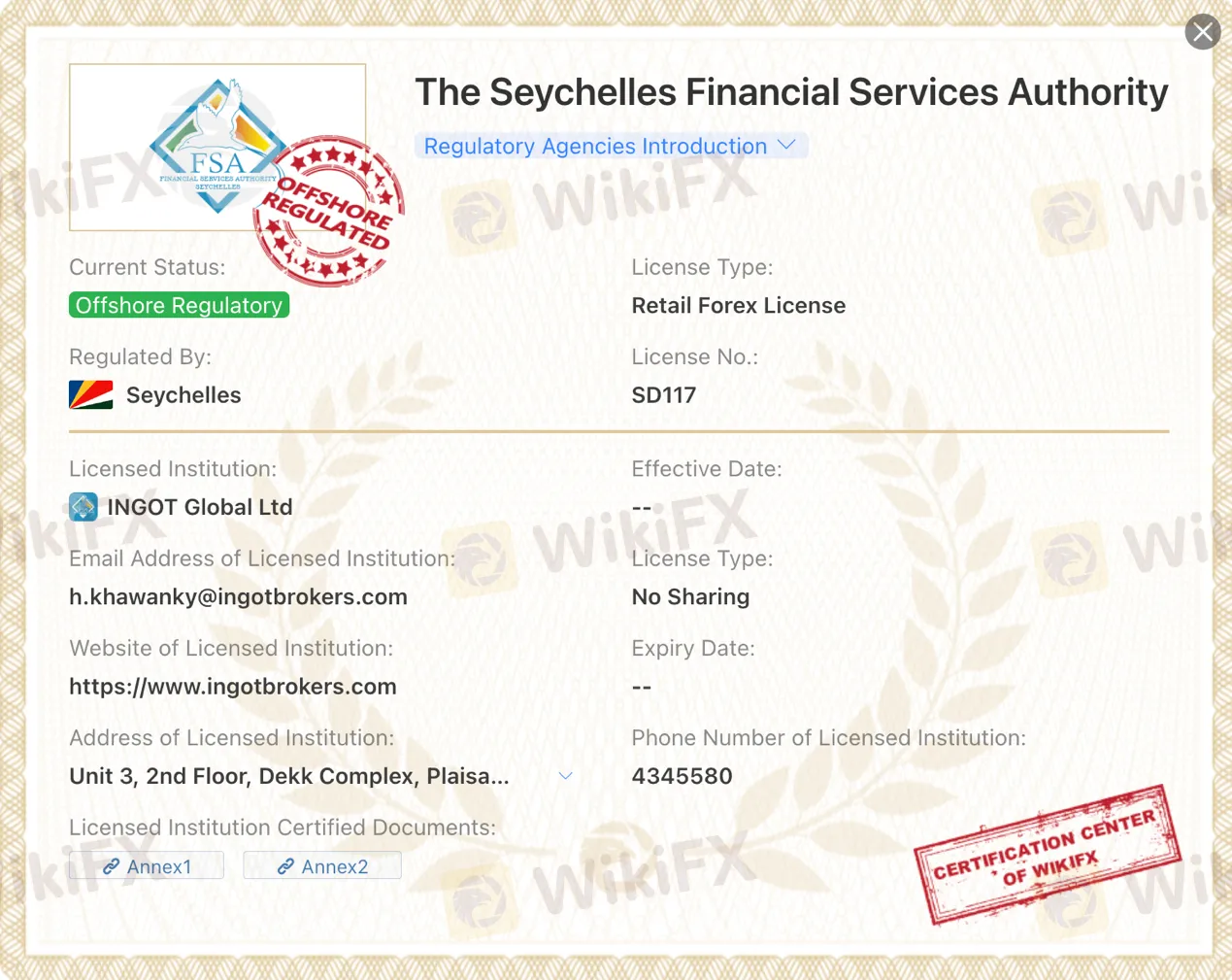

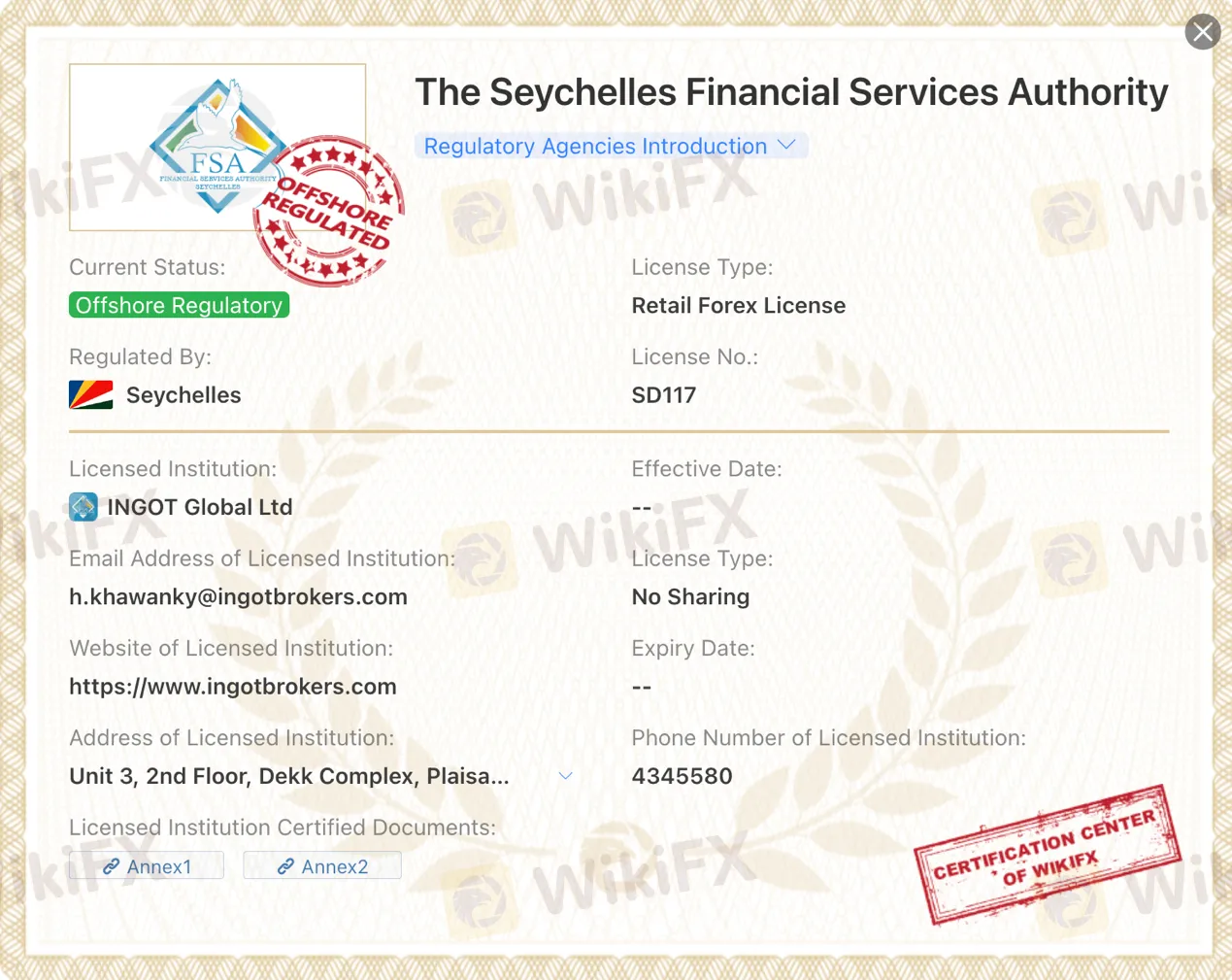

According to the information provided, INGOT BROKERS (AUSTRALIA) PTY LTD, operating in Australia, is regulated by the Australia Securities & Investment Commission (ASIC) with license number 428015. They are licensed as a Market Maker (MM). However, it's important to note that the license type mentioned is “No Sharing,” which could indicate limitations on the services provided.

On the other hand, INGOT Global Ltd, operating in Seychelles, is regulated by the Seychelles Financial Services Authority (FSA) with license number SD117. The FSA in Seychelles is classified as an offshore regulatory agency.

It's worth mentioning that WikiFX Risk Alerts have raised concerns about INGOT BROKERS, with a detection date of 2023-06-05. According to WikiFX, they have received 10 complaints about this broker in the past three months, indicating a potential risk or scam. Additionally, WikiFX advises caution regarding the offshore regulation by the Seychelles FSA (SD117), as offshore regulations generally offer lesser protection compared to stricter regulatory frameworks.

Therefore, based on the information provided, it appears that INGOT BROKERS is not regulated by a major financial regulatory authority such as ASIC in Australia, which typically provides higher levels of investor protection. The offshore regulation in Seychelles also raises concerns regarding the level of oversight and protection for clients. It is recommended to exercise caution and conduct further research or seek advice from trusted financial professionals before engaging with this broker.

Market Instruments

INGOT BROKER offers 1,000+ trading instruments across 8 asset classes, including agriculture, energies, metals, stocks, indices, ETFs, currencies and cryptocurrencies.

Agriculture: INGOT Brokers provides agricultural commodities such as corn, soymeal, wheat, and more. These commodities allow traders to participate in the agricultural market and diversify their portfolios.

Energies: Traders can access energy commodities like natural gas through INGOT Brokers. These energy products provide exposure to the energy sector and its price fluctuations.

Metals: INGOT Brokers offers popular metals like gold, copper, silver, and others. These metals are commonly traded for their value and act as a hedge against inflation.

Stocks: INGOT Brokers allows trading of stocks from global brands. Traders can engage in the stock market and potentially benefit from the performance of well-known companies such as Meta, Lyft, Snap, and more.

Indices: INGOT Brokers provides indices that represent the overall performance of a collection of stocks from specific nations. Traders can use indices to diversify their portfolios and gain exposure to broader market trends, including DAX 40, S&P 500, NASDAQ 100, and others.

ETFs: INGOT Brokers offers Exchange-Traded Funds (ETFs) that track the performance of indices, sectors, and other assets. ETFs provide a convenient way to diversify portfolios as they contain a mix of investment types. Examples of ETFs include GOVT, FIVG, SDOW, and more.

Currencies: INGOT Brokers allows trading of various currency pairs, including major pairs like EURUSD, GBPUSD, USDCAD, and others. Currency trading enables traders to take advantage of fluctuations in exchange rates.

Cryptocurrencies: INGOT Brokers supports popular cryptocurrencies like Bitcoin (BTCUSD), Ethereum (ETHUSD), Litecoin (LTCUSD), and more. Cryptocurrencies offer opportunities for traders interested in the digital currency market.

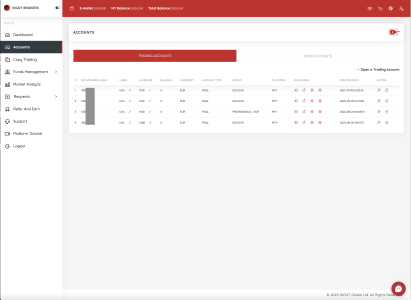

Account Types

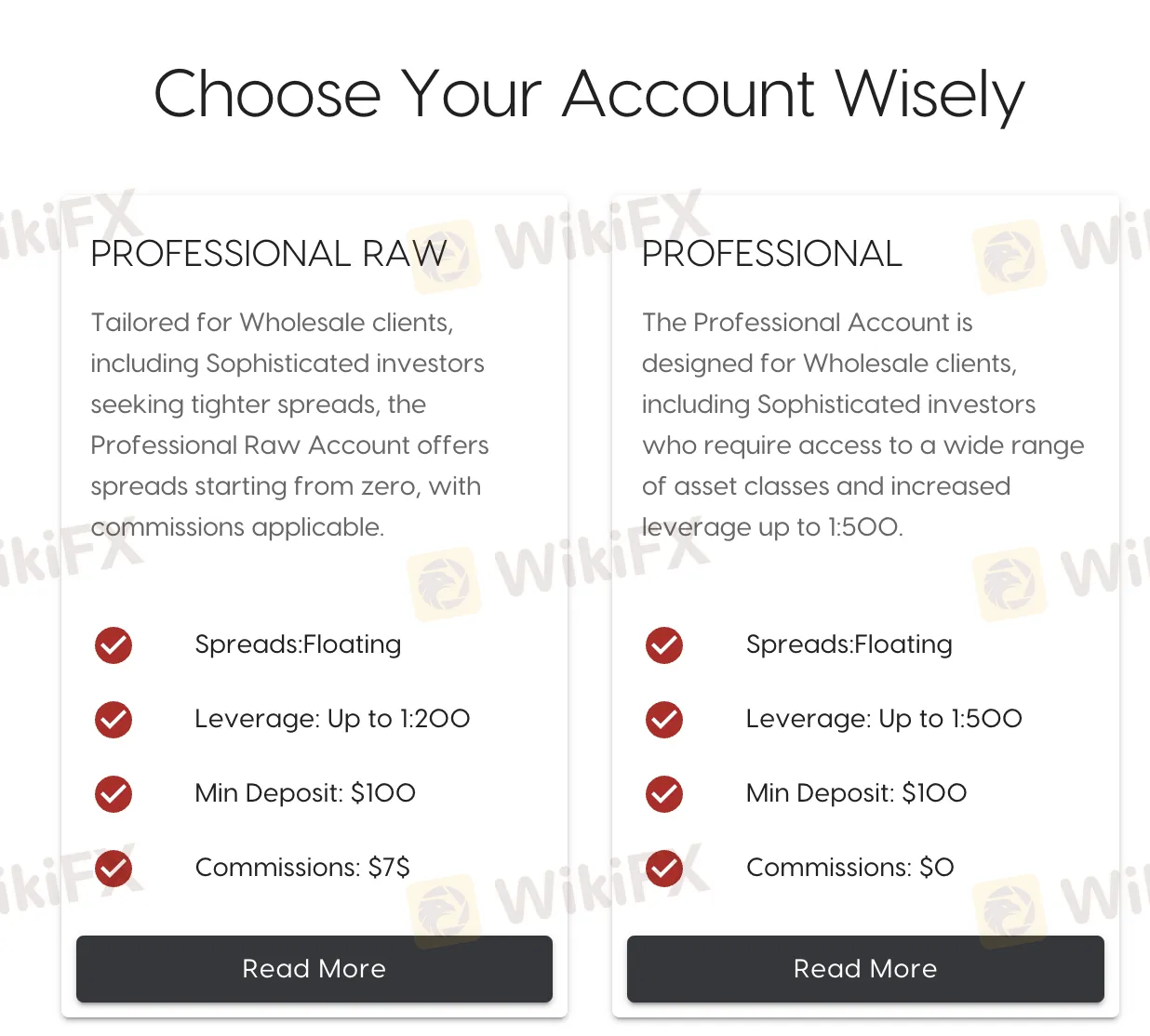

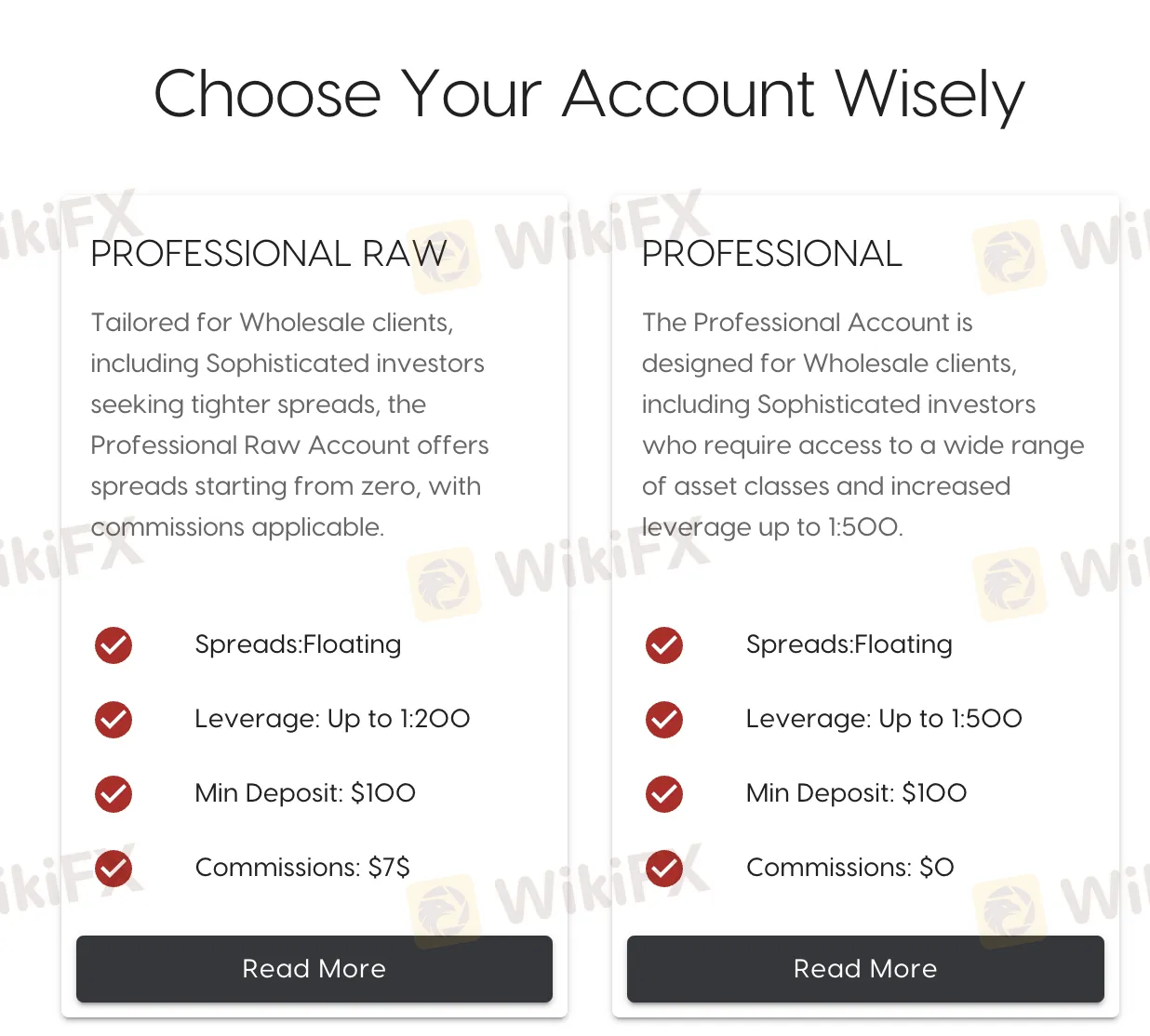

INGOT Brokers offers a variety of account types to cater to the diverse needs of traders. With options such as the Professional Raw Account and the Professional Account, traders can choose the account type that aligns with their trading preferences and requirements. These accounts provide access to a wide range of asset classes, different leverage options, and low spreads. In this way, INGOT Brokers aims to provide a flexible trading experience for both Wholesale clients and Sophisticated investors.

PROFESSIONAL RAW:

The Professional Raw Account is tailored for Wholesale clients, including Sophisticated investors. This account offers spreads starting from zero, with commissions applicable. Traders who choose this account can benefit from floating spreads, leverage of up to 1:200, and a minimum deposit requirement of $100. However, it's important to note that a commission fee of $7 applies to this account type.

PROFESSIONAL:

The Professional Account is designed for Wholesale clients, including Sophisticated investors who require access to a wide range of asset classes and increased leverage. Traders opting for this account type can enjoy floating spreads, leverage of up to 1:500, and a minimum deposit requirement of $100. Unlike the Professional Raw Account, there is no commission fee associated with this account type.

How to Open an Account ?

To open an account with INGOT BROKERS and start trading, follow these steps:

1. Visit the INGOT BROKERS website: Go to the official website of INGOT BROKERS.

2. Click on ‘Start Trading’: Look for a button or link that allows you to start the account opening process.

3. Fill in your personal information: Provide your first name, last name, email address, country of residence, citizenship, phone number, and choose a password. Ensure that the password you choose meets the minimum requirements, usually a minimum of 8 characters.

4. Select the account type and currency: Choose the type of account you wish to open, such as an Individual Account. Select the currency in which you want to operate your trading account.

5. Review and accept the terms and conditions: Read through the terms and conditions carefully. Ensure that you understand and agree to the terms before proceeding.

6. Submit your application: After filling in all the required information and reviewing the terms and conditions, submit your application.

7. Verification process: INGOT BROKERS may require you to verify your identity and provide additional documents to comply with regulatory requirements. Follow the instructions provided to complete the verification process.

8. Fund your account: Once your account is approved and verified, you can proceed to fund your trading account. INGOT BROKERS provides various deposit methods, such as wire transfers, cryptocurrencies, and credit/debit cards. Choose the most convenient method for you and follow the instructions to deposit funds into your account.

9. Start trading: After funding your account, you can access the trading platform provided by INGOT BROKERS, such as MetaTrader 4 or MetaTrader 5. Familiarize yourself with the platform, explore the available trading instruments, and execute trades according to your trading strategy.

Leverage

Three accounts offer different trading leverage. The maximum leverage for the Professional account is up to 1:500, and for the ECN account is up to 1:200. While the Prime account holders can experience leverage up to 1:100.

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads & Commissions

Spreads and commissions with INGOT BROKERS are scaled with the accounts offered. Specifically, the spread starts from 1 pip on the Professional account, and 0 pips on the ECN and Prime accounts.

As for the commission, there is no commission on the Professional account, a $7 commission on the ECN account, and a $5 commission on the Prime account.

Trading Platform

INGOT Brokers offers its clients the popular and widely used MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. These platforms provide traders with access to global financial markets with ease, offering a range of features and tools.

MetaTrader 4 (MT4) is a well-known platform that offers a user-friendly interface and advanced trading capabilities. It provides traders with access to 30 technical indicators, allowing them to analyze price patterns on charts. Traders can execute buy or sell orders, known as open orders, and choose from 9 different timeframes to analyze price movements. MT4 also supports the use of 128 charts for in-depth technical analysis. The platform is available for iOS and Android devices, desktop computers, and also offers a web trader option.

MetaTrader 5 (MT5) is a multi-asset trading platform that includes advanced technical and fundamental analysis tools. It offers an economic calendar to keep traders informed about important economic events and news that may impact market prices. MT5 provides access to 38 technical indicators for analyzing price patterns on charts. Traders can place pending orders, which are buy or sell orders that have not yet been executed. The platform offers 21 different timeframes and allows the use of an unlimited number of charts for comprehensive technical analysis. MT5 is available for iOS and Android devices, desktop computers, and also offers a web trader option.

Trading Tools

Trading Tools offered by INGOT Brokers include:

Trader's Calculator: This tool helps traders calculate essential trading parameters such as margin, spreads, and leverage. By accurately analyzing these numbers, traders can make informed trading decisions.

2. Economic Calendar: INGOT Brokers provides an economic calendar that highlights important dates and events relevant to the global economy. Traders can stay updated on key economic indicators and news releases that might impact the financial markets.

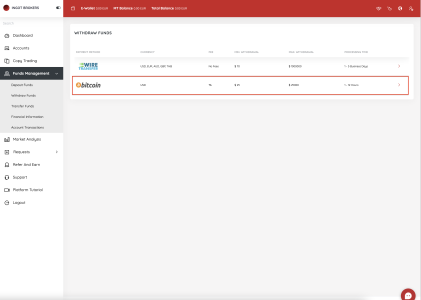

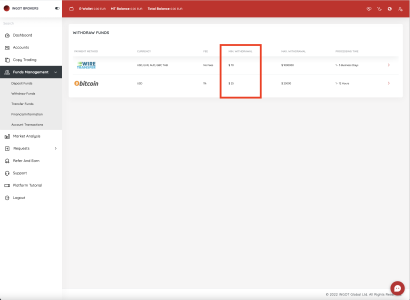

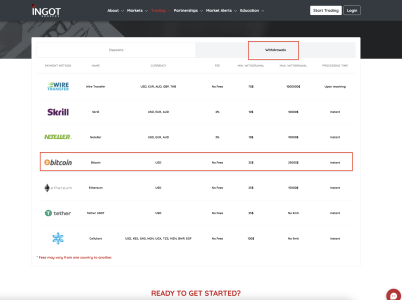

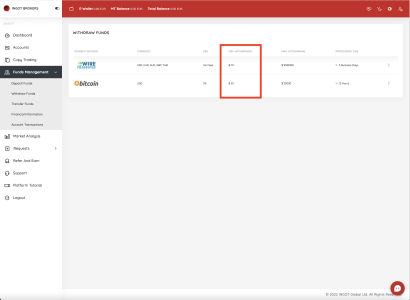

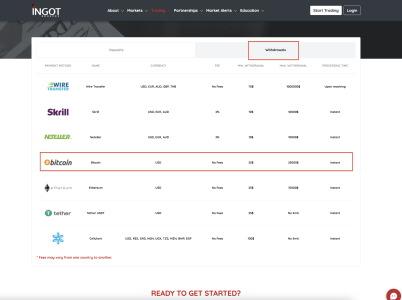

Deposit & Withdrawal

INGOT BROKERS offers a variety of deposit and withdrawal methods to cater to the needs of their clients. The accepted deposit methods include Wire transfers, Bitcoin, Ethereum, Visa, MasterCard, Apple Pay, and Tether. This provides flexibility and convenience for clients to fund their trading accounts using their preferred payment method. The minimum deposit amount is $10, allowing for accessibility and affordability.

When it comes to withdrawals, INGOT BROKERS supports Wire transfers, Bitcoin, Ethereum, Tether, and Cellulant. Clients can choose the method that suits them best for withdrawing their funds. It's important to note that there are some withdrawal fees charged by the broker, which can vary depending on the chosen withdrawal method.

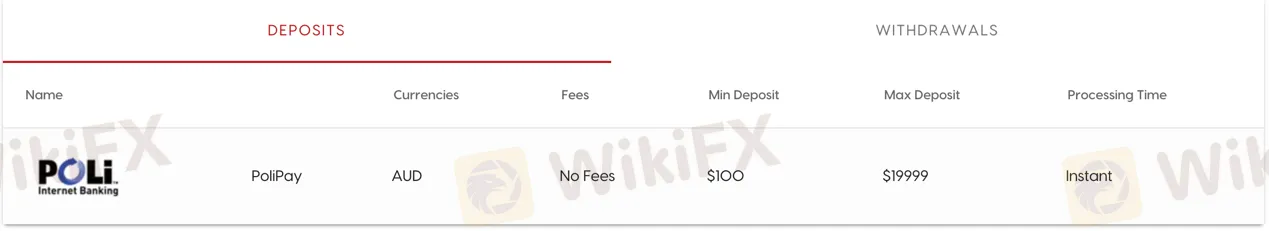

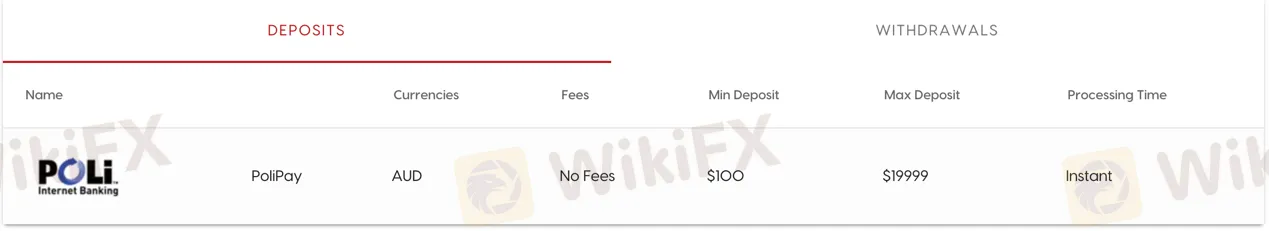

Here is a breakdown of the deposit and withdrawal options provided by INGOT BROKERS:

Deposit Methods:

PoliPay

Currency: AUD

Deposit Fees: No Fees

Minimum Deposit: $100

Maximum Deposit: $19,999

Processing Time: Instant

Wire Transfer

Currencies: USD, EUR, AUD, GBP, KES

Deposit Fees: No Fees (an amount of 25 USD will be charged for wire transfers lower than 500 USD)

Minimum Deposit: $100

Maximum Deposit: $1,000,000

Processing Time: 1 - 5 Business Days

It's important to note that while INGOT Brokers does not charge any commission on bank wire transfer deposits and withdrawals, the concerned bank may impose its own commissions or fees on these transactions.

Customer Support

Telephone Support: INGOT BROKERS provides telephone support to their clients. You can reach them at +61280466500 in Sydney, Australia.

Email Support: They offer email support for general inquiries at info@ingotbrokers.com.au and dedicated support at customerservice@ingotbrokers.com.au.

Live Chat: INGOT BROKERS has a live chat feature on their website, allowing clients to communicate with their support team in real-time.

Social Media: They have a presence on various social media platforms such as Telegram, Skype, Twitter, Facebook, Instagram, YouTube, and LinkedIn. Clients can reach out to them through these channels as well.

Company Address: The physical address of INGOT BROKERS is Unit 3, 2nd Floor, Dekk Complex, Plaisance, Mahe, Seychelles.

INGOT BROKERS ensures that their customer service team is available 24/5 to assist clients with their inquiries and concerns.

Frequently Asked Questions (FAQs)

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX