Company Summary

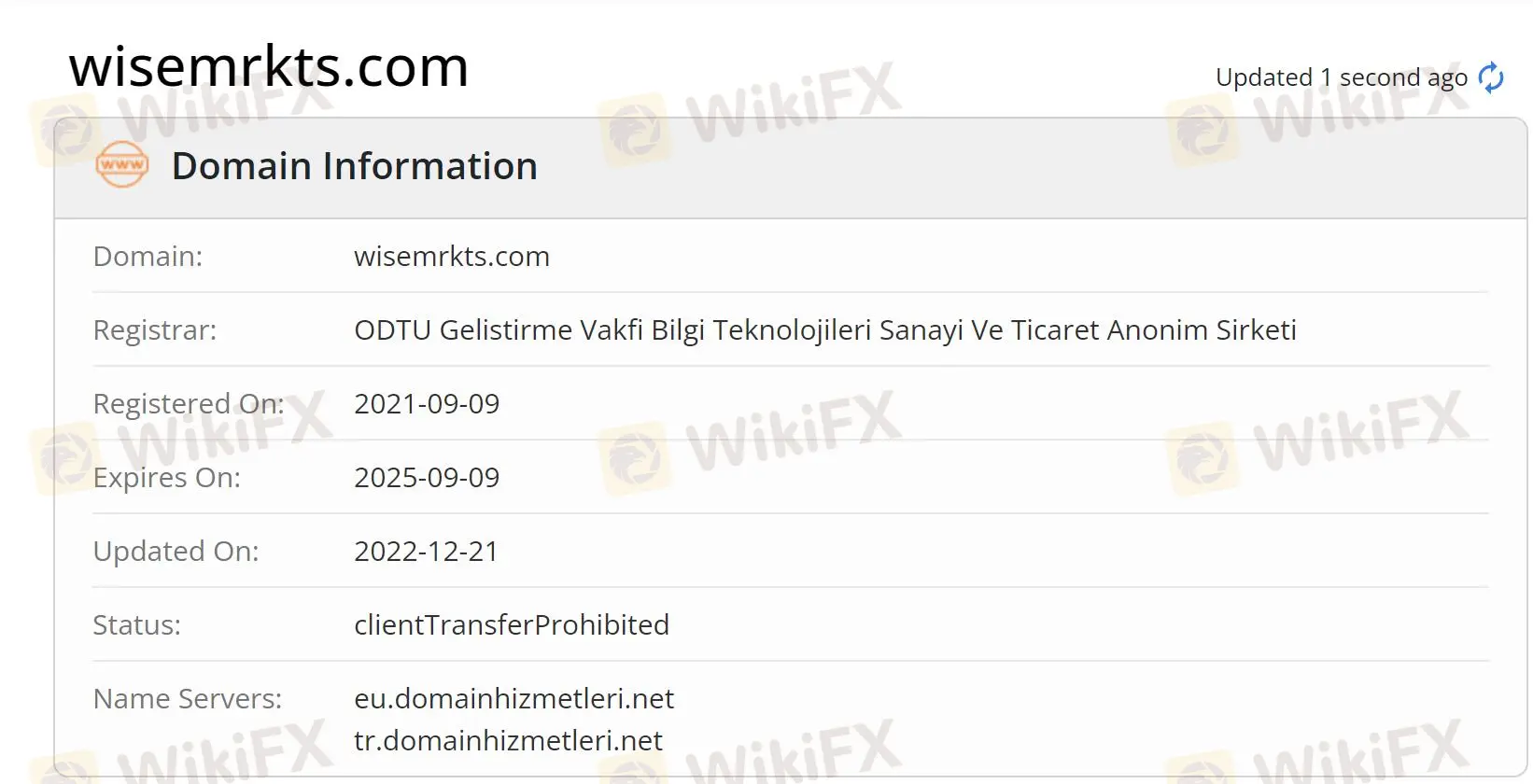

Note: Swiss Crypto Bank's official website: https://swiss-cryptobank.io/ is currently inaccessible normally.

| Swiss Crypto BankReview Summary | |

| Founded | 2021 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | Not regulated |

| Market Instruments | Cryptocurrencies, Forex, Commodities, Indices, Shares |

| Demo Account | / |

| Leverage | Up to 1:400 |

| Spread | 1 pip |

| Trading Platform | Web-based |

| Min Deposit | $250 |

| Customer Support | Phone: +44 7488871880, +1 4378374275 |

| Email: support@swiss-cryptobank.io | |

| Whatsapp: +447871179660 | |

Swiss Crypto Bank was founded in 2021 in Saint Vincent and the Grenadines. It offers various trading assets like Cryptocurrencies, Forex, Commodities, Indices and Shares. Besides, its leverage is up to 1:400. However, it is not regulated.

Pros and Cons

| Pros | Cons |

| Various trading assets | High minimum deposit |

| Multiple account choices | Not regulated |

| Lack transparency | |

| Unavailable website | |

| Inactivity fee charged |

Is Swiss Crypto Bank Legit?

Swiss Crypto Bank is not regulated by any financial authorities. And it is not supervised by any regulations. Traders should be cautious when trading.

What Can I Trade on Swiss Crypto Bank?

| Tradable Instruments | Supported |

| Cryptocurrencies | ✔ |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Shares | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFS | ❌ |

Account Type

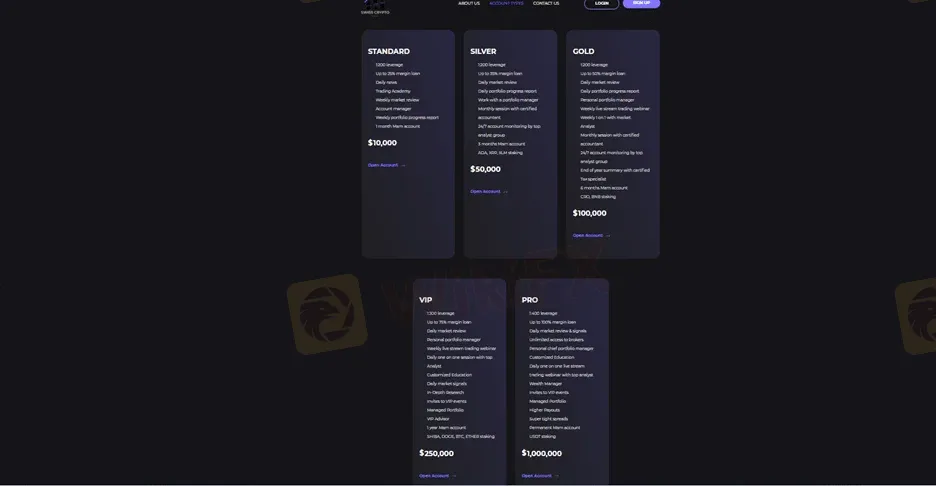

Swiss Crypto Bank offers six account types: BASIC, STANDARD, SILVER, GOLD, VIP, and PRO.

| Account Type | Minimum Deposit |

| BASIC | $250 |

| STANDARD | $10 000 |

| SILVER | $50 000 |

| GOLD | $100 000 |

| VIP | $250 000 |

| PRO | $1 000 000 |

Standard Account: With a minimum deposit of $10,000, this account provides a 20% margin loan. Traders can access a basic account with standard features and trading capabilities.

Silver Account: For a deposit of $50,000, traders can take advantage of a 35% margin loan. This account offers 24/7 account monitoring by a top analyst group, providing valuable insights and support. Additionally, traders get a 3-month Multi-Account Manager (MAM) account for enhanced portfolio management.

Gold Account: Traders can open a Gold Account with a deposit of $100,000, gaining a 50% margin loan. Alongside 24/7 account monitoring by top analysts, this account includes a 6-month MAM account for more extended portfolio management. Traders can also participate in cryptocurrency staking for CRO & BNB, along with monthly sessions with a certified accountant.

VIP Account: For a deposit of $250,000, traders can access the VIP Account, which comes with a 75% margin loan. This account level offers 24/7 account monitoring by top analysts, a 12-month MAM account for comprehensive portfolio management, and the opportunity to stake cryptocurrencies such as SHIBA, DOGE, and BTC. Additionally, traders receive monthly sessions with a certified accountant and personalized support from a VIP advisor. The VIP Account also provides higher leverage, offering traders a 1:300 ratio.

Pro Account: The Pro Account is the highest tier, requiring a minimum deposit of $1,000,000. With a 100% margin loan, traders can maximize their trading potential. Traders can participate in cryptocurrency staking and benefit from monthly sessions with a certified accountant. The Pro Account provides an even higher leverage of 1:400 and offers USDT staking as an additional feature.

Leverage

Swiss Crypto Bank's leverage varies by the accounts. Apart from VIP account's leverage is 1:300 and PRO's account is 1:400, other accounts' leverage is 1:200. Higher leverage always comes with high returns and high losses.

Spreads

The spread of Swiss Crypto Bank is from 1 pip.

Other Fees

There is a $30 charge for accounts that have been inactive for 60 days.

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

| Web-based | ✔ | Web | Experienced traders |

Deposit and Withdrawal

SwissCryptobank can deposit through Credit/Debit cards. The required deposit amount is no less than $10 000 to open an account, but the minimum deposit is $250.

As for withdrawals, the minimum withdrawal amount is $1 000 for Wire Transfers and $100 for Credit/Debit cards, and the fees are free.