Company Summary

| ManCu | Basic Information |

| Founded | 2015 |

| Headquarters | Australia |

| Regulation | FinCEN(regulated), NFA (General Registration) |

| Tradable Assets | Forex, indices, stock index |

| Minimum Deposit | Not mentioned |

| Maximum Leverage | 400:1 |

| Spreads & Commissions | Variable spread with no commission |

| ECN spread of 0.1 pips with a fixed fee of $10 per trade | |

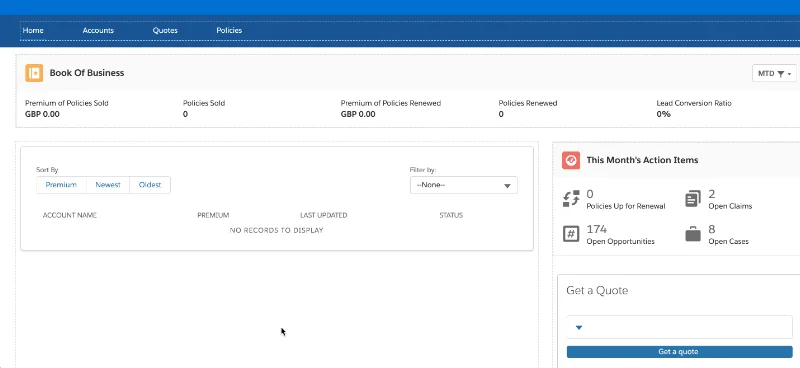

| Trading Platform | MancuFX6 platform |

| Customer Support | Live chat, email: mancu@mancu.com |

ManCu Information

ManCu, founded in 2015 and headquartered in Australia, is a financial trading platform offering forex, indices, and stock index with leverage up to 400:1. With a regulatory oversight from the Financial Crimes Enforcement Network (FinCEN), ManCu ensures compliance with anti-money laundering and financial crime prevention regulations.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

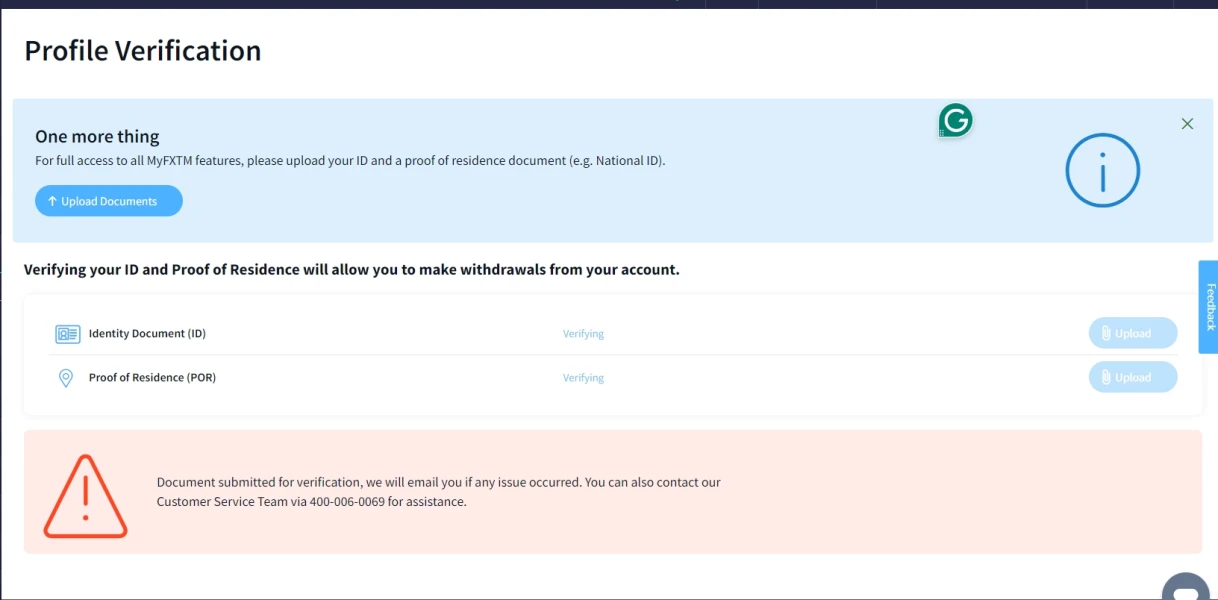

Is ManCu Legit?

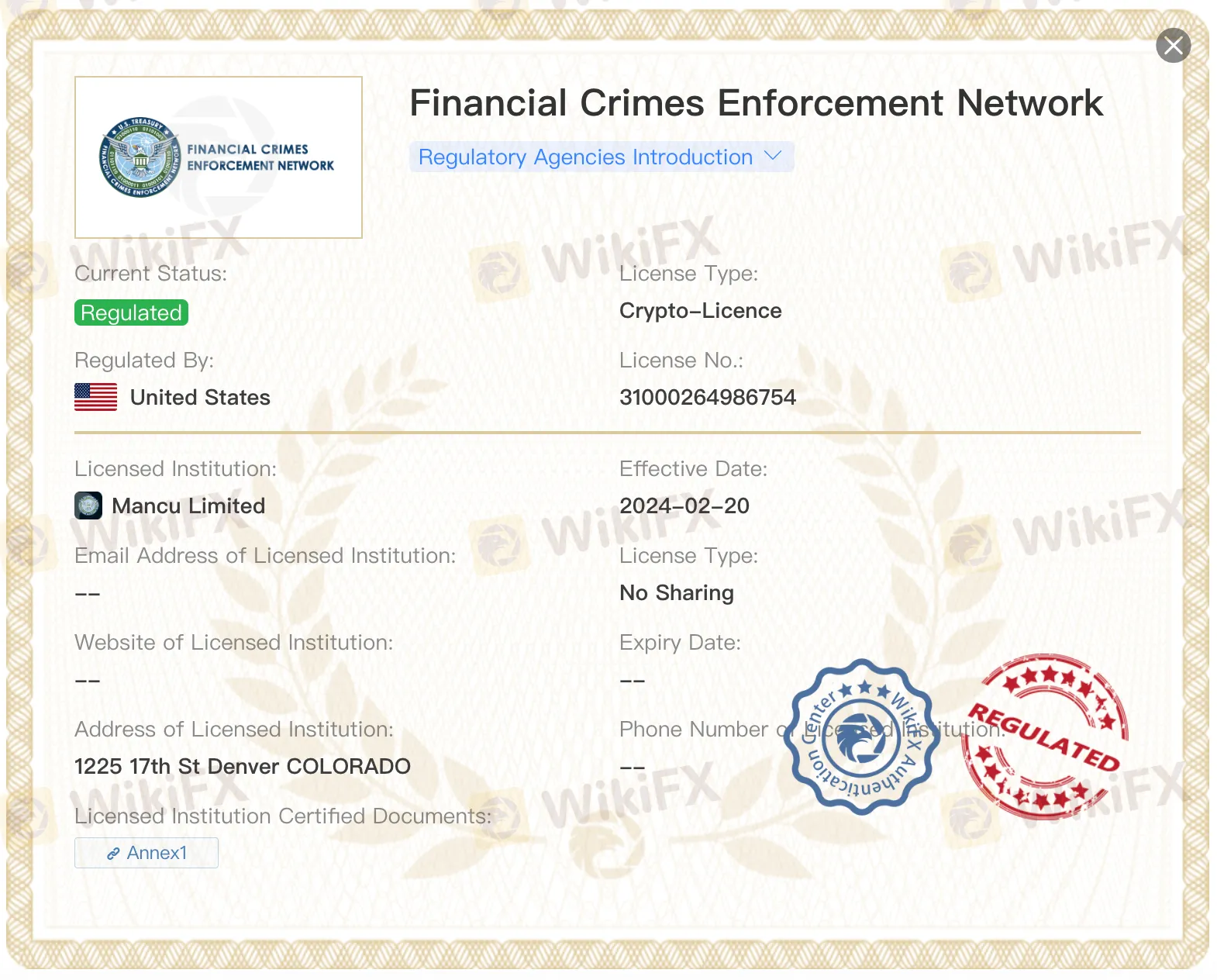

ManCu is regulated by the Financial Crimes Enforcement Network (FinCEN) in the United States, holding a Crypto-License with license number 31000264986754. It also has a general registration license of NFA.

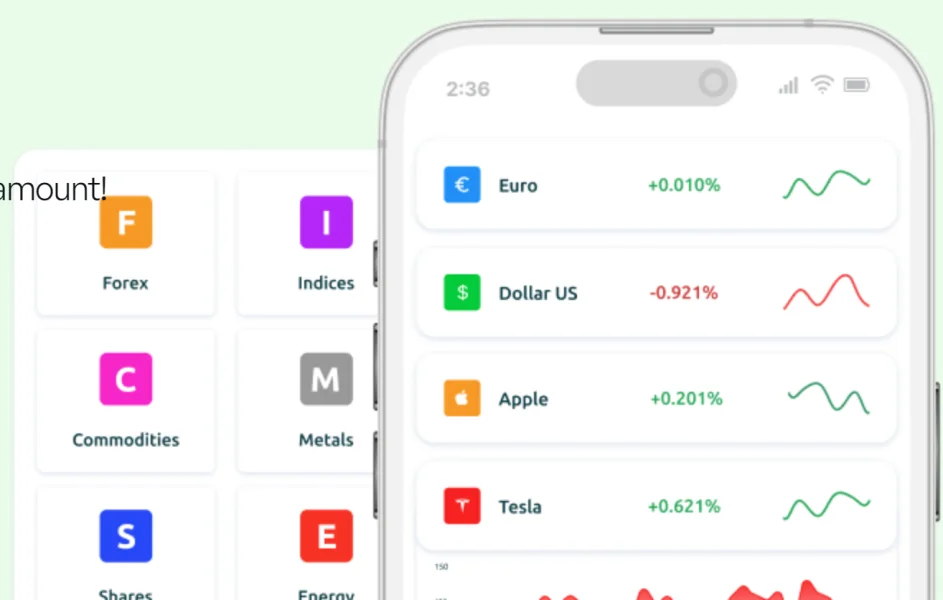

Trading Instruments

Compared to other brokers, trading instruments available at ManCu offers is limited, only 80+, including 50 spot and forward FX currency pair CFDs, indices (gold, oil and silver), and stock index.

Leverage

Leverage at ManCu allows traders to amplify their trading positions with ratios of up to 400:1, enabling them to control larger positions with a smaller amount of capital.

Spreads & Commissions

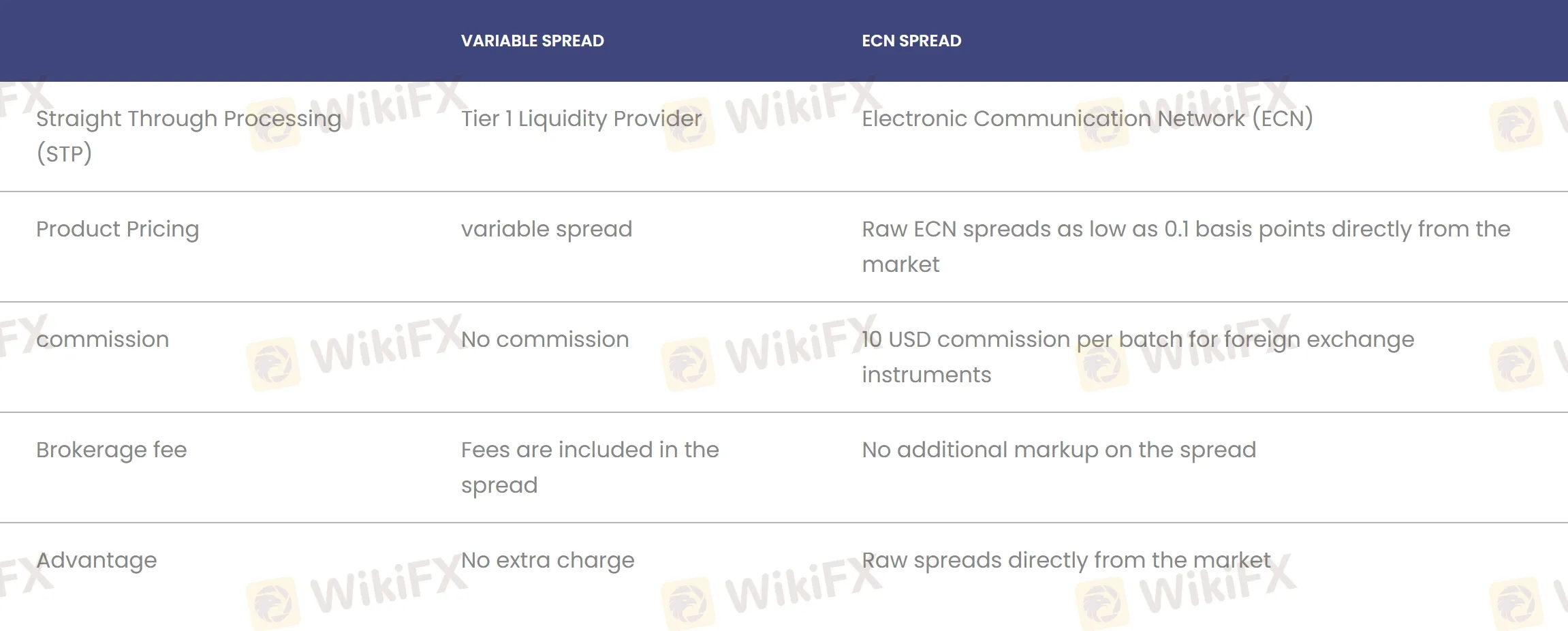

ManCu offers two types of spreads, including variable spread with no commission, and ECN spread as low as 0.1 pips with a fixed fee of $10 per trade.

Trading Platforms

Instead of the industry leading MT4 and MT5, ManCu only offers the MancuFX6 platform. You can also trade on the go, whether via iOS or Android devices.

Customer Support

Live chat

Email: mancu@mancu.com

Address: FLAT/RM B5/F GAYLORD COMMERCIAL

Q&A

Does ManCu provide popular MT4 and MT5 platforms?

No. Instead, it only offers MancuFX6 platform.

Is ManCu a good broker for beginners?

No. Although it is a regulated broker, no demo accounts, no educational resources, beginners can have better choices.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

FX1827134652

United States

Won't even answer back to emails or account information.

Exposure

FX3768802619

United States

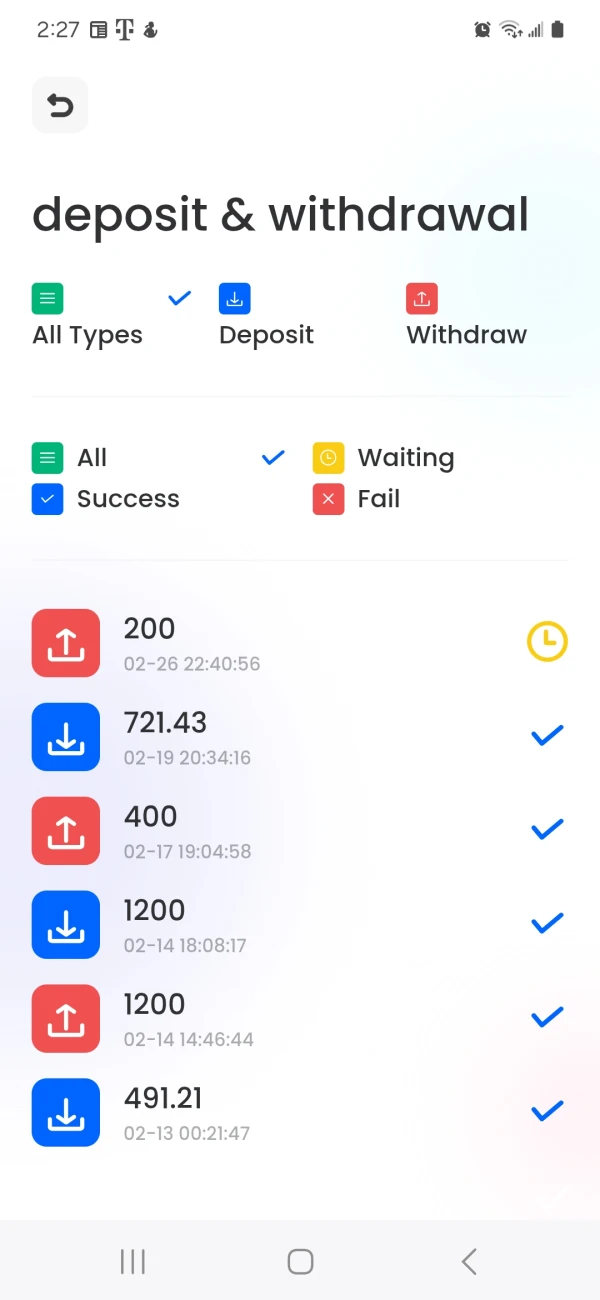

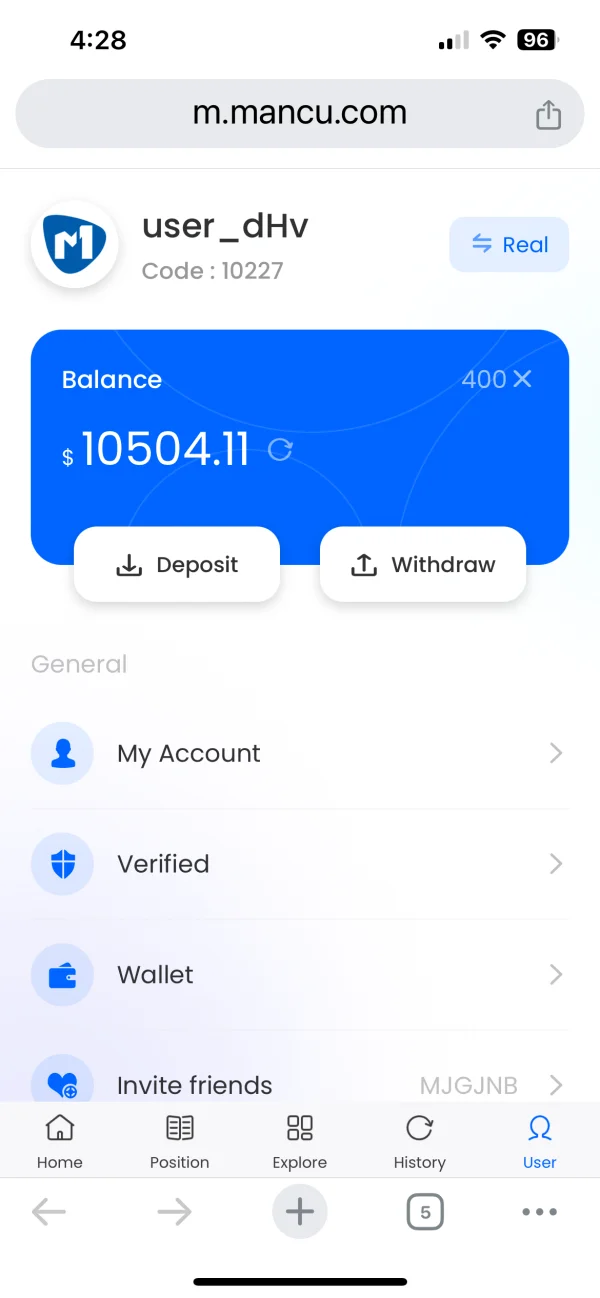

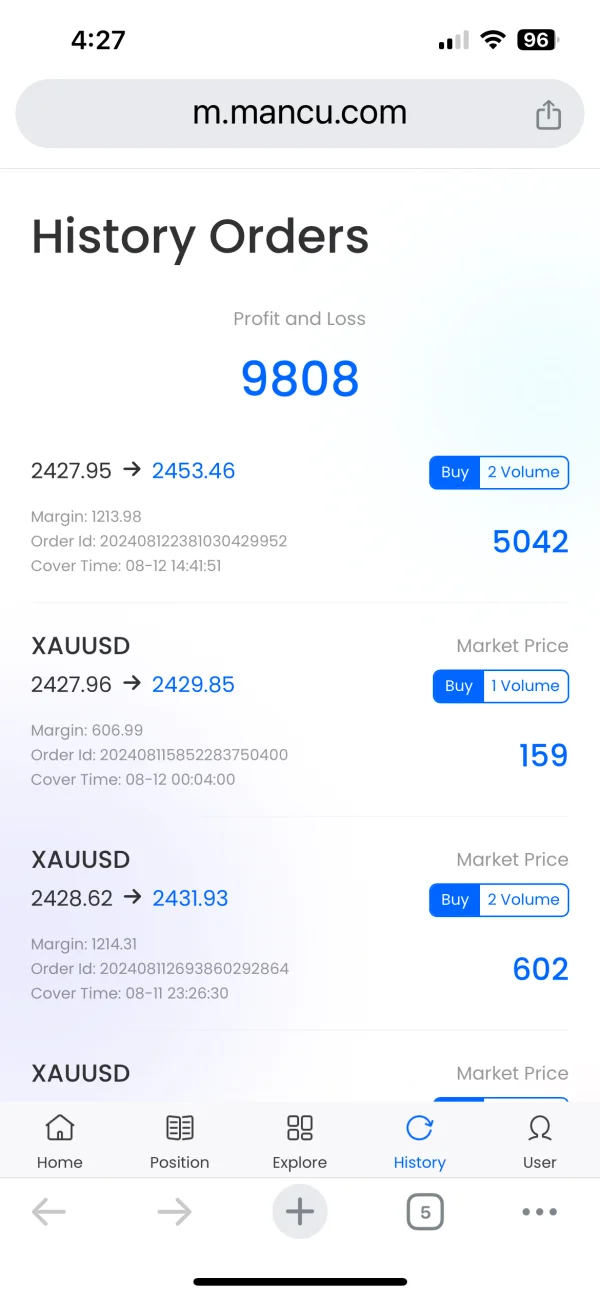

start in July 17.2024 trading gold w 1700 US dollars , was able to generate so called profit in the account .Withdraw $500 , 2 times and no problems . Meanwhile continue to trade and saw the profit up then attempt to take out $1000 . The platform blocked me saying that I launder money / tax evasion then ask me yo deposit equal amount of money that I have in the acct 10504 US dollars before I den take money out … any of you have had this problem ? scam ?

Exposure

PEACELOVE1

New Zealand

User-friendly platform and fast withdrawals. The range of financial instruments is impressive

Positive

PEACELOVE1

New Zealand

User-friendly platform and fast withdrawals. The range of financial instruments is impressive

Positive

EXOKAY

Kazakhstan

Attended their Trading Club and they asked me if I can add a review of the course (bit cheeky). Don't mind leaving them 5 stars though because in truth the class was really good and I learned a lot about Technical Analysis.

Positive

Gapday

Nigeria

Very good broker seldom have any problems just that sometimes on New York sessions I cannot connect to my broker Via tradingview on my laptop Atleast C-Trader on the phone is always accessible

Positive

Charlie Edward

United Kingdom

6 months in with ManCu, and I'm a huge fan! Their spreads are unbeatable compared to any other broker I've tried. The platform itself is lightning-fast, and trade executions are super speedy too. Deposits and withdrawals are a breeze – both easy and quick. The only point that I am not satisfied was that its small product options.

Positive

Runningman

Australia

I was trading with $5 but when there is a news on USD you can't trade with the same $5 (for 1: unlimited) making me miss that trade.

Neutral