No data

Do you want to know which is the better broker between Swissquote and Interactive Brokers ?

In the table below, you can compare the features of Swissquote , Interactive Brokers side by side to determine the best fit for your needs.

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of swissquote, interactive-brokers lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Swissquote | Basic Information |

| Founded in | 1996 |

| Headquarters | Gland, Switzerland |

| Regulation | FINMA, FCA, MFSA, SFC |

| Tradable Instruments | Forex, Stocks, Options, Futures, CFDs, ETFs |

| Account Types | Standard, Premium |

| Minimum Initial Deposit | $1,000 |

| Maximum Leverage | 1:100 |

| Commission | Depends on the account type and instrument traded |

| Spreads | Variable, starting from 0.6 pips |

| Trading Assets | Currencies, Stocks, Bonds, Options, Futures, and Funds |

| Trading Platforms | MetaTrader 4, MetaTrader 5 |

| Customer Support | Phone, Email, Live Chat |

| Educational Resources | Webinars, Tutorials, Market Analysis, News |

| Additional Features | Swiss DOTS (Structured Products), Robo-Advisory |

Swissquote is a leading online forex and financial trading broker headquartered in Switzerland. It was established in 1996 and has since grown to become a popular choice among traders worldwide. The broker offers a wide range of financial instruments to trade, including forex, stocks, indices, commodities, bonds, and cryptocurrencies.

Swissquote offers several account types, including Standard, Premium, Prime, and Professional, to cater to different trader needs. The minimum deposit for a Standard account is $1,000, which is relatively high compared to some other brokers. However, the broker's range of account types and trading conditions may appeal to professional traders who require higher leverage and tighter spreads.

Swissquote provides its clients with access to several trading platforms, including MetaTrader 4 and 5, Advanced Trader, and their proprietary platform, Swissquote EDGE. The broker's platforms are user-friendly, feature-rich, and offer advanced trading tools and charting capabilities.

Yes, Swissquote is a legitimate broker with four entities under respective jurisdictions:

Swissquote Bank Ltd, which is based in Switzerland, is regulated by the Swiss Financial Market Supervisory Authority (FINMA).

Swissquote Ltd, which is based in the United Kingdom, is regulated by the Financial Conduct Authority (FCA).

Swissquote MEA Ltd, which is based in Dubai, is regulated by the Dubai Financial Services Authority (DFSA).

SWISSQUOTE FINANCIAL SERVICES (MALTA) LTD, is regulated by the Malta Financial Services Authority (MFSA).

These regulatory authorities ensure that Swissquote adheres to strict standards in terms of financial stability, transparency, and investor protection.

Swissquote is areputable and regulated broker, offering an array of financial instruments and account types for traders to choose from. As with any broker, there are advantages and disadvantages to consider. In the following table, we present a summary of the key pros and cons of trading with Swissquote. Swissquote undoubtedly offers a comprehensive range of trading instruments and state-of-the-art trading platforms that are designed to cater to the diverse trading needs of both novice and experienced traders. However, despite its many strengths, it falls short in terms of customer support, as it does not provide round-the-clock assistance, which can be a major drawback for traders who require immediate assistance during off-hours or in emergency situations. Whether you are a beginner or an experienced trader, this information can help you make an informed decision about whether Swissquote is the right broker for you.

| Pros | Cons |

| Regulated by reputable authorities including FINMA and FCA | Relatively high trading fees compared to other brokers |

| Wide range of trading instruments including forex, stocks, ETFs, bonds, and cryptocurrencies | Limited education and research resources |

| Competitive spreads and commissions | Inactivity fee charged after 24 months of inactivity |

| Demo Account Available | No 24/7 customer support |

| Various account types with different features to suit different trading needs | High minimum deposit requirement |

| Availability of advanced trading platforms including MT4, MT5, and Advanced Trader | Limited customer support options outside of business hours |

| Efficient and reliable customer support during business hours | No US clients accepted |

Swissquote offers a wide range of market instruments for trading, including over 130 currency pairs, commodities, stock indices, shares, bonds, and cryptocurrencies. As a well-established Swiss broker, Swissquote is able to offer trading on several Swiss-specific instruments, such as the Swiss Market Index (SMI) and the Swissquote Group Holding Ltd. (SQN) stock, as well as access to other global exchanges such as the NYSE, NASDAQ, and LSE. With such a broad range of market instruments, traders of different experience levels can find suitable trading options that align with their trading strategies and investment goals.

Swissquote offers a range of account types to cater to the varying needs and preferences of its clients. The primary account types available are the Premium Account, Prime Account, Elite Account and Professional Account. Each account type comes with distinct features and benefits, such as different minimum deposit requirements, leverage ratios, and spreads. The Premium Account requires a minimum deposit of 1,000 CHF or equivalent, while the Prime Accounts require a higher minimum deposit of 5,000 CHF or equivalent. The Elite and Professional accounts ask for the highest minimum deposit of 10,0000 CHF or equivalent.

The Standard Account provides clients with access to a wide range of financial instruments, including forex, CFDs, stocks, options, futures, and bonds. The Premium Account, on the other hand, is designed for high-volume traders and offers lower spreads and commissions, as well as personalized service. The Prime Account is designed for institutional clients and provides them with a dedicated account manager, as well as access to exclusive liquidity and pricing.

Moreover, Swissquote also offers an Islamic Account, which is compliant with Sharia law and is available to clients who follow the Islamic faith.

Swissquote offers a free demo account for clients to practice trading strategies and test out the broker's trading platforms without risking any real funds. The demo account provides users with virtual funds to trade on the same live markets as the actual trading accounts. The account comes with real-time pricing and charting tools, allowing traders to simulate trading conditions as closely as possible. This is an excellent opportunity for traders to get familiar with the broker's platforms and trading environment before committing any real money. Moreover, the demo account is ideal for both novice and experienced traders who want to try new trading strategies or test their current trading strategies without incurring any financial risk.

Overall, demo accounts are a valuable resource for any trader who wishes to sharpen their skills and become more proficient in their trading activities.

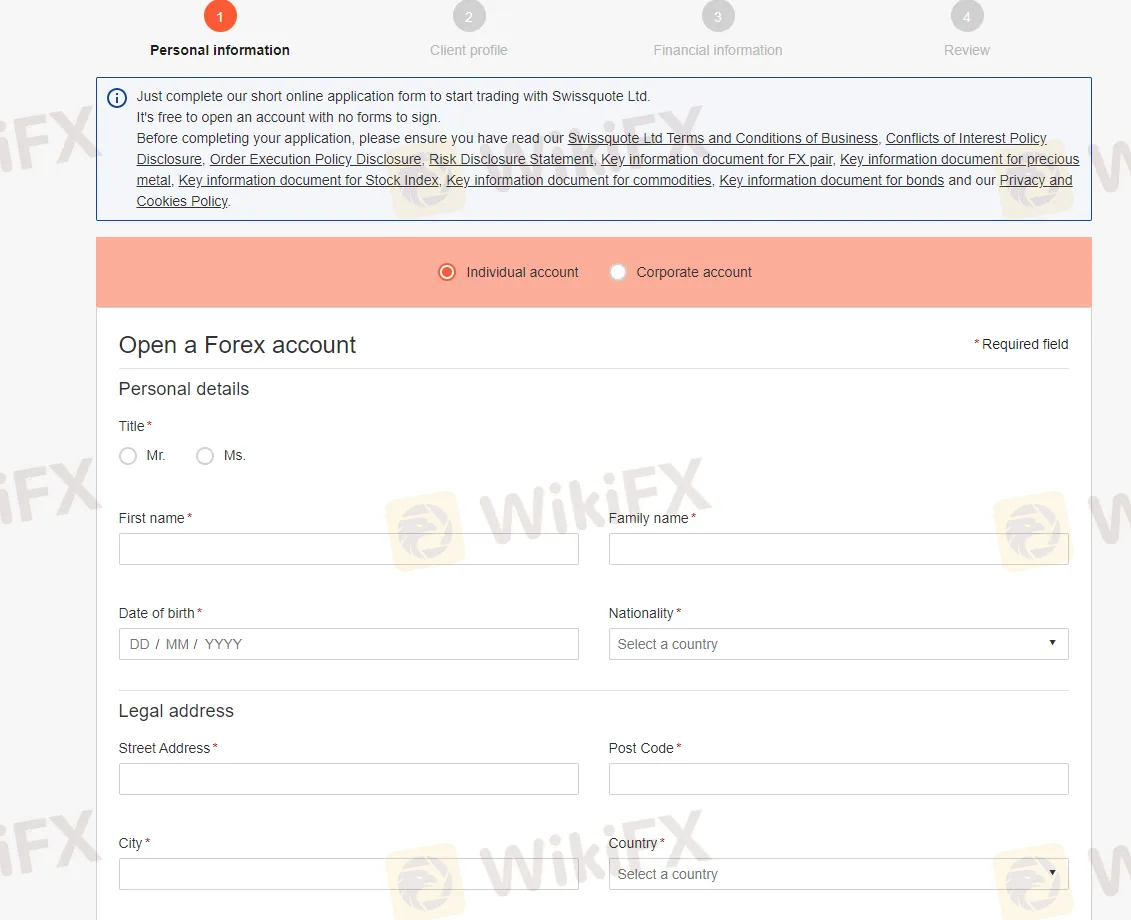

Visit the Swissquote website and click on the “Open your Account” button.

Provide personal information, such as name, email, and phone number, along with a valid identification document, such as a passport or driver's license.

After the account is created and verified, the next step is to select the desired account type and deposit funds, such as Premium, Prime or Elite accounts.

Agree to the terms and conditions and submit your application.

Swissquote offers several convenient deposit methods, including bank transfer, credit/debit card, and online payment services. Once the account is funded, traders can access the trading platforms, begin analyzing the markets, and placing trades on a variety of financial instruments.

Swissquote offers variable leverage levels depending on the financial instrument and the account type. For forex trading, the maximum leverage available is typically 1:30 for retail clients and up to 1:100 for professional clients who meet certain criteria. For CFD trading on indices, commodities, and cryptocurrencies, the maximum leverage ranges from 1:10 to 1:5, depending on the underlying asset.

Always keep in mind that high leverage can significantly increase the potential gains, but it can also magnify the losses, so it's important to use it with caution and always keep in mind the risks involved.

Swissquote offers competitive spreads and commissions to its clients. The exact costs depend on the type of account and the trading instrument being traded. The Premium Account has variable spreads, with the EUR/USD spread starting from 1.3 pips, while the Prime Account offers spreads starting from 0.6 pips. The Elite Account offers spreads as low as 0.0 pips, but it requires a higher minimum deposit and trading volume. The professional accounts provide spreads from 0.0 pips too.

In terms of commissions, the Premium Account and Prime Account charge zero commission. The Elite Account and the Professional Account charge a commission of EUR2.5 per side per lot traded. Overall, Swissquote is often seen as competitive in terms of spreads and commissions when compared to other major brokers.

Below is a comparison table illustrating the spreads of EUR/USD, UK100, Gold, and Silver offered by Swissquote and three other brokers - FXTM, XM, and Plus500:

| Broker | EUR/USD Spread | UK100 Spread | Gold Spread | Silver Spread |

| Swissquote | 1.3 | 1 | 0.25 | 0.03 |

| FXTM | 1.5 | 1.2 | 0.35 | 0.03 |

| XM | 1.6 | 1 | 0.35 | 0.03 |

| Plus500 | 0.6 | 1 | 0.37 | 0.03 |

Non-trading fees are fees that Swissquote charges its clients for services that are not directly related to trading activities. Swissquote has a relatively low level of non-trading fees compared to other brokers. Swissquote does not charge deposit fees, but it charges withdrawal fees, which depend on the method used. Swissquote also charges an inactivity fee of CHF 50 per quarter if no trades have been made during the last six months. This fee is lower than the industry average, which is around $15 per month.

Besides, Swissquote also charges overnight swap fees, also known as rollover fees or financing fees, on positions that are held overnight. The amount of the fee depends on the currency pair, the size of the position, and the prevailing interest rates in the respective countries.

Swissquote offers a range of trading platforms suitable for both beginner and advanced traders. Its flagship platform is the Advanced Trader, which is a user-friendly and customizable platform that provides access to multiple markets and a wide range of trading tools. Additionally, the broker offers the popular MetaTrader 4 and 5 platforms, which are favored by many traders for their advanced charting capabilities and expert advisor features.

Swissquote Advanced Trader is a proprietary trading platform developed by Swissquote. It is a fully customizable platform designed to cater to the needs of professional traders. The platform offers advanced charting tools, a variety of technical indicators, and the ability to create and backtest trading strategies using the integrated programming language. Swissquote Advanced Trader also offers real-time news and market analysis to keep traders up-to-date with market events. The platform is available for desktop, web, and mobile devices.

Swissquote offers the popular MetaTrader 4 (MT4) trading platform to its clients, which is widely recognized in the industry for its reliability, speed, and advanced charting tools. MT4 is available for download on desktop, web, and mobile devices, allowing traders to access their accounts and manage their trades from anywhere at any time. Swissquote also offers a range of customized tools and indicators, allowing traders to personalize their trading experience on the platform. Additionally, Swissquote provides free access to Autochartist, a popular technical analysis tool that helps traders identify potential trading opportunities.

Swissquote offers the MetaTrader 5 (MT5) platform to its clients, which is the successor to the popular MT4 platform. MT5 has several advanced features such as improved charting capabilities, additional order types, and an economic calendar. Clients can also use MT5's algorithmic trading capabilities through the use of Expert Advisors (EAs) to automate their trading strategies. Swissquote's MT5 platform is available for desktop, web, and mobile devices, making it easily accessible for traders on the go.

Here is a table comparing the trading platforms offered by Swissquote, IG, and IC Markets:

| Trading Platform | Swissquote | IG Markets | IC Markets |

| MetaTrader 4 | √ | √ | √ |

| MetaTrader 5 | √ | √ | √ |

| Advanced Trader | √ | × | × |

| WebTrader | √ | √ | √ |

| Mobile App | √ | √ | √ |

Swissquote offers two primary deposit methods: wire transfer and debit card deposit. With wire transfer, clients can make deposits in various currencies, but the process may take longer, typically taking one to two business days to reflect on their account. On the other hand, debit card deposits are processed faster, typically within a few minutes, and they are available in CHF, EUR, GBP, EUR, AUD, JPY, PLN, CZK, HUF and USD.

Swissquote, a prominent brokerage firm in the financial market, has set its minimum deposit threshold at a noteworthy sum of CHF 1,000 or its equivalent in other currencies, which may be considered relatively high compared to other brokers in the industry.

Below is a comparison table depicting the minimum deposit prerequisites of Swissquote, Exness, and IG:

| Broker | Minimum Deposit |

| Swissquote | $1,000 |

| Exness | $1 |

| IG | $300 |

For withdrawals, Swissquote typically processes requests within one to two business days. Clients can withdraw funds using the same methods they used to deposit funds. However, it's important to note that some withdrawal methods may incur fees, so it's essential to check with the broker first before initiating a withdrawal request.

Swissquote offers customer support via various channels to ensure its clients receive timely and efficient assistance. Clients can reach Swissquote's customer support team via phone, email, and live chat, available during business hours. However, Swissquote's customer support is not available 24/7, which may be a disadvantage for clients who require immediate assistance outside of business hours. Nonetheless, the broker offers a comprehensive FAQ section on its website, which provides answers to some common questions, and clients can also seek assistance by submitting a ticket through the website. In addition, Swissquote offers support in several languages, including English, French, German, Italian, and Spanish, to cater to its global client base.

Swissquote offers a plethora of educational resources to help traders of all levels enhance their knowledge and skills. The broker provides various learning materials, including webinars, seminars, online courses, and e-books. Additionally, Swissquote offers market analysis and news to keep clients informed about the latest developments in the financial markets. This valuable information can help traders make informed decisions when executing their trades.

| Pros | Cons |

| Comprehensive educational material on various topics | No formal education program |

| Interactive webinars and seminars with industry experts | Limited language options for educational material |

| Wide range of market analysis tools and resources | No demo account for educational purposes |

| Access to Swissquote's research and analysis reports | Some educational material requires a paid subscription |

| Free educational material for all account holders | No personalized coaching or mentoring programs |

In conclusion, Swissquote is a well-established and highly regulated forex broker offering a wide range of trading instruments, advanced trading platforms, and competitive trading conditions. The broker has earned a strong reputation for its commitment to security, transparency, and innovation, which has made it a preferred choice for traders looking for a reliable and trustworthy trading partner. While the broker's high minimum deposit requirement may be a challenge for some traders, its educational resources and excellent customer support help to offset this disadvantage.

Q: Is Swissquote a regulated broker?

A: Yes, Swissquote is regulated by several financial authorities, including the Swiss Financial Market Supervisory Authority (FINMA) and the Financial Conduct Authority (FCA) in the UK

Q: What trading platforms are offered by Swissquote?

A: Swissquote offers several trading platforms, including the MetaTrader 4 and 5 platforms, the Advanced Trader platform, and a mobile trading app.

Q: What is the minimum deposit required to open an account with Swissquote?

A: The minimum deposit required to open an account with Swissquote is $1000.

Q: Does Swissquote offer a demo account?

A: Yes, Swissquote offers a free demo account with virtual funds for traders to practice trading strategies.

Q: How can I deposit and withdraw funds from my Swissquote account?

A: You can deposit and withdraw funds from your Swissquote account using wire transfer or debit card.

| Aspect | Information |

| Company Name | Interactive Brokers |

| Registered Country/Area | United States |

| Founded year | 1978 |

| Regulation | Suspicious Clone under ASIC, FCA, CBI, MAS |

| Market Instruments | Stocks, ETFs, forex, bonds, options, futures, CFDs, cryptocurrencies, warrants, structured products |

| Minimum Deposit | $0 |

| Customer Support | Social media (Twitter, Facebook, Instagram, YouTube, LinkedIn) |

Interactive Brokers, founded in the United States, offers a wide array of trading assets including stocks, ETFs, forex, bonds, options, and futures, providing traders with various opportunities across global markets.

However, risks have been raised about its legitimacy, with reports of the platform being identified as a suspicious clone. Traders are directly impacted by the platform's regulatory status, influencing oversight, transparency, and legal protections. Adherence to regulatory standards instills confidence among traders regarding the platform's reliability and security, while any suspicion or regulatory ambiguity may undermine trust and deter participation, emphasizing the importance of due diligence.

Interactive Brokers is identified as Suspicious Clone under various regulatory bodies such as the Australian Securities and Investments Commission (ASIC), the Financial Conduct Authority (FCA) in the United Kingdom, the Central Bank of Ireland (CBI), and the Monetary Authority of Singapore (MAS).

However, the presence of “Suspicious Clone” designations in some regions suggests potential regulatory risks. Traders on the platform are directly impacted by the regulatory status, as it influences the level of oversight, transparency, and legal protections afforded to their investments.

Adherence to regulatory standards instills confidence among traders regarding the platform's reliability and security, while any suspicion or regulatory ambiguity may undermine trust and deter participation. Thus, traders are likely to favor jurisdictions where Interactive Brokers maintains clear and reputable regulatory standing, ensuring a safer trading environment.

The prevalence of clone brokers is increasingly alarming, as deceptive entities exploit the names of reputable firms to lure unsuspecting clients into believing they are trading with regulated forex firms.

These fraudulent companies go to great lengths, even utilizing the license numbers of legitimate brokers, to deceive traders into opening accounts with them. Remaining vigilant is paramount to avoid falling prey to such scams. Additionally, these unscrupulous entities resort to aggressive tactics, akin to boiler room operations, pressuring clients into opening accounts or increasing their deposits.

It's crucial to heed the adage: if something sounds too good to be true, it likely is. Traders must exercise caution and conduct thorough research before engaging with any brokerage firm to safeguard their investments and financial security.

| Pros | Cons |

| Wide range of tradable assets | Identify as Suspicious Clone |

| Access to global markets | Limited customer support options |

| Potential for technical glitches | |

| Risk of exposure to scams |

Pros:

Wide range of tradable assets: Interactive Brokers offers an extensive selection of tradable assets, including stocks, ETFs, forex, bonds, options, and futures. This diversity provides traders with ample opportunities to diversify their portfolios and explore various investment strategies, catering to different risk appetites and objectives.

Access to global markets: The platform grants users access to a broad range of global markets, enabling them to trade securities and currencies from around the world. This global reach allows traders to capitalize on international market trends, economic developments, and geopolitical events, enhancing their trading flexibility and potential for profit.

Cons:

Identified as Suspicious Clone: Some users have reported instances where Interactive Brokers was identified as a suspicious clone, potentially raising risks about the platform's legitimacy and trustworthiness. Such allegations can undermine user confidence and deter participation in trading activities.

Limited customer support options: Interactive Brokers may offer limited options for customer support, which can lead to delays in addressing user inquiries, resolving issues, or providing assistance when needed. This lack of robust support channels may frustrate users and hinder their overall trading experience.

Potential for technical glitches: Like any online platform, Interactive Brokers is susceptible to technical glitches or system failures, which can disrupt trading activities, cause delays in order execution, or lead to inaccuracies in account information. These technical issues may impede users' ability to trade effectively and impact their overall experience on the platform.

Risk of exposure to scams: Users may face the risk of exposure to scams or fraudulent activities associated with Interactive Brokers, such as clone brokers attempting to deceive traders. Falling victim to such schemes can result in financial losses and damage to one's reputation, highlighting the importance of vigilance and due diligence when engaging with the platform.

Interactive Brokers offers a wide range of tradable financial instruments on its platform.

Traders can access a variety of assets including Stocks, ETFs, Forex, Funds, Bonds, Options, Futures, CFDs, Cryptocurrencies, Warrants, and Structured Products.

This extensive selection provides traders with opportunities to diversify their investment portfolios and pursue different trading strategies across global markets.

With access to such a broad array of instruments, traders have the flexibility to capitalize on market opportunities and manage risk effectively.

Interactive Brokers offers a variety of payment methods to fund your account:

Bank wire transfer: This is the most common and preferred method. It's free for most currencies.

ACH transfer: This is another electronic transfer option available for US accounts. It's also free.

Check: You can mail a check to Interactive Brokers. However, there may be processing fees and delays associated with this method.

Wire transfer from another brokerage: You can transfer funds from another brokerage account to your Interactive Brokers account. This may be subject to fees from both brokers.

Bill pay: This option is available for US accounts only. It allows you to pay your Interactive Brokers account from your bank's online bill pay service.

Third-party deposits: Interactive Brokers generally discourages and rejects third-party deposits due to potential fraud and money laundering risks.

There is no minimum deposit required to open an Interactive Brokers account. This makes it a good option for beginners who want to start with a small amount of money.

Interactive Brokers provides the following contact information for customer support:

Twitter: @IBKR

Facebook: Interactive Brokers

Instagram: Interactive Brokers

YouTube: Interactive Brokers

LinkedIn: Interactive Brokers

These social media platforms serve as channels for reaching out to Interactive Brokers for support and assistance. However, Interactive Brokers' customer support lacks efficiency and responsiveness. Traders often encounter significant delays in receiving assistance, with support tickets remaining unresolved for extended periods. Communication channels such as Twitter, Facebook, Instagram, YouTube, and LinkedIn are available, but their effectiveness in addressing customer risks is questionable.

Users have reported a single instance of exposure related to a pyramid scheme complaint, which unveiled a potential scam on the Interactive Brokers platform.

The complaint alleges that the platform induced clients to participate in activities, promising withdrawal options upon event completion. However, upon attempting to withdraw profits, users encountered obstacles, including unexpected tax requirements not deducted from the platform. The inability to access funds and unresponsive customer service exacerbates the situation for affected users. Such exposure to fraudulent activities undermines trust and confidence in the platform, potentially dissuading traders from engaging in further transactions.

This instance of Interactive Brokers is suspected to be a clone operated by a company known as Interactive Brokers Group, Inc. Notably, this particular iteration of Interactive Brokers lacks regulation, posing potential risks for traders. Therefore, it is advisable for traders to refrain from engaging with this broker.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive swissquote and interactive-brokers are, we first considered common fees for standard accounts. On swissquote, the average spread for the EUR/USD currency pair is -- pips, while on interactive-brokers the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

swissquote is regulated by FCA,MFSA,FINMA,DFSA. interactive-brokers is regulated by ASIC,FCA,CBI,MAS.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

swissquote provides trading platform including professional ,standard,prime,premium and trading variety including custom. interactive-brokers provides trading platform including -- and trading variety including --.