No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between Plus500 and Tickmill ?

In the table below, you can compare the features of Plus500 , Tickmill side by side to determine the best fit for your needs.

EURUSD: 0.2

XAUUSD: 1.6

Long: -6.14

Short: 2.69

Long: -32.81

Short: 22

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of plus500, tickmill lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Plus500 Review Summary of 10 Points | |

| Founded | 2008 |

| Headquarters | Israel |

| Regulation | FCA, CySEC, ASIC, FMA, MAS |

| Market Instruments | forex, cryptocurrencies, stocks, indices, commodities, and options |

| Demo Account | Available |

| Leverage | 1:30 (forex), 1:20 (indices), 1:10 (commodities), 1:2 (cryptocurrencies), 1:5 (stocks) |

| EUR/USD Spread | 0.5 pips |

| Trading Platforms | own proprietary trading platform (desktop, web, and mobile) |

| Minimum deposit | $/€/£100 |

| Customer Support | 24/7 email, WhatsApp and live chat |

Plus500 is an online trading platform that offers Contracts for Difference (CFDs) on a range of financial instruments including stocks, forex, commodities, cryptocurrencies, options, and indices. The platform was founded in 2008 and is headquartered in Israel, with additional offices in the UK, Cyprus, Australia, and Singapore. Plus500 is authorized and regulated by several financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, and the Australian Securities and Investments Commission (ASIC) in Australia. The platform is available in more than 50 countries and supports over 30 languages.

Plus500 is a CFD (Contracts for Difference) broker, which means that it offers trading on derivatives based on various financial assets without actually owning the underlying assets. Traders can speculate on the price movements of assets such as stocks, forex, commodities, cryptocurrencies, and indices without having to buy or sell the assets themselves. As a CFD broker, Plus500 allows traders to take both long and short positions, and offers leverage which can increase potential profits (and losses).

Plus500 is a good option for traders looking for a user-friendly platform to trade a wide range of markets and instruments, with competitive spreads and no commissions.

However, traders who require advanced charting tools, educational resources, and alternative trading platforms may need to consider other brokers.

| Pros | Cons |

| • Simple and easy-to-use trading platform | • Limited product offering |

| • Commission-free trading | • Limited research and educational tools |

| • Tight spreads | • No support for MetaTrader platform |

| • Negative balance protection | • Limited customer support options |

| • Regulated by reputable financial authorities | • No phone support |

| • Free demo account | • Withdrawal fees for some payment methods |

| • Limited trading tools and features |

Note that the information presented in the table is based on general observations and may vary depending on individual circumstances and preferences.

There are many alternative brokers to Plus500, and the best one for you will depend on your individual trading needs and preferences. Here are some popular alternatives to Plus500:

eToro: eToro is a social trading platform that allows you to copy the trades of other traders. It offers a wide range of trading instruments and has a user-friendly platform.

IG: IG is a well-established broker that offers a wide range of trading instruments, including forex, stocks, and commodities. It also offers a range of educational resources and has a user-friendly platform.

XM: XM is a popular broker that offers competitive spreads and a range of trading instruments, including forex, stocks, and commodities. It also offers a range of educational resources and has a user-friendly platform.

Pepperstone: Pepperstone is a popular broker that offers competitive spreads and a range of trading instruments, including forex, stocks, and commodities. It also offers a range of educational resources and has a user-friendly platform.

IC Markets: IC Markets is a popular broker that offers competitive spreads and a range of trading instruments, including forex, stocks, and commodities. It also offers a range of educational resources and has a user-friendly platform.

It's important to do your own research and compare the features and fees of different brokers before making a decision.

Plus500 is considered legitimate as it is authorized and regulated by several top-tier financial authorities, including the UK's Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC). Plus500 is also publicly traded on the London Stock Exchange, which provides additional transparency and accountability. The broker has been in operation since 2008 and has a large and established customer base. However, it is worth noting that no broker is entirely risk-free, and traders should always do their own due diligence before depositing funds with any broker.

Plus500 takes several measures to ensure the safety and protection of its clients, and the fact that it is a regulated broker provides additional reassurance to clients. Here is a table outlining how Plus500 protects its clients:

| Protection Measure | Detail |

| Segregated Funds | Client funds are kept separate from company funds |

| Negative Balance Protection | Clients can't lose more than their account balance |

| Risk Management Tools | Stop loss, limit order and other tools to help manage risk |

| Account Verification | Rigorous account verification process to prevent fraud and unauthorized access |

| SSL Encryption | Secure Socket Layer (SSL) encryption used for all communication and data transfer |

| Regulatory Oversight | Regulated by multiple reputable financial authorities |

| Investor Compensation Fund | Eligible clients may receive compensation in the event of insolvency or bankruptcy |

Note: This table provides a brief overview of Plus500's client protection measures and is not exhaustive. Clients should always refer to Plus500's official website and legal documents for complete and up-to-date information.

Overall, Plus500 appears to be a reliable broker with a strong emphasis on client protection. The company is regulated by multiple reputable financial authorities, has a robust risk management system in place, and offers negative balance protection to clients. Plus500 also uses encryption technology to protect clients' personal and financial information.

However, it is important to note that no broker is completely risk-free, and clients should always carefully consider their investment goals and risk tolerance before trading with any broker.

Plus500 offers a wide range of trading instruments including:

Forex pairs - major, minor, and exotic currency pairs

Stocks - CFDs on stocks from various international markets

Indices - CFDs on major stock indices like S&P 500, Nasdaq, FTSE 100, and more

Commodities - CFDs on precious metals, energies, and agricultural products

Cryptocurrencies - CFDs on popular digital currencies like Bitcoin, Ethereum, Litecoin, and more

Plus500 offers two types of accounts: a live trading account and a demo account.

The live trading account requires a minimum deposit of $100 and provides access to real-time market prices and trading in over 2,000 instruments. Traders can use leverage of up to 1:30 for retail clients and up to 1:300 for professional clients. The live account offers various features such as stop loss, take profit, and guaranteed stop loss orders. There are no commissions charged on trades. Instead, the company earns money through the bid-ask spread.

The demo account is free and allows traders to practice trading using virtual funds with access to the same trading instruments as the live account. It is a great way for traders to learn how the platform works, practice trading strategies, and get familiar with trading instruments before investing real money. The demo account is available for unlimited time and can be used to test new trading strategies without the risk of losing real money.

Plus500 offers leverage for different financial instruments. The maximum leverage offered depends on the instrument and the jurisdiction where the trader is located. In general, the leverage for forex trading can be up to 1:30 for retail clients in the European Union, and up to 1:300 for professional clients.

For other instruments, such as stocks, commodities, and cryptocurrencies, the leverage can vary between 1:5 and 1:30 for retail clients, and up to 1:300 for professional clients.

It's important to note that higher leverage can amplify both profits and losses, and traders should use it with caution and proper risk management.

Plus500 offers floating spreads on all trading instruments, meaning the spreads can fluctuate based on market conditions. The spreads can start from as low as 0.5 pips for major currency pairs like EUR/USD. Plus500 does not charge any commission on trades, and their revenue comes solely from the spreads offered.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| Plus500 | 0.5 pips | No |

| eToro | 1.0 pips | No |

| IG | 0.75 pips | Yes |

| XM | 1.6 pips | No |

| Pepperstone | 0.16 pips | Yes |

| IC Markets | 0.1 pips | Yes |

Note that spreads and commissions are subject to change and can vary depending on the account type, trading platform, and other factors. Traders should always check the broker's website for the most up-to-date and accurate information.

The Plus500 trading platform is an in-house developed web-based platform that can be accessed directly from the Plus500 website. The platform is user-friendly and intuitive, making it easy for traders to navigate and trade various financial instruments. It is also available in several languages.

The Plus500 trading platform offers several advanced features, including price alerts, real-time charts, and technical analysis tools. The platform also includes a demo account that traders can use to practice trading without risking any real money.

Overall, the Plus500 trading platform is well-designed and functional, but it may lack some of the advanced features found in other trading platforms. See the trading platform comparison table below:

| Broker | Trading Platforms |

| Plus500 | Plus500 WebTrader, Plus500 Windows Trader, Plus500 mobile app |

| eToro | eToro WebTrader, eToro mobile app |

| IG | IG Trading Platform, IG mobile app |

| XM | MetaTrader 4, MetaTrader 5, XM WebTrader, XM mobile app |

| Pepperstone | MetaTrader 4, MetaTrader 5, cTrader, Pepperstone mobile app |

| IC Markets | MetaTrader 4, MetaTrader 5, cTrader, IC Markets mobile app |

Plus500 offers several deposit and withdrawal methods, including:

Credit/debit card (Visa or Mastercard)

PayPal

Bank transfer

Electronic wallets (Skrill, Neteller)

It's worth noting that the availability of certain payment methods may vary depending on your location.

Plus500 does not charge deposit or withdrawal fees, but some payment providers may charge transaction fees, which should be checked with the provider directly. Plus500 also requires users to withdraw funds using the same payment method that was used for depositing funds, up to the deposited amount. Any excess profits can be withdrawn using any other payment method supported by Plus500.

The minimum deposit requirement for Plus500 varies depending on the jurisdiction and the account type. In general, the minimum deposit ranges from $100 to $1,000. For example, in the UK, the minimum deposit is £100. In Australia, it is AUD 100, and in the EU, it is €100. It is recommended to check the specific minimum deposit requirement for your country and account type on the Plus500 website.

| Plus500 | Most other | |

| Minimum Deposit | $/€/£100 | $/€/£100 |

To withdraw funds from Plus500, you need to follow these steps:

Step 1: Log in to your Plus500 account and click on the “Funds Management” tab.

Step 2: Click on “Withdrawal” and select your preferred withdrawal method.

Step 3: Enter the amount you wish to withdraw and any additional information required for the withdrawal method you have chosen.

Step 4: Click on “Submit” to initiate the withdrawal process.

It is worth noting that Plus500 may require additional documentation or information to verify your identity before processing your withdrawal request. The processing time for withdrawals may also vary depending on your chosen withdrawal method.

Plus500 charges overnight funding fees for holding positions overnight. There are no fees for deposits and withdrawals, and inactivity fees only apply after three months of inactivity.

The overnight funding fee is a cost incurred for holding positions overnight and can be a credit or debit to your account depending on the direction of the position and the prevailing interest rates. The funding rate varies based on the instrument traded.

It is important to note that Plus500 may also charge additional fees for certain actions like guaranteed stop-loss orders or currency conversions.

Overall, while the fees for Plus500 are relatively low, traders should be aware of the potential for higher overnight funding fees, as well as any additional fees that may apply for certain actions.

See the fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| Plus500 | Free | $5-$10 | $10/month |

| eToro | Free | $5 | $10/month |

| IG | Free | Free | $18/month |

| XM | Free | Free | $5/month |

| Pepperstone | Free | Free | $0 |

| IC Markets | Free | $3.5 | $0 |

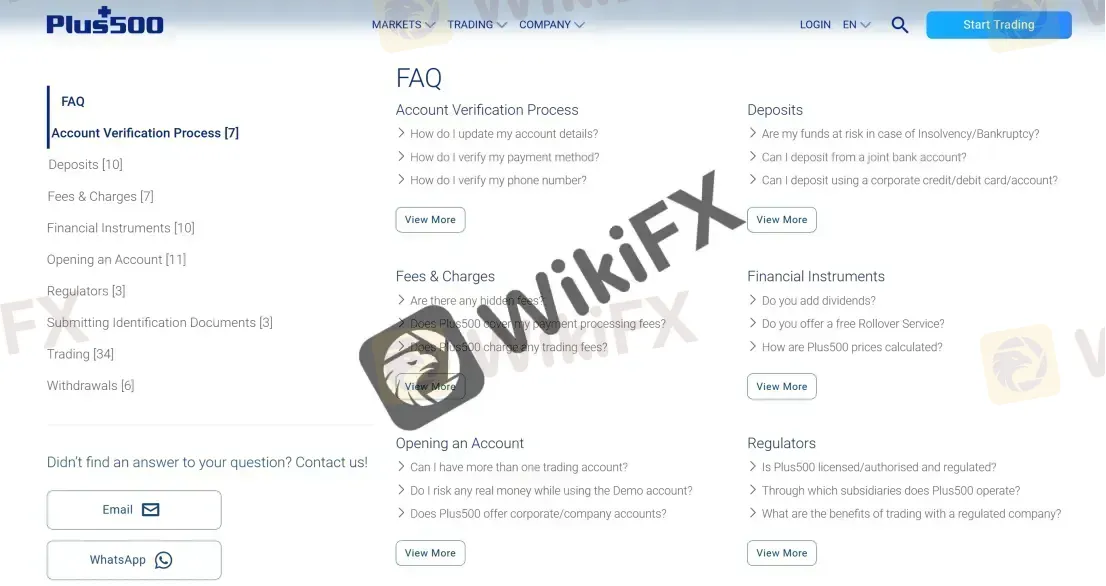

Plus500 offers customer service through email, WhatsApp and live chat. The live chat is available 24/7, while email and WhatsApp support is available during business hours. Plus500 also provides an extensive FAQ section on their website, which covers many commonly asked questions about their services and trading platform.

You can also follow Plus500 on some social networks such as Facebook, Twitter and Instagram.

Overall, Plus500's customer service is considered to be adequate, with prompt responses and helpful support staff. However, some users have reported difficulty reaching support during busy times or experiencing long wait times for responses to their queries.

| Pros | Cons |

| • 24/7 customer support via live chat | • No phone support available |

| • Multilingual support | • Sometimes response is not prompt |

| • User-friendly help center and FAQ section |

Note: These pros and cons are subjective and may vary depending on the individual's experience with Plus500's customer service.

Plus500 provides an educational section on their website, which includes video tutorials, a demo account, and a FAQ section. The educational resources cover topics such as trading basics, technical analysis, and risk management. However, the educational content is relatively limited compared to some other brokers and may not be sufficient for beginners looking to learn about trading.

Overall, Plus500 is a reputable and reliable online broker that offers a user-friendly trading platform, competitive spreads, and a wide range of trading instruments. It has a strong regulatory framework and offers various measures to protect its clients. Plus500 also provides excellent customer service with a 24/7 support team available via live chat.

However, Plus500 does have some drawbacks, such as limited educational resources, lack of a dedicated account manager, and a relatively high inactivity fee. Additionally, the broker's trading platform may not be suitable for advanced traders who require advanced charting tools and features.

In summary, Plus500 is an excellent option for beginner traders who are looking for a straightforward and easy-to-use trading platform with a low minimum deposit requirement. It is also a good choice for experienced traders who prioritize a strong regulatory framework and reliable customer service over advanced trading features.

| Q 1: | Is Plus500 regulated? |

| A 1: | Yes. Plus500 is regulated by FCA, CySEC, ASIC, FMA, and MAS. |

| Q 2: | Does Plus500 offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does Plus500 offer industry-standard MT4 & MT5? |

| A 3: | No. Instead, Plus500 offers its own proprietary trading platform (desktop, web, and mobile). |

| Q 4: | What is the minimum deposit for Plus500? |

| A 4: | The minimum initial deposit to open an account is $/€/£100. |

| Q 5: | Is Plus500 a good broker for beginners? |

| A 5: | Yes. Plus500 is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

| Tickmill Review Summary in 10 Points | |

| Founded | 2014 |

| Headquarters | London, UK |

| Regulation | FCA, CySEC, FSCA, LFSA |

| Market Instruments | Forex, stock indices, stocks & ETFs, bonds, commdities, cryptos, futuires & options |

| Demo Account | Available |

| Copy Trading | Yes |

| Leverage | 1:1-1:500 |

| Spread from | 1.6 pips (Classic) |

| Trading Platforms | MT4, MT5, Tickmill Mobile App |

| Minimum deposit | $/€/£/R100 |

| Customer Support | Live chat, phone, email, social media, FAQ |

| Bonus | A $30 welcome bonus |

Tickmill, the trading name of Tickmill Group of companies, is a regulated global forex and CFD brokerage company established in 2014, headquartered in London, UK. Tickmill offers trading in forex, stock indices, stocks & ETFs, bonds, commdities, cryptos, futuires & options, and provides clients with a choice of three trading accounts, which are the Classic account, the Pro account, and the VIP account. Tickmill also offers MetaTrader4/5 and proprietry mobile app platforms for trading, as well as a range of trading tools and educational resources.

Tickmill operates as a no dealing desk (NDD) broker. This means that the broker doesn't take the other side of clients' trades but instead passes them on to liquidity providers. Tickmill offers both retail and institutional trading services and provides access to a wide range of financial instruments. They also offer various trading platforms and account types to suit different trading styles and needs.

| Pros | Cons |

| • Regulated by multiple reputable authorities | • Regional restrictions |

| • Tight spreads and low commissions | • No 24/7 customer support |

| • Wide range of trading platforms | |

| • Access to a variety of markets | |

| • Negative balance protection | |

| • Multiple account types to suit different traders | |

| • Rich educational resources |

Tickmill is a reputable and reliable broker that offers competitive trading conditions and a wide range of trading instruments. Its low spreads and fees, multiple account types, various trading platforms and rich tarding tools and educational resources are attractive to traders of all levels.

However, Tickmill is not available in all countries, and their customer support operates within specific working hours. It's important for potential users to verify these details ahead of registration.

Nonetheless, its overall transparency, security, and quality of service make it a popular choice among traders worldwide.

Tickmill is a regulated broker that holds licenses from respected financial authorities, including Financial Conduct Authority (FCA, No. 717270), Cyprus Securities and Exchange Commission (CYSEC, No. 278/15), Financial Sector Conduct Authority (FSCA, No. 49464), and Labuan Financial Services Authority (LFSA, No. MB/18/0028).

This indicates that it complies with the required regulations and standards to provide financial services to their clients. Additionally, Tickmill has been in operation since 2014 and has gained a good reputation in the industry, which suggests that they are a legitimate broker.

Tickmill uses segregated accounts to keep client funds separate from its operational funds, which provides an additional layer of protection in case of the company's insolvency.

Tickmill also uses advanced security protocols and encryption technology to protect clients' personal and financial information.

The company also offers negative balance protection, which ensures that clients cannot lose more than their account balance, and it has a compensation scheme in place that can provide additional protection to eligible clients in case of the company's insolvency.

More details can be found in the table below:

| Protection Measure | Detail |

| Regulation | FCA, CySEC, FSCA, LFSA |

| Segregated Accounts | Client funds are held in segregated accounts, separated from the company's operating funds |

| Negative Balance Protection | Ensuring clients' accounts cannot go below zero |

| Investor Compensation Scheme | Clients are covered by the Financial Services Compensation Scheme (FSCS) up to £85,000 per person in the event of the broker's insolvency |

| SSL Encryption | Protecting clients' personal and financial information from unauthorized access |

| Two-Factor Authentication | To add an extra layer of security to clients' accounts |

| Anti-Money Laundering Policy | To prevent money laundering and other illegal activities |

| Privacy Policy | Ensuring clients' personal information is kept confidential and used only for legitimate purposes |

Note that this table is not exhaustive and there may be other protections or security measures in place at Tickmill.

Our Conclusion on Tickmill Reliability:

Based on the information available, Tickmill appears to be a reliable and trustworthy broker. It is regulated by reputable authorities, has been in operation for several years, and has received positive reviews from many customers.

However, as with any investment, there is always some level of risk involved, and it is important for traders to do their own research and carefully consider their options before investing.

Tickmill is a comprehensive trading platform that offers 180+ financial instruments. Their offerings include over 60 forex currency pairs, more than 15 stock indices, 500+ stocks and ETFs, bonds, various commodities including precious metals and energies, cryptocurrencies, as well as futures and options such as S&P 500, DJIA, and NASDAQ. These options provide users with the flexibility to diversify their investment portfolio.

Tickmill offers its clients three account types designed to suit different trading styles and preferences.

Classic Account: The Classic Account is suitable for new traders who want to experience real trading conditions with a low deposit.

Pro Account: The Pro Account is designed for more experienced traders who require tighter spreads and lower trading costs.

VIP Account: The VIP Account is suitable for high net worth individuals and institutional traders who require premium trading conditions.

The minimum deposit requirement is $/€/£/R100 for Classic and Pro accounts. The minimum balance is $/€/£/R50,000 on the VIP account.

All account types at Tickmill offer access to the same range of trading instruments. Additionally, all accounts can be opened as Islamic accounts, which are swap-free accounts for traders who follow Sharia law.

Prior to committing to various live trading accounts, clients have the option to explore Go Markets' offerings through the provided demo accounts, allowing them to familiarize themselves with the trading environment before engaging in real trading activities.

Step 1: Register

Click on ‘Create account’. Enter your personal details and check your email for verification.

Step 2: Upload Documents

Submit your Proof of Identity and Proof of Address to complete registration.

Step 3: Fund and Choose Platform

Open a trading account, deposit to your Tickmill wallet, transfer funds from your Tickmill wallet to your live trading account and download the trading platform of your choice to start trading.

Tickmill offers flexible leverage ranging from 1:1 to 1:500, depending on the account type and the instrument traded. The maximum leverage available for forex trading is 1:500. For stock indices, commodities and bonds, the maximum leverage is 1:100. For cryptocurrencies, the maximum leverage is 1:200.

| Forex | 1:500 |

| Stock indices | 1:100 |

| Commodities | 1:100 |

| Bonds | 1:100 |

| Cryptocurrecnies | 1:200 |

It's important to note that higher leverage levels increase the potential profits but also increase the potential losses, so it's important to use leverage carefully and manage risk appropriately.

Tickmill offers different account types with different spread and commission structures. Specifically, clients on the Classic account have spread from 1.6 pips with no commission charged, the Pro account has spread from 0.0 pips with a commission of 2 per side per 100,000 traded, and the VIP account has spread from 0.0 pips with a commission of 1 per side per 100,000 traded.

| Spread | Commission | |

| Classic Account | From 1.6 pips | 2 per side per 100,000 traded |

| Pro Account | From 0.0 pips | no commission |

| VIP Account | From 0.0 pips | 1 per side per 100,000 traded |

TickMill extends a genuine welcome bonus of $30 to new traders, manifested as an automatic complimentary deposit of $30 into the Welcome Account upon account opening. However, the Welcome Account is denominated exclusively in US Dollars (USD).

Tickmill offers several trading platforms for its clients, including:

MetaTrader 4 (MT4): This is a popular trading platform among forex traders due to its advanced charting capabilities, numerous technical indicators, and ability to run automated trading strategies.

MetaTrader 5 (MT5): This is an upgraded version of MT4, offering additional features such as more timeframes, depth of market, and the ability to trade other instruments such as stocks and commodities.

Tickmill Mobile App: This is a proprietary platform developed by Tickmill, offering a user-friendly interface, advanced charting tools, and the ability to trade directly from charts.

Overall, Tickmill's trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders.

Tickmill offers copy trading features. This allows less experienced traders to copy the trades of more experienced traders, potentially increasing their chances of making profitable trades. It's a strategy often used by new traders or those looking to diversify their trading. You can copy top traders on Tickmill's website.

Another crucial factor while selecting a Forex broker is to see how to transfer money to or from your trading account. Obviously, regulated brokers adhere to best practices and are regulated by their authority in terms of money management.

Tickmill offers various deposit and withdrawal methods to its clients. The available methods may vary depending on the client's country of residence. Here are the most common methods:

Payment Options:

Bank wire transfer

Crypto payments

Credit/debit cards (Visa, Mastercard)

Skrill

Neteller

Sticpay

FasaPay

Union Pay

Web Money

Tickmill does not charge any fees for deposits or withdrawals. However, clients are advised to check with their payment providers for any transaction fees that may apply at their end. Most deposits are instant, while the typical withdrawal processing time is within 1 working day.

Minimum deposit requirement

As we have mentioned before, the minimum deposit with Tickmill is $/€/£/R100 for the Classic and Pro accounts, while the higher-grade VIP accounts will require more money of up to $/€/£/R50,000, as designed for traders with experience.

| Tickmill | Most other | |

| Minimum Deposit | $/€/£/R100 | $/€/£100 |

To withdraw funds from your Tickmill account, you need to follow these steps:

Step 1: Log in to your Tickmill Client Area.

Step 2: Select the “Withdraw Funds” option under the “Deposit & Withdraw” tab.

Step 3: Choose the payment method you want to use for withdrawal.

Step 4: Enter the amount you wish to withdraw.

Step 5: Fill out any necessary information related to your selected payment method.

Step 6: Submit your withdrawal request.

Once your withdrawal request is approved, the funds will be transferred to your selected payment method.

Tickmill does not charge deposit and withdrawal fees, but fees may be incurred by the payment method used. Also, inactivity fees of $10 per month are charged on accounts that have been inactive for over six consecutive months.

Tickmill offers customer support services to its clients via various channels, including email, phone, live chat, and social media. The broker has a multilingual customer support team that provides assistance in several languages, including English, Spanish, Italian, Chinese, and more.

Tickmill's customer service has received positive feedback from traders for its prompt and helpful responses. The broker also provides an extensive FAQ section on its website, which addresses various queries related to trading, accounts, and other services.

Tickmill is committed to providing a comprehensive education for traders at every level of experience. Their educational resources include webinars and seminars conducted by industry professionals, geared to enhance their clients' trading knowledge and skills. They offer extensive reading material such as eBooks, articles and infographics that cover a wide range of trading topics.

Tickmill also accommodates a detailed forex glossary for quick reference. They provide insights into market analysis both from a fundamental and technical perspective, offering daily market insights that help traders navigate the financial markets. This array of educational tools is designed to support traders in making informed trading decisions.

Overall, Tickmill is a good option for traders who are looking for a reliable and transparent broker with competitive trading conditions. Some of the advantages of Tickmill include its strong regulatory framework, low trading fees, a wide range of trading instruments, multiple trading platforms, and excellent customer support.

It is particularly suitable for experienced traders who are looking for a broker that provides access to a variety of markets and trading instruments, as well as competitive trading conditions. Additionally, Tickmill's demo account allows traders to test their strategies and trading skills before investing real money.

| Question 1: | Is Tickmill regulated? |

| Answer 1: | Yes. It is regulated by FCA, CySEC, FSCA, and LFSA. |

| Question 2: | At Tickmill, are there any regional restrictions for traders? |

| Answer 2: | Yes. The services of Tickmill and the information on this site are not directed at citizens/residents of the United States and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. |

| Question 3: | Does Tickmill offer demo accounts? |

| Answer 3: | Yes. |

| Question 4: | Does Tickmill offer the industry-standard MT4 & MT5? |

| Answer 4: | Yes. Both MT4 and MT5 are available. |

| Question 5: | What is the minimum deposit for Tickmill? |

| Answer 5: | The minimum initial deposit to open an account is $/€/£/R100. |

| Question 6: | Is Tickmill a good broker for beginners? |

| Answer 6: | Yes. It is a good choice for beginners because Tickmill is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 and MT5 platforms. Also, it offers demo accounts that allow beginners to practice trading without risking any real money. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive plus500 and tickmill are, we first considered common fees for standard accounts. On plus500, the average spread for the EUR/USD currency pair is -- pips, while on tickmill the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

plus500 is regulated by ASIC,FSA,CYSEC,FCA,FMA,MAS. tickmill is regulated by FCA,CYSEC,FSCA,LFSA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

plus500 provides trading platform including -- and trading variety including --. tickmill provides trading platform including FUTURES ACCOUNT,PRO ACCOUNT,VIP ACCOUNT,CLASSIC ACCOUNT and trading variety including CME, NYMEX, COMEX, CBOT, EUREX.