User Reviews

Sort by content

- Sort by content

- Sort by time

User comment

4

CommentsWrite a review

2024-02-23 11:16

2024-02-23 11:16

2023-03-13 11:17

2023-03-13 11:17

Bangladesh|5-10 years|

Bangladesh|5-10 years| http://www.ificbank.com.bd/

Website

Influence

B

Influence index NO.1

Bangladesh 8.02

Bangladesh 8.02No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

09666716250

More

IFIC Bank Limited.

IFIC Bank

Bangladesh

Pyramid scheme complaint

Expose

| Registered in | Bangladesh |

| Regulated by | Information not available |

| Year(s) of establishment | 40+ years |

| Products and services | deposit accounts, loans, cards, and online banking. |

| Minimum Initial Deposit | Information not available |

| Maximum Leverage | Information not available |

| Minimum spread | Information not available |

| Trading platform | own platform |

| Deposit and withdrawal method | Bank wire transfer |

| Customer Service | Email, phone number, address, live chat |

| Fraud Complaints Exposure | No for now |

It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Pros:

Wide range of banking products and services.

Competitive interest rates and fees.

User-friendly online and mobile banking platforms.

Strong reputation and trustworthiness.

Comprehensive educational resources for customers.

Cons:

Limited availability or eligibility requirements for some products and services.

High fees and charges for certain services.

Limited physical presence and branch network.

Some customers may prefer traditional banking methods and may not be comfortable with online or mobile banking.

Technical issues or downtime may occur, causing inconvenience or delay for customers.

| Advantages | Disadvantages |

| Offers a range of products and services for both retail and business customers | May have limited accessibility in some regions |

| Provides digital banking services for convenient account access | Some customers may prefer traditional banking methods |

| Has a network of branches and ATMs throughout the country | Branches and ATMs may not be as numerous as some other banks |

| Offers competitive interest rates and fees | Fees and charges may still be high compared to some other financial institutions |

| Has a strong reputation as a reliable and trusted financial institution | Some customers may prefer to bank with a smaller, community-based bank |

IFIC Bank is a private commercial bank in Bangladesh. It provides various banking products and services to individual and corporate clients. The bank is licensed and regulated by the Bangladesh Bank, the central bank of Bangladesh. It operates through a network of branches and ATMs across the country, as well as digital banking platforms.

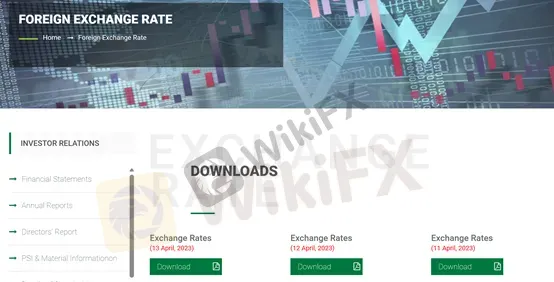

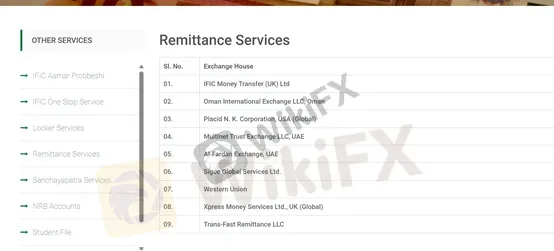

IFIC Bank is a private commercial bank in Bangladesh that was established in 1976. The bank offers a range of financial products and services to individuals and corporate customers, including deposit accounts, loans, remittance services, foreign exchange services, and more.

IFIC Bank has a strong presence in Bangladesh, with a network of over 150 branches and 278 ATM booths across the country. The bank also has a presence in Nepal and Pakistan through its subsidiaries.

In recent years, IFIC Bank has made efforts to modernize its banking services and improve its customer experience through the introduction of new technologies and digital banking solutions. The bank has also focused on expanding its SME (small and medium-sized enterprises) financing operations, aiming to support the growth of these businesses and drive economic development in Bangladesh.

Overall, IFIC Bank is considered to be one of the leading private banks in Bangladesh and has received several awards and recognitions for its performance and customer service.

In the following article, we will analyse the characteristics of this broker in all its dimensions, providing you with easy and well-organised information. If you are interested, read on.

| Advantages | Disadvantages |

| The bank has a long history of operating in the region and is well-established in the financial industry. | Some customers may prefer banks with a more global presence or reputation. |

| The bank is known for its strong commitment to corporate social responsibility and community development initiatives. | Some customers may have concerns about the bank's ethical practices or may have heard negative reviews or rumors about the bank. |

IFIC Bank has been operating for over 40 years and has established a reputation as a reliable and trustworthy financial institution. The bank has won several awards and recognition for its contribution to the banking industry in Bangladesh. In addition, IFIC Bank has a strong focus on compliance and regulatory requirements, ensuring that its operations are transparent and ethical. The bank's commitment to customer service and satisfaction has also helped to build trust and loyalty among its customers. However, there have been some concerns raised about the bank's handling of certain issues, such as the loan recovery process and customer complaints, which may have affected its reputation in some cases.

| Advantages | Disadvantages |

| Wide range of products and services, including deposit accounts, loans, cards, and online banking. | Some products and services may have limited availability or eligibility requirements. |

| Competitive interest rates and fees compared to other banks in the region. | Fees and charges may still be high compared to some other financial institutions. |

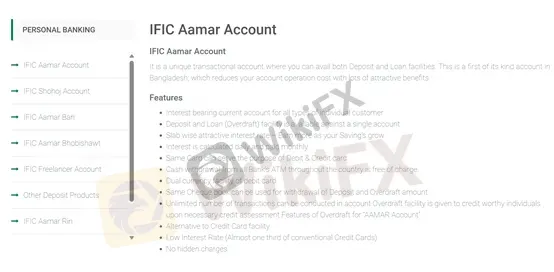

IFIC Bank offers a wide range of products to cater to the needs of its diverse customer base. For individuals, the bank provides savings accounts, fixed deposit accounts, and recurring deposit accounts that offer competitive interest rates. In addition, the bank offers credit and debit cards that come with various benefits and rewards programs. For businesses, IFIC Bank offers various loan and financing products, including term loans, working capital loans, and export-import financing services. The bank also provides trade services such as letters of credit, guarantees, and remittances. Overall, IFIC Bank's product range is quite comprehensive and is designed to meet the financial needs of both individuals and businesses.

IFIC Bank offers competitive interest rates on its products and services compared to other banks in the region. This makes it an attractive option for customers who are looking for a reliable financial institution that can provide them with a good return on their investments. Additionally, the bank's interest rates are regularly reviewed and updated to reflect changes in the market, ensuring that customers get the best possible rates. However, it's important to note that interest rates can vary depending on the type of account or service, and some may have minimum balance requirements or other eligibility criteria.

| Advantages | Disadvantages |

| Transparent fee structure, with all charges and fees clearly outlined and explained to customers. | Some fees may be higher than those of other banks, depending on the type of account or service. |

| Limited hidden fees or charges, ensuring that customers are not surprised by unexpected costs. | Some customers may prefer banks that offer no-fee or low-fee accounts and services. |

IFIC Bank has transparent fee structures for its banking services. The bank does not charge any fees for opening or maintaining a savings account. However, the bank may charge fees for certain services, such as ATM withdrawals, debit and credit card transactions, and international money transfers. These fees are reasonable compared to those of other banks, but they can still add up for frequent users. It's essential for customers to be aware of the fees and charges associated with their accounts and transactions to avoid any surprises.

| Advantages | Disadvantages |

| Variety of accounts and services to meet different customer needs | Services may not be as extensive as some competitors |

| Digital banking services provide easy access to accounts and transactions at any time and from anywhere | Some customers may find it difficult to navigate the digital banking platform |

IFIC Bank offers a variety of accounts and services to meet the needs of different customers. For retail customers, there are savings accounts, current accounts, fixed deposit accounts, and recurring deposit accounts. Business customers can benefit from current accounts, term loan facilities, and export-import financing services. In addition, IFIC Bank offers digital banking services such as internet banking, mobile banking, SMS banking, and debit and credit card facilities. These services provide customers with easy access to their accounts and transactions at any time and from anywhere. However, the bank's services may not be as extensive as some of its competitors, and some customers may find it difficult to navigate the digital banking platform.

Here is a video about their Amar account on their official YouTube channel.

| Advantages | Disadvantages |

| Online and mobile banking platforms are user-friendly and offer a range of convenient features, such as bill payment, fund transfer, and account management. | Some customers may prefer traditional banking methods and may not be comfortable with online or mobile banking. |

| Bank's website and mobile app are secure and reliable, ensuring that customer data and financial transactions are protected. | Technical issues or downtime may occur, causing inconvenience or delay for customers. |

IFIC Bank offers its customers convenient and user-friendly online and mobile banking platforms. With these platforms, customers can easily manage their accounts, pay bills, and transfer funds from anywhere and at any time. The bank's website and mobile app are also secure and reliable, ensuring the safety of customer data and financial transactions. However, some customers may prefer traditional banking methods and may not be comfortable with online or mobile banking. Additionally, technical issues or downtime may occur, causing inconvenience or delay for customers. Overall, the bank's online and mobile banking services provide a convenient and secure way for customers to manage their finances.

Based on the information available on IFIC Bank's website, it does not appear that the bank provides leverage or margin trading services. It primarily focuses on traditional banking services such as deposits, loans, and other related financial products. However, customers can still benefit from the bank's competitive interest rates and fees, as well as its online and mobile banking platforms, which offer a range of convenient features for managing their accounts and transactions.

| Advantages | Disadvantages |

| Multiple options for deposit and withdrawal including cash, cheques, and online transfers | Some deposit and withdrawal methods may have restrictions or fees |

| 24/7 availability of ATM services and online banking | Limited number of physical branches, which may not be convenient for all customers |

| Fast and efficient processing of transactions | Security concerns, such as the risk of fraud or theft, especially when using cash transactions |

| Flexible transaction limits and account balance requirements | Foreign exchange transactions may have additional fees or charges |

IFIC Bank offers various deposit and withdrawal options to its customers. Deposits can be made through cash or check, and there are also options for online deposits. Withdrawals can be made through ATMs, checks, or online transfer. The bank also offers international remittance services, making it easy for customers to send and receive money from abroad. However, some customers may face difficulties in accessing physical branches or ATMs, particularly in remote areas. Additionally, fees and transaction limits may vary depending on the specific deposit or withdrawal method chosen.

It does not appear that IFIC Bank offers any specific educational resources or programs for its customers. This may be a disadvantage for customers who are looking for educational materials or resources to help them better understand financial concepts or to make informed decisions about their finances. However, it is worth noting that many financial institutions do not offer such resources, so this may not be a significant disadvantage for all customers.

| Advantages | Disadvantages |

| 24/7 customer service available via phone, email, and online chat. | Some customers may experience long wait times or difficulty reaching a representative during busy periods. |

| Complaints and issues are resolved quickly and efficiently by the bank's dedicated customer support team. | Some customers may prefer in-person support, which may not be available in all areas. |

IFIC Bank has a customer-centric approach, and its customer service team is available to assist customers with any queries or concerns. Customers can contact the bank through phone, email, or in-person visits to any of its branches. The bank also provides a complaint management system for customers to report any grievances they may have. However, some customers have reported issues with the responsiveness of the customer service team and the resolution of their complaints.

In conclusion, IFIC Bank offers a wide range of products and services to meet the needs of its diverse customer base. The bank's competitive interest rates, easy-to-use online and mobile banking platforms, and educational resources make it an attractive option for both retail and business customers. However, some customers may find the bank's services limited compared to its competitors, and technical issues or downtime may cause inconvenience for those who rely heavily on digital banking. Despite these drawbacks, IFIC Bank has established a reputation as a trustworthy and reliable financial institution with a commitment to customer satisfaction. With a strong focus on innovation and technology, IFIC Bank is well-positioned to continue providing quality services to its customers in the future.

Q: What types of accounts and services does IFIC Bank offer?

A: IFIC Bank offers a variety of accounts and services for both retail and business customers, including savings accounts, current accounts, fixed deposit accounts, recurring deposit accounts, term loan facilities, export-import financing services, and digital banking services such as internet banking, mobile banking, SMS banking, and debit and credit card facilities.

Q: Is IFIC Bank's online and mobile banking secure?

A: Yes, IFIC Bank's online and mobile banking platforms are secure and reliable, ensuring that customer data and financial transactions are protected. However, technical issues or downtime may occur, causing inconvenience or delay for customers.

Q: What are the advantages of banking with IFIC Bank?

A: IFIC Bank offers a wide range of products and services, competitive interest rates and fees, user-friendly online and mobile banking platforms, educational resources for customers, and a strong reputation and trustworthiness in the banking industry.

Q: Does IFIC Bank offer leverage?

A: No, IFIC Bank does not offer leverage as it is not a forex or brokerage company. It is a commercial bank that provides traditional banking services such as deposit accounts, loans, and cards.

Q: Does IFIC Bank have a good reputation in the banking industry?

A: Yes, IFIC Bank has a strong reputation and trustworthiness in the banking industry due to its long-standing history, wide range of products and services, competitive interest rates and fees, and user-friendly online and mobile banking platforms.

Sort by content

User comment

4

CommentsWrite a review

2024-02-23 11:16

2024-02-23 11:16

2023-03-13 11:17

2023-03-13 11:17