No data

Do you want to know which is the better broker between STARTRADER and ATFX ?

In the table below, you can compare the features of STARTRADER , ATFX side by side to determine the best fit for your needs.

EURUSD: -0.6

XAUUSD: 4.5

Long: -5.36

Short: 2.47

Long: -30.8

Short: 18.9

EURUSD: 0.3

XAUUSD: 1.2

Long: -6.02

Short: 2.33

Long: -34.43

Short: 19.17

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of iv-markets, atfx lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| STARTRADER | Basic Information |

| Registered Country/Region | Seychelles |

| Founded | 10-15 years |

| Regulation | FCA, FSA (Offshore), FSCA (General registration) |

| Tradable Instruments | 35+ currency pairs, 70+ stocks, 20+ commodities, 20+ indices |

| Account Types | Standard, ECN |

| Demo Accounts | Yes |

| Maximum Leverage | 1:500 |

| Spreads | From 0.1 pips |

| Trading Platforms | MT4, MT5, COPY TRADE, WEB TRADER |

| Trading Tools | VPS, Economic Calendar, News Room |

| Minimum Deposit | $50 |

| Deposit & Withdrawal | Bank Wire Transfer, Visa/MasterCard, Sticpay, PerfectMoney, Skrill, Neteller, etc. |

| Educational Resources | Knowledge Center, Webinars |

| Customer Support | 24/5 live chat, online messaging, email: INFO@STARTRADER.COM, social media |

*Please note that the information in this table is subject to change and you should always refer to the broker's official website for the most up-to-date information.

STARTRADER is a forex broker that offers trading services for 200+ financial instruments, including forex currency pairs, commodities such as gold and oil, indices such as the S&P 500, and more.

The broker offers two different types of trading accounts, that is Standard and ECN accounts, each with its own unique features and benefits, a minimum deposit of $50 is required to start trading on the platform.

STARTRADER offers multiple trading platforms, including MT4, MT5, as well as COPY TRADE as well as WEB TRADER. These platforms include advanced charting tools, real-time quotes, and a range of technical analysis indicators to help traders make informed decisions. The platform also offers one-click trading, hedging capabilities, and the ability to set stop-loss and take-profit orders.

The broker offers leverage up to 1:500 and competitive spreads starting from 0.1 pips. STARTRADER also provides traders with educational resources, market analysis, and a customer support team that is available 24/5 to assist with any queries or issues.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. We will also briefly summarize the main advantages and disadvantages so that you can understand the broker's characteristics at a glance.

STARTRADER has three entities under regulation:

Startrader Pro Limited is regulated by the Financial Conduct Authority (FCA) under regulatory license number: 600837.

STARTRADER Limited is offshore regulated by the Seychelles Financial Services Authority (FSA) under regulatory license number SD049.

STARTRADER INTERNATIONAL PTY LTD is generally registered by the Financial Sector Conduct Authority (FSCA) under regulatory license number 52464.

These regulatory bodies typically require brokers to follow strict operational guidelines intended to protect traders.

Further adding to the broker's credibility is its employment of security measures like segregated client accounts, which refers to the practice of keeping client funds separate from the company's operating funds. It also guarantees negative balance protection, preventing clients from losing more than their account balance. The use of SSL encryption technology ensures secure data transfer.

All these factors suggest that STARTRADER is not a scam and can be considered a legit broker.

However, it's crucial for traders to be cautious and alert. This includes understanding the broker's terms and conditions and researching online reviews to gain a comprehensive understanding of other traders' experiences with the broker.

STARTRADER offers a wide range of tradable instruments, and generous leverage up to 1:500. The broker also provides multiple trading platforms with advanced charting tools and technical analysis indicators, as well as educational resources for traders.

However, there are some potential downsides, such as regional restrictions and limited account types offered.

| Pros | Cons |

| Regulated by FCA | Regional restrictions |

| A good range of tradable instruments | Limited account types offered |

| Competitive spreads starting from 0.1 pips | Limited payment methods for deposits and withdrawals |

| Multiple trading platforms | No clear information on the minimum deposit for each accounts |

| Educational resources available | Limited research tools and market analysis |

| No commissions charged on trades | No 24/7 customer support |

| Demo account available for testing | No Islamic account |

| No deposit fees | |

| Low minimum deposit ($50) | |

| STP & ECN accounts to choose from | |

| Negative balance protection provided |

STARTRADER offers 200+ market instruments for traders to choose from, providing ample opportunities for traders to invest and diversify their portfolios.

Forex: STARTRADER offers over 35 currency pairs, including major, minor, and exotic currency pairs for forex trading, including EUR/USD, GBP/USD, USD/JPY, and AUD/CAD, among others.

Metals: This typically includes trading in commodities like gold, silver, platinum, and palladium.

Indices: They also provide more than 20 indices, tracking various segments of the financial markets, both globally and regionally.

Shares: The broker also provides access to over 70 different stocks, allowing traders to take a position on a wide range of companies across various sectors.

Commodities: STARTRADER offers more than 20 commodities, providing an opportunity for traders to engage in the trading of both soft (like wheat, cocoa, or coffee) and hard commodities (like gold, oil, or natural gas).

This mix of offerings gives traders ample choices for diversifying their portfolios and opportunities to take advantage of different market conditions. However, it's essential to fully understand each instrument's characteristics and risks and to develop a suitable strategy based on one's trading objectives and risk tolerance.

Apart from demo accounts, STARTRADER offers two primary live account types, catering to traders with different levels of experience and trading strategies.

The Standard account is designed for traders who prefer fixed spreads, and is well-suited for beginners or traders who prefer a simpler trading experience. This account type offers spreads from 1.3 pips and leverage up to 1:500, with no minimum deposit disclosed. Additionally, traders can access a wide range of tradable instruments, including forex, commodities, indices, cryptocurrencies, and shares.

The ECN account, on the other hand, is tailored to more experienced traders who require a more sophisticated trading experience. This account type offers variable spreads and allows traders to access the interbank market, which can provide greater liquidity and potentially tighter spreads. Traders can also take advantage of the advanced trading platform provided by STARTRADER, which features advanced charting tools, technical analysis indicators, and more. The ECN account also offers competitive leverage up to 1:500, with no minimum deposit disclosed.

When choosing an account type, traders should carefully consider their trading objectives, risk tolerance, and overall experience in the markets.

Opening an account with STARTRADER is a straightforward and easy process that can be completed in just a few simple steps.

Step 1: First, visit the STARTRADER website and click on the “REGISTER” button. You will be prompted to fill out a registration form, which requires you to provide some personal information, such as email address and password.

Step 2: Next, you will need to provide some additional information, such as your preferred account type (Standard or ECN), currency preference, and trading platform preference.

Step 3: After completing the registration form, you will be asked to verify your email address by clicking on a link sent to your email inbox. You will then need to provide proof of identity and address by uploading a copy of your government-issued ID and a recent utility bill or bank statement.

Step 4: Once your account is approved, you can fund your account and start trading immediately. STARTRADER supports a range of payment methods, including Bank Wire Transfer, Visa/MasterCard, Sticpay, PerfectMoney, Skrill, Neteller, and more.

TARTRADER offers a maximum trading leverage of up to 1:500, depending on the account type and the instrument being traded. For Standard account holders, the maximum leverage available is 1:500, which is still relatively high compared to other brokers in the industry. For ECN account holders, the maximum leverage available is also 1:500.

While leverage can magnify potential profits, it can also increase the risks associated with trading. Traders should always use leverage responsibly and consider their risk tolerance and trading strategy before choosing a leverage level.

While STARTRADER does offer transparent trading fees, the exact commission charges for ECN accounts are different due to the instrument being traded and other factors such as account activity.

For Standard accounts, there are no commissions charged on trades made through the account. Instead, the broker makes money through the spread, which is the difference between the bid and ask price of a financial instrument. The spreads offered by this broker are 1.3 pips.

For ECN accounts, the spreads offered by the broker are typically lower, starting from as low as 0.1 pips. However, traders are charged a commission on each trade.

While the commission charges are not specifically outlined on the broker's website, STARTRADER does offer a transparent fee structure and provides traders with real-time information on the spreads and commissions applicable to their trades. Traders can also access detailed trading reports that provide a breakdown of their trading costs and fees.

In addition to trading fees, STARTRADER also charges non-trading fees, which traders should be aware of when considering trading with the broker.

One of the non-trading fees charged by STARTRADER is an inactivity fee. If an account remains inactive for a period of 90 days, a fee of $10 will be charged each month until the account becomes active again.

Another non-trading fee charged by the broker is a withdrawal fee. For each withdrawal made, STARTRADER charges a fee of 1% of the withdrawal amount, with a minimum fee of $30 and a maximum fee of $500.

STARTRADER also charges a fee for currency conversion. If a trader deposits funds in a currency other than the base currency of their account, the broker will convert the funds to the base currency at the current exchange rate and charge a fee of 2% of the converted amount.

STARTRADER caters to the diverse trading needs of its clients by offering them access to three distinct trading platforms: the widely popular and extensively-used MetaTrader 4 (MT4), its newer and more sophisticated version, MetaTrader 5 (MT5), and its proprietary WebTrader platform, which is a browser-based trading platform designed to provide traders with easy access to the financial markets from any device with an internet connection.

MT4 is renowned for its advanced technical analysis tools, algorithmic trading capabilities, and high-speed trade execution, making it a favored platform amongst traders of all experience levels. It offers traders an array of features, such as customizable charting, real-time quotes, and a vast selection of technical indicators.

MT5, on the other hand, is the latest version of the MetaTrader platform, offering even more advanced features and capabilities, including enhanced charting and analytical tools, multi-currency support, and a more extensive selection of timeframes. It is also designed to support additional types of assets such as stocks and futures, providing traders with greater market diversity.

STARTRADER's proprietary WebTrader platform, meanwhile, is a web-based trading platform that allows traders to access their trading accounts from anywhere in the world, providing them with the flexibility and convenience of trading on-the-go. It offers traders a wide range of tools, including real-time quotes, charting tools, and technical analysis indicators, while also providing a user-friendly interface that is easy to navigate.

STARTRADER also provides an App, allowing users to trade anytime and anywhere. It is available for iOS and Android platforms, making it convenient for global traders to use.

The following is a comparison table prepared, highlighting the trading platforms offered by STARTRADER, INFINOX, CPT Markets, and Eightcap:

| Broker | Trading Platforms |

| STARTRADER | MT4, MT5, WebTrader |

| INFINOX | MT4, MT5, IXO Platform |

| CPT Markets | MT4, Sirix WebTrader, CPT Markets GO |

| Eightcap | MT4, MT5, WebTrader |

STARTRADER's offering of a copy trading feature is great for traders who prefer to capitalize on the expertise of successful traders. Copy trading allows traders to directly copy the positions opened and managed by another selected trader. Hence, when the copied trader makes a trade, the same trade is automatically executed in the copying trader's account.

This can be particularly beneficial for novice traders who are still learning the ropes or people who don't have the time to study and monitor the markets consistently. It provides a form of passive management and can be a way to learn and understand more about trading strategies in real-time.

However, it's crucial to remember that all trading involves risks and just because a trader was successful in the past does not guarantee they will be in the future. Always practice risk management and ensure to align copy trading actions with your risk tolerance and financial goals.

STARTRADER offers a suite of impressive trading tools that contribute towards a comprehensive and efficient trading experience.

They provide a Virtual Private Server (VPS) service which allows traders to run automated algorithmic strategies continuously 24/7 on a virtual machine, facilitating more robust connectivity and faster order execution.

Their economic calendar is a vital tool for fundamental analysis, helping traders track important economic events that have the potential to impact financial markets. This can be beneficial for planning trades and managing risk.

In addition, their news room serves as a source for real-time market news, keeping traders updated about significant developments that can cause market volatility.

These three essential tools offered by STARTRADER reflect their commitment to providing their customers with resources that help to enhance their trading strategies and overall trading experience.

STARTRADER supports a variety of deposit and withdrawal methods for its clients, with a minimum deposit requirement of $50. The broker allows deposits via several methods, including Bank Wire Transfer, Visa/MasterCard, Sticpay, PerfectMoney, Skrill, Neteller, and more. There are zero deposit fees on most payment methods.

Deposits made via bank wire transfer can take 3-5 business days to clear, while deposits made via other methods are typically processed instantly. For withdrawals, clients can use the same methods as for deposits, with processing times varying depending on the chosen method.

To withdraw funds, you should log to “My account” with your username and password. Initiate the request to withdraw funds. Here are some important notifications you should notice when withdrawing funds:

STARTRADER offers some educational resources designed to help traders improve their knowledge and skills in the Forex and CFD markets. These resources include webinars and a knowledge center.

The educational webinars are conducted by market experts who provide traders with insights and analysis on a range of topics, from technical analysis to risk management. The webinars are designed to help traders stay up to date with market developments and make informed trading decisions.

In addition to webinars, STARTRADER also provides traders with a knowledge center, which includes some educational materials such as e-books, videos, and tutorials. These materials are aimed at traders of all levels, from beginners to advanced traders, and cover a wide range of topics such as trading strategies, market analysis, and risk management.

STARTRADER offers 24/5 customer support through a variety of channels, including live chat, email: INFO@STARTRADER.COM and a contact form on their website, as well as social media platforms like Facebook, Instagram, Twitter, LinkedIn, YouTube, Tiktok and Telegram.

| Q 1: | Is STARTRADER regulated well? |

| A 1: | Yes. It is regulated by FCA. |

| Q 2: | At STARTRADER, are there any regional restrictions for traders? |

| A 2: | Yes. It is not available for Afghanistan, Cuba, Eritrea, Iraq, Islamic Republic of Iran, Israel, Liberia, Libya, Malaysia, Nicaragua, Pakistan, Russian Federation, Somalia, Syrian Arab Republic, Sudan, United States or any other jurisdiction where such distribution, publication, availability or use would be contrary to applicable law or regulation. |

| Q 3: | Does STARTRADER offer demo accounts? |

| A 3: | Yes. It offers demo accounts for testing. |

| Q 4: | What is the maximum leverage offered by STARTRADER? |

| A 4: | The maximum leverage offered by STARTRADER is up to 1:500. |

| Q 5: | Does STARTRADER offer industry leading MT4 & MT5? |

| A 5: | Yes. STARTRADER offers MetaTrader4 (MT4), MetaTrader5 (MT5), and its proprietary WebTrader platform. |

| Q 6: | What is the minimum deposit for STARTRADER? |

| A 6: | $50. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

| ATFX | Basic Information |

| Company Name | AT Global Markets (UK) Limited |

| Regulated By | FCA, CYSEC |

| Year Founded | 2014 |

| Headquarters | London, UK |

| Trading Platforms | MT4, MT5, and their own proprietary trading platform |

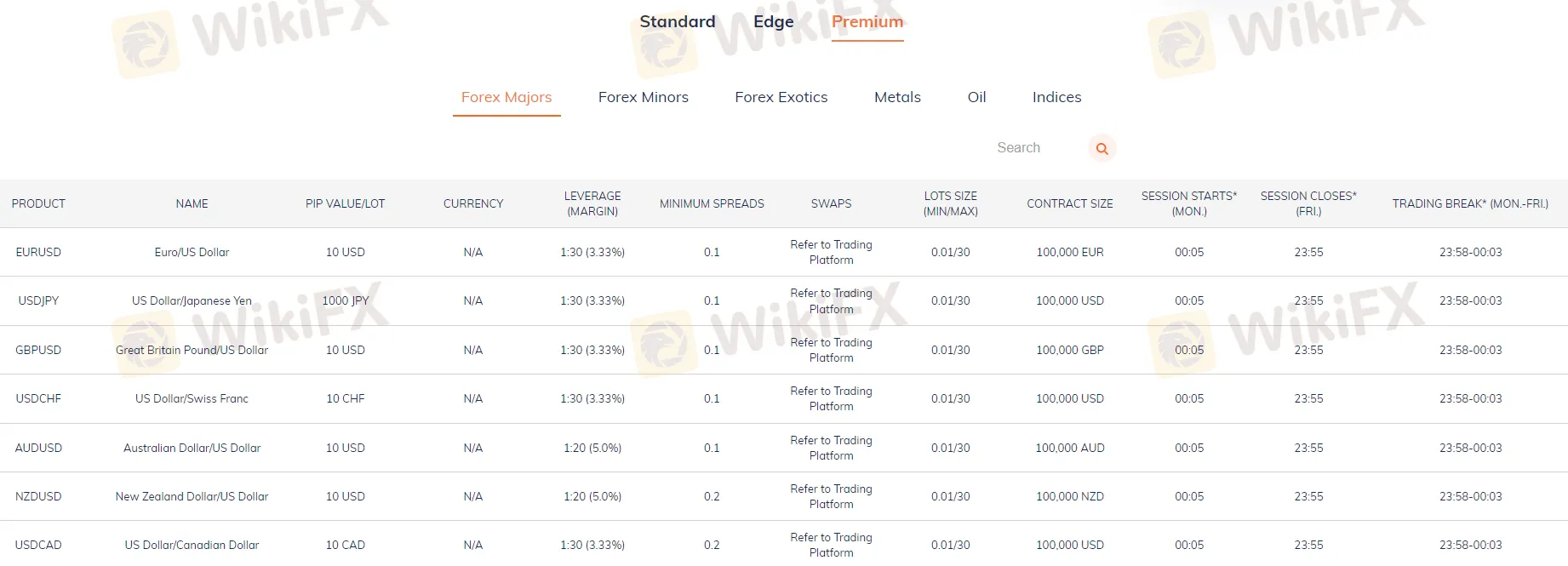

| Account Types | Standard, Edge, Premium |

| Demo Account | Yes |

| Minimum Deposit | $/€/£100 |

| Leverage | Up to 1:30 for retail traders and up to 1:400 for professional traders |

| Spreads | Variable, starting from 0.0 pips |

| Tradable Assets | Forex, CFDs on indices, commodities, and stocks |

| Deposits & Withdrawal Methods | VISA, MasterCard, Skrill, Neteller, Bank Transfer, Trustly |

| Education and Analysis | Webinars, articles, daily market outlooks, technical analysis tools |

| Customer Support | 24/5 via phone, email, live chat, and social media |

ATFX is a global online forex and CFD broker established in 2014, offering a range of trading instruments, including forex, commodities, indices, and shares. The broker also offers several account types, including the Standard Account, Edge Account, and Premium Account, each with different features and benefits to suit different trading needs, with $100 to start. Besides, the broker also offers a demo account for traders to practice and test their strategies. One of the key features of ATFX is its trading platforms. The broker offers the popular MetaTrader 4 (MT4) platform, which is known for its advanced charting tools and user-friendly interface.

ATFX provides its clients with a range of educational resources to help traders improve their trading knowledge and skills. These resources include trading guides, webinars, seminars, and video tutorials. The broker also offers customer support services 24/5 via live chat, phone, and email.

ATFX is a legitimate forex broker that operates under strict regulations. TThis broker is currently regulated by two major financial regulators, the Financial Conduct Authority (FCA) in the United Kingdom and the Cyprus Securities and Exchange Commission (CySEC) in Cyprus. These regulators are known for their strict oversight and regulations in the financial industry, which provides traders with a higher level of security and protection. ATFX's compliance with these regulations demonstrates its commitment to transparency and fairness in its business practices.

ATFX has a number of advantages and disadvantages that traders should consider before choosing this broker. On the positive side, ATFX is a well-regulated broker that offers a range of trading platforms and tools, including MetaTrader 4, WebTrader, and mobile trading apps. The broker also provides a wide range of trading instruments, including forex, CFDs, and cryptocurrencies, and offers competitive spreads and low trading fees. In addition, ATFX provides its clients with a variety of educational resources to improve their trading skills and knowledge, and customer support services are available 24/5 through live chat, phone, and email.

On the downside, ATFX has limited options for deposit and withdrawal methods, as it only accepts payments via bank transfers and credit/debit cards. Another potential disadvantage is that ATFX does not offer social trading or copy trading features, which may be important to some traders. Finally, ATFX has limited research and analysis tools compared to other brokers, which may be a concern for more advanced traders.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ATFX provides a wide range of tradable assets to its clients, including forex, metals, oils, indices, cryptocurrencies, and shares. This diverse range of instruments allows traders to diversify their portfolios and take advantage of various market conditions.

Forex-The forex market is the largest financial market in the world, and ATFX provides access to over 100 currency pairs, including major, minor, and exotic pairs.

Precious Metals-The broker also offers trading in precious metals such as gold and silver, which are popular safe-haven assets during times of market volatility.

Indices-Additionally, traders can speculate on the price movements of various indices, including the popular S&P 500 and NASDAQ.

Oils-Oils, such as Brent and Crude Oil, are also available for trading, which are popular among traders due to their high volatility.

Cryptocurrency-ATFX also offers trading in cryptocurrencies such as Bitcoin, Ethereum, and Litecoin, which have gained increasing popularity in recent years.

Shares-Lastly, traders can also invest in shares of some of the world's largest companies such as Apple, Amazon, and Google.

| Pros | Cons |

| Wide range of market instruments including forex, metals, oils, indices, cryptocurrencies, and shares. | The selection of instruments may not be as extensive as some other brokers. |

| Highly liquid markets, allowing for efficient trading and price discovery. | Market volatility can lead to significant price fluctuations and potential losses. |

| Ability to trade on leverage, allowing traders to increase their buying power and potential profits. | Trading on leverage also increases the risk of losses, especially for inexperienced traders. |

| Opportunity for diversification, as traders can access a variety of different asset classes through a single broker. | Certain market instruments may have high trading fees or commissions. |

| Market events or news can have a significant impact on market instruments, making them unpredictable at times. |

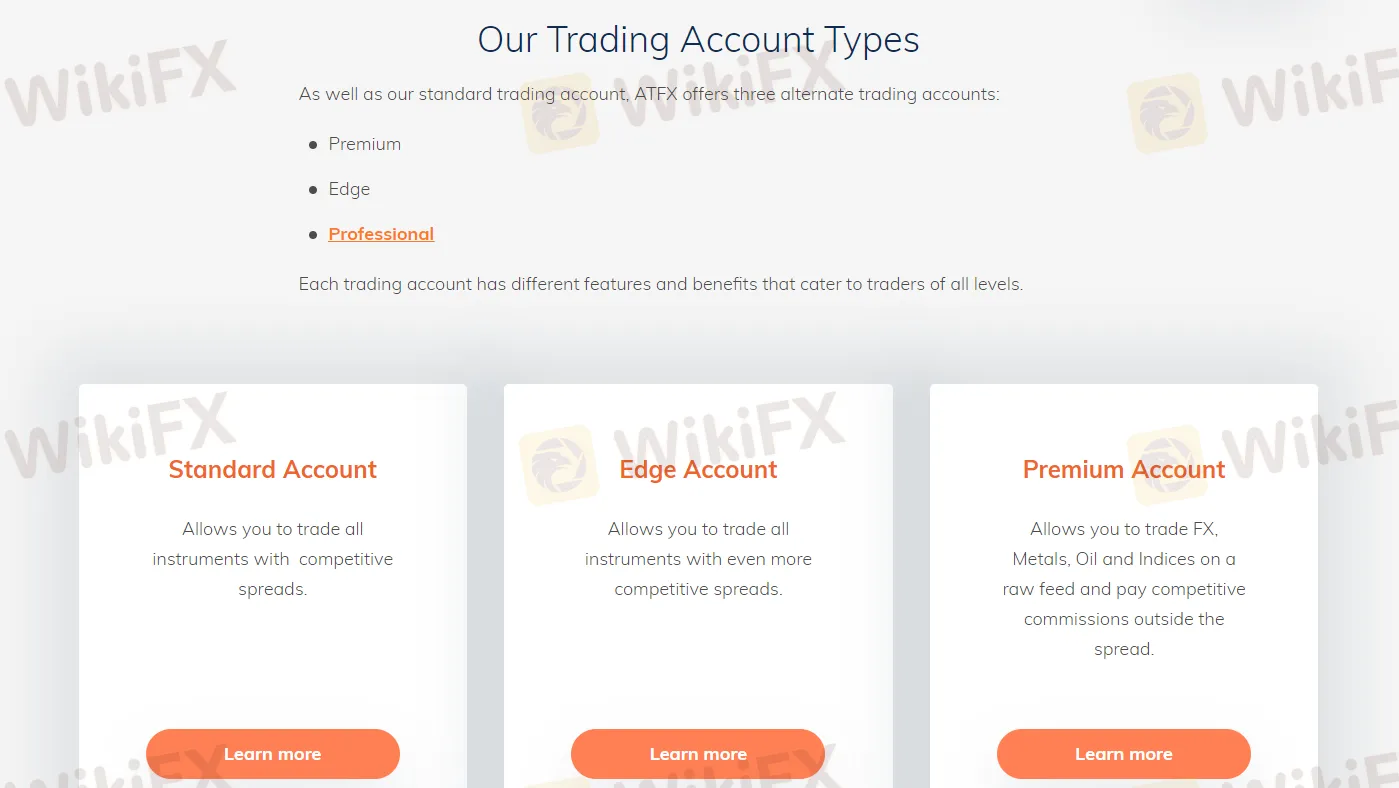

ATFX understands that every trader has their own trading style, preferences, and needs, which is why the broker offers a range of account types to choose from. Whether you're a beginner or an experienced trader, there is an account type that is suitable for you.

The Standard Account is a basic account type that is suitable for beginner traders who are just starting in the forex market. It requires a minimum deposit of $100 and offers fixed spreads starting from 1.0 pips. This account type also provides access to the MT4 trading platform and a range of trading instruments, including forex, metals, oils, indices, cryptocurrencies, and shares.

The Edge Account is a more advanced account type that is suitable for traders who have some experience in the forex market. It requires a minimum deposit of $5,000 and offers variable spreads starting from 0.6 pips. This account type also provides access to the MT4 trading platform and a range of trading instruments, including forex, metals, oils, indices, cryptocurrencies, and shares. In addition, the Edge Account offers free VPS hosting, market analysis, and a personal account manager.

The Premium Account is the most advanced account type offered by ATFX, designed for professional traders who require advanced trading features and tools. It requires a minimum deposit of $10,000 and offers variable spreads starting from 0.0 pips. This account type also provides access to the MT4 trading platform and a range of trading instruments, including forex, metals, oils, indices, cryptocurrencies, and shares. The Premium Account offers free VPS hosting, market analysis, a personal account manager, and access to exclusive trading tools, such as Autochartist and Trading Central.

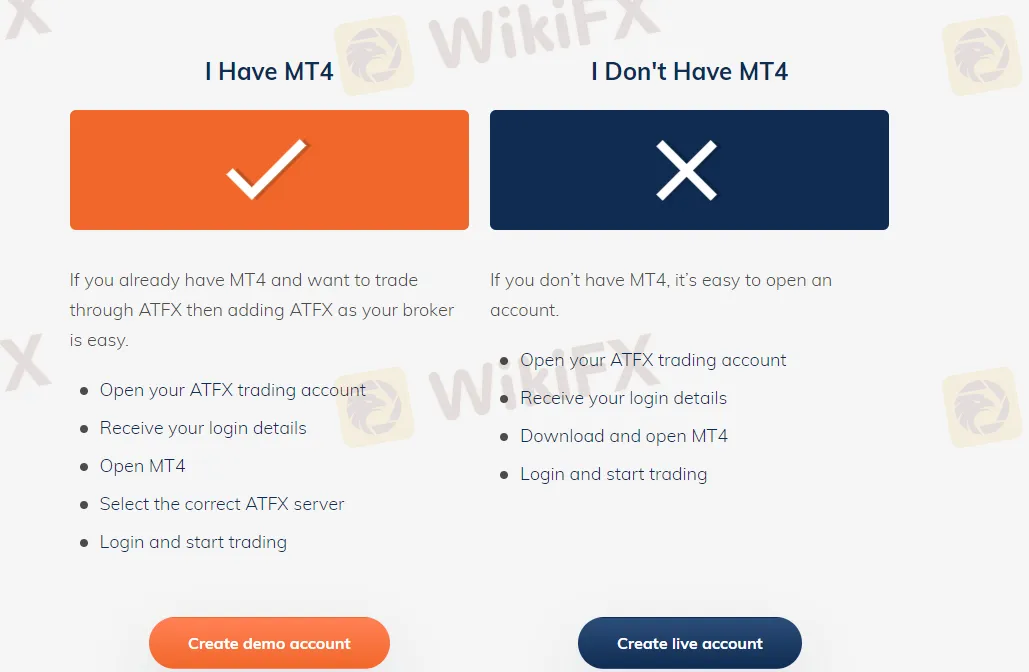

ATFX offers demo trading accounts to its clients, allowing them to practice and familiarize themselves with the trading platform and strategies before committing real funds. Demo accounts are available for all account types, including Standard, Edge, and Premium accounts. These accounts simulate real market conditions, providing traders with the opportunity to test their trading skills and strategies without any financial risks.

The demo accounts are also an excellent tool for beginners who are new to trading as it enables them to learn the basics of trading without the fear of losing money. The demo accounts offer the same features as live accounts, including access to all trading instruments and educational resources, enabling traders to experience the real trading environment.

ATFX's demo accounts have no time limit, giving traders ample time to perfect their trading strategies and techniques. Moreover, traders can switch between the demo and live accounts anytime they want, enabling them to transition smoothly to live trading when they are ready. The demo accounts offered by ATFX are an excellent resource for traders looking to improve their trading skills and strategies in a risk-free environment.

Visit the ATFX website: Go to the ATFX website and click on the “Start Trading” button on the top right corner of the homepage.

Fill in your personal information: You will be directed to a page where you will need to provide your personal information, including your full name, date of birth, contact details, and country of residence. You will also need to choose your preferred account type.

Provide your financial information: You will be asked to provide information about your financial status, including your employment status, annual income, and investment experience.

Submit verification documents: To complete the registration process, you will need to submit a copy of your passport or ID card, as well as a proof of address, such as a utility bill or bank statement.

Fund your account: Once your account is verified, you can fund it using one of the available payment methods, such as bank transfer, credit/debit card, or e-wallet.

Start trading: Once your account is funded, you can start trading on the ATFX platform using your preferred trading instruments and strategies.

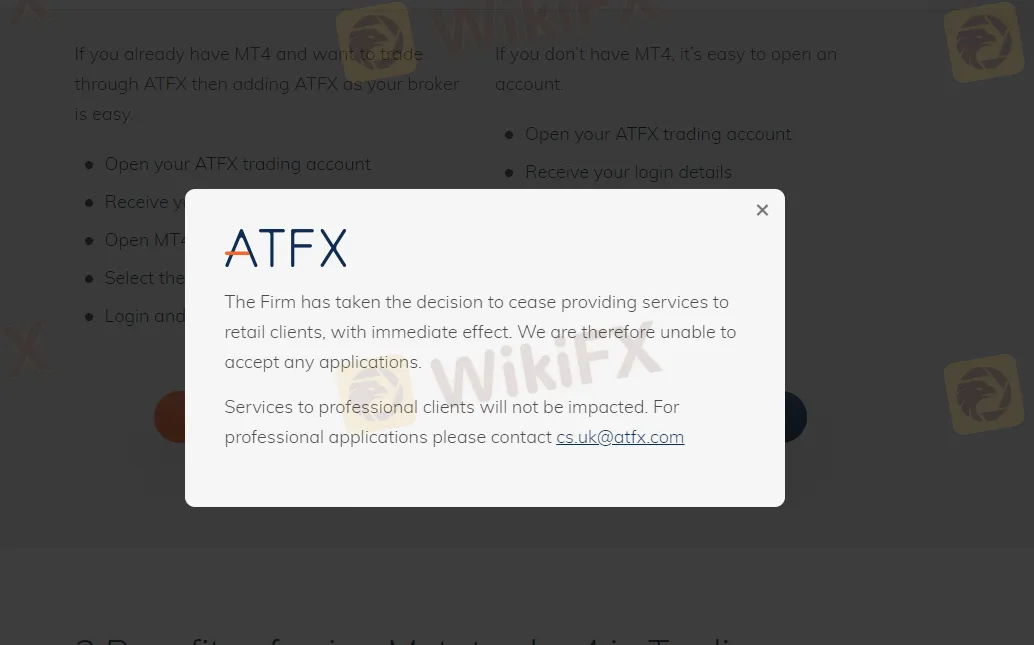

However, when browsing through the broker's website, an unwelcomed page showed up. A message popped up on the screen informing us that only the big shots - professional clients - were allowed to use the trading platform, while retail clients were left out in the cold.

Here's a table that compares the spreads on EUR/USD, UK100, and Oil offered by ATFX, Avatrade, IC Markets, and FP Markets:

| Broker | EUR/USD Spread | UK100 Spread | Oil Spread |

| ATFX | 0.6 pips | 2.5 pips | 0.05 pips |

| Avatrade | 0.9 pips | 1.0 pips | 0.03 pips |

| IC Markets | 0.1 pips | 1.0 pips | 0.03 pips |

| FP Markets | 0.0 pips | 1.0 pips | 0.02 pips |

ATFX offers varying levels of leverage depending on the type of trading account and financial instrument.

For forex trading, the maximum leverage available for retail clients is typically 30:1 for major currency pairs and 20:1 for minor and exotic currency pairs. Professional clients may have access to higher leverage, up to a maximum of 400:1, depending on their trading experience and other criteria.

For trading other financial instruments such as commodities, indices, and shares, the leverage may vary depending on the asset class and market conditions.

It's important to note that while leverage can amplify potential profits, it also magnifies potential losses, so it's crucial to use leverage responsibly and only trade with funds you can afford to lose. Additionally, different regulations may apply in different regions and countries, which could impact the maximum leverage available to traders.

ATFX offers competitive spreads and commissions on its trading accounts, which vary depending on the type of account and trading instrument.

For forex trading, ATFX offers both fixed and variable spreads, depending on the account type. The spreads for major currency pairs on the standard account start from 1.0 pip, while the spreads on the Edge account start from 0.0 pips but come with a commission of $7 per lot traded.

For other financial instruments such as commodities, indices, and shares, the trading fees may vary depending on the specific asset class and trading platform used.

Aside from trading fees, ATFX may charge non-trading fees that traders should be aware of, including:

Inactivity Fee: ATFX may charge an inactivity fee of $50 per quarter for accounts that have been inactive for more than 90 days. This fee may be waived for active traders or in certain circumstances.

Conversion Fees: If you deposit or withdraw funds in a currency different from your account's base currency, ATFX may charge a conversion fee to cover the costs of currency conversion.

Overnight Financing Charges: If you hold a position overnight, ATFX may charge or credit you with an overnight financing charge, also known as a swap fee. This fee is based on the interest rate differential between the two currencies being traded and is typically charged at a fixed percentage of the position value.

Withdrawal Fees: While ATFX does not charge any withdrawal fees, third-party payment providers may charge a fee for their services.

Deposit Fees: ATFX does not charge any deposit fees, but third-party payment providers may charge a fee for their services.

ATFX currently provides the MetaTrader 4 (MT4) platform for its traders, which is a widely used platform among forex traders. It offers advanced charting tools, technical analysis indicators, and automated trading options through Expert Advisors (EAs).

While some traders may prefer other trading platforms, the MT4 platform is a robust and reliable option with a large community of users and third-party developers creating and sharing custom indicators and EAs.

In addition to the MT4 platform, ATFX also offers a range of trading tools and resources, including economic calendars, market analysis, and educational resources such as webinars and tutorials.

Check out this table that compares the trading platforms of ATFX, IC Markets, FP Markets, and Exness:

| Feature | ATFX | IC Markets | FP Markets | Exness |

| Trading Platform | MT4 | MT4, MT5 | MT4, MT5 | MT4, MT5 |

| Web Trading Platform | Yes | Yes | Yes | Yes |

| Mobile Trading Platform | Yes | Yes | Yes | Yes |

| Social Trading | No | Yes | Yes | No |

| Copy Trading | Yes | Yes | Yes | Yes |

| Trading Signals | Yes | Yes | Yes | Yes |

| Automated Trading | Yes | Yes | Yes | Yes |

| Scalping Allowed | Yes | Yes | Yes | Yes |

| Hedging Allowed | Yes | Yes | Yes | Yes |

ATFX's minimum deposit requirement of $100 makes it an accessible option for traders who are just starting out or those who prefer to trade in smaller amounts. The following payment methods are available for deposits:

Credit/Debit Cards: Visa and Mastercard are accepted. The processing time for deposits made via credit/debit cards is instant, and there are no fees charged by ATFX.

Bank Wire Transfer: Deposits can be made via bank wire transfer. The processing time for this method varies, and it may take 2-5 business days to reflect in the trader's account. ATFX does not charge fees for deposits made through bank wire transfer, but traders should check with their bank for any charges that may apply.

Online Payment Methods: ATFX also supports online payment methods such as Skrill, Neteller, and Trustly. Deposits made using these methods are typically processed instantly. ATFX does not charge fees for deposits made through online payment methods, but third-party payment providers may charge a fee for their services.

How to withdraw money from my trading account?

Log in to the secure Client Portal section of our homepage, then click “Withdrawal”.

This broker will always return funds to the original source they were deposited. For example, if a deposit is made by credit card, funds will be returned to the same credit card. The return can be done through bank transfer, credit/debit card or e-wallet transfers.

If you are withdrawing profit, this broker may ask you for bank account details to send funds directly to your account.

Please note: Your bank account must be fully verified before submitting a withdrawal request.

The time it takes for funds to return to a trader's bank account will depend on the withdrawal method used.

For bank transfers, once the funds have been removed from the trading account, it will take 3-5 business days before they arrive in the trader's bank account. The actual time required for processing may vary, and traders should refer to their bank for more information.

If using an e-wallet, funds will typically be returned to the trader's e-wallet within 2 business days.

For refunds to credit/debit cards, the process typically takes 2-5 business days after the withdrawal has been successfully processed. However, if there are restrictions preventing funds from being returned to the card, ATFX may request a valid bank statement and return the funds to the trader's registered bank account. In such cases, the trader will be contacted by their relationship manager.

All withdrawal requests received before 2 pm (UK time) on a business day will be processed on the same day. Requests received after this time will be processed on the next available business day.

It seems that ATFX understands the importance of providing reliable and efficient customer support to help traders along the way. Whether you're a seasoned professional or just starting out, the brokerage firm offers a range of customer support options to ensure that you have access to the assistance you need, when you need it.

Live Chat: ATFX provides a live chat feature on their website, which allows traders to chat with a customer support representative in real-time. This option is convenient and efficient, as traders can get their questions answered without having to wait for a response via email or phone.

Email: Traders can contact ATFX's customer support team by email. The brokerage firm aims to respond to all queries within 24 hours, making this a good option for non-urgent matters.

Phone: ATFX also provides a phone number for traders to call if they prefer to speak to a customer support representative directly. The phone lines are open from Monday to Friday, during business hours.

FAQ Section: ATFX's website also features a comprehensive FAQ section, which covers a range of topics such as account opening, funding, trading platforms, and more. This section can be a useful resource for traders who prefer to find answers to their questions independently.

Social Media: ATFX has an active presence on social media platforms such as Facebook, Twitter, and LinkedIn. Traders can use these channels to connect with the company and stay up to date with news and updates.

ATFX offers a wide range of educational resources to help traders improve their skills and knowledge.

One of the primary educational resources available through ATFX is their comprehensive online trading academy. This academy provides traders with a variety of resources, including webinars, videos, articles, and e-books, all designed to help traders learn the fundamentals of trading and improve their strategies. The academy covers a range of topics, from basic concepts such as market analysis and risk management to more advanced topics like trading psychology and algorithmic trading.

In addition to the online trading academy, ATFX also offers a range of educational resources specifically tailored to the needs of different traders. For example, beginners can take advantage of the company's beginner's course, which provides an introduction to the basics of trading, while more experienced traders can benefit from advanced courses covering topics such as technical analysis and trading psychology.

ATFX also provides traders with access to a variety of market analysis tools and resources. These include daily market analysis reports, economic calendars, and real-time news feeds, all of which can help traders stay informed about the latest market trends and make more informed trading decisions.

ATFX is a well-known brokerage firm that offers a variety of trading services and features for traders of all levels. The brokerage's competitive trading conditions, such as low spreads, high leverage, and multiple trading instruments, provide traders with opportunities across various markets.

Additionally, ATFX provides several customer support channels, including live chat, email, and phone, to help traders with their queries and concerns. The brokerage also offers educational resources, such as an online trading academy and tailored courses, to help traders develop their knowledge and skills.

While ATFX has received positive feedback from some traders, as with any brokerage firm, there are also negative reviews and complaints online. However, these reviews should be taken with a grain of salt, and traders are encouraged to conduct their research and make informed decisions before investing their funds with any broker.

Q: Is ATFX a regulated broker?

A: Yes, ATFX is a regulated broker that is authorized and regulated by multiple financial authorities, including the FCA in the UK, the CySEC in Cyprus.

Q: What is the minimum deposit requirement for ATFX?

A: The minimum deposit requirement for ATFX is $100.

Q: What trading platforms does ATFX offer?

A: ATFX offers the popular MetaTrader 4 (MT4) trading platform for desktop, web, and mobile devices.

Q: What are the trading fees and spreads at ATFX?

A: ATFX offers competitive trading conditions, including tight spreads and low commissions. The exact trading fees will depend on the account type and trading instrument.

Q: What payment methods are accepted by ATFX?

A: ATFX accepts a range of payment methods, including bank wire transfer, credit/debit cards, and e-wallets. The availability of payment methods may vary depending on the trader's location.

Q: Does ATFX offer a demo account?

A: Yes, ATFX offers a demo account for traders to practice their trading strategies and familiarize themselves with the trading platform before trading with real money.

Q: Does ATFX offer customer support?

A: Yes, ATFX provides customer support through multiple channels, including live chat, email, and phone. Traders can also access a comprehensive FAQ section on the ATFX website.

Q: Is ATFX suitable for beginner traders?

A: Yes, ATFX offers a range of educational resources, including an online trading academy and tailored courses, to help beginner traders develop their knowledge and skills. Additionally, the broker offers a demo account for traders to practice their trading strategies before trading with real money.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive iv-markets and atfx are, we first considered common fees for standard accounts. On iv-markets, the average spread for the EUR/USD currency pair is from 0.1 pips, while on atfx the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

iv-markets is regulated by ASIC,FSA,FSCA. atfx is regulated by ASIC,FCA,CYSEC,SCA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

iv-markets provides trading platform including ECN ACCOUNT,STANDARD ACCOUNT and trading variety including 35+ currency pairs, 70+ stocks, 20+ commodities, 20+ indices. atfx provides trading platform including -- and trading variety including --.