No data

Do you want to know which is the better broker between Grand Capital and OLYMPTRADE ?

In the table below, you can compare the features of Grand Capital , OLYMPTRADE side by side to determine the best fit for your needs.

EURUSD: 4.3

XAUUSD: --

Long: -10.14

Short: 0.13

Long: -52.23

Short: 2.5

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of grand-capital, olymptrade lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Company Name | Grand Capital |

| Headquarters | Hong Kong |

| Regulations | Regulated by the Securities and Futures Commission (SFC) of Hong Kong |

| Market Instruments | Securities, Futures, Stock Options, Fixed Income |

| Account Types | Individual, Joint, Corporate, Asset Management, Private Banking |

| Spread | N/A |

| Deposit/Withdraw Methods | Bank Transfer, Cheques, Overseas Remittance |

| Trading Platforms | Desktop, Web, Mobile |

| Customer Support | Phone: +852 3891 9888, Email: cs@grandch.com |

| Educational Resources | N/A |

Grand Capital Holdings Limited, headquartered in Hong Kong, operates as a financial services provider encompassing two wholly-owned subsidiaries: Grand Capital Securities Limited and Grand Capital Futures Limited. These entities offer a broad spectrum of financial services to a diverse clientele, including individuals, corporations, and institutions. Services provided by Grand Capital encompass brokerage services, wealth management, asset management, and institutional services. These services facilitate access to a variety of financial markets and instruments, allowing clients to engage in trading activities across a range of asset classes. Additionally, the company provides a selection of trading platforms to cater to different trading preferences, ensuring accessibility and convenience for its clientele.

Grand Capital, operating under the entity Grand Capital Futures Limited in Hong Kong, is a legitimate broker in the context of its regulatory status. It is regulated by the Securities and Futures Commission (SFC) of Hong Kong, a reputable regulatory authority known for its stringent oversight of financial institutions. Grand Capital holds a valid license for “Dealing in futures contracts” with License No. BOM175, issued by the SFC, and this license was effective from October 10, 2019.

The fact that Grand Capital is regulated by the SFC and holds a valid license indicates that it has met the regulatory requirements and standards set by the regulatory authority. This regulatory oversight provides a level of assurance to clients that the broker operates within the legal framework and adheres to industry regulations and standards.

Grand Capital presents a range of advantages for traders seeking financial services. Firstly, it boasts regulatory oversight by the Securities and Futures Commission (SFC) of Hong Kong, instilling confidence in clients regarding the broker's commitment to industry standards. The broker offers a diverse selection of financial products, including securities, futures, stock options, and fixed income, allowing clients to diversify their portfolios. Grand Capital prioritizes accessibility by providing trading platforms for desktop, web, and mobile devices, accommodating traders with varying preferences. Additionally, the inclusion of wealth management services and a physical office presence in Hong Kong enhances the overall client experience.

However, several considerations must be kept in mind. The lack of fee transparency could result in unexpected costs for traders, impacting their overall trading experience. Grand Capital's limited educational resources might hinder traders from developing essential skills and knowledge. Furthermore, unclear deposit and withdrawal information may create inconvenience and uncertainty, and the absence of disclosed spread details leaves traders unaware of potential trading costs. Lastly, the dependency on the Grand Authenticator app for Two-Factor Authentication may not align with all clients' preferences or accessibility needs.

| Pros | Cons |

| 1. Regulatory Oversight | 1. Lack of Fee Transparency |

| 2. Diverse Product Range | 2. Limited Educational Resources |

| 3. Multi-Platform Accessibility | 3. Unclear Deposit and Withdrawal Information |

| 4. Wealth Management Services | 4. No Spread Information |

| 5. Physical Office Presence | 5. 2FA App Dependency |

Grand Capital offers a diverse array of financial products, catering to a wide spectrum of investment strategies and preferences. One of its core offerings is securities trading, providing clients with access to global stock markets in over 20 countries, including major exchanges like NYSE, NASDAQ, and more. Investors can engage in the trading of listed stocks, equities, ETFs, REITs, derivative warrants, inline warrants, CBBCs, and fixed-income products. This expansive range allows clients to diversify their portfolios across international markets and asset classes, aligning with their investment goals and risk tolerance.

Furthermore, Grand Capital provides futures trading opportunities, empowering self-directed investors to participate in futures and options on futures contracts. These include equity, foreign exchange, commodities, interest rates, and single stock futures products. The inclusion of stock options and fixed-income products further enhances the depth of Grand Capital's product offerings, giving clients the tools and opportunities to explore various trading strategies and achieve their financial objectives.

Grand Capital offers a wide range of financial services to meet the diverse needs of its clients, making it a versatile player in the financial industry. The company provides brokerage services, enabling clients to access global markets and trade a variety of financial instruments. Whether for individual or institutional investors, Grand Capital's brokerage services offer a gateway to international markets, facilitating portfolio diversification and investment opportunities.

In addition to traditional brokerage, Grand Capital offers comprehensive wealth management and asset management services. Clients can leverage the expertise of the firm's professionals to create tailored investment strategies that align with their financial goals. The inclusion of institutional services and fund set-up services further underscores Grand Capital's commitment to serving a wide range of clients, including institutional investors and fund managers. The firm's global markets multi-asset approach allows clients to explore opportunities across various asset classes and regions, providing a holistic and diversified approach to investment and wealth management.

Grand Capital offers a versatile range of account types to accommodate the diverse needs of its clients. For individual investors, the firm provides both securities accounts, which can be further categorized into cash or margin accounts, and futures and options accounts. These options empower investors to choose the account type that aligns with their risk tolerance and trading preferences. Additionally, Grand Capital caters to clients interested in stock options trading, providing a dedicated account type for this purpose.

For more sophisticated investors seeking professional portfolio management, Grand Capital offers asset management accounts. These accounts allow clients to leverage the expertise of professional fund managers to achieve their investment goals. Furthermore, the firm extends its services to high-net-worth individuals through private banking accounts, ensuring personalized financial solutions and a tailored approach to wealth management. Grand Capital's diverse account offerings reflect its commitment to providing a comprehensive suite of options to cater to the unique financial objectives and preferences of its clientele.

To open an account with Grand Capital online, the process is straightforward and can be completed in a few simple steps:

Go to www.grandch.com and navigate to the account opening section.

Select the type of account you wish to open, such as an individual or corporate account.

Fill out the online application form with your personal information, financial details, and other required information.

Upload the necessary identification and verification documents as specified by Grand Capital.

Double-check the provided information, agree to the terms and conditions, and submit your application.

Grand Capital's team will review your application and notify you once your account is approved and ready for trading.

Alternatively, clients can opt for an in-person account opening by scheduling a visit to Grand Capital's offices, where experienced staff will assist with the process. Additionally, for those who prefer to open an account by mail, Grand Capital can send the relevant account opening documents upon request, which can then be completed and sent back to the office for processing. These alternative methods provide flexibility to clients in choosing the most convenient way to open their accounts with Grand Capital.

Grand Capital's lack of disclosure regarding fees or spreads associated with trading activities may present challenges for traders in assessing the true cost of their trades. Without clear information on fees, commissions, or spreads, clients may find it difficult to accurately calculate their trading expenses, potentially leading to unexpected costs that can impact overall profitability. Transparency in fee structures is crucial for traders to make informed decisions and manage their trading costs effectively. Therefore, prospective clients should exercise caution and seek clarity on fee-related information before engaging in trading activities with Grand Capital.

Grand Capital offers a robust and versatile trading platform that caters to the needs of both securities and futures traders. Clients can access a range of platforms, including iTrade and WebTrade for online trading, as well as desktop applications for a more comprehensive trading experience. Notably, Grand Capital provides mobile trading options through the Play Store and App Store, offering basic and advanced versions of their trading platform, ensuring accessibility for traders on the go. This multiplatform availability allows traders to conveniently access their account balances, positions, market data, and other essential information from various devices, enhancing flexibility and convenience in their trading activities.

In addition to its trading platforms, Grand Capital offers the Grand Authenticator app, which serves as a Two-Factor Authentication (2FA) solution. This app adds an extra layer of security to clients' accounts, helping protect against unauthorized access. Users can easily download the app for both iOS and Android devices, ensuring their account security while trading. By implementing 2FA through the Grand Authenticator app, clients can benefit from enhanced peace of mind and safeguard their trading accounts from potential security breaches.

Grand Capital offers several methods for deposits and withdrawals, including bank transfers, cheques, and overseas remittances. Clients can choose the option that aligns with their preferences and location. Bank transfers provide a secure and direct way to move funds to and from their trading accounts. However, it's important to note that fees may apply for these transactions, and the exact charges may vary depending on the bank and location. Additionally, the processing time for bank transfers can vary, ranging from a few business days to potentially longer for international transfers.

Clients opting for cheque deposits or overseas remittances should also be aware of potential fees and processing times associated with these methods. It's essential for traders to review the broker's fee schedule and terms for each transaction method to make informed decisions regarding their deposits and withdrawals, as fees and processing times can impact the overall cost and speed of accessing their funds.

Grand Capital's commitment to customer support is evident through its accessible contact information and dedicated service channels. Clients can reach out to the company through various means, including telephone support via the provided contact number, ensuring direct and immediate assistance. Additionally, clients can utilize the provided email address to contact the customer support team, offering a convenient way to seek assistance, address inquiries, or resolve any issues.

The company's physical presence at its Hong Kong office further underscores its dedication to customer service. Grand Capital's central office location in Hong Kong enhances accessibility for clients who prefer in-person consultations or support. Overall, Grand Capital's multi-channel customer support approach demonstrates its commitment to providing responsive and accessible assistance to its clientele, contributing to a positive trading experience.

The absence of educational resources in Grand Capital could hinder traders, especially newcomers, from acquiring the knowledge and skills necessary for effective trading. Without access to tutorials, webinars, and trading guides, they may face increased risks, potential losses, and limited opportunities for skill development, making it less attractive for those seeking comprehensive support and guidance in trading.

In summary, Grand Capital is a Hong Kong-based financial services firm with a diverse range of offerings for traders and investors. It provides access to global financial markets, including securities, futures, stock options, and fixed-income products, catering to a wide range of investment preferences. The broker offers multi-platform accessibility, regulatory oversight by the SFC, wealth management services, and a physical office presence in Hong Kong for client convenience.

However, concerns arise due to the lack of fee transparency, limited educational resources, and unclear information regarding deposit and withdrawal methods. Traders should exercise caution and seek comprehensive information before engaging with this broker to ensure they align with their specific trading needs and preferences.

Q: Is Grand Capital regulated?

A: Yes, Grand Capital is regulated by the Securities and Futures Commission (SFC) of Hong Kong, providing regulatory oversight.

Q: What financial products does Grand Capital offer?

A: Grand Capital offers a diverse range of products, including securities, futures, stock options, and fixed-income instruments.

Q: How can I contact Grand Capital's customer support?

A: You can reach Grand Capital's customer support through phone at +852 3891 9888 or via email at cs@grandch.com.

Q: What trading platforms are available at Grand Capital?

A: Grand Capital offers multiple trading platforms, including desktop, web, and mobile options to suit different preferences.

Q: What payment methods are accepted for deposits and withdrawals?

A: Grand Capital facilitates deposits and withdrawals through bank transfers, cheques, and overseas remittances, although specific fees and processing times may apply.

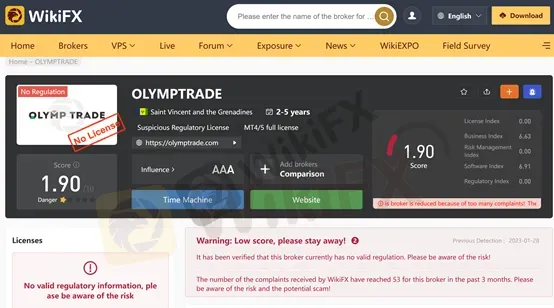

| Registered in | St. Vincent and the Grenadines |

| Regulated by | No effective regulation at this time |

| Year(s) of establishment | 2-5 years |

| Trading instruments | Information not available |

| Minimum Initial Deposit | Information not available |

| Maximum Leverage | Information not available |

| Minimum spread | Information not available |

| Trading platform | MT4 |

| Deposit and withdrawal method | Information not available |

| Customer Service | Email/phone number/address |

| Fraud Complaints Exposure | Yes |

Note: At this time, we only have a cursory look at OLYMPTRADE as the company's official website (https://olymptrade.com/ ) does not open properly.

Screenshot time: 01/28/2023

WikiFX provides dynamic scoring, it will track the broker's dynamic real-time scoring, the current time screenshot scores do not represent past and future scoring.

OLYMPTRADE is registered in St. Vincent and the Grenadines and appears to be a fraudulent broker without any credible regulation, with a history of no more than 5 years. Unfortunately, we could not find any more detailed information about this broker on the internet.

OLYMPTRADE caters to a diverse range of traders, including beginners and experienced traders alike.The platform offers a wide range of financial instruments for trading, including currencies, stocks, metals, indices, commodities, cryptocurrencies, ETFs, OTC, and composites. Traders have the flexibility to choose between two types of accounts: Real Account and Demo Account. The Real Account allows traders to engage in live trading with real money, while the Demo Account provides a risk-free environment for practice. While specific information about spreads is not available on the website, OLYMPTRADE mentions that there are no commissions charged.Traders can access the OLYMPTRADE trading platform via a downloadable application on both mobile and desktop devices. The platform offers a user-friendly interface with various trading tools, features, educational resources, market analysis reports, and customer support services available 24/7.

When choosing a forex broker, you should know that a regulatory license does not necessarily guarantee the reliability of a broker as it may be an expired or cloned regulatory license, but a broker without any regulatory license has a high probability of being unreliable.

OLYMPTRADE offers a user-friendly trading platform with a wide range of market instruments, a demo account for practice, comprehensive customer support, and educational resources. However, it is not regulated by a reputable authority, lacks transparency on leverage and spreads, provides limited information on fees and commissions, has a relatively low minimum deposit requirement, and offers limited advanced features. Traders should carefully consider these pros and cons before deciding to trade with OLYMPTRADE.

| Pros | Cons |

| User-friendly trading platform with a range of tools and features. | Not regulated by a reputable financial authority, which carries higher risk. |

| Wide selection of market instruments, including currencies, stocks, metals, cryptocurrencies, and more. | Lack of transparency regarding leverage and spreads. |

| Demo account available for practice and learning. | Limited information on trading fees and commissions. |

| Comprehensive customer support available 24/7. | Relatively low minimum deposit requirement may attract inexperienced traders. |

| Educational resources to enhance trading knowledge and skills. | Limited availability of advanced trading features and platforms. |

OLYMPTRADE offers a diverse range of market instruments, including currencies, stocks, metals, indices, commodities, cryptocurrencies, ETFs, OTC trading, and composites, providing traders with ample opportunities to engage in various trading strategies.

Currencies: OLYMPTRADE offers a wide range of currency pairs for trading, including major pairs such as EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic pairs like USD/TRY and NZD/CAD. Traders can speculate on the exchange rate movements between these currency pairs.

Stocks: OLYMPTRADE provides access to a variety of stocks from global markets. Traders can invest in individual company stocks, such as Apple, Amazon, or Google, and speculate on their price movements. Stock trading allows traders to benefit from the performance of specific companies.

Metals: OLYMPTRADE allows trading in precious metals like gold, silver, platinum, and palladium. These metals are often seen as safe-haven assets and can be used as a hedge against inflation or economic uncertainties. Traders can speculate on the price fluctuations of these metals.

Indices: OLYMPTRADE offers trading on major stock indices from around the world, including the S&P 500, NASDAQ, FTSE 100, and Nikkei 225. Index trading allows traders to speculate on the overall performance of a specific stock market, rather than individual stocks.

Commodities: OLYMPTRADE provides access to various commodities such as oil, natural gas, and agricultural products like corn and wheat. Commodity trading allows traders to speculate on the price movements of these essential goods, which can be influenced by factors like supply and demand dynamics, weather conditions, and geopolitical events.

Cryptocurrencies: OLYMPTRADE offers trading in popular cryptocurrencies like Bitcoin, Ethereum, Litecoin, and Ripple. Cryptocurrency trading allows traders to speculate on the price volatility of these digital assets, which have gained significant popularity in recent years.

ETFs (Exchange-Traded Funds): OLYMPTRADE allows trading in ETFs, which are investment funds traded on stock exchanges. These funds are composed of a basket of assets, such as stocks, bonds, or commodities. Traders can invest in ETFs to gain exposure to a diversified portfolio of assets.

OTC (Over-the-Counter): OLYMPTRADE provides over-the-counter trading, which refers to trading financial instruments directly between two parties without the involvement of an exchange. OTC trading allows for more flexible and customized transactions, particularly for certain derivatives and exotic instruments.

Composites: OLYMPTRADE offers composite instruments, which are synthetic assets created by combining multiple financial instruments. These composites can represent various strategies or themes, such as a basket of stocks from a particular sector or a combination of different asset classes. Traders can speculate on the performance of these composites.

Although a long time has passed since the launch of MT4, it is still a major player in the market and is loved by traders all over the world. Accessing it from different devices also makes it easier for users to trade.

OLYMPTRADE offers two types of accounts: Real Account and Demo Account. The Real Account allows traders to engage in live trading with real money, providing access to the full range of market instruments and features offered by OLYMPTRADE. Traders can deposit funds into their Real Account and trade in real-time market conditions, experiencing the actual risks and rewards of trading.

On the other hand, the Demo Account is a practice account that allows traders to simulate trading without using real money. It is an excellent option for beginners or those who want to test trading strategies and explore the platform's functionalities. The Demo Account provides virtual funds, enabling traders to practice and gain confidence before venturing into live trading.

Here is a brief description of the account opening process for OLYMPTRADE:

Registration: Visit the OLYMPTRADE website and click on the “Register” button to start the registration process. Fill in the required information, such as your name, email address, and preferred password. Make sure to read and agree to the terms and conditions before proceeding.

Account Verification: After completing the registration, you may need to verify your account. OLYMPTRADE may require you to provide certain documents for verification purposes, such as a copy of your identification document (e.g., passport or driver's license) and proof of address (e.g., utility bill or bank statement). Follow the instructions provided by OLYMPTRADE to submit the necessary documents.

Account Funding: Once your account is verified, you can proceed to fund your account. OLYMPTRADE offers various deposit methods, such as credit/debit cards, bank transfers, and electronic payment systems. Choose your preferred payment method and follow the instructions to make a deposit. Be aware of any minimum deposit requirements set by OLYMPTRADE.

Platform Access: Once your account is funded, you will gain access to the OLYMPTRADE trading platform. You can log in using your registered email address and password. The platform provides a user-friendly interface with a range of trading tools and features.

Account Configuration: Before you start trading, you may need to configure your account settings. This includes selecting your preferred language, setting up notifications, and adjusting other platform preferences according to your trading preferences. Take some time to explore the platform and familiarize yourself with its features.

It's important to note that the specific steps and requirements may vary, so it's advisable to refer to the official OLYMPTRADE website or contact their customer support for the most accurate and up-to-date information regarding the account opening process.

The official website of OLYMPTRADE does not provide specific information about leverage. However, it is common for similar types of brokers to offer leverage ratios ranging from 100:1 to 500:1. Please note that leverage allows traders to multiply their trading positions, but it also amplifies both potential profits and losses. It is important to fully understand the implications of leverage and exercise responsible risk management when trading on any platform. For accurate and up-to-date information about leverage on OLYMPTRADE, it is recommended to refer to the broker's official website or contact their customer support.

Spreads & Commissions (Trading Fees)

OLYMPTRADE's official website does not provide specific information about spreads. However, it is mentioned that there are no commissions charged. In general, similar brokers in the industry offer spreads that start from 0 to 0.1 pips. Spreads refer to the difference between the bid and ask prices of a financial instrument and can vary depending on market conditions and the specific asset being traded. For accurate and up-to-date information about spreads on OLYMPTRADE, it is recommended to refer to the broker's official website or contact their customer support.

OLYMPTRADE provides a simple and convenient deposit and withdrawal process for its traders. The minimum deposit amount is 10 USD/10 EUR, making it accessible for traders with varying budgets. OLYMPTRADE supports multiple deposit and withdrawal methods, including Bank Transfer, Credit/Debit Cards, Bank Wire Transfer, E-wallets, and Cryptocurrency.

Traders can choose to deposit funds using popular payment options such as credit or debit cards, bank transfers, and e-wallets.

Similarly, when it comes to withdrawing funds, OLYMPTRADE supports the same methods used for deposits. The withdrawal process is typically straightforward, and the platform strives to process withdrawal requests promptly. However, the processing time may vary depending on the chosen withdrawal method and the policies of the respective financial institutions involved.

The support service provided by OLYMPTRADE is not very extensive. It can only be accessed via email, address and a phone number. Since the company's website is not currently open, we do not know if it offers other services such as live chat, callback, FAQ, 24/7 or 24/5 service, etc.

Below are the details about the customer service.

Email: support@olymptrade.com

support-en@olymptrade.com

Phone Number: +356 20341634

Address: 54, Immakulata, Triq il-Mina ta Hompesch, ZABBAR ZBR 9016.

On our website, you can see that many users have reported scams. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

OLYMPTRADE is an online trading platform that caters to a diverse range of traders, offering a wide selection of market instruments and account types. The platform provides a user-friendly interface, downloadable on mobile and desktop devices, with access to real-time market quotes, trading tools, and educational resources. However, it is important to note that OLYMPTRADE is not regulated by a reputable financial authority, which poses a higher risk for traders. The platform lacks transparency on leverage and spreads, limited information on fees and commissions, and advanced features. Traders should carefully evaluate these pros and cons before deciding to trade with OLYMPTRADE. While OLYMPTRADE offers convenience and comprehensive customer support, traders should exercise caution and conduct thorough research before opening an account.

Q: Is OLYMPTRADE a regulated broker?

A: No, OLYMPTRADE is not a regulated broker.

Q: What is the minimum deposit required to open an account with OLYMPTRADE?

A: The minimum deposit required to open an account with OLYMPTRADE is 10 USD/10 EUR.

Q: What trading instruments are available at OLYMPTRADE?

A: OLYMPTRADE offers a wide range of trading instruments, including currencies, stocks, metals, indices, commodities, cryptocurrencies, ETFs, OTC trading, and composites

Q: Does OLYMPTRADE offer a demo account?

A: Yes, OLYMPTRADE offers a demo account that allows clients to practice trading in a risk-free environment with virtual funds.

Q: What trading platforms does OLYMPTRADE offer?

A: OLYMPTRADE offers their our trading platform.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive grand-capital and olymptrade are, we first considered common fees for standard accounts. On grand-capital, the average spread for the EUR/USD currency pair is -- pips, while on olymptrade the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

grand-capital is regulated by SFC. olymptrade is regulated by --.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

grand-capital provides trading platform including -- and trading variety including --. olymptrade provides trading platform including -- and trading variety including --.