No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between Global Prime and Spreadco ?

In the table below, you can compare the features of Global Prime , Spreadco side by side to determine the best fit for your needs.

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of global-prime, spreadco lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Registered in | Australia |

| Regulated by | ASIC, FSA |

| Year(s) of establishment | 10-15 years |

| Trading instruments | Currency pairs, indices, commodities, metals, energy, cryptocurrencies, stocks, bonds |

| Minimum Initial Deposit | No minimum deposit |

| Maximum Leverage | 1:100 |

| Minimum spread | Tight spreads |

| Trading platform | MT4 and tradingview |

| Deposit and withdrawal method | Paypal, mastercard, visa, etcetera |

| Customer Service | Email/phone number/address |

| Fraud Complaints Exposure | Yes |

General information and regulations of Global Prime

Registered in Australia, Global Prime is an online forex broker that has been providing service for more than a decade.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on.

At the end of the article, we will also briefly summarize the main advantages and disadvantages so that you can understand the broker's characteristics at a glance.

Market instruments

Currency pairs, indices, commodities, metals, energy, cryptocurrencies, stocks, bonds .....Global Prime allows clients to access a huge range of trading markets. Therefore, both beginners and experienced traders can find what they want to trade on Global Prime.

Spreads and commissions for trading with Global Prime

In Global Prime, the spreads are shown in a separate page and the commissions are 7 USD per lot. We can see that the minimum spreads for major forex pairs are 0.0 pips.

Account Types for Global Prime

Demo Account: Global Prime provides a demo account that allows you to try out the financial markets without the risk of losing money.

Live Account: Global Prime only provides one type of ECN account, the commission is 7 USD per lot, no minimum deposit and spreads are tight.

Trading platforms offered by Global Prime

When it comes to trading platforms, Global Prime provides MT4 and Tradingview, both are among the most popular platforms in the world. The clients may choose the one they prefer freely.

Leverage offered by Global Prime

The maximum leverage offered by Global Prime is only 1:30 or 1:100, which may seem too low to you. In reality, those leverage of up to 1:500 or even 1:1000 are all from unregulated or offshore regulated brokers, and as we know, offshore regulation is much less strict regulation. For brokers that are formally regulated by the major regulatory bodies, they can only offer leverage of 1:30 or 1:50 at best, which is sufficient for the novice Forex trader. Lower leverage reduces the potential gains on trades, but more importantly, it reduces much of the risk. We recommend that you always keep your account risk at 2% or less.

Deposit and withdrawal methods and fees

In terms of deposit and withdrawal, like many good brokers, Global Prime provides a detailed form with important information about currency, payment method, minimum amount, arrival date, fees, etc.

Educational resources

A series of educational resources is available at Global Prime, such as autochartist alerts, economic calendar, market opportunities, chrome extender, VPS, autotrade, pip calculator, etcetera.

Customer support of Global Prime

Below are the details about the customer service.

Language(s): English, Portuguese

Service Hours: 24/5

Email: support@globalprime.com

Phone Number: +61 (2) 8379 3622

Address: Global Prime PTY Ltd (ABN 74 146 086 017), Suite 504, 35 Grafton Street, Bondi Junction, Australia

Global Prime FX (Company Number 40256), Govant Building, BP 1276, Port Vila, Vanuatu

Social media: Facebook, LinkedIn, YouTube, twitter

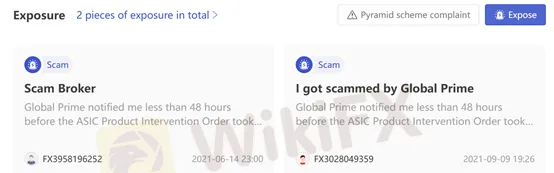

Users exposures on WikiFX

On our website, you can see that some users have reported scams. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Frequent asked questions about Global Prime

Is this broker well regulated?

Yes, it is currently effectively regulated by ASIC and FSA.

| Registered Country/Region | United Kingdom |

| Regulation | FCA |

| Minimum Deposit | $200 |

| Maximum Leverage | 1:30 |

| Minimum Spreads | 0.8 pips on the EUR/USD pair |

| Trading Platform | Web Platform, Mobile Apps |

| Demo Account | Yes |

| Trading Assets | Forex, Equities, Commodities, ETFs, Indices |

| Payment Methods | Bank wire transferDebit and credit cardSkrill |

| Customer Support | 5/24, Email, Phone |

General Information & Regulation

Spread Co Limited is a limited liability company registered in England and Wales with its registered office at 22 Bruton Street, London W1J 6QE. Company No. 05614477. Spread Co is an online spread betting and CFD broker specialising in forex, commodities, equities and indices. Spread Co Limited is authorised and regulated by the Financial Conduct Authority with regulatory license no. 446677.

Market Instruments

With a Spread Co account, investors can trade on a wide range of global markets, from major indices and global equities to foreign exchange currency pairs, commodities, crude oil, precious metals, and bitcoin, to meet a wide range of investment needs.

Account Types

Spread Co has two different types of accounts, the spread trading account and the CFD account. Minimum deposits depend on account types. To open a spread trading account, traders are required a minimum initial deposit of £200 and £250 for a CFD account.

Demo Account

Spread Co does offer a demo trading account for beginners to practice forex trading in a 100% risk-free environment. The Spread Co demo account does not have a specific expiry date. Some features of the Spread Co demo accounts include the following:

Practice trading with £25,000 virtual funds

Develope you strategies with no risk

Learn how risk management tools work

Leverage

Leverage level offered by Spread Co do depends on the regulatory requirement you trading with and the brokerage operates. This applies due to various safety measures applied to eliminate the risks involved while trading, specially for retail traders.

With Spread Co, LverageTrading leverage vary by different instruments:

1:30 for Forex currency pairs,

1:10 for commodities

1:20 for indices

1:5 for enquities

Spreads & Commissions

Spread Co offers commission-free trading, and the broker only takes its cut from the spread. EURUSD spreads start from 0.8 pips, 4 pips for US Crude Oil, 4 pips for Gold, and 40 pips for Bitcoin/USD.

There are no other fee indicated for Spread Co, but traders are advised to verified fees pertainning to the following:

Account maintenance and management

Inactivity fees and Conversion fees

Trading Platforms

What Spread Co offers traders is not the MT4 trading platform, which is currently the most popular one, but its in-house developed online trading platform. This online trading platform requires no download and allows traders to customize their trading experience for experienced traders and novice traders. Anyway, lack of widely used MT4 & MT5 trading platforms really a drawback for such a big broker.

Deposit and Withdrawal of Spread Co

Spread Co allows traders to deposit and withdraw funds from their investment accounts via the following methods:

Credit Card;

UK Credit Card;

Bank Transfer;

Skrill

Spread Co does not charge traders any fees for withdrawals or deposits . Spread Co has no limit to how much you can fund via the platform, but the maximum amount which it can accept for your first payment is GBP500 via the phone. Successfully authorized payments will be available immediately.

Spread Co suppports the following deposit currencies when deposits and withdrawals are made to end from the trading account: GBP, USD, EUR.

Customer Support

Customer services are available in several options: email, whatapp, Live chat, and telephone.

Here are some contact details:

Telephone: 0800 078 9398

Email: info@spreadco.com

Or you can also follow this broker on some social media platforms, such as Facebook, Twitter, and Youtube.

Educational Resources

Spread Co provides clients support through relationship managers that provide assistance as well as providing eucation. The broker provides educational library with multiple guides and video updates along with the market overview, platform, news and economic calendars.

Pros & Cons

| Pros | Cons |

| FCA-regulated | Additional non-trading fees |

| Competitive trading conditions | Limited product portfolios |

| 7/24 customer support | No Ilslamic account provided |

| Demo accounts available | Withdrawal fees are charged |

| No deposit fees | Conservative leverage |

| Commission-free CFD trading |

Frequently Asked Questions

Is Spread Co legal ?

Yes, Spread Co is a legal broker that adheres to rules and regulations stipulated by the FCA.

Does Spread Co offer a demo account?

Yes, Spread Co does offer a demo account that is valid for 2 weeks.

What is the maximum trading leverage offered by Spread Co?

The maximum trading leverage offered by Spread Co is up to 1:30.

What are the deposit and withdrawal methods supported by Spread Co ?

Payment methods supported by Spread Co include Bank Wire Transfer, Credit/Debit Cards, Skrill.

What is the overall rating for Spread Co ?

The overall rating for Spread Co is 7.06/10 based on its License Index, Business Index, Risk Management Index, Software Index and Regulatory Index.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive global-prime and spreadco are, we first considered common fees for standard accounts. On global-prime, the average spread for the EUR/USD currency pair is 0.4 pips, while on spreadco the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

global-prime is regulated by ASIC,FSA,VFSC. spreadco is regulated by FCA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

global-prime provides trading platform including Commission Free,Spreads + Commission and trading variety including 100. spreadco provides trading platform including CFD Account,Spread betting account and trading variety including shares, commodities, forex, cryptocurrencies.