No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between FXTM and BCR ?

In the table below, you can compare the features of FXTM , BCR side by side to determine the best fit for your needs.

Long: -7.04

Short: 2.53

Long: -37.89

Short: 19.3

EURUSD: -0.5

XAUUSD: 0.1

Long: -5.22

Short: 0.74

Long: -32.4

Short: 16.2

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of fxtm, bcr lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| FXTM | Basic Infromation |

| Registered Country/Region | United Kingdom |

| Founded in | 2011 |

| Headquarters | Cyprus, UK, Belize |

| Regulated By | FCA, CySEC, FSCA (Out of Scope Business) |

| Minimum Deposit | $10 |

| Leverage | Up to 1:2000 |

| Account Types | Micro, Advantage, and Advantage Plus |

| Demo Account | Yes |

| Trading Instruments | Forex, Commodities, Indices, Shares, Cryptocurrencies |

| Trading Platforms | MetaTrader 4, MetaTrader 5, FXTM Trader |

| Mobile Trading | Yes |

| Islamic Account | Yes |

| Payment Methods | Credit/Debit Cards, Bank Wire, E-wallets |

| Minimum Spread on EUR/USD | From 0.1 pips |

| Customer Support | 24/5 Live Chat, Email, Phone |

| Educational Resources | Yes |

| Negative Balance Protection | Yes |

FXTM, or Forex Time, is a global forex and CFD broker founded in 2011. The company is headquartered in Cyprus and is regulated by the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and other regulatory bodies in various countries. FXTM offers a variety of trading instruments, including forex, commodities, indices, shares, and cryptocurrencies.

FXTM is its extensive range of account types, which cater to traders of all experience levels and preferences. The broker offers five different account types, including the Micro, Advantage, and Advantage Plus accounts, as well as demo accounts and Islamic accounts. Each account type comes with its own unique features, including different leverage options, spreads, and minimum deposit requirements. In terms of trading fees, FXTM offers variable spreads on most of its instruments, with spreads starting from as low as 0.1 pips.

FXTM also offers a range of trading platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms are available in desktop, web, and mobile versions, allowing traders to trade on the go and from anywhere in the world.

Lastly, FXTM provides customer support in multiple languages, which is available 24/5 via live chat, email, and phone. The broker also offers a range of educational resources, including webinars, seminars, and trading guides.

FXTM is currently regulated by two reputable regulatory bodies, the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC) in Cyprus. These regulatory bodies ensure that the broker operates within strict guidelines and rules.

Forextime Ltd (Its CYSEC entity), is authorized and regulated by the Cyprus Securities and Exchange Commission (CYSEC) under regulatory license number 185/12.

Exinity UK Ltd, its UK entity, is authorized and regulated by the Financial Conduct Authority (FCA) under regulatory license number 777911.

FOREXTIME LTD is authorized by the Financial Conduct Authority (FSCA), holding a license of Financial Service Authority under license no. 46614.

FXTM is a well-known broker that offers a range of trading services to its clients, including forex, commodities, and CFDs. While there are many benefits to trading with FXTM, there are also some drawbacks to consider. In this table, we'll take a closer look at the pros and cons of trading with FXTM, so you can make the right choice about whether this broker is right for you. Some of the pros we'll cover include their range of account types, competitive spreads, and excellent customer support, while some of the cons we'll discuss include the lack of cryptocurrency trading and high withdrawal fees.

| Pros | Cons |

| Regulated by top-tier financial authorities, FCA and CYSEC | Limited product offerings compared to some competitors |

| Wide range of account types for different trading needs | High inactivity fee |

| Low minimum deposit requirements | Limited payment methods |

| Demo Accounts Available | Limited research tools and resources |

| Islamic Accounts Available | |

| Access to a variety of trading platforms, including MT4 and MT5 | |

| Multiple funding and withdrawal options | |

| Rich Eductaional Resources | |

| Rich Trading Tools | |

| High-quality customer support |

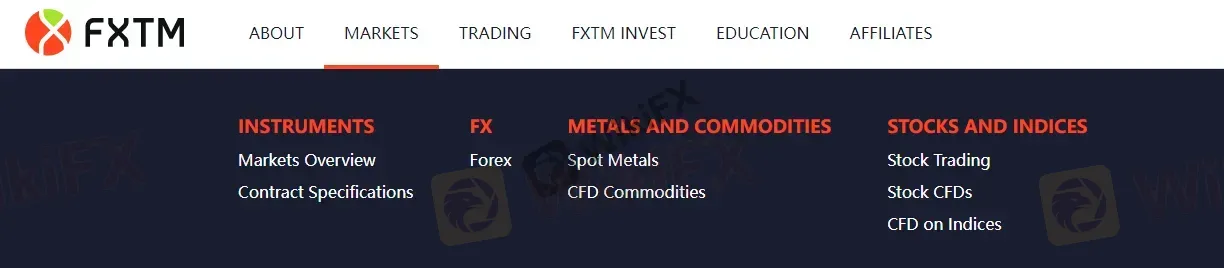

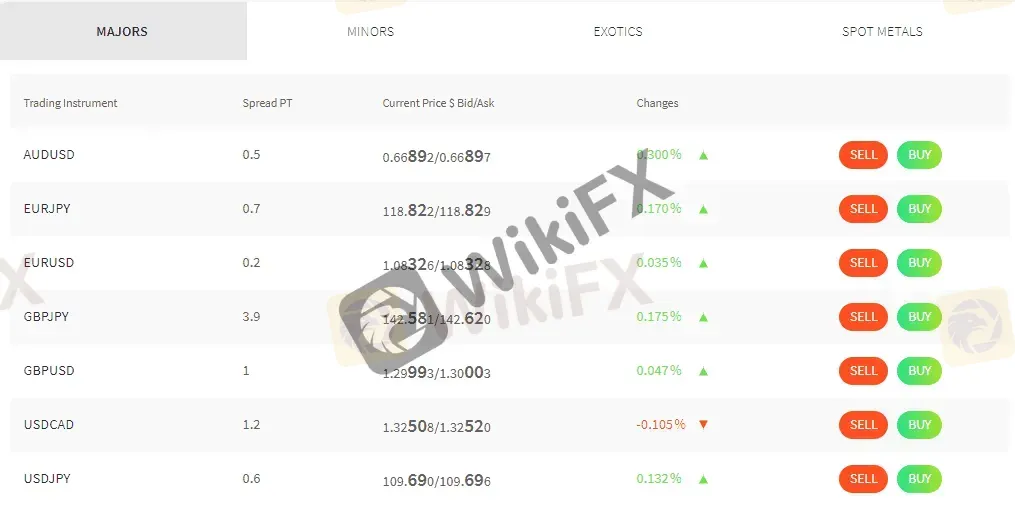

FXTM offers a diverse range of trading instruments for its clients, which includes forex, spot metals, CFD commodities, stock, stock CFDs, and CFDs on indices. The forex market is the largest financial market in the world, and FXTM provides access to a wide range of major, minor and exotic currency pairs. This means that traders have the flexibility to trade the currency pairs that best suit their trading strategies.

In addition to forex, FXTM offers trading in spot metals, which include gold, silver, and platinum. Spot metals can be a useful tool for diversifying a portfolio or hedging against inflation or geopolitical risks. FXTM also provides CFD trading in commodities, such as oil, natural gas, and agricultural commodities. CFD trading allows traders to speculate on the price movements of these commodities without having to own them physically.

FXTM also offers trading in stocks and stock CFDs. With access to global markets, traders have the opportunity to invest in some of the world's leading companies, such as Apple, Amazon, and Facebook. Moreover, traders can benefit from dividend payments when holding stock CFDs for the long term.

Finally, FXTM provides CFD trading on indices, which allows traders to speculate on the performance of a particular stock market. This is particularly useful for traders who want to take a broader view on the direction of a market, rather than focusing on individual stocks.

Overall, FXTM's range of market instruments provides traders with a wide variety of opportunities to diversify their trading portfolio and explore new trading strategies.

| Pros | Cons |

| Offers a wide range of markets to trade, including forex, spot metals, and CFDs on commodities, stocks, and indices | Limited selection of individual stocks compared to some competitors |

| Competitive spreads and commissions | Margin requirements on some instruments may be higher than other brokers |

| Access to both major and minor forex pairs, as well as exotic currency pairs | Limited cryptocurrency offerings compared to some competitors |

| Opportunity to diversify portfolio with a variety of markets | The number of CFDs on commodities may be limited compared to other brokers |

| Offers both MetaTrader 4 and MetaTrader 5 platforms for trading | Availability of certain markets may vary depending on the trader's location |

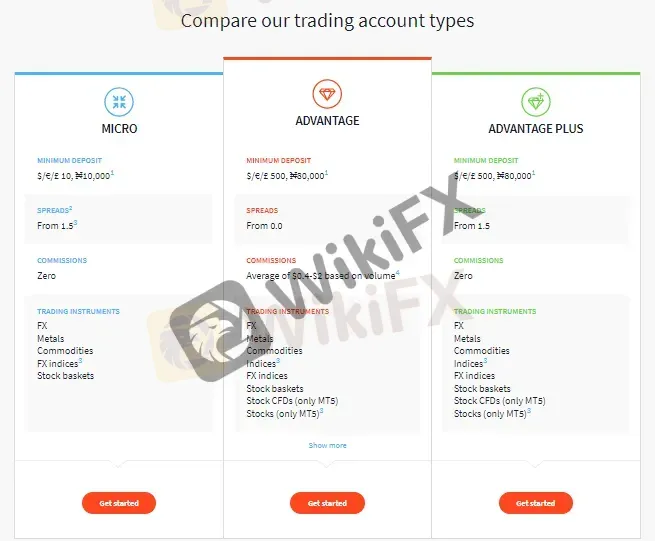

FXTM offers three different types of trading accounts, which are the Micro account, the Advantage account, and the Advantage Plus account. The Micro account requires a minimum deposit of $10, the Advantage account requires a minimum deposit of $100, and the Advantage Plus account requires a minimum deposit of $500.These account types are designed to cater to the varying needs and preferences of traders, ranging from beginner traders with limited capital to experienced traders looking for more advanced trading features. Each account type has its own unique features and benefits, such as different minimum deposit requirements, leverage ratios, and spreads, allowing traders to choose the one that suits them best. The Micro account is ideal for novice traders with a limited budget, while the Advantage account is suitable for experienced traders who require advanced trading tools and a competitive trading environment. The Advantage Plus account is designed for professional traders who require high-volume trading and personalized support from a dedicated account manager.

| Pros | Cons |

| Micro account has low initial deposit | Micro account has higher spreads compared to other types |

| Advantage account has low spreads | Advantage account has a higher minimum deposit |

| Advantage Plus account offers lower commissions | Advantage Plus account has the highest minimum deposit |

FXTM offers demo accounts for all its account types, including Micro, Advantage, and Advantage Plus. These demo accounts allow traders to test their trading strategies in a risk-free environment using virtual funds. Demo accounts are also useful for new traders who want to learn how to trade before committing real money to live trading. With FXTM's demo accounts, traders can access all the trading tools and features available in the live trading platform. The demo accounts are also available in multiple languages, making it accessible for traders from different countries. However, it's important to note that demo trading doesn't completely simulate the emotional and psychological aspects of real trading, which could affect a trader's performance in the live markets.

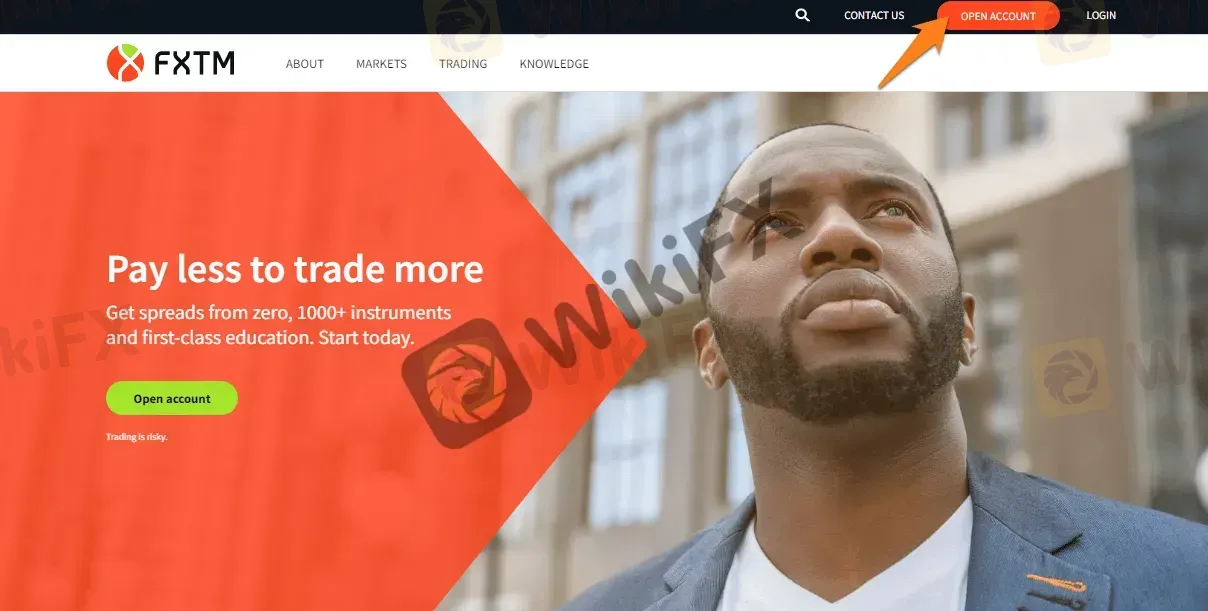

To open an account with FXTM, you first need to visit their website and click on the “OPEN ACCOUNT” button on the top right-hand corner of the page.

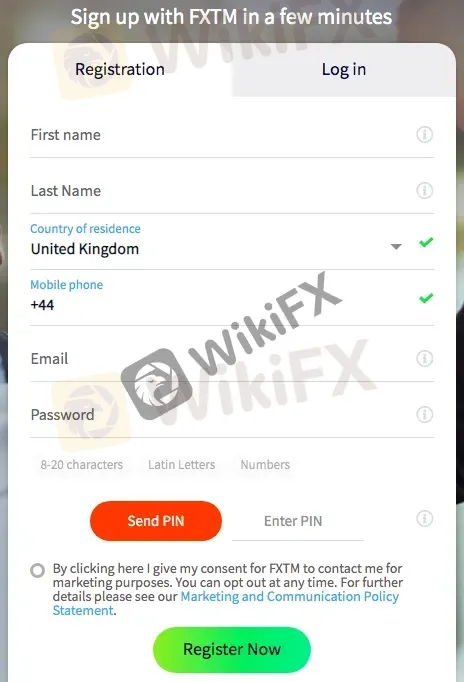

This will take you to the account registration page where you will need to fill out some basic personal information like your name, email address, and phone number.

Next, you will be asked to choose the type of account you want to open. FXTM offers three main account types - Micro, Advantage, and Advantage Plus, each with its own features and benefits. You will also need to select the base currency of your account and agree to the terms and conditions of the broker.

Once you have selected your account type and base currency, you will be prompted to provide some additional personal information like your date of birth, occupation, and address. You will also need to answer a few questions about your trading experience and investment goals.

After you have completed the registration process, you will need to verify your account by providing some additional documents like a copy of your ID or passport and a proof of address like a utility bill or bank statement.

Finally, once your account is verified, you can then make your first deposit and start trading.

FXTM offers leverage of up to 1:2000, depending on the account type and trading instrument. The highest leverage is available for forex trading on the FXTM Pro account, while the other account types offer leverage up to 1:30 for EU traders and up to 1:2000 for non-EU traders. It's important to note that while high leverage can increase potential profits, it also increases the risk of losses. Therefore, it's recommended to use leverage wisely and only trade with funds you can afford to lose. FXTM also offers negative balance protection, which ensures that traders can not lose more than their account balance. This feature can provide additional peace of mind when trading with high leverage.

The spreads and commissions vary depending on the account type. For the Micro account, the spreads start from 1.5 pips, and no commission is charged. For the Advantage account, the spreads start from 1.1 pips, and a commission of $2 is charged per lot. For the Advantage Plus account, the spreads start from 0.0 pips, and a commission of $4 is charged per lot. It's important to note that the spreads are floating and may widen during periods of high market volatility.

The spreads offered by FXTM are typically lower than those offered by many other brokers in the industry, particularly on the Advantage and Advantage Plus accounts. The Micro account, however, has slightly higher spreads, which is to be expected due to the smaller minimum deposit requirement.

Here we have created a comparison table of the average spreads and commissions offered by FXTM and some other popular forex brokers such as IC Markets, Exness, and FP Markets:

| Broker | EUR/USD Spread | Commission | Minimum Deposit |

| FXTM (Micro) | 1.5 pips | No commission | $10 |

| FXTM (Advantage) | 0.5 pips | No commission | $100 |

| FXTM (Advantage Plus) | 0.1 pips | No commission | $500 |

| IC Markets (Raw Spread) | 0.1 pips | $7 round turn | $200 |

| Exness (Raw Spread) | 0.3 pips | No commission | $1 |

| FP Markets (Raw Spread) | 0.0 pips | $7 round turn | $100 |

Apart from trading fees, FXTM charges some non-trading fees that traders should also consider before choosing this broker. Some of the non-trading fees charged by FXTM include inactivity fee, withdrawal fee, deposit fee, and overnight fee. The inactivity fee is charged when a trader does not perform any trading activity on their account for a period of 6 months. The fee charged is $5 per month. Withdrawal fees vary depending on the method used, with bank transfers attracting a higher fee compared to e-wallets. Deposit fees are not charged for most methods, but a 2.5% fee is charged when depositing via Neteller. Overnight fees are charged when a position is held open overnight, and they vary depending on the instrument being traded

Here is a table showing the comparison of non-trading fees charged by FXTM and some other popular forex brokers:

| Broker | Inactivity Fee | Deposit Fee | Withdrawal Fee |

| FXTM | $5/month after 6 months of inactivity | Free | Fees may occur |

| Avatrade | $50/quarter after 3 months of inactivity | Free | Fees may occur |

| IC Markets | $0 | Free | Fees may occur |

| Exness | $0 | Free | Fees may occur |

| FP Markets | $0 | Free | Fees may occur |

FXTM offers a range of trading platforms, including the popular MetaTrader 4 and 5 platforms, as well as their proprietary trading platform called FXTM Trader. The MetaTrader 4 and 5 platforms are known for their ease of use, comprehensive charting tools, and customizability, while FXTM Trader offers advanced features such as price alerts, multiple chart types, and a news feed.

One of the main advantages of using MetaTrader 4 and 5 is the vast community of traders who have developed and shared custom indicators and trading strategies, making it easy to find and use powerful tools that can help improve your trading performance.

Another advantage of FXTM's trading platforms is their compatibility with a range of devices, including desktop, mobile, and web-based platforms, making it easy to trade on the go or from any device.

Here's a table comparing the trading platforms offered by FXTM, IC Markets, Avatrade, and Exness

| Broker | Platform Types | Desktop | Web-Based | Mobile |

| FXTM | MT4, MT5, FXTM Trader | ✔ | ✔ | ✔ |

| IC Markets | MT4, MT5, cTrader | ✔ | ✔ | ✔ |

| Avatrade | MT4, AvaTradeGO, WebTrader | ✔ | ✔ | ✔ |

| Exness | MT4, MT5 | ✔ | ✔ | ✔ |

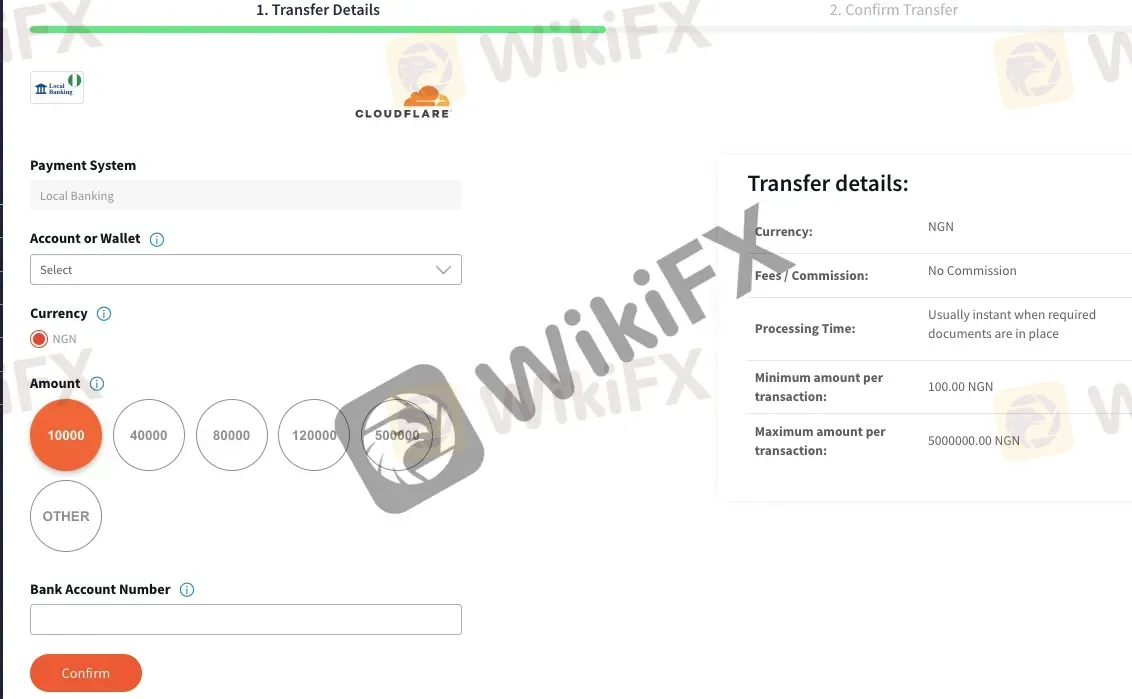

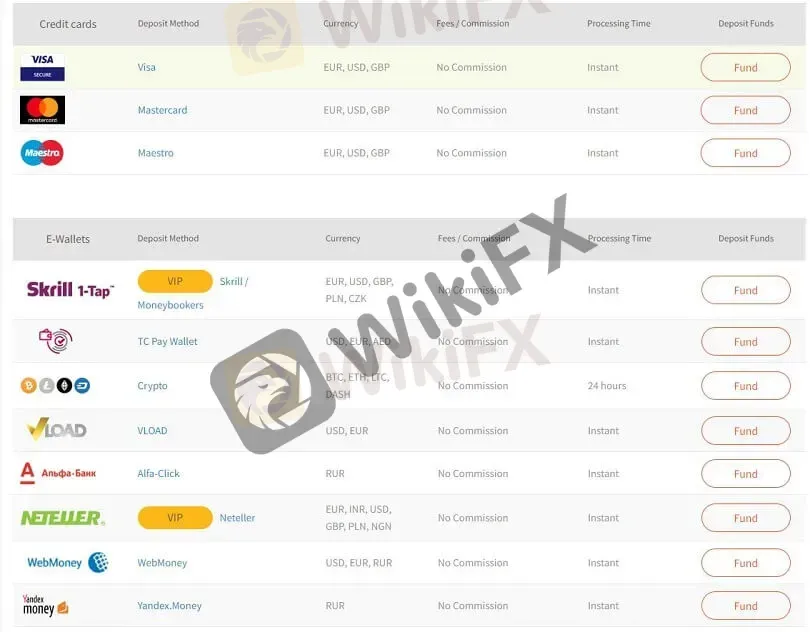

FXTM offers a variety of deposit and withdrawal options for its clients. Traders can deposit funds into their trading account using credit/debit cards, bank wire transfers, e-wallets, and other online payment methods. The minimum deposit amount varies depending on the account type selected by the trader.

For credit/debit card deposits, FXTM accepts Visa, Mastercard, and Maestro. There are no deposit fees for credit/debit card transactions, and funds are usually credited to the trading account instantly.

Bank wire transfers are also available as a deposit option. This method takes longer to process compared to other deposit methods and may incur charges from the bank. The minimum deposit amount for bank wire transfers varies depending on the currency selected, and it may take up to five business days for funds to appear in the trading account.

E-wallets such as Skrill, Neteller, and WebMoney are also accepted by FXTM. Deposits made through e-wallets are usually credited to the trading account instantly and are free of charge. The minimum deposit amount for e-wallet transactions varies depending on the selected e-wallet.

Withdrawals can be made using the same methods as deposits, with the exception of Mastercard. Withdrawals made through credit/debit cards may take up to three business days, while withdrawals made through e-wallets are usually processed within 24 hours. Bank wire transfers may take up to five business days for the funds to be credited to the trader's bank account.

FXTM may charge withdrawal fees for some methods. Traders are advised to check the fees and processing times associated with each method before making a deposit or withdrawal.

| Pros | Cons |

| Multiple deposit and withdrawal methods | Some withdrawal methods may have higher fees |

| No deposit fees | Minimum withdrawal amounts may be higher than other brokers |

| Fast deposit and withdrawal processing times | Some deposit methods may not be available in certain regions |

| Supports various currencies for transactions |

FXTM is known for providing excellent customer support to its clients. The broker offers various channels for clients to contact their support team, including live chat, email, and phone support. The customer support team is available 24/5 and is multilingual, which means clients can communicate with them in their preferred language.

FXTM also provides an extensive FAQ section on their website that covers various topics, such as account opening, deposit and withdrawal methods, trading platforms, and more. This section is helpful for clients who prefer to find answers to their questions without contacting the support team.

| Pros | Cons |

| Live chat support available | No 24/7 customer support |

| Fast response times | No phone support for some countries |

| Knowledgeable and helpful staff | Limited educational resources for clients |

| Various support channels available | |

| A FAQs section |

FXTM offers various educational resources to its clients to enhance their trading skills and knowledge. These resources include webinars, seminars, articles, e-books, educational videos, and more.

Webinars and seminars are live sessions conducted by market experts and analysts who provide insights and analysis on market trends and trading strategies. The sessions cover a wide range of topics, including technical and fundamental analysis, risk management, and trading psychology. The webinars and seminars are interactive, allowing clients to ask questions and get feedback from experts.

FXTM also provides a wide range of educational articles and e-books that cover a variety of trading topics. These resources are available to all clients, regardless of their account type, and can be accessed on the FXTM website.

In addition to these resources, FXTM offers educational videos that cover various aspects of trading, including market analysis, trading strategies, and risk management. These videos are designed to be engaging and informative, making them a useful tool for traders at all levels of experience.

| Pros | Cons |

| Wide range of educational resources available | Some resources may be outdated or not relevant |

| Multiple formats available (webinars, articles, etc.) | Limited in-depth educational resources |

| Demo account available for practice trading | Educational resources may not be suitable for all levels of traders |

| Educational resources available in multiple languages | Some resources may require a subscription or additional fees |

FXTM is a well-regulated and respected forex broker with a wide range of market instruments, competitive trading conditions, and user-friendly trading platforms. They offer various account types with reasonable minimum deposits and leverage options. FXTM's customer support is also responsive and helpful, while their educational resources can be useful for both novice and experienced traders.

However, there are also some potential drawbacks to consider. FXTM's non-trading fees, such as withdrawal fees, can be high, and their spreads can be wider than some of their competitors. Additionally, some traders may find their educational resources lacking in depth or variety.

Q: Is FXTM regulated?

A: Yes, FXTM is regulated by top-tier financial authorities such as the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC).

Q: What trading instruments are available on FXTM?

A: FXTM offers a range of trading instruments including forex, spot metals, CFD commodities, stock CFDs, and CFDs on indices.

Q: What types of trading accounts are available on FXTM?

A: FXTM offers three main types of trading accounts: the Micro account, Advantage account, and Advantage Plus account.

Q: What is the minimum deposit required to open an account on FXTM?

A: The minimum deposit required for each account type on FXTM is as follows: Micro account - $10, Advantage account - $100, and Advantage Plus account - $500.

Q: What trading platforms are available on FXTM?

A: FXTM offers a range of trading platforms including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms.

Q: What are the deposit and withdrawal options on FXTM?

A: FXTM offers a variety of deposit and withdrawal options including bank transfers, credit/debit cards, and e-wallets such as Skrill, Neteller, and more.

Q: What are the deposit and withdrawal options on FXTM?

A: FXTM offers a variety of deposit and withdrawal options including bank transfers, credit/debit cards, and e-wallets such as Skrill, Neteller, and more.

| BCR | Basic Information |

| Registered Country | Australia |

| Founded | 2008 |

| Regulation | ASIC, FSC (Offshore) |

| Tradable Assets | Forex, CFDs on metals, commodities, indices |

| Account Types | Standard, Advantage, Alpha, and Affiliate. |

| Demo Account | Yes |

| Islamic Account | Not specified |

| Maximum Leverage | 400:1 |

| Spreads | From 3.0 pips |

| Trading Platforms | MT4 |

| Minimum Deposit | $300 |

| Payment Methods | Bank transfer, MasterCard, Direct Debit, Visa, UnionPay, Fasapay, helpay2, NPAY, Skrill, Neteller, POLi, USDT |

| Customer Support | 24/5 online chat, contact form, phone: +44 3300010590, email: info@thebcr.com, social media |

BCR is an Australian forex broker that was established in 2008 under the company name BACERA CO PTY LTD. The broker is regulated by ASIC (Australian Securities and Investments Commission) and offshore regulated by FSC (Financial Services Commission), ensuring compliance with financial regulations and providing a level of trust and security for traders.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on.

We will also briefly summarize the main advantages and disadvantages so that you can understand the broker's characteristics at a glance.

| Pros | Cons |

| • Regulated by ASIC | • Limited Account Types |

| • Demo Account | • Wide Spreads |

| • Commission-free | • No 24/7 Support |

| • Advanced MT4 Trading Platform | |

| • Various Market Research Tools |

Pros:

• Regulation: BCR is regulated by ASIC (Australian Securities and Investments Commission), which provides a level of security and trustworthiness for traders.

• Demo Account: BCR provides a demo account, allowing traders to practice and test their trading strategies in a risk-free environment.

• Commission-free: BCR offers commission-free trading for all account types.

• Advanced Trading Platforms: BCR provides access to advanced MT4 trading platform, offering comprehensive charting tools, indicators, and automated trading capabilities.

• Market Research Tools: BCR offers various market research tools, including economic calendars and market live, to help traders stay informed and make well-informed trading decisions.

Cons:

• Limited Account Types: BCR only offers two account types, which could restrict options for traders with specific needs or preferences.

• Wide Spreads: BCR offers spreads from 3.0 pips, while the industry average spread is just 1.5 pips.

• Customer Support Availability: The availability of customer support might be limited outside of regular business hours, which could be inconvenient for traders in different time zones or those requiring immediate assistance.

BCR operates within a well-regulated framework, authorized and regulated by respected financial authorities, including the Australian Securities and Investments Commission (ASIC, No. 328794) and offshore regulated by the Financial Services Commission (FSC, No. SIBA/L/19/1122) in the Virgin Islands.

This regulatory oversight ensures that BCR complies with stringent financial regulations, industry standards, and best practices. The ASIC and FSC play a crucial role in monitoring and supervising Doo Prime's operations, ensuring that the broker maintains transparency, ethical practices.

Additionally, BCR's practice of keeping segregated client funds means that client money is kept separate from the company's own funds. This can offer an additional layer of security for traders, since in the event of a company bankruptcy, these funds would not be treated as recoverable assets by general creditors of the company. This practice is common among regulated brokers as it provides more protection for traders' investments.

Forex, CFDs on metals, commodities, indices... BCR allows clients to access 300+ trading markets. Therefore, both beginners and experienced traders can find what they want to trade on BCR.

This includes prominent global forex currency pairs, allowing for trading in the foreign exchange market.

They also offer CFDs on metals, which may include precious metals like gold and silver, as well as industrial metals.

In addition, traders can access CFDs on commodities, from energy sources like oil and gas to agricultural products.

This is extended to indices, tracking performance of groups of shares in a particular market or sector.

However, cryptocurrencies are currently unavailable.

This extensive offering enables traders to diversify their portfolios and engage in different markets based on their investment preferences and strategies.

Apart from demo accopunts, BCR offers four live account types: Standard, Advantage, Alpha, and Affiliate. All account types provide leverage up to 400:1, a 50% stop-out level, micro-lot trading (0.01), and access to single stock CFDs, except for the Alpha account. The minimum deposit requirements range from $300 USD for the Standard and Advantage accounts to $3,000 USD for the Affiliate account. Spreads start from 1.2 pips for the Advantage account, with the Alpha account offering zero spreads. Additionally, the Advantage account charges a $3 USD commission per lot per side. The lot size per transaction is capped at 20 for all account types.

Here are four specific steps to open an account with BCR:

Step 1: Visit the BCR official website: Go to the BCR website using a web browser on your computer or mobile device. Navigate to the account opening section: Look for the “Join Now” button on the website on the homepage.

Step 2: Fill out the account application form: Click on the account opening button/link, and you will be directed to an online form. Provide the requested information, including your full name, contact details (such as phone number and email address), and password.

Step 3: Submit identification documents: As part of the account verification process, BCR may require you to provide identification documents. These documents may include a copy of your passport or national ID card, proof of address (such as a utility bill or bank statement), and any other documents requested by the broker.

Step 4: Review and agree to the terms and conditions: Before finalizing your account creation, carefully read through the terms and conditions provided by BCR. Make sure you understand and agree to all the terms before proceeding. If you have any questions or concerns, you can contact their customer support for clarification.

BCR provides traders with maximum levearge up to 400:1.

Leverage, in simple terms, is a tool that enables traders to control a larger position in the market with a smaller amount of capital. It can be a valuable tool for experienced traders who understand its risks and benefits. By using leverage, traders can potentially generate higher returns on their investments.

However, leverage is a double-edged sword. While it can enhance profits, it can also magnify losses. Traders should exercise caution and implement effective risk management strategies when utilizing leverage. It is crucial to have a thorough understanding of the market and the associated risks before engaging in leveraged trading.

BCR provides traders with a variety of options when it comes to spreads and commissions, catering to different trading needs and preferences. The Standard account offers a zero-commission trading environment, allowing traders to execute trades without incurring any additional charges. Spreads for the Standard account start from 8.0 pips.

For those seeking even tighter spreads, the Advantage account is available. With spreads starting from 3.0 pips and no commissions, this account offers enhanced trading conditions for traders looking to optimize their trading strategies and minimize their trading costs.

Spreads and commissions vary on the trading symbol, more details can be found in the screenshot below.

BCR provides traders with a versatile trading platform that encompasses the renowned MT4 (MetaTrader4) platform as well as a user-friendly webtrader. The MT4 platform is highly regarded in the industry for its robust features and comprehensive tools, empowering traders with advanced charting capabilities, technical indicators, and a wide range of order types to suit their trading strategies. With MT4, traders can analyze market trends, execute trades with precision, and effectively manage their positions.

BCR provides its customers with a variety of payment options, catering to different banking preferences. The options available for depositing and withdrawing funds include Bank transfer, MasterCard, Direct Debit, Visa, UnionPay, Fasapay, helpay2, NPAY, Skrill, Neteller, POLi, and USDT. This selection gives traders a good deal of flexibility.

In terms of withdrawal request processing, BCR operates a specific schedule. The cut-off time for processing on the same day is 10:00 AM. Requests submitted before this time will be processed on the same day, whereas requests submitted afterwards will not be processed until the following business day.

Additionally, BCR does not charge any fees for deposits or withdrawals. However, transactions between international banks might incur fees such as intermediary fees.

BCR is dedicated to providing its clients with a comprehensive trading experience by offering valuable trading tools and educational resources.

Their economic calendar is a must-have tool for traders, allowing them to stay informed about important economic events that have the potential to impact the markets. Identifying these events can help with planning trading strategies.

Their glossary is an excellent educational resource, especially for beginner traders. It provides definitions for numerous terms used in trading, helping traders become familiar with industry jargon.

Additionally, BCR offers a 'Market Live' feature, which provides real-time updates about market conditions and trends.

These tools, combined with their educational resources, assist traders in making informed decisions and understanding the complexity of the markets, which ultimately contributes towards a more efficient trading experience.

Customer support through multiple channels, including phone, email, contact form and online chat. This multi-channel approach ensures that traders have various options to reach out for assistance or inquiries.

By offering phone support, BCR allows traders to have direct communication with their support team, enabling them to receive real-time assistance and resolve any urgent matters.

Email support provides traders with a written record of their communication, allowing them to articulate their queries or concerns in detail and receive responses at their convenience.

Additionally, BCR's online chat support enables traders to have quick and direct interactions with a support representative. This live chat feature allows for instant messaging and real-time responses.

Below are the details about customer service.

Language(s): English, Chinese, Vietnamese, Japanese, etc.

Service Time: 24/5

Live chat, Contact Form

Email: info@thebcr.com

Phone: +44 3300010590

Social Media: Facebook, Twitter, Instagram, LinkedIn

Address: BCR Co Pty Ltd, Trident Chambers, Wickhams Cay 1, Road Town, Tortola, British Virgin Islands.

| Q 1: | Is BCR regulated well? |

| A 1: | Yes. It is regulated by ASIC and offshore regulated by FSC. |

| Q 2: | What assets can I trade with BCR? |

| A 2: | Forex and CFDs on metals, commodities, and indices. |

| Q 3: | Does BCR offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does BCR offer industry leading MT4 & MT5? |

| A 4: | Yes. It supports MT4. |

| Q 5: | What is the minimum deposit for BCR? |

| A 5: | $300. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive fxtm and bcr are, we first considered common fees for standard accounts. On fxtm, the average spread for the EUR/USD currency pair is From 1.5 pips, while on bcr the spread is 0.0+.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

fxtm is regulated by CYSEC,FCA,FSC,FSCA. bcr is regulated by ASIC,FSC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

fxtm provides trading platform including ADVANTAGE PLUS,ADVANTAGE and trading variety including FX Metals Commodities Indices FX indices Stock baskets Stock CFDs (only MT5) Stocks (only MT5). bcr provides trading platform including ALPHA ,STANDARD ,SWAP-FREE and trading variety including --.