No data

Do you want to know which is the better broker between FOREX EXCHANGE and OLYMPTRADE ?

In the table below, you can compare the features of FOREX EXCHANGE , OLYMPTRADE side by side to determine the best fit for your needs.

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of forex-exchange, olymptrade lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Basic | Information |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Founding Time | 2004 |

| Minimum Deposit | No limitation |

| Maximum Leverage | 1:25 |

| Minimum Spreads | From 0.7 pips on EUR/USD |

| Trading Platform | MT4 trading platfom |

| Trading Assets | Currency pairs, commodity futures and stock futures |

| Payment Methods | Regular bank transfers and quick transfers |

| Customer Support | 5 /24 Live Chat, Phone, Emails |

General Information & Regulation

FOREX EXCHANGE was established in 2004, registered for financial futures trading business in January 2006, joined the Financial Futures Trading Association in February 2006, and registered for first-class financial instruments business in September 2007. In 2008, FOREX EXCHANGE moved its headquarters to Tokyo, and in November of the same year, it registered for the second financial instruments business, and in 2009, it registered for investment advice/institutions, and in April of the same year, it joined the Japan Investment Advisors Association. FOREX EXCHANGE's business also includes forex margin trading in accordance with the Financial Instruments and Exchange Act and all related businesses. FOREX EXCHANGE currently holds a retail foreign exchange license authorized by the Japan Financial Services Agency (Regulatory No. 2010001141146).

Market Instruments

Investors on the FOREX EXCHANGE platform can trade popular currency pairs in the foreign exchange market, as well as commodity futures and stock futures.

Minimum Deposit

There is no initial minimum deposit requirement, but investors are advised to deposit at 100,000 JPY into their MT4 account.

Spreads & Commissions

The EURUSD spread is 0.7 pips, the USDJPY spread is 0.6 pips, the minimum spread for EURJPY is 0.7 pips, the minimum spread for GBPJPY is 1.4 pips, and the spread for AUDJPY is 1 pip.

Trading Platforms Available

Traders trading with FOREX EXCHANGE can apply the MT4 trading platform, which is currently the most popular platform in the market. Since its release in 2005, the MT4 trading platform has become a popular platform for financial institutions and investors worldwide due to the convenience of the trading system and the ability to customize charts freely. The most attractive aspect of MT4 is that it can automatically buy and sell, and users can view exchange rates to buy and sell, and by pre-determining trading rules, trades can be made automatically.

Deposit and Withdrawal

Traders can make deposits to their investment accounts via regular bank transfers and quick transfers. A regular bank transfer is a method of transferring funds to the company's designated account at Internet banking, ATMs, or over-the-counter at financial institutions. The quick transfer is a method of transferring funds from a trader's computer or smartphone to [My MT4]. The client is responsible for transfer fees when transferring funds to the bank account designated by FOREX EXCHANGE. Withdrawals are, in principle, free of charge, but if the withdrawal amount is less than 10,000 yen and the withdrawal amount exceeds 5 times per month, a fee of 540 yen will be charged for each withdrawal.

Pros & Cons of FOREX EXCHANGE

| Pros | Cons |

| FSA-regulated | ONLY MT4 supported |

| MT4 trading platform available | Conservative leverage |

| Competive spreads | |

| No minimum deposit requirements | |

| Commodities & Stocks also available |

Customer Support

If clients have any inquiries or trading-related issues, they can get in touch with FOREX EXCHANGE through the following contact channels:

Telephone: +81 03-3537-2311

Email: support@forex-exchange.com

| Registered in | St. Vincent and the Grenadines |

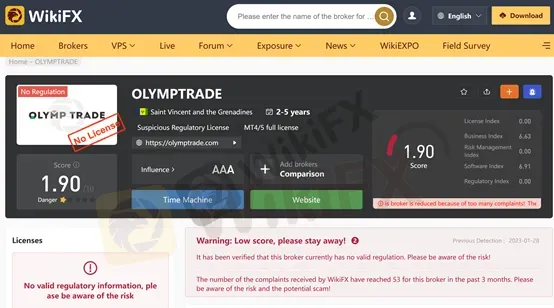

| Regulated by | No effective regulation at this time |

| Year(s) of establishment | 2-5 years |

| Trading instruments | Information not available |

| Minimum Initial Deposit | Information not available |

| Maximum Leverage | Information not available |

| Minimum spread | Information not available |

| Trading platform | MT4 |

| Deposit and withdrawal method | Information not available |

| Customer Service | Email/phone number/address |

| Fraud Complaints Exposure | Yes |

Note: At this time, we only have a cursory look at OLYMPTRADE as the company's official website (https://olymptrade.com/ ) does not open properly.

Screenshot time: 01/28/2023

WikiFX provides dynamic scoring, it will track the broker's dynamic real-time scoring, the current time screenshot scores do not represent past and future scoring.

OLYMPTRADE is registered in St. Vincent and the Grenadines and appears to be a fraudulent broker without any credible regulation, with a history of no more than 5 years. Unfortunately, we could not find any more detailed information about this broker on the internet.

OLYMPTRADE caters to a diverse range of traders, including beginners and experienced traders alike.The platform offers a wide range of financial instruments for trading, including currencies, stocks, metals, indices, commodities, cryptocurrencies, ETFs, OTC, and composites. Traders have the flexibility to choose between two types of accounts: Real Account and Demo Account. The Real Account allows traders to engage in live trading with real money, while the Demo Account provides a risk-free environment for practice. While specific information about spreads is not available on the website, OLYMPTRADE mentions that there are no commissions charged.Traders can access the OLYMPTRADE trading platform via a downloadable application on both mobile and desktop devices. The platform offers a user-friendly interface with various trading tools, features, educational resources, market analysis reports, and customer support services available 24/7.

When choosing a forex broker, you should know that a regulatory license does not necessarily guarantee the reliability of a broker as it may be an expired or cloned regulatory license, but a broker without any regulatory license has a high probability of being unreliable.

OLYMPTRADE offers a user-friendly trading platform with a wide range of market instruments, a demo account for practice, comprehensive customer support, and educational resources. However, it is not regulated by a reputable authority, lacks transparency on leverage and spreads, provides limited information on fees and commissions, has a relatively low minimum deposit requirement, and offers limited advanced features. Traders should carefully consider these pros and cons before deciding to trade with OLYMPTRADE.

| Pros | Cons |

| User-friendly trading platform with a range of tools and features. | Not regulated by a reputable financial authority, which carries higher risk. |

| Wide selection of market instruments, including currencies, stocks, metals, cryptocurrencies, and more. | Lack of transparency regarding leverage and spreads. |

| Demo account available for practice and learning. | Limited information on trading fees and commissions. |

| Comprehensive customer support available 24/7. | Relatively low minimum deposit requirement may attract inexperienced traders. |

| Educational resources to enhance trading knowledge and skills. | Limited availability of advanced trading features and platforms. |

OLYMPTRADE offers a diverse range of market instruments, including currencies, stocks, metals, indices, commodities, cryptocurrencies, ETFs, OTC trading, and composites, providing traders with ample opportunities to engage in various trading strategies.

Currencies: OLYMPTRADE offers a wide range of currency pairs for trading, including major pairs such as EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic pairs like USD/TRY and NZD/CAD. Traders can speculate on the exchange rate movements between these currency pairs.

Stocks: OLYMPTRADE provides access to a variety of stocks from global markets. Traders can invest in individual company stocks, such as Apple, Amazon, or Google, and speculate on their price movements. Stock trading allows traders to benefit from the performance of specific companies.

Metals: OLYMPTRADE allows trading in precious metals like gold, silver, platinum, and palladium. These metals are often seen as safe-haven assets and can be used as a hedge against inflation or economic uncertainties. Traders can speculate on the price fluctuations of these metals.

Indices: OLYMPTRADE offers trading on major stock indices from around the world, including the S&P 500, NASDAQ, FTSE 100, and Nikkei 225. Index trading allows traders to speculate on the overall performance of a specific stock market, rather than individual stocks.

Commodities: OLYMPTRADE provides access to various commodities such as oil, natural gas, and agricultural products like corn and wheat. Commodity trading allows traders to speculate on the price movements of these essential goods, which can be influenced by factors like supply and demand dynamics, weather conditions, and geopolitical events.

Cryptocurrencies: OLYMPTRADE offers trading in popular cryptocurrencies like Bitcoin, Ethereum, Litecoin, and Ripple. Cryptocurrency trading allows traders to speculate on the price volatility of these digital assets, which have gained significant popularity in recent years.

ETFs (Exchange-Traded Funds): OLYMPTRADE allows trading in ETFs, which are investment funds traded on stock exchanges. These funds are composed of a basket of assets, such as stocks, bonds, or commodities. Traders can invest in ETFs to gain exposure to a diversified portfolio of assets.

OTC (Over-the-Counter): OLYMPTRADE provides over-the-counter trading, which refers to trading financial instruments directly between two parties without the involvement of an exchange. OTC trading allows for more flexible and customized transactions, particularly for certain derivatives and exotic instruments.

Composites: OLYMPTRADE offers composite instruments, which are synthetic assets created by combining multiple financial instruments. These composites can represent various strategies or themes, such as a basket of stocks from a particular sector or a combination of different asset classes. Traders can speculate on the performance of these composites.

Although a long time has passed since the launch of MT4, it is still a major player in the market and is loved by traders all over the world. Accessing it from different devices also makes it easier for users to trade.

OLYMPTRADE offers two types of accounts: Real Account and Demo Account. The Real Account allows traders to engage in live trading with real money, providing access to the full range of market instruments and features offered by OLYMPTRADE. Traders can deposit funds into their Real Account and trade in real-time market conditions, experiencing the actual risks and rewards of trading.

On the other hand, the Demo Account is a practice account that allows traders to simulate trading without using real money. It is an excellent option for beginners or those who want to test trading strategies and explore the platform's functionalities. The Demo Account provides virtual funds, enabling traders to practice and gain confidence before venturing into live trading.

Here is a brief description of the account opening process for OLYMPTRADE:

Registration: Visit the OLYMPTRADE website and click on the “Register” button to start the registration process. Fill in the required information, such as your name, email address, and preferred password. Make sure to read and agree to the terms and conditions before proceeding.

Account Verification: After completing the registration, you may need to verify your account. OLYMPTRADE may require you to provide certain documents for verification purposes, such as a copy of your identification document (e.g., passport or driver's license) and proof of address (e.g., utility bill or bank statement). Follow the instructions provided by OLYMPTRADE to submit the necessary documents.

Account Funding: Once your account is verified, you can proceed to fund your account. OLYMPTRADE offers various deposit methods, such as credit/debit cards, bank transfers, and electronic payment systems. Choose your preferred payment method and follow the instructions to make a deposit. Be aware of any minimum deposit requirements set by OLYMPTRADE.

Platform Access: Once your account is funded, you will gain access to the OLYMPTRADE trading platform. You can log in using your registered email address and password. The platform provides a user-friendly interface with a range of trading tools and features.

Account Configuration: Before you start trading, you may need to configure your account settings. This includes selecting your preferred language, setting up notifications, and adjusting other platform preferences according to your trading preferences. Take some time to explore the platform and familiarize yourself with its features.

It's important to note that the specific steps and requirements may vary, so it's advisable to refer to the official OLYMPTRADE website or contact their customer support for the most accurate and up-to-date information regarding the account opening process.

The official website of OLYMPTRADE does not provide specific information about leverage. However, it is common for similar types of brokers to offer leverage ratios ranging from 100:1 to 500:1. Please note that leverage allows traders to multiply their trading positions, but it also amplifies both potential profits and losses. It is important to fully understand the implications of leverage and exercise responsible risk management when trading on any platform. For accurate and up-to-date information about leverage on OLYMPTRADE, it is recommended to refer to the broker's official website or contact their customer support.

Spreads & Commissions (Trading Fees)

OLYMPTRADE's official website does not provide specific information about spreads. However, it is mentioned that there are no commissions charged. In general, similar brokers in the industry offer spreads that start from 0 to 0.1 pips. Spreads refer to the difference between the bid and ask prices of a financial instrument and can vary depending on market conditions and the specific asset being traded. For accurate and up-to-date information about spreads on OLYMPTRADE, it is recommended to refer to the broker's official website or contact their customer support.

OLYMPTRADE provides a simple and convenient deposit and withdrawal process for its traders. The minimum deposit amount is 10 USD/10 EUR, making it accessible for traders with varying budgets. OLYMPTRADE supports multiple deposit and withdrawal methods, including Bank Transfer, Credit/Debit Cards, Bank Wire Transfer, E-wallets, and Cryptocurrency.

Traders can choose to deposit funds using popular payment options such as credit or debit cards, bank transfers, and e-wallets.

Similarly, when it comes to withdrawing funds, OLYMPTRADE supports the same methods used for deposits. The withdrawal process is typically straightforward, and the platform strives to process withdrawal requests promptly. However, the processing time may vary depending on the chosen withdrawal method and the policies of the respective financial institutions involved.

The support service provided by OLYMPTRADE is not very extensive. It can only be accessed via email, address and a phone number. Since the company's website is not currently open, we do not know if it offers other services such as live chat, callback, FAQ, 24/7 or 24/5 service, etc.

Below are the details about the customer service.

Email: support@olymptrade.com

support-en@olymptrade.com

Phone Number: +356 20341634

Address: 54, Immakulata, Triq il-Mina ta Hompesch, ZABBAR ZBR 9016.

On our website, you can see that many users have reported scams. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

OLYMPTRADE is an online trading platform that caters to a diverse range of traders, offering a wide selection of market instruments and account types. The platform provides a user-friendly interface, downloadable on mobile and desktop devices, with access to real-time market quotes, trading tools, and educational resources. However, it is important to note that OLYMPTRADE is not regulated by a reputable financial authority, which poses a higher risk for traders. The platform lacks transparency on leverage and spreads, limited information on fees and commissions, and advanced features. Traders should carefully evaluate these pros and cons before deciding to trade with OLYMPTRADE. While OLYMPTRADE offers convenience and comprehensive customer support, traders should exercise caution and conduct thorough research before opening an account.

Q: Is OLYMPTRADE a regulated broker?

A: No, OLYMPTRADE is not a regulated broker.

Q: What is the minimum deposit required to open an account with OLYMPTRADE?

A: The minimum deposit required to open an account with OLYMPTRADE is 10 USD/10 EUR.

Q: What trading instruments are available at OLYMPTRADE?

A: OLYMPTRADE offers a wide range of trading instruments, including currencies, stocks, metals, indices, commodities, cryptocurrencies, ETFs, OTC trading, and composites

Q: Does OLYMPTRADE offer a demo account?

A: Yes, OLYMPTRADE offers a demo account that allows clients to practice trading in a risk-free environment with virtual funds.

Q: What trading platforms does OLYMPTRADE offer?

A: OLYMPTRADE offers their our trading platform.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive forex-exchange and olymptrade are, we first considered common fees for standard accounts. On forex-exchange, the average spread for the EUR/USD currency pair is -- pips, while on olymptrade the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

forex-exchange is regulated by FSA. olymptrade is regulated by --.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

forex-exchange provides trading platform including -- and trading variety including --. olymptrade provides trading platform including -- and trading variety including --.