Opposition to EU's Budget Increases Euro's Downside Risk

Abstract:Recently, EUR/USD grew to as high as 1.1869 amid the rising risk sentiment fueled by the progress in new vaccine and the signing of the Regional Comprehensive Economic Partnership (RCEP) Agreement.

WikiFX News (18 Nov.) - Recently, EUR/USD grew to as high as 1.1869 amid the rising risk sentiment fueled by the progress in new vaccine and the signing of the Regional Comprehensive Economic Partnership (RCEP) Agreement. However, the pair remains at the risk of dropping down.

Executive Board member Isabel Schnabel stressed the need for “further monetary policy support to underpin economic activity” in light of the second wave of Covid-19 infections.

In addition, Hungary and Poland blocked approval of the EU's €750-billion economy rescue package. The two countries, who have been attacked over the rule of law so far, are opposed to the plan in its present form to tie rule of law criteria to budget decisions. A delay to the package may hamper the bloc's economic recovery, putting downside pressure on the euro.

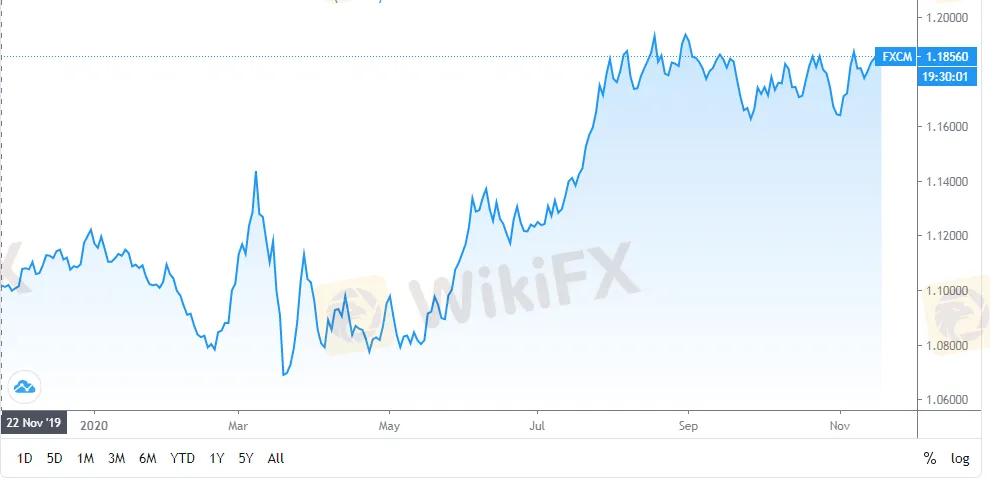

According to EUR/USD trend chart, the pair's price is trying to break the recent high of 1.1869, while bearish RSI divergence suggests that a pullback towards the 1.1832 could be on the cards. Breaching that would likely result in price testing the 200-DMA of 1.17800.

All the above is provided by WikiFX, a platform world-renowned for forex information. For details, please download the WikiFX App: bit.ly/wikifxIN

Chart: Trend of EUR/USD

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Euro Overview

Euro Jumps to 1-Month High as ECB's Lagarde Fails to Calm Rate Hike Bets.

Euro Technical Analysis: EUR/USD, EUR/JPY Eyeing Push to Higher Highs

Euro Technical Analysis: EUR/USD, EUR/JPY Eyeing Push to Higher Highs

EU’s Recovery Fund Will Affect Euro’s Trend

Germany and France jointly proposed on the 18th to establish an European Union recovery fund to offer financial aids to members struck by the economic fallout of the pandemic.

Euro Longs at Record Level Suggest a Bullish Trend

Though euro is falling against US dollar towards a 3-year’s low, fund managers are stepping up their bullish bets on the euro.

WikiFX Broker

Latest News

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

FCAA warns Investors against Fintech Market

PH SEC Warns Against TRADE 13.0 SERAX

CFI Collaborates with TradingView for Enhanced Trading Experience

U.S. Seeks 3-Year Sentence for Ex-Binance CEO Zhao

FCA exposed a clone firm

Crypto.com Faces Regulatory Issues with South Korea's Launch

Crypto Exchange CoinW Launches Prop Trading in Dubai

Clone of Morgan Financial Ltd.

CAPPMOREFX AGAIN IN NEWS !!

Currency Calculator