Bitcoin Outlook

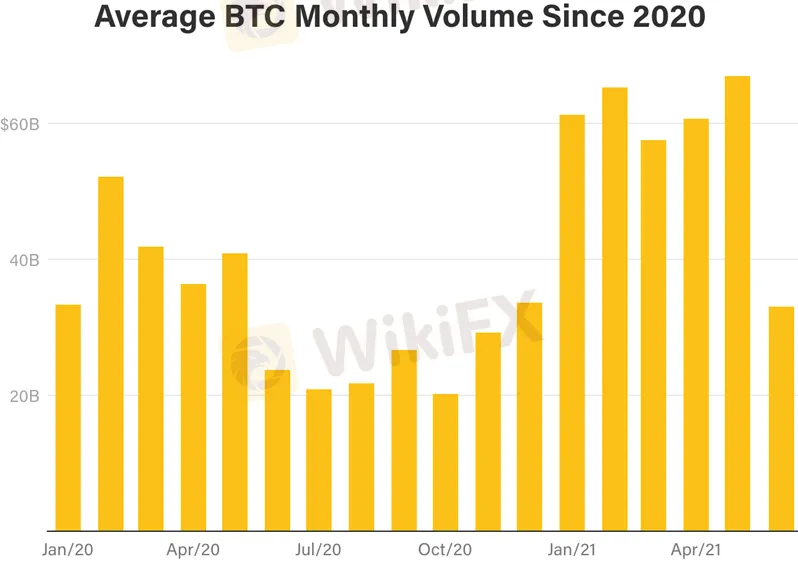

Abstract:Bitcoin prices plummeted a staggering 53% from the record highs in April with the sell-off responding to downtrend support.

Bitcoin prices plummeted a staggering 53% from the record highs in April with the sell-off responding to downtrend support. Wednesday marked the third test of this critical support zone and while the broader outlook remains ominous from a technical backdrop, the immediate decline may be vulnerable here with the bears at risk in the near-term. These are the updated targets and invalidation levels that matter on the BTC/USD technical price charts.

BITCOIN PRICE CHART – BTC/USD DAILY

Notes: A closer look at Bitcoin price action shows BTC/USD trading within the confines of an descending pitchfork formation extending off yearly highs. Wednesdays rebound off the lower parallel has Bitcoin targeting initial resistance at the June Open at 37280 with the objective monthly opening-range highs just beyond at 39490. Broader bearish invalidation remains with the 61.8% Fibonacci retracement of the yearly-to-date 2021 range / 200day moving average at 41930. Initial support steady at the yearly low-day close at 32005 with a break below 30655 needed to mark resumption of the broader downtrend towards subsequent support objective at the 2021 yearly open 28999 and the 61.8% retracement of the 2020 rally / yearly opening-range low at 27169/734.

Bottom line: Bitcoin has rebounded off confluence downtrend support- the immediate focus is on this recovery. From at trading standpoint, look for topside exhaustion ahead of 39490 IF price is indeed heading lower with a break / close below 30655 needed to mark resumption. Ultimately, a breach / close above 41930 would be needed to validate a broader reversal pattern with such a scenario exposing downtrend resistance, currently near 45500.

Stay Tuned with the Latest Market News and Trends on WikiFX!

Website - https://bit.ly/wikifxIN

Download app - Android: https://bit.ly/3kyRwgw | iOS: https://bit.ly/wikifxapp-ios

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Bitcoin hovers below $50K after weekend wipeout – Crypto Roundup, Dec 6, 2021

Global market jitters spread to crypto at the weekend, with Bitcoin falling to $42K before bouncing to almost $50K.

Bitcoin (BTC/USD) Surges Back to Multi-Month Highs on Renewed ETF Chatter

Bitcoin futures ETF – when not if? Bitcoin all-time high likely to be tested soon.

Can Bitcoin (BTC) rise faster than Binance Coin (BNB) and Cardano (ADA)?

The market has slightly increased after a fall, and only some coins are in the red zone.

Bitcoin Cash Price Prediction

Pair Holds Steady After BCH SV 51% Attack

WikiFX Broker

Latest News

Italy's CONSOB blocked five illegal websites

Multimillion-Dollar FX Ponzi Scheme Unveiled by CFTC

FOREX TODAY: US DOLLAR RISES AHEAD OF FED TALK AND HOUSING FIGURES

FOREX TODAY: US DOLLAR CONSOLIDATES AHEAD OF FEDSPEAK

Unveiling Fraud: FPFX vs. Funded Engineer Legal Battle

Gold Prices Stable as Traders Eye Fed's Rate Plans

NIGERIA'S FOREIGN EXCHANGE RESERVES FALL BY MORE THAN $2 BILLION IN LESS THAN A MONTH

SEC Warns Filipinos Against COINMATE PLUS Crypto Investment Scam

Watchout CNMV Warning List & Be Alert

FOREX TODAY: AFTER THE CPI-DRIVEN USD RISE, ALL EYES ARE ON THE ECB'S POLICY PRONOUNCEMENTS.

Currency Calculator