Strong AUD could be problem for RBA

Abstract:Strong AUD could be problem for RBA

#USDJPY Hits 6 Month High.

#EURUSD Hit by Drop in German Yields.

Strong #AUD Problem for RBA.

#CAD Resumes Rally Ahead of Q4 GDP.

The month of March kicked off with a strong rally in equities that saw the Dow Jones Industrial Average erase all of Friday‘s losses. Ten year Treasury yields resumed their rise and the U.S. dollar rose to its strongest level against the Japanese Yen in six months. However the dollar’s gains were not universal as the improvement in risk appetite drove the Australian, New Zealand and Canadian dollars higher against the greenback.

There are a lot of reasons for investors to be optimistic this month.Spring is right around the corner and the warmer weather will bring restaurants out of hibernation and provide a more supportive environment for outdoor dining. Congress is also widely expected to pass the $1.9 trillion dollar stimulus bill this month. The bill has been approved by the House and handed off to the Senate. Democrats are expected to abandon their push for a $15 minimum wage in the hopes that a deal can be done. The clock is ticking with millions of Americans set to lose their extra pandemic unemployment benefits on March 14th so Congress needs to approve a deal quickly.

Recent economic reports also show countries around the world survived the second virus wave better than the first. Despite strict lockdowns, Eurozone and U.K. manufacturing PMIs were revised higher for the month of February. Both indices are well above the key 50 mark that separates contraction from expansion. The U.S. ISM manufacturing index also hit a 3 year high last month thanks to a surge in new orders. Demand has been particularly robust for electronics and furniture. With each passing day, more people are receiving COVID-19 vaccinations and with the weather improving, travel and spending should pickup.

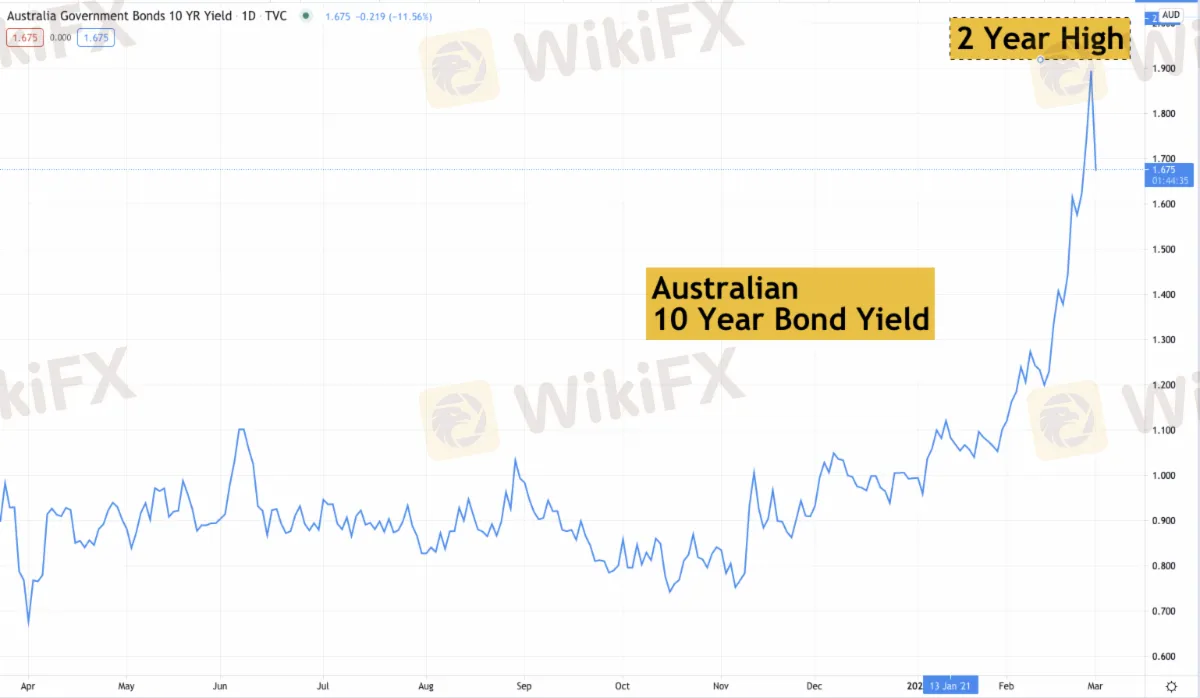

The Australian dollar was the day‘s best performing currency and this strength will be a problem for the Reserve Bank. Last night, the RBA surprised the market when they announced AUD 4 billion worth of bond purchases. This follows an unscheduled AUD 3 billion purchase of short term bonds on Friday. The central bank is taking aggressive measures to stem the rise in bond yields. While everyone has been focusing on the rise in U.S. Treasury rates and German bund rates, Australian yields experienced a similar surge. At the beginning of February the 10-year Australian bond yield was 1.12% and this past Friday, it hit a high of 1.91%. There’s no question that when the RBA meets tonight, theyll vocalize their concerns about rising rates. For there to be a durable recovery, interest rates need to remain low and to achieve this goal, the RBA needs to sound dovish. Just as rising yields threaten the recover, so does a strong currency. AUD/USD hit a 3 year high last week and verbal intervention would be an easy way to halt the rise.

Although Eurozone and UK PMIs were revised higher for the month of February, euro and sterling failed to participate in the risk rally. Yields are still the primary driver of currencies and with German bond yields falling for the second day in a row when U.S. yields are rising, it is no surprise to see EUR/USD underperform. German labor market numbers are scheduled for release along with Eurozone CPI tomorrow. Improvements are expected all around.

The same cannot be said of Canadas upcoming GDP reports. Quarterly and monthly GDP numbers are due for release tomorrow. The third quarter was strong for every one whereas Q4 was more of a struggle. Consumer demand in particular cratered with retail sales falling sharply towards the end of the year. The Canadian dollar has been in a relentless uptrend and soft GDP numbers could halt the rally, paving the way for a relief rally in USD/CAD.

------------------

WikiFX, the world's No.1 broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience! https://bit.ly/2XhbYt5

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Easy Trading Online Shines as Gold Sponsor at BrokersView Expo Dubai 2024

The BrokersView Expo Dubai 2024 is a premier event in the financial industry, bringing together top financial institutions, brokers, and technology providers from around the globe. As the Gold Sponsor of BrokersView Expo Dubai 2024, Easy Trading Online took the opportunity to showcase our latest products, service technologies, and core competitive advantages in the forex trading field.

Easy Trading Online at the Wiki Gala Night

On the 23rd of March, the Easy Trading Online family had the distinguished pleasure of being the Table Sponsor at the prestigious Wiki Gala Night. As we reflect on the event, it’s with a sense of pride and joy that we share the highlights and our takeaways from an evening that was as inspiring as it was splendid.

Explore Easy Trading Online - Discover the World’s Leading Forex Trading Platform

Easy Trading Online Broker Proud to be a trusted Forex trading platform. Fulfilling all the mentioned criteria, we provide: A trading platform that is easy to use and understand. Advanced market analysis tools To help you keep track of market changes and make effective trading decisions. Competitive trading fees It will help you save on your expenses. Professional customer support team Always available to advise when in doubt 24/7.

Easy Trading Online Recognized as Best Online Trading Services at the 2024 Award for Brokers with Outstanding Assessment·Middle East Ceremony

Easy Trading Online, a leading global CFDs broker regulated by ASIC, won the Best Online Trading Services Award at the BrokersView 2024 Award for Brokers with Outstanding Assessment·Middle East in Dubai. The award recognizes their excellence in trading services, leveraging technology and ensuring liquidity.

WikiFX Broker

Latest News

Caution in Online Trading: Intersphere Enterprises Alleged Scam

Breaking: Orfinex defrauded $40,000.

True Forex Funds Comes Back with New Trading Technology

Binance in Legal Crosshairs: Ontario Court Gives Nod to Class Action

Ocean Markets Review: Unregulated Trading Platform Analysis

CySEC Added 12 Firms into its New Warning List

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

FXORO Penalized €360K by CySEC for Investment Law Breaches

PH SEC Warns Against TRADE 13.0 SERAX

Leverate Losses ICF Membership & CIF Authorization

Currency Calculator