Daily Forex Analysis - 2 December 2020

Abstract:Daily currency trading guides and market forecasts: NZD/USD, AUD/USD, USD/JPY, EUR/USD, GBP/USD, USD/CAD, GBP/JPY, EUR/JPY

USD Overview (02 December 2020)

Yesterday, USD weakened against all major currencies.

The U.S. ISM Manufacturing PMI data (Actual: 57.5, Forecast: 57.9, Previous: 59.3) released yesterday indicated a slight slowdown in the expansion of the manufacturing sector.

Federal Reserve Chairman Jerome Powell will be testifying on the CARES Act later at 2300 (SGT). During this time, there may be volatility in USD.

NZD/USD Outlook (02 December 2020)

Overall, NZD/USD is trending upwards. Recently, NZD/USD bounced off the support zone of 0.70000.

The New Zealand Building Consents m/m data (Forecast: NA, Previous: 3.6%) will be released tomorrow at 0545 (SGT).

NZD/USDs next support zone is at 0.70000 and the next resistance zone is at 0.72000.

Look for buying opportunities of NZD/USD.

AUD/USD Outlook (02 December 2020)

Overall, AUD/USD is trending upwards. Recently, AUD/USD trended into the resistance zone of 0.73900.

Yesterday, the Reserve Bank of Australia (RBA) kept its monetary policy unchanged and held interest rate unchanged at 0.10%.

The Australian GDP q/q data (Actual: 3.3%, Forecast: 2.4%, Previous: -7.0%) released earlier today indicated that Australian economy bounced back from negative growth during the third quarter, ending the technical recession.

Currently, AUD/USD is testing the resistance zone of 0.73900 and the next support zone is at 0.72200.

Look for short-term buying opportunities of AUD/USD if it breaks the resistance zone of 0.73900.

USD/JPY Outlook (02 December 2020)

Overall, USD/JPY is ranging across.

USD/JPYs next support zone of 103.400 and the next resistance zone is at 105.600.

Look for buying opportunities of USD/JPY.

EUR/USD Outlook (02 December 2020)

Overall, EUR/USD is ranging across. Recently, EUR/USD broke the resistance zone of 1.19800.

The eurozone CPI Flash Estimate y/y data released yesterday indicated no change in the annual rate of inflation in November from the previous month.

- CPI Flash Estimate y/y (Actual: -0.3%, Forecast: -0.2%, Previous: -0.3%)

- Core Flash Estimate y/y (Actual: 0.2%, Forecast: 0.2%, Previous: 0.2%)

The eurozone unemployment rate data (Forecast: 8.4%, Previous: 8.3%) will be released later at 1800 (SGT).

Currently, EUR/USD is moving towards the key level of 1.21. Its next support zone is at 1.19800 and the next resistance zone is at 1.21800.

Look for buying opportunities of EUR/USD if it breaks above the key level of 1.21.

GBP/USD Outlook (02 December 2020)

Overall, GBP/USD is trending upwards.

The UK Final Manufacturing PMI data (Actual: 55.6, Forecast: 55.2, Previous: 55.2) released yesterday indicated a slight upward revision in the rate of expansion of the manufacturing sector in November.

GBP/USDs next support zone is at 1.32200 and the next resistance zone is at 1.34600.

Look for buying opportunities of GBP/USD.

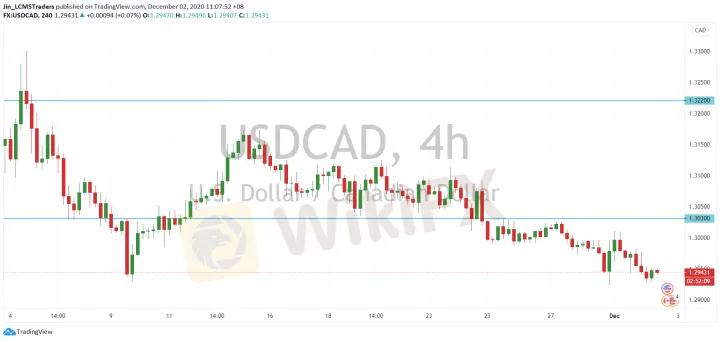

USD/CAD Outlook (02 December 2020)

Overall, USD/CAD is trending downwards.

The Canadian GDP m/m data (Actual: 0.8%, Forecast: 0.9%, Previous: 0.9% revised from 1.2%) released yesterday indicated a slight slowdown in economic growth in September.

Also, the Canadian Manufacturing PMI data (Actual: 55.8, Forecast: NA, Previous: 55.5) released indicated little change in the rate of expansion of the Canadian manufacturing sector.

USD/CADs next support zone is at 1.28400 and the next resistance zone is at 1.30300.

Look for selling opportunities of USD/CAD.

GBP/JPY Outlook (02 December 2020)

Overall, GBP/JPY is trending upwards. Recently, GBP/JPY trended into the resistance zone of 140.000.

The UK Final Manufacturing PMI data (Actual: 55.6, Forecast: 55.2, Previous: 55.2) released yesterday indicated a slight upward revision in the rate of expansion of the manufacturing sector in November.

Currently, GBP/JPY is testing the resistance zone of 140.000 and the next support zone is at 137.500.

Look for buying opportunities of GBP/JPY if it breaks the resistance zone of 140.000.

EUR/JPY Outlook (02 December 2020)

Overall, EUR/JPY is trending upwards. Recently, EUR/JPY broke the resistance zone of 124.750.

The eurozone CPI Flash Estimate y/y data released yesterday indicated no change in the annual rate of inflation in November from the previous month.

- CPI Flash Estimate y/y (Actual: -0.3%, Forecast: -0.2%, Previous: -0.3%)

- Core Flash Estimate y/y (Actual: 0.2%, Forecast: 0.2%, Previous: 0.2%)

The eurozone unemployment rate data (Forecast: 8.4%, Previous: 8.3%) will be released later at 1800 (SGT).

EUR/JPYs next support zone is at 124.750 and the next resistance zone is at 126.700.

Look for buying opportunities of EUR/JPY.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Daily Forex Analysis - 13th September 2021

Daily currency trading guides and market forecasts: NZD/USD, AUD/USD, USD/JPY, EUR/USD, GBP/USD, USD/CAD, GBP/JPY, EUR/JPY

Daily Forex Analysis - 10th September 2021

Daily currency trading guides and market forecasts: NZD/USD, AUD/USD, USD/JPY, EUR/USD, GBP/USD, USD/CAD, GBP/JPY, EUR/JPY

Daily Forex Analysis - 7th September 2021

Daily currency trading guides and market forecasts: NZD/USD, AUD/USD, USD/JPY, EUR/USD, GBP/USD, USD/CAD, GBP/JPY, EUR/JPY

Daily Forex Analysis -6th September 2021

Daily currency trading guides and market forecasts: NZD/USD, AUD/USD, USD/JPY, EUR/USD, GBP/USD, USD/CAD, GBP/JPY, EUR/JPY

WikiFX Broker

WikiFX Broker

Latest News

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

FCAA warns Investors against Fintech Market

PH SEC Warns Against TRADE 13.0 SERAX

U.S. Seeks 3-Year Sentence for Ex-Binance CEO Zhao

FCA exposed a clone firm

Crypto.com Faces Regulatory Issues with South Korea's Launch

Crypto Exchange CoinW Launches Prop Trading in Dubai

Clone of Morgan Financial Ltd.

CFI Collaborates with TradingView for Enhanced Trading Experience

CAPPMOREFX AGAIN IN NEWS !!

Currency Calculator