Daily Forex Analysis - 08 January 2021

Abstract:Daily currency trading guides and market forecasts: NZD/USD, AUD/USD, USD/JPY, EUR/USD, GBP/USD, USD/CAD, GBP/JPY, EUR/JPY

USD Overview (08 January 2021)

Yesterday, USD strengthened against all major currencies.

The U.S. ISM Services PMI data (Actual: 57.2, Forecast: 54.5, Previous: 55.9) released yesterday indicated an increase in the pace of expansion of the services sector in December.

The U.S. Non-Farm Payroll data will be released later at 2130 (SGT).

- Average Hourly Earnings m/m (Forecast: 0.2%, Previous: 0.3%)

- Non-Farm Employment Change (Forecast: 68K, Previous: 245K)

- Unemployment Rate (Forecast: 6.8%, Previous: 6.7%)

NZD/USD Outlook (08 January 2021)

Overall, NZD/USD is trending upwards. Recently, NZD/USD bounced down from the key level of 0.73000.

NZD/USDs next support zone is at 0.72000 and the next resistance zone is at 0.73700.

Look for short-term buying opportunities of NZD/USD.

AUD/USD Outlook (08 January 2021)

Overall, AUD/USD is trending upwards. Recently, AUD/USD bounced down from the key level of 0.78.

The Australian Retail Sales m/m data (Forecast: NA, Previous: 7.0%) will be released next Monday at 0830 (SGT).

AUD/USD next support zone is at 0.76800 and the next resistance zone is at 0.79100.

Look for short-term buying opportunities of AUD/USD.

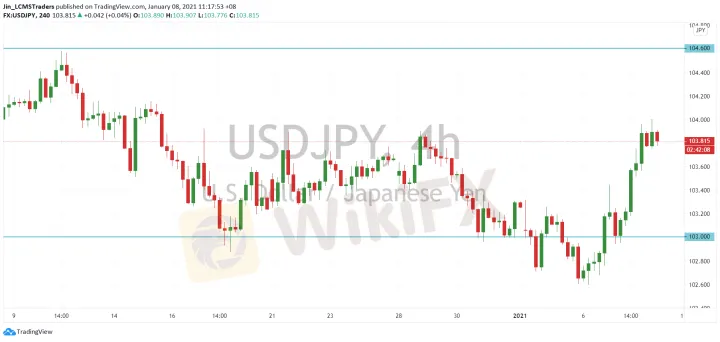

USD/JPY Outlook (08 January 2021)

Overall, USD/JPY is ranging across. Recently, USD/JPY broke the resistance zone of 103.000.

Japanese banks will be close next Monday in observance of Coming-of-Age Day. Lower volatility and trading volume is expected during the Japanese market session.

USD/JPYs next support zone is at 103.000 and the next resistance zone of 104.600.

Look for short-term buying opportunities of USD/JPY.

EUR/USD Outlook (08 January 2021)

Overall, EUR/USD is trending upwards. Recently, EUR/USD broke below the key level of 1.23.

The eurozone CPI flash estimate y/y data released yesterday indicated no change in the rate of inflation from the previous month.

- CPI Flash Estimate y/y (Actual: -0.3%, Forecast: -0.2%, Previous: -0.3%)

- Core CPI Flash Estimate y/y (Actual: 0.2%, Forecast: 0.2%, Previous: 0.2%)

The eurozone unemployment rate data (Forecast: 8.5%, Previous: 8.4%) will be released later at 1800 (SGT).

EUR/USDs next support zone is at 1.21800 and the next resistance zone is at 1.24800.

Look for short-term buying opportunities of EUR/USD.

GBP/USD Outlook (08 January 2021)

Overall, GBP/USD is trending upwards. Recently, GBP/USD broke below the key level of 1.36.

The UK Construction PMI data (Actual: 54.6, Forecast: 54.6, Previous: 54.7) released yesterday indicated continued expansion in the construction sector in December.

GBP/USDs next support zone is at 1.34800 and the next resistance zone is at 1.37800.

Look for short-term selling opportunities of GBP/USD.

USD/CAD Outlook (08 January 2021)

Overall, USD/CAD is trending downwards.

The Canadian Ivey PMI data (Actual: 46.7, Forecast: 53.1, Previous: 52.7) released yesterday indicated a contraction in business activities in December.

The Canadian employment data will be released later at 2130 (SGT).

- Employment Change (Forecast: -32.5K, Previous: 62.1K)

- Unemployment Rate (Forecast: 8.7%, Previous: 8.5%)

USD/CADs next support zone is at 1.25720 and the next resistance zone is at 1.27900.

Look for short-term selling opportunities of USD/CAD.

GBP/JPY Outlook (08 January 2021)

Overall, GBP/JPY is ranging across. Recently, GBP/JPY broke the resistance zone of 140.000.

The UK Construction PMI data (Actual: 54.6, Forecast: 54.6, Previous: 54.7) released yesterday indicated continued expansion in the construction sector in December.

Japanese banks will be close next Monday in observance of Coming-of-Age Day. Lower volatility and trading volume is expected during the Japanese market session.

Currently, GBP/JPY is testing to break above the key level of 141. Its next support zone is at 140.000 and the next resistance zone is at 142.200.

Look for short-term selling opportunities of GBP/JPY if it bounces down from the key level of 141.

EUR/JPY Outlook (08 January 2021)

Overall, EUR/JPY is ranging across. Recently, EUR/JPY broke the resistance zone of 126.800.

Japanese banks will be close next Monday in observance of Coming-of-Age Day. Lower volatility and trading volume is expected during the Japanese market session.

The eurozone CPI flash estimate y/y data released yesterday indicated no change in the rate of inflation from the previous month.

- CPI Flash Estimate y/y (Actual: -0.3%, Forecast: -0.2%, Previous: -0.3%)

- Core CPI Flash Estimate y/y (Actual: 0.2%, Forecast: 0.2%, Previous: 0.2%)

The eurozone unemployment rate data (Forecast: 8.5%, Previous: 8.4%) will be released later at 1800 (SGT).

EUR/JPYs next support zone is at 126.800 and the next resistance zone is at 129.500.

Look for short-term buying opportunities of EUR/JPY.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Daily Forex Analysis - 13th September 2021

Daily currency trading guides and market forecasts: NZD/USD, AUD/USD, USD/JPY, EUR/USD, GBP/USD, USD/CAD, GBP/JPY, EUR/JPY

Daily Forex Analysis - 10th September 2021

Daily currency trading guides and market forecasts: NZD/USD, AUD/USD, USD/JPY, EUR/USD, GBP/USD, USD/CAD, GBP/JPY, EUR/JPY

Daily Forex Analysis - 7th September 2021

Daily currency trading guides and market forecasts: NZD/USD, AUD/USD, USD/JPY, EUR/USD, GBP/USD, USD/CAD, GBP/JPY, EUR/JPY

Daily Forex Analysis -6th September 2021

Daily currency trading guides and market forecasts: NZD/USD, AUD/USD, USD/JPY, EUR/USD, GBP/USD, USD/CAD, GBP/JPY, EUR/JPY

WikiFX Broker

Latest News

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

FCAA warns Investors against Fintech Market

PH SEC Warns Against TRADE 13.0 SERAX

CFI Collaborates with TradingView for Enhanced Trading Experience

U.S. Seeks 3-Year Sentence for Ex-Binance CEO Zhao

FCA exposed a clone firm

Crypto.com Faces Regulatory Issues with South Korea's Launch

Crypto Exchange CoinW Launches Prop Trading in Dubai

Clone of Morgan Financial Ltd.

CAPPMOREFX AGAIN IN NEWS !!

Currency Calculator