Sentiment and Forex Trading

Abstract:Market sentiment defines how investors feel about a particular market or financial instrument. As traders, sentiment becomes more positive as general market consensus becomes more positive. Likewise, if market participants begin to have a negative attitude, sentiment can become negative.

Market sentiment defines how investors feel about a particular market or financial instrument. As traders, sentiment becomes more positive as general market consensus becomes more positive. Likewise, if market participants begin to have a negative attitude, sentiment can become negative.

As such, traders use sentiment analysis to define a market as bullish or bearish, with a bear market characterized by assets going down, and a bull market by prices going up. Traders can gauge market sentiment by using a range of tools such as sentiment indicators, and by simply watching the movement of the markets, using the resulting information to make their decisions.

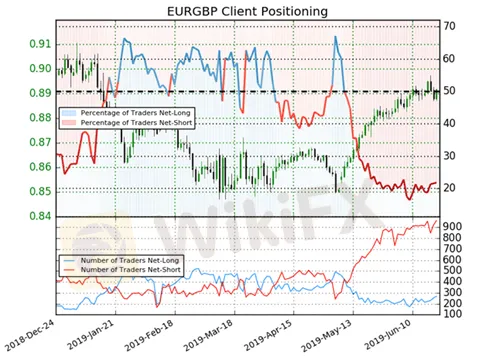

An example of net short sentiment can be seen in the EUR/GBP chart below, with 21.9% of traders net-long with a ratio of traders short to long at 3.58 to 1. The chart shows in blue the percentage of traders taking a net long position, and in red the percentage taking a net short position.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

FCAA warns Investors against Fintech Market

PH SEC Warns Against TRADE 13.0 SERAX

U.S. Seeks 3-Year Sentence for Ex-Binance CEO Zhao

FCA exposed a clone firm

Crypto.com Faces Regulatory Issues with South Korea's Launch

Crypto Exchange CoinW Launches Prop Trading in Dubai

Clone of Morgan Financial Ltd.

CFI Collaborates with TradingView for Enhanced Trading Experience

CAPPMOREFX AGAIN IN NEWS !!

Currency Calculator