Charting the Global Economy: Getting Back to Growth...Slowly

Abstract:The global economy is righting itself after a severe lashing from the coronavirus pandemic, but the pace of improvement is laboring.

The global economy is righting itself after a severe lashing from the coronavirus pandemic, but the pace of improvement is laboring.

In the U.S., while the housing market has bounced back with gusto, millions of Americans continue to file for jobless benefits. Europes service providers and manufacturers are expanding once again, while China is set to experience tepid economic growth.

Here are some of the charts that appeared on Bloomberg this week, offering insight into the latest developments in the global economy:

World

Daily Activity Indices

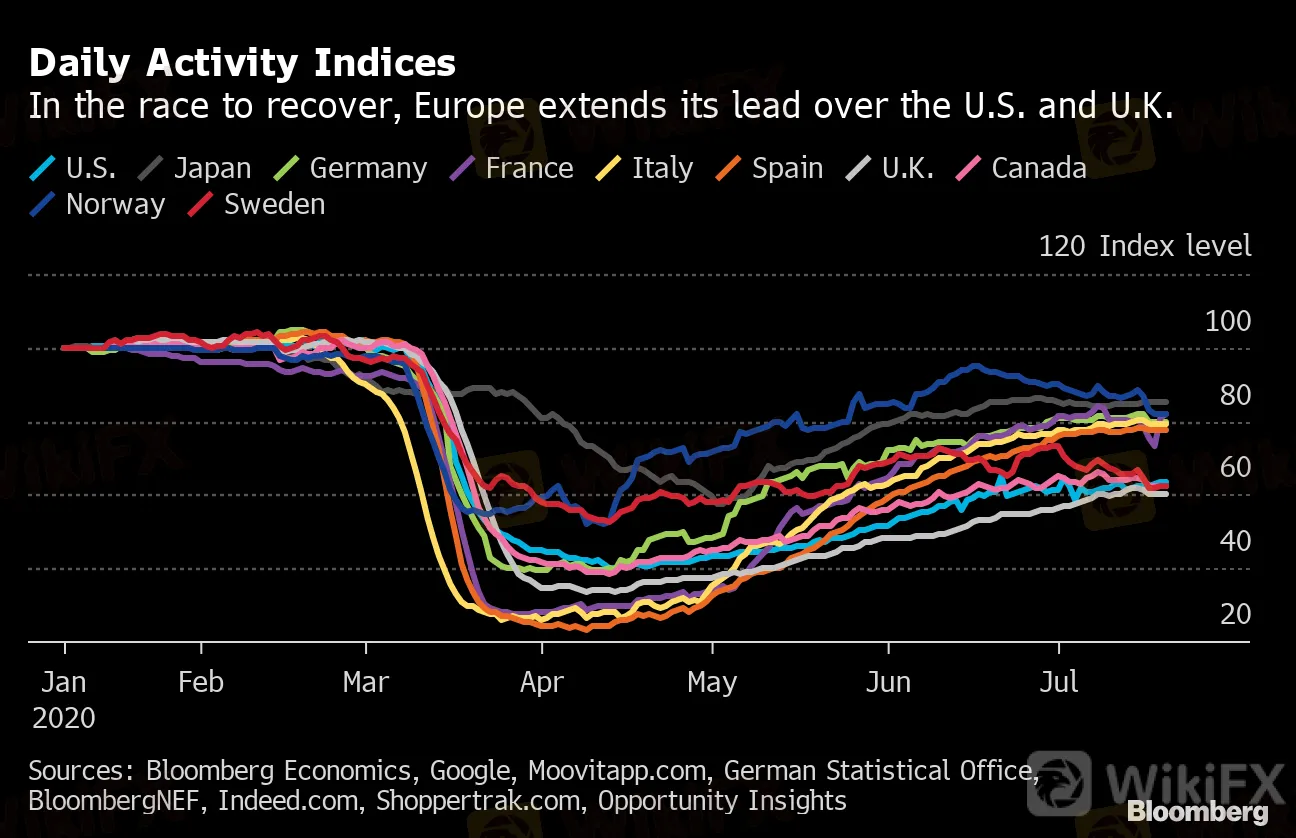

In the race to recover, Europe extends its lead over the U.S. and U.K.

Sources: Bloomberg Economics, Google, Moovitapp.com, German Statistical Office, BloombergNEF, Indeed.com, Shoppertrak.com, Opportunity Insights

In all major advanced economies the pace of recovery has flattened as some countries approach their pre-crisis levels of activity, according to Bloomberg Economics daily gauges. Within that overarching trend, the gap between leading euro-area countries and the lagging U.K., U.S. and Canada has widened in the past week.

U.S.

New-home sales increased to an almost 13-year high in June, fueled by record-low borrowing costs and adding to evidence that residential real estate is the brightest spot in the economy.

While the housing market is flexing plenty of muscle, the labor market remains feeble. From weekly filings for unemployment benefits to restaurant dining to air travel, recent high-frequency data show waning momentum in the economy as the coronavirus remains formidable.

Europe

Europes economy is finally showing signs of growing again after months of an unprecedented slump caused by the coronavirus pandemic. Private-sector activity in the euro area rose to the highest in more than two years in July, with both services and manufacturing showing expansion.

Virus Slump

Russia downturn is shallower than feared, but the recovery is looking slow

Source: Federal Statistics Service, Bloomberg Economics

Russias Covid-19 downturn is shaping up to be shallower than feared -- Bloomberg Economics now expects the economy to shrink by 5.4% in 2020, rather than the 6.3% blow predicted earlier -- but the recovery looks slow.

Asia

Weak Rebound

Chinas growth picking back up but still forecast to be weakest since 1970s

Source: National Bureau of Statistics, Bloomberg survey

China‘s economy will continue to rebound for the rest of 2020, according to the median economist estimate in a Bloomberg survey, but the expansion will be the weakest since 1976’s contraction.

Abandoned Stores

Hong Kong sees vacancy rates climb across shopping districts

Source: Cushman & Wakefield Research

Empty storefronts are becoming a common sight in Hong Kongs shopping districts as vacancy rates skyrocket across the city. The city will get an update on where it stands next week when the government publishes second-quarter GDP figures.

Emerging Markets

Who‘s Bouncing Back, Who’s Struggling?

Ranking 75 emerging and frontier economies across the world

Source: Bloomberg Economics

All countries are battling the same virus, yet the downturns across emerging and frontier economies look very different: Taiwan, Botswana, South Korea and Thailand are doing best in Bloomberg Economics ranking of 75 economies based on confirmed deaths from Covid-19, the level of activity compared with the pre-virus normal and the policy space available to counter the damage.

— With assistance by Ziad Daoud, Scott Johnson, Tom Orlik, Bjorn Van Roye, Jinshan Hong, Eric Lam, Cynthia Li, Carolynn Look, and Fergal O'Brien

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

FCAA warns Investors against Fintech Market

PH SEC Warns Against TRADE 13.0 SERAX

CFI Collaborates with TradingView for Enhanced Trading Experience

U.S. Seeks 3-Year Sentence for Ex-Binance CEO Zhao

FCA exposed a clone firm

Crypto.com Faces Regulatory Issues with South Korea's Launch

Crypto Exchange CoinW Launches Prop Trading in Dubai

Clone of Morgan Financial Ltd.

CAPPMOREFX AGAIN IN NEWS !!

Currency Calculator