India Q2 GDP Preview: A Slow Climb After A Great Fall

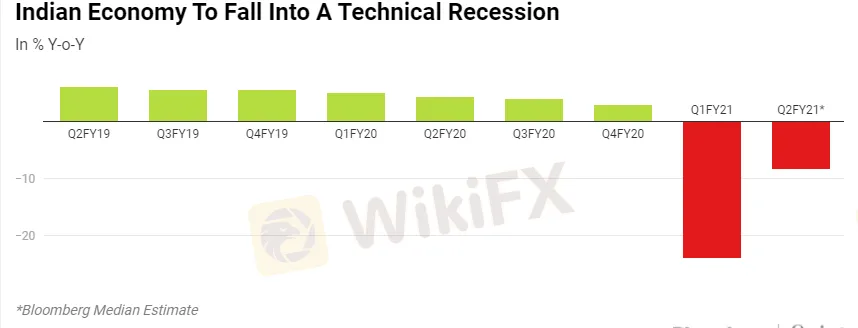

Abstract:India will enter a technical recession this week with the economy set to contract for a second consecutive quarter. The pace of contraction, though, is likely to be significantly below what was seen in the first quarter of the year. GDP data for the July-September quarter is due to be released on Friday.

India will enter a technical recession this week with the economy set to contract for a second consecutive quarter. The pace of contraction, though, is likely to be significantly below what was seen in the first quarter of the year. GDP data for the July-September quarter is due to be released on Friday.

Indias GDP contracted by a record 23.9% in the April-June quarter when a nationwide lockdown brought vast swaths of the economy to a halt. Even though economic activity picked up in the July-September quarter, a contraction in GDP is inevitable.

The GDP data, however, is backward looking and what economists will be watching for is an improvement in activity between the first and second quarters.

The recovery in activity in Q2 FY21 is likely broad-based, according to Rahul Bajoria, chief India economist at Barclays, who estimates GDP will contract by 8.5%.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

FCAA warns Investors against Fintech Market

PH SEC Warns Against TRADE 13.0 SERAX

U.S. Seeks 3-Year Sentence for Ex-Binance CEO Zhao

FCA exposed a clone firm

Crypto.com Faces Regulatory Issues with South Korea's Launch

Crypto Exchange CoinW Launches Prop Trading in Dubai

Clone of Morgan Financial Ltd.

CFI Collaborates with TradingView for Enhanced Trading Experience

CAPPMOREFX AGAIN IN NEWS !!

Currency Calculator