WikiFX Review: Is CCAM Trustworthy?

Abstract:In today’s article, WikiFX will take you on a comprehensive review of CCAM to see if this broker is worth investing in.

About CCAM

CCAM is a forex broker based in Cayman Islands. The company name of this broker is City Credit Asset Management Co. Ltd. CCAM is newly-established and have trading experience of only less than one year. On its website, this broker did not emphasize when exactly this broker was founded. But we do know that the broker from the information on the bottom of the website.

We think this broker is established in 2017. The physical address of this broker is 4th Floor, Harbour Place, 103 South Church Street, Grand Cayman KY1-1002, Cayman Islands. WikiFX has given this broker a low score of 1.02/10.

Brand Story

On 17th November 2020, CCAM claimed it has been awarded the Best Hedge Fund Manager 2020 – Cayman Islands in Worldwide Finance Award 2020 hosted by Acquisition International.

Account Type & Minimum Deposit

Due to the lack of information on its website, we cannot find enough information about the account types and minimum deposit. However, clients still need to submit the account opening request in order to invest.

Customer Service

In addition to specify its physical address, CCAM also offers Telephone number 62-21-50889715. And email address: op-enquiry@ccaml.net. Clients can fill the enquiry to get more information.

Regulation

CCAM is not a regulated broker. CCAM claimed it to be administered by Cayman Islands Monetary Authority (CIMA) under the Securities Investment Business Law in Cayman. However, this claim is not reliable as we search no information about this broker on CIMA. This is a red flag you should consider before trading with CCAM.

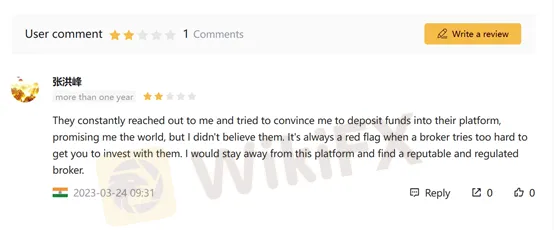

Feedback from Trader

WikiFX did not receive exposure related to this broker yet, butin the “User comment” section, one trader claims that the staffs of CCAM “constant reached out to him and tried too hard to persuade him to invest.” We think taat it is another red flag that traders need to be careful with.

Conclusion

CCAM is not a reputable broker as we consider it as an unregulated broker. And it has a fairly low score on WikiFX which makes the risk obvious. WikiFX advise traders to seek better alternatives.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Interactive Brokers Now Allows 22-Hour Treasury Bond Trading

Interactive Brokers has expanded trading hours for US Treasury bonds, now allowing trading for 22 hours daily.

Are Prop Firms Worth the Hype?

Proprietary trading firms, commonly known as prop firms, have been gaining attention in the forex and cryptocurrency industry. These firms recruit traders to trade with their capital, offering potentially lucrative opportunities. However, the question arises: Are prop firms truly worth the hype?

CFI Collaborates with TradingView for Enhanced Trading Experience

CFI Financial Group integrates with TradingView, offering clients access to 4,000 trading instruments and a community of 50M+ traders, along with advanced charting tools for an improved trading journey.

eToro Introduces Onfido Selfie Motion Biometric Authentication Feature

eToro, the online brokerage platform, has unveiled its latest innovation: the Onfido Selfie Motion biometric authentication feature.

WikiFX Broker

Latest News

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

FCAA warns Investors against Fintech Market

PH SEC Warns Against TRADE 13.0 SERAX

U.S. Seeks 3-Year Sentence for Ex-Binance CEO Zhao

FCA exposed a clone firm

Crypto.com Faces Regulatory Issues with South Korea's Launch

Crypto Exchange CoinW Launches Prop Trading in Dubai

Clone of Morgan Financial Ltd.

CFI Collaborates with TradingView for Enhanced Trading Experience

CAPPMOREFX AGAIN IN NEWS !!

Currency Calculator