Abstract:The online broker eToro is adding new elements to its Economic Calendar in order to give its customers even more useful data.

The Consumer Price Index (CPI) statistics, which monitors inflation by estimating the average shift over time in the costs of products and services usually bought by families, are now included in the schedule. This is a fantastic resource for dealers to keep up with market patterns.

The Economic Calendar on eToro will also include interest rate choices and times for market holidays, which has been a highly desired tool by customers. This demonstrates that eToro constantly listens to its customers and works to offer the features and tools they require.

The option to view ETF payout days is a fantastic addition to the Economic Calendar. For individuals who depend on profits as a source of money, this option is particularly helpful.

It's important to remember that in December 2022, eToro published a unique Economic Calendar on its website. This feature makes it possible for traders to view the times of earnings reports for particular companies in their inventory, which is very beneficial for making wise investment choices.

Simply select “Economic Calendar” from the primary left-side option by clicking or tapping on it. You can view all forthcoming earnings report deadlines for the companies in your account from there. The schedule also offers other crucial details like ex-dividend days and payout dates.

How to Use the Economic Calendar to Improve Your Forex Strategy

The foreign exchange market, or forex market, is influenced by economic events like central bank policy decisions, economic data releases, and geopolitical events. To trade forex successfully, traders need to use an economic calendar to stay informed and adjust their trading strategy accordingly. Here are some tips for using an economic calendar to improve your forex strategy:

Understand the impact of economic events

Monitor the calendar regularly

Use the calendar to plan your trades

Pay attention to market expectations

By following these tips, traders can make informed decisions and reduce their trading risks, ultimately improving their chances of success in the forex market.

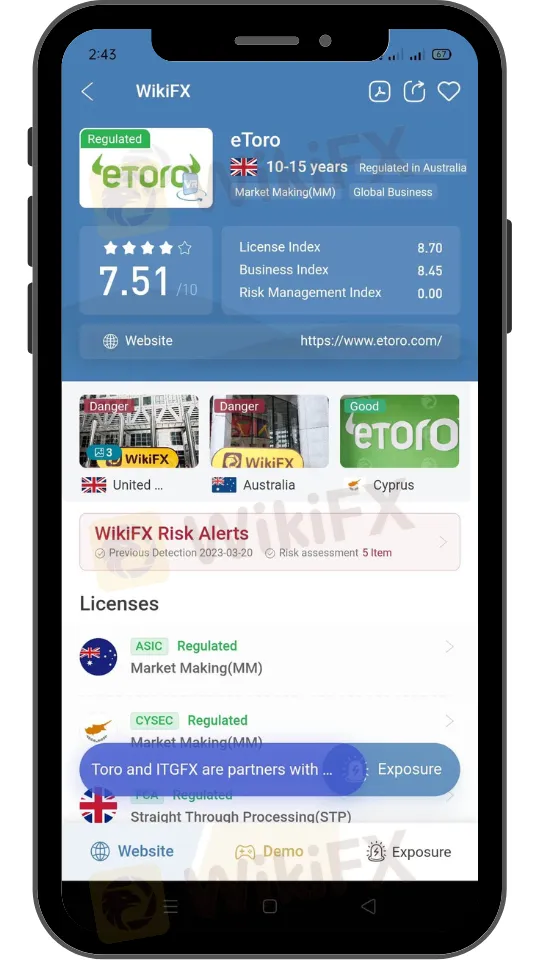

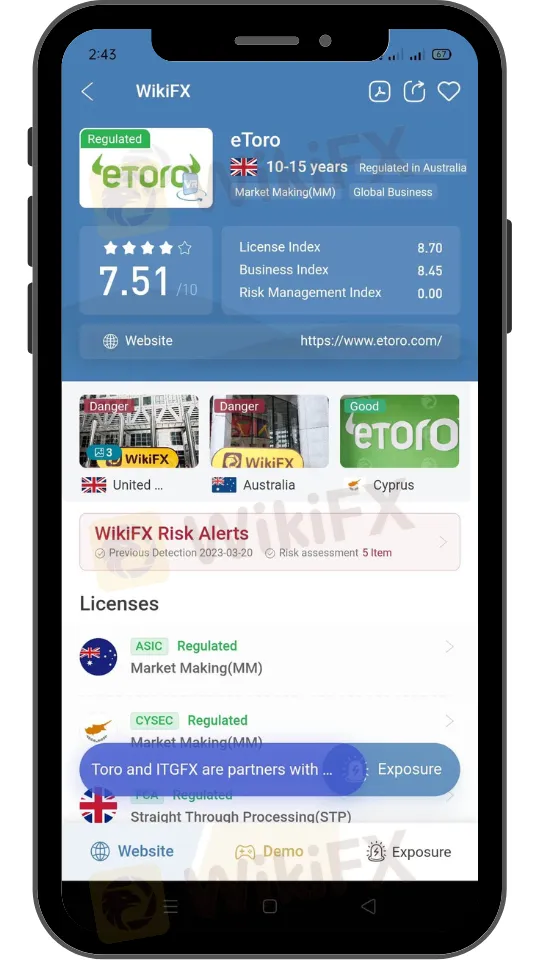

Install the WikiFX App on your smatphone to stay updated on the latest news.

Download link: https://www.wikifx.com/en/download.html?source=fma3