Britannia Financial Expands Its Prime Brokerage Offering with FX, Index, and Commodity CFDs

Abstract:Britannia Financial Group has announced that the Prime Brokerage product of Britannia Global Markets Limited has been expanded to include trading of FX, Index, and Commodity CFDs.

Britannia Financial Group has announced that Britannia Global Markets Limited's Prime Brokerage product has been expanded to cover the trading of FX, Index, and Commodity CFDs.

The new service will be backed up by cutting-edge technology platforms such as Lucera, PrimeXM, MetaQuotes, and MaxxTrader.

Britannia's collaborations with award-winning financial services technology vendors will enable the Group to deliver cutting-edge aggregation software, ultra-low-latency connection, institutional-grade hosting solutions, and high-end MT4/MT5 Bridging and White Labels to its customers.

Britannia will also join the XCore community, confirming its dedication to the FX and CFD industries.

“We are thrilled to extend our Prime Brokerage offering to include CFDs and further enhance our technology infrastructure, which will enable us to successfully serve our customers' growing demand,” said Samuel Gunter, Head of Foreign Exchange Trading.

Britannia is dedicated to providing best-in-class service to our expanding professional and institutional customers by offering a diverse variety of trading and investing options. This new product and investment reflect the underlying goal of Britannia, which is to use technology to develop the Group's hallmark boutique, individualized services.

About Britannia Global Markets Inc.

Britannia Global Markets is a multi-asset brokerage that provides institutions, businesses, and UHNWs with execution, give-ins and give-ups, custody, and clearing services for a wide variety of financial instruments. Stock indices, interest rates, precious and base metals, agriculture, energies, financials, spot and forward foreign exchange, and equities are among the key global derivative markets accessible via the firm. Britannia is a stock exchange member in London as well as the Dubai Gold and Commodities Exchange. Britannia Global Markets is a subsidiary of the Britannia Financial Group, which is headed by Venezuelan/Italian banker Julio Herrera Velutini.

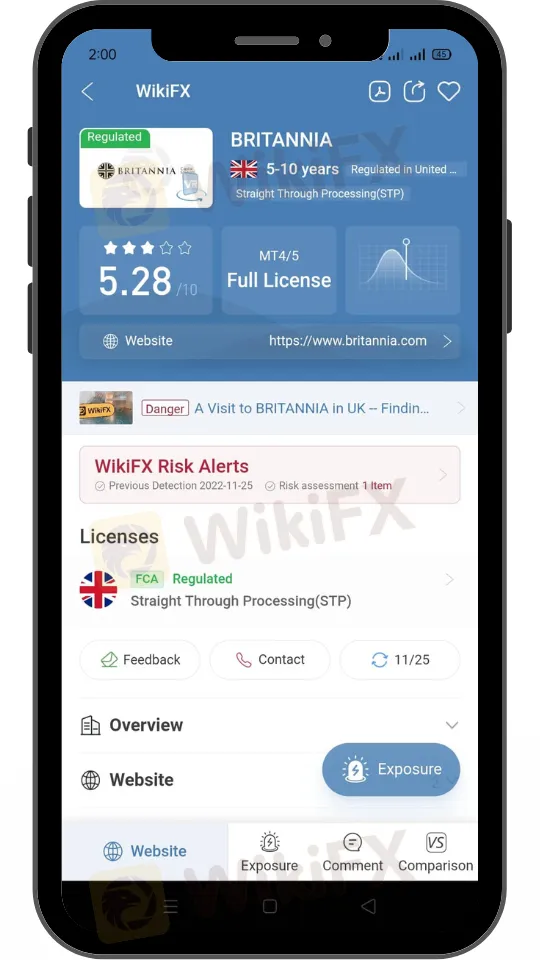

You can check out more of Britannia Capital Markets here: https://www.wikifx.com/en/dealer/8521258365.html

Stay tuned for more Forex Broker news.

Download the WikiFX App from the App Store or Google Play Store to stay updated on the latest news.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

FOREX TODAY: AS THE NEW WEEK BEGINS, THE MARKET IS FEELING BETTER

The US stock index futures had a solid start to the week, suggesting that the market's perception of risk has changed. The preliminary April Consumer Confidence numbers will be released by the European Commission on Monday, along with a speech by the president of the European Central Bank (ECB). No significant data releases on the US economic docket are scheduled.

ASIC Warns of New Bond and Deposit Scam

The Australian Securities and Investments Commission (ASIC) has flagged a concerning trend in financial fraud, cautioning investors about a sophisticated scam targeting bonds and term deposits.

Interactive Brokers Launches Daily Options on CAC 40 Index

Interactive Brokers expands its product suite with Daily Options on the CAC 40 index, providing investors with more tools for short-term trading strategies.

Spring FX Signals Requests Payments in Exchange for Withdrawals

In a cautionary tale that reverberates through the digital trading landscape, Moideen, found himself ensnared in the web of deception spun by Spring FX Signals.

WikiFX Broker

Latest News

Crude Oil Prices Inch Up Despite Uncertainties in US Demand

FCA Exposed Two Major Red Flags

Capitalix Denies Withdrawals to Copy-Trading Clients

ED smashed a fake app with the help of Binance

ASIC Warns of New Bond and Deposit Scam

FOREX TODAY: AHEAD OF THIS WEEK'S MAJOR EVENTS, MARKET ACTIVITY SLOWS DOWN

Coinbase Sees $1.2B Profit Amid Crypto ETF Launch

FOREX TODAY: AS THE NEW WEEK BEGINS, THE MARKET IS FEELING BETTER

FOREX TODAY: TO START THE WEEK, GOLD REACHES YET ANOTHER RECORD HIGH.

Spring FX Signals Requests Payments in Exchange for Withdrawals

Currency Calculator