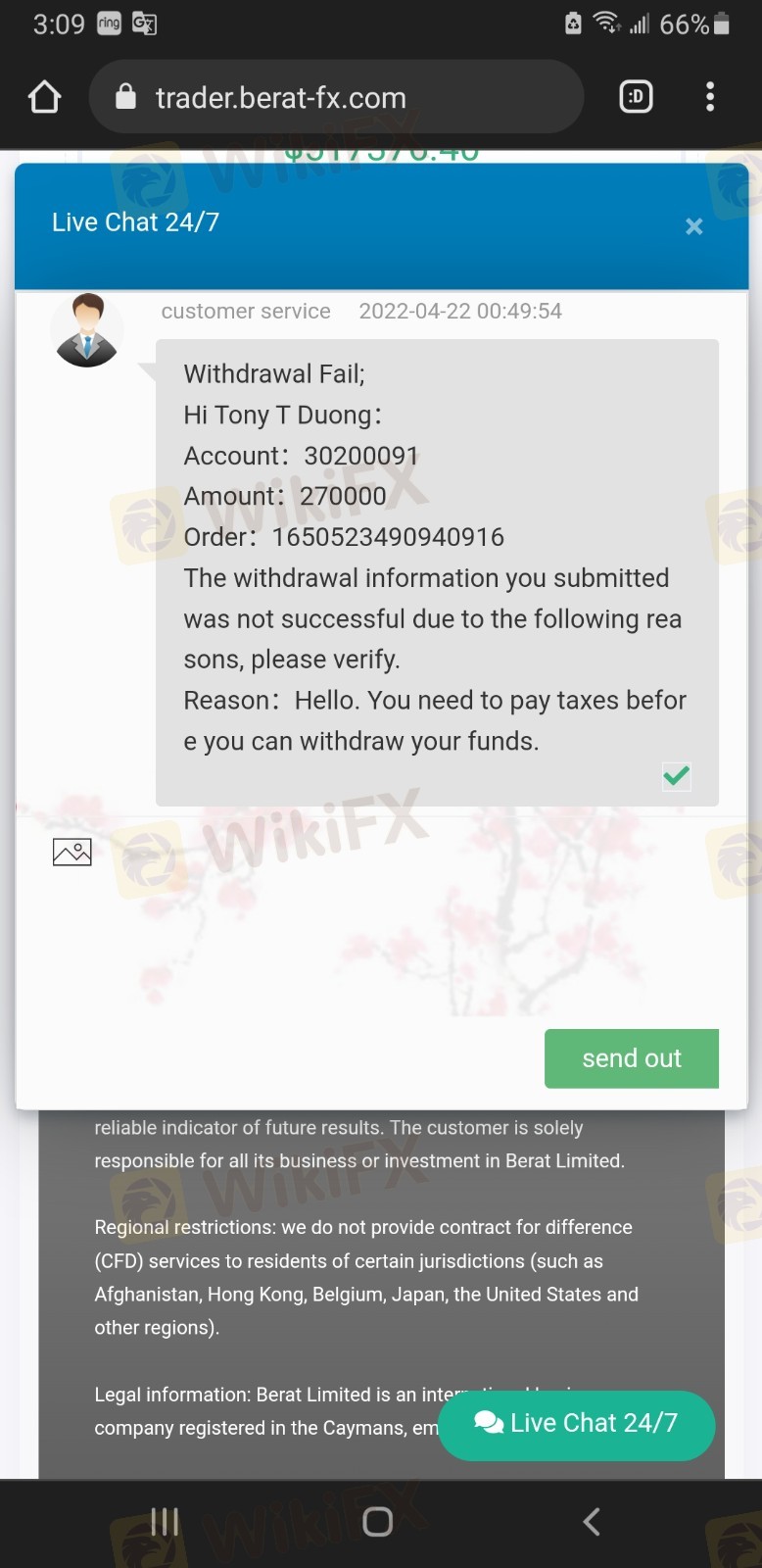

>>> CANNOT WITHDRAW MY MONEY with 10% tax to pay !!!

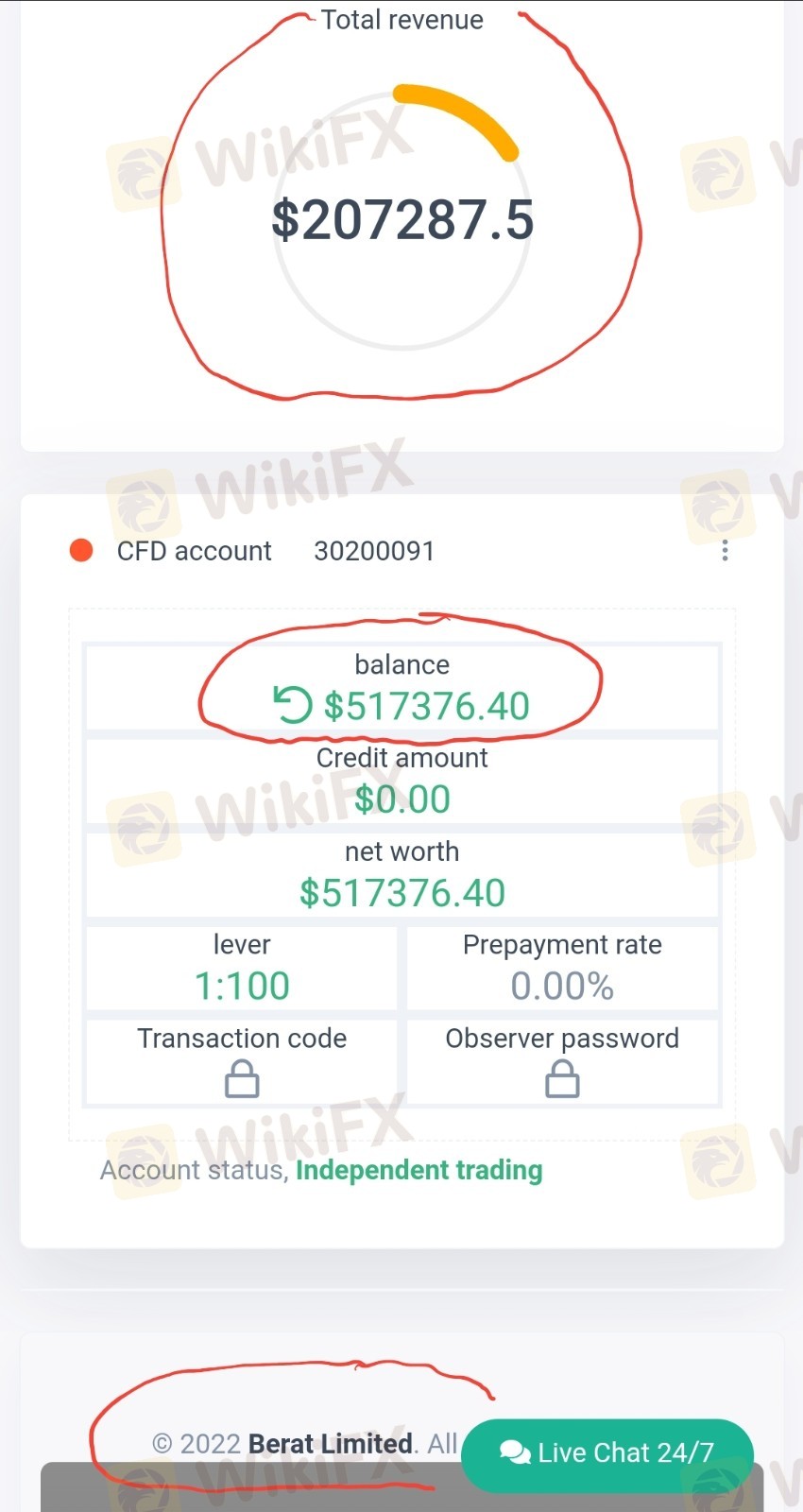

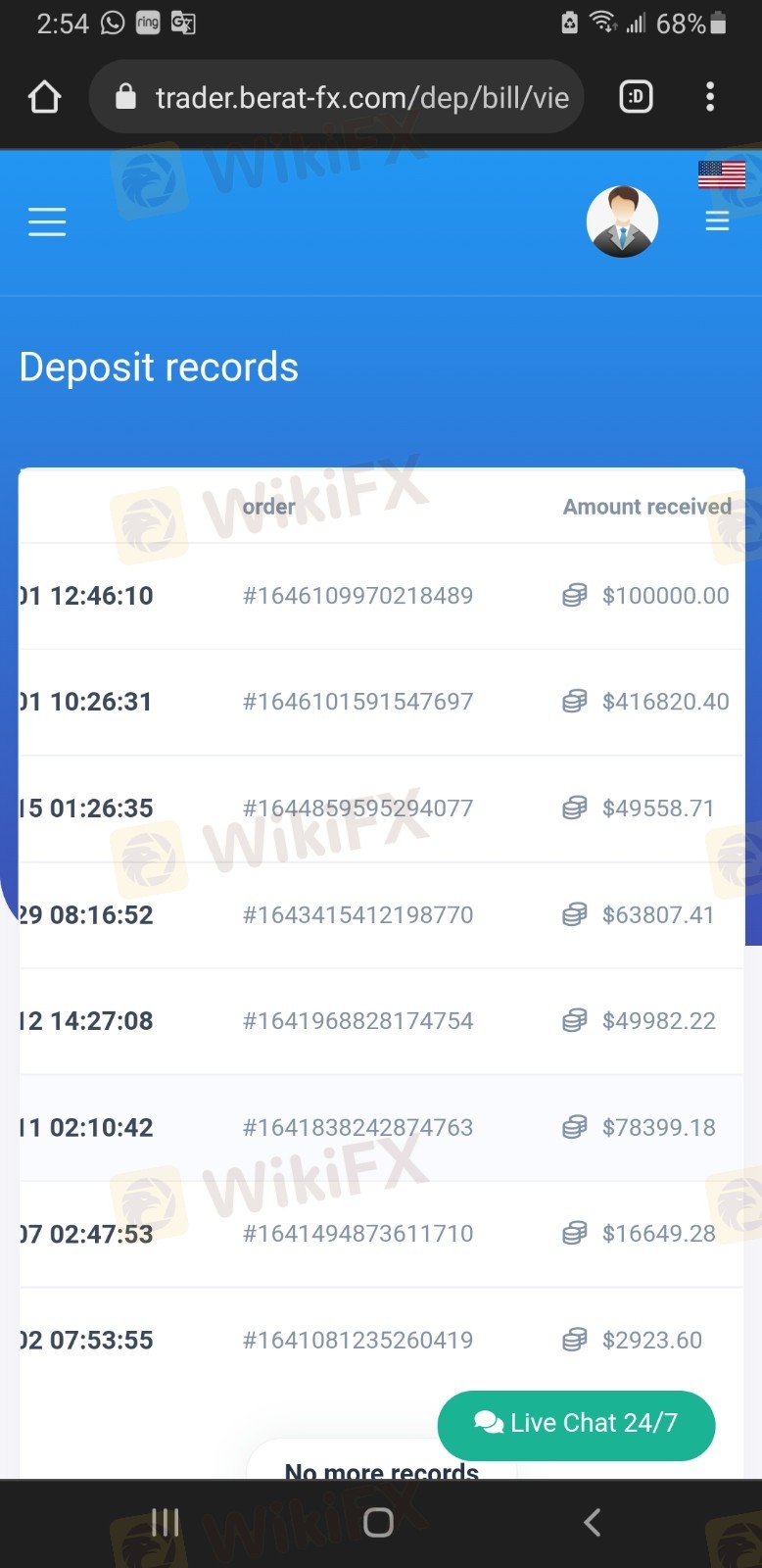

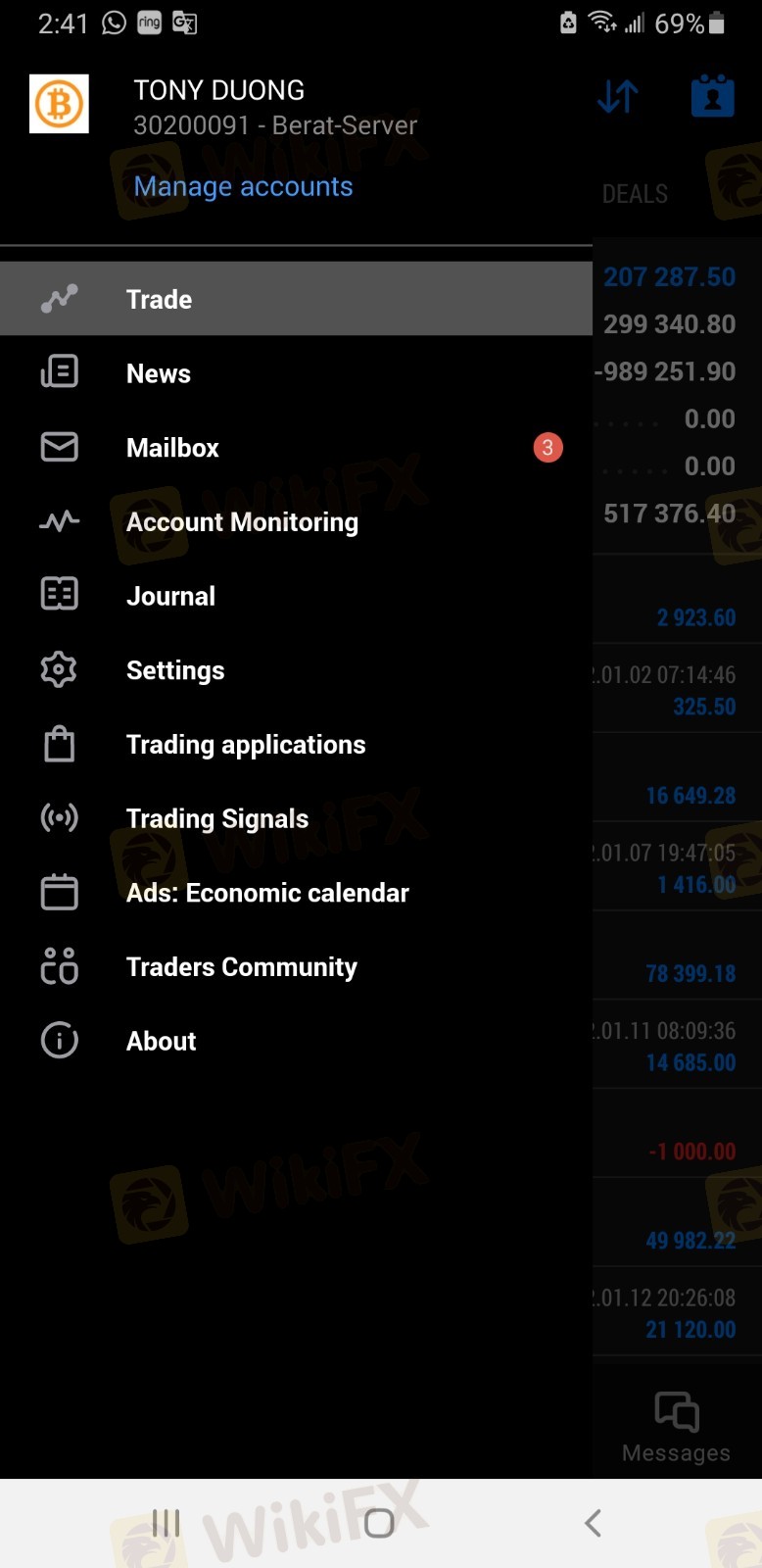

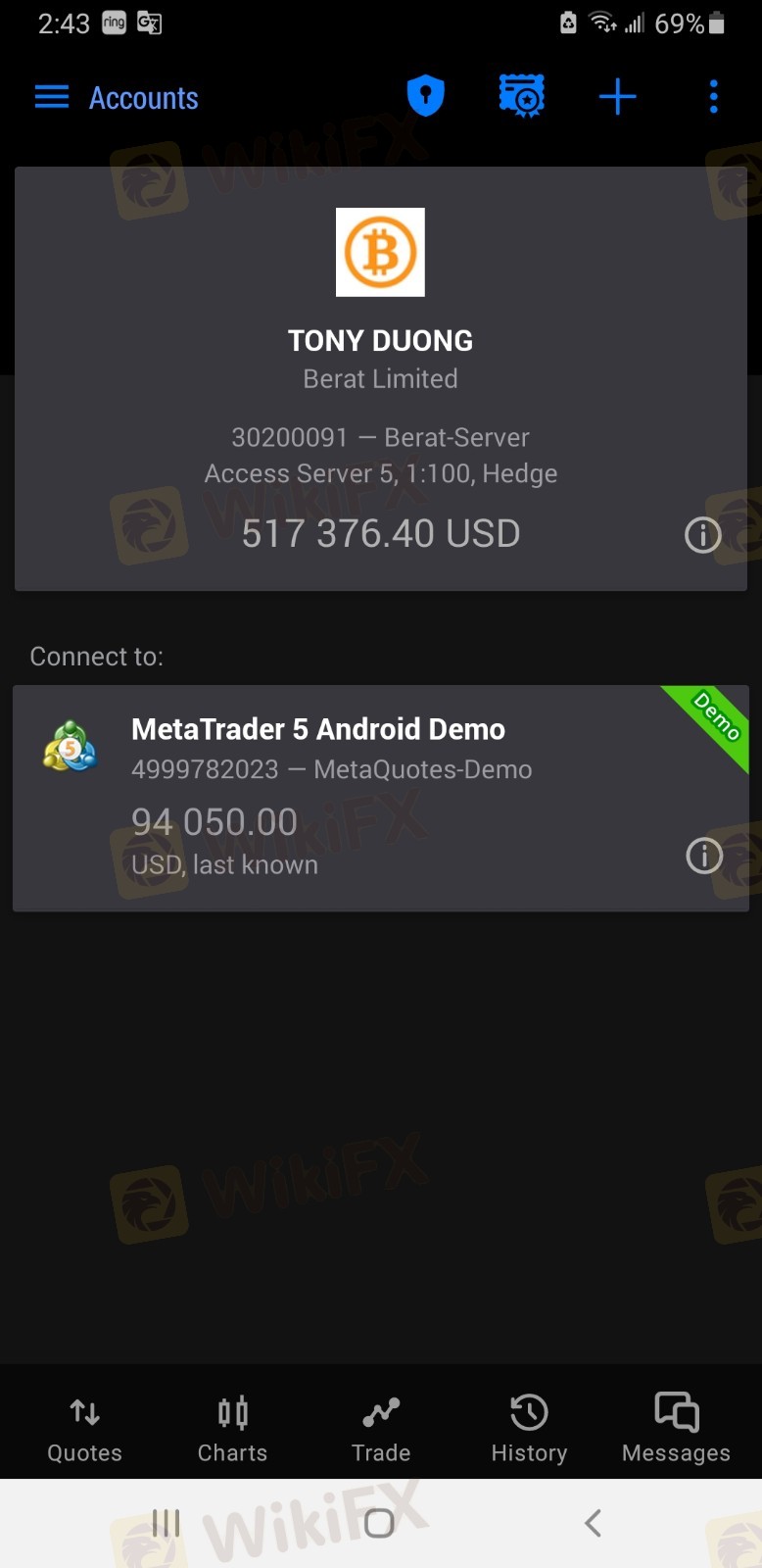

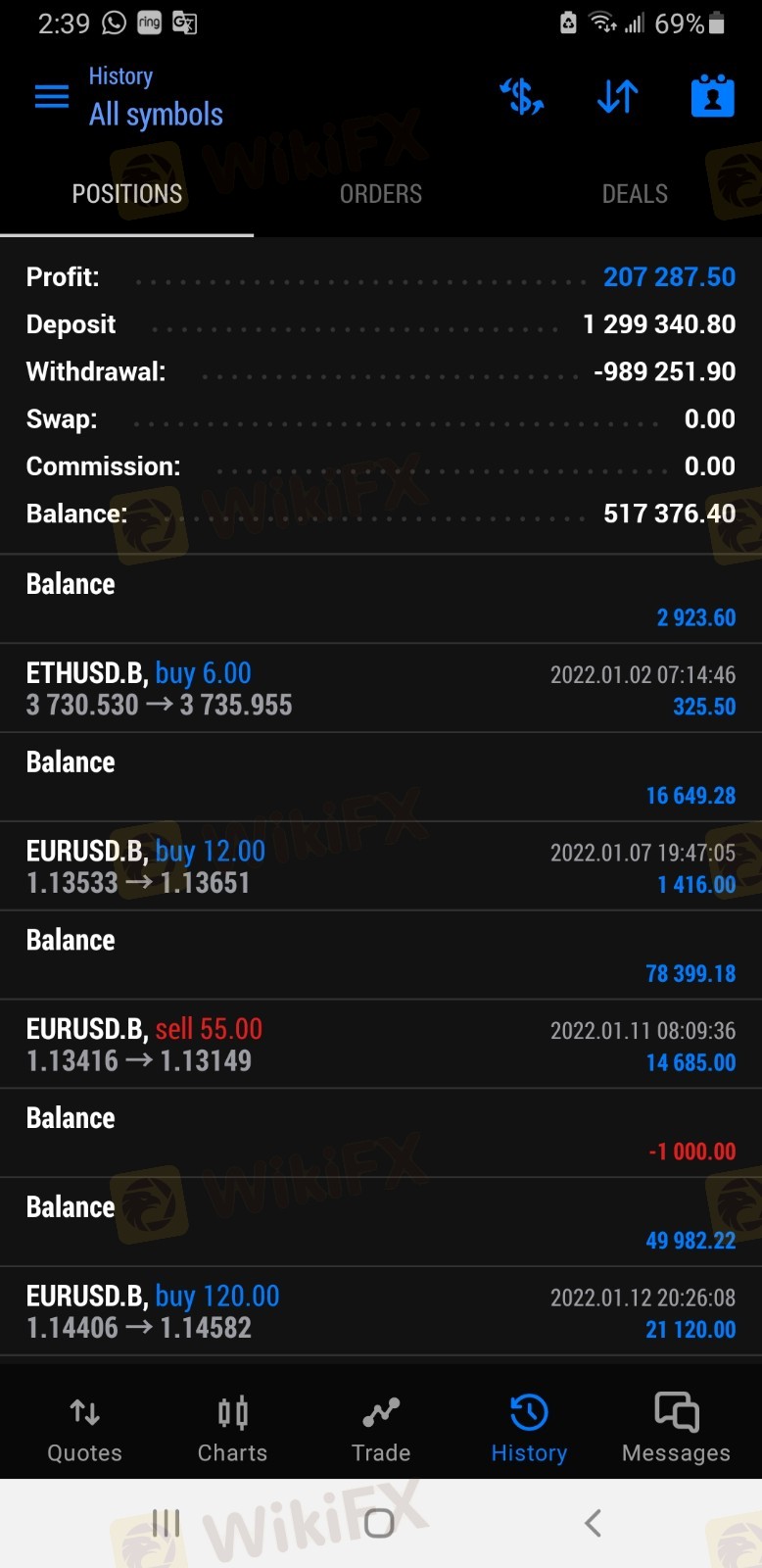

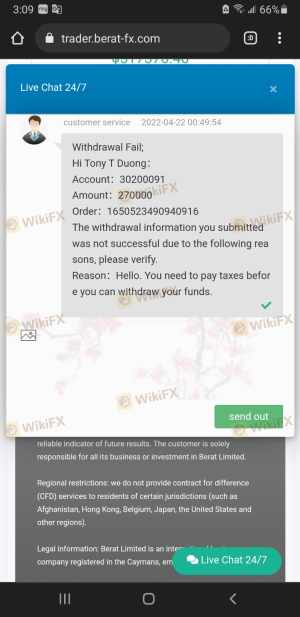

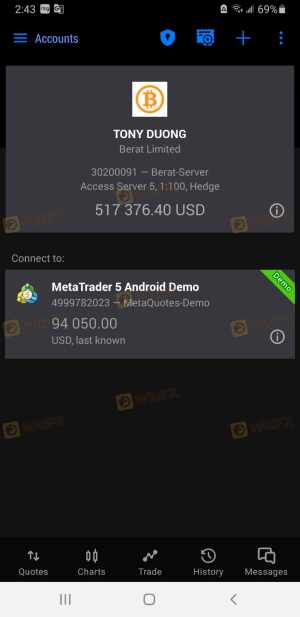

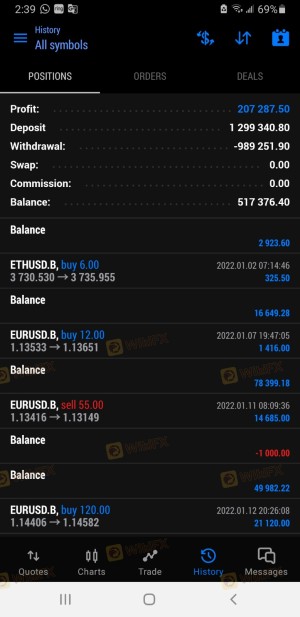

The deposit is USDT 310000. Trade profit is USDT 207287. The balance now is USDT 517376. When I requested to withdraw money. The customer service rejected my request and asked me to pay extra 10% tax is 51737.64USDT separately instead of direct deduction from my balance. Tax must pay under USDT cryptocurrency through them to Hong Kong Inland Revenue Department which is not persuasive for me to believe it at all. They are offshore broker accepting deposit without any questions but asking 10% tax when to withdraw. Please contact their manager to step in to solve my problem. I want all my funds back without any issues. It is not acceptable for asking tax when Hong Kong Inland Revenue Department confirm by email to me :"We do not charge personal income tax or withholding tax on investment income and capital gain. You can follow this link (https://www.ird.gov.hk/eng/pdf/tax_guide.pdf) for further information on the tax system and collection of taxes in Hong Kong." more "The amount of tax payable in Hong Kong dollars (instead of foreign currencies or cryptocurrencies) and the due date for payment are stipulated in each notice of assessment served to the taxpayer’s last known postal address." But they asked me to pay my tax to their tax crypto wallet at: "Tax address: 0xdF86B385a0E9231Ec9891991B27CB775e290a84D"