Company Summary

| CITIC Futures Review Summary | |

| Founded | 2007 |

| Registered Country/Region | China |

| Regulation | CFFEX |

| Services | Brokerage Service, Investment Advisory, Technical Support, Asset Management |

| Demo Account | ✅ |

| Trading Platform | Fast Issue (V2), Fast Issue (V3), Mandarin WH6, etc. |

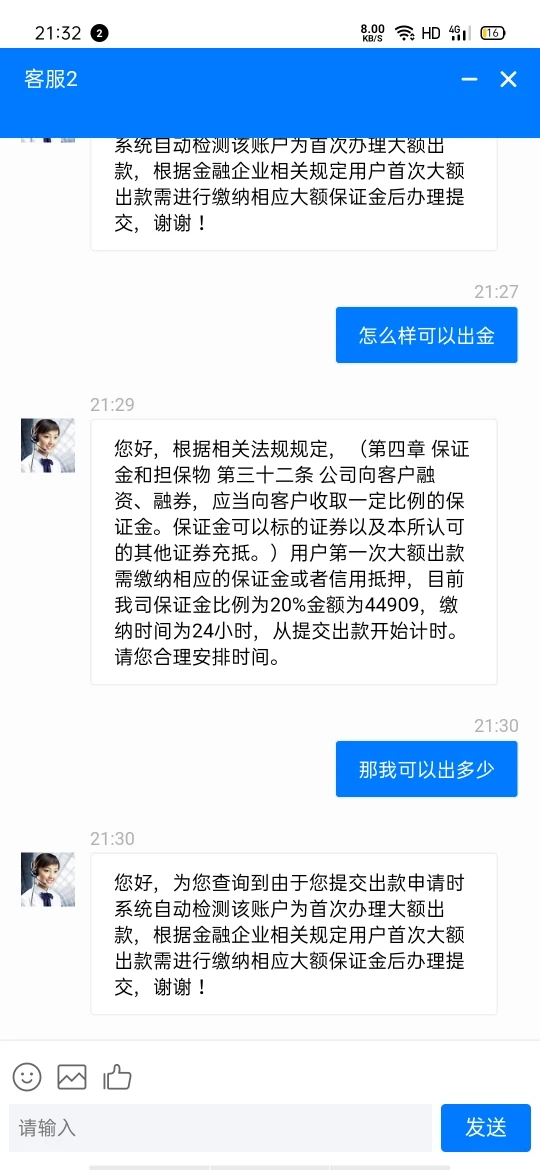

| Customer Support | 24/7 live chat |

| Tel: 400-9908-826 | |

| Fax: 0755-83217421 | |

| Zip Code: 518048 | |

| Address: Room 1301-1305, 13F and 14F, North Block, Times Square Excellence (Phase II), No. 8 Zhongxin 3rd Road, Futian District, Shenzhen, 518048, China | |

| Facebook, X, Instagram, LinkedIn | |

CITIC Futures Information

CITIC Futures is a regulated service provider of premier brokerage and financial services, which was founded in China in 2007. It offers services for Brokerage Service, Investment Advisory, Technical Support and Asset Management.

Pros and Cons

| Pros | Cons |

| Demo accounts | Limited trading products |

| Long operation time | Various fees charged |

| Various contact channels | |

| Regulated well |

Is CITIC Futures Legit?

Yes. CITIC Futures is licensed by CFFEX to offer services. Its license number is 0018. CFFEX, established with the approval of the State Council of the Peoples Republic of China and the China Securities Regulatory Commission (CSRC), is an incorporated exchange specializing in providing trading and clearing services for financial futures, options and other derivatives.

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| China Financial Futures Exchange (CFFEX) | Regulated | 中信期货有限公司 | Futures License | 0018 |

CITIC Futures Services

| Services | Supported |

| Brokerage Service | ✔ |

| Investment Advisory | ✔ |

| Technical Support | ✔ |

| Asset Management | ✔ |

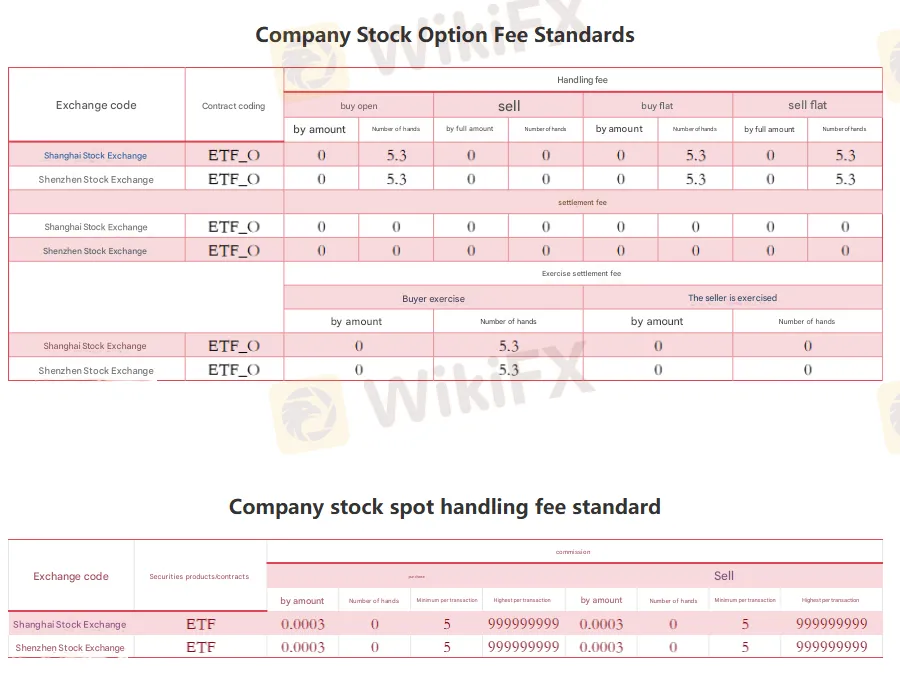

CITIC Futures Fees

Different fees for different products on different exchanges, please visit the official website for details (the picture is translated by Google, not very clear, please visit the official website for details).

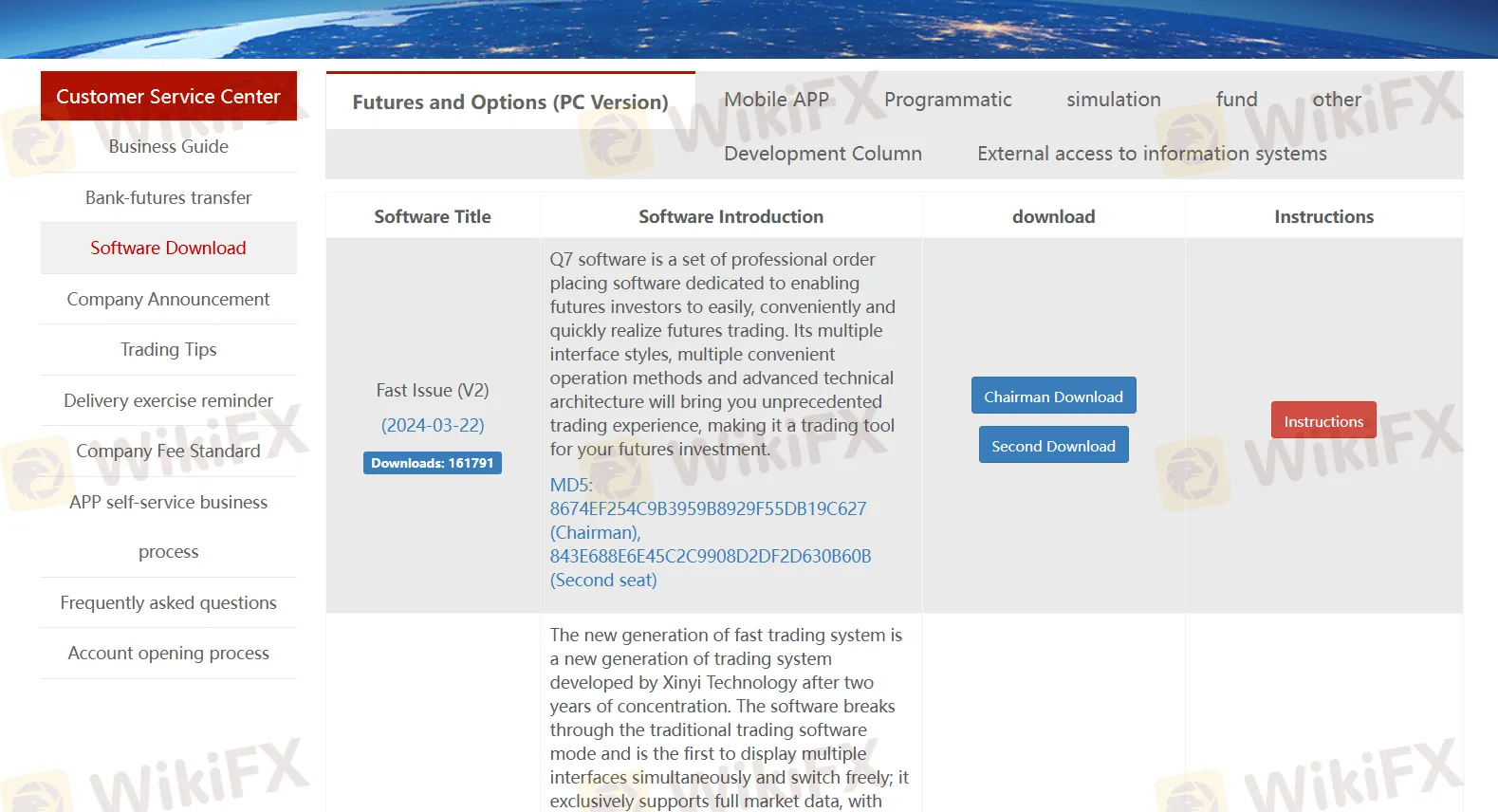

Trading Platform

| Trading Platform | Supported | Available Devices |

| Fast Issue (V2) | ✔ | PC, laptop, tablet |

| Fast Issue (V3) | ✔ | PC, laptop, tablet |

| Mandarin WH6 | ✔ | PC, laptop, tablet |

| Boyi Master 7 | ✔ | PC, laptop, tablet |

| Boyi Master 5 | ✔ | PC, laptop, tablet |

| CITIC Futures Tonghuashun Futures | ✔ | PC, laptop, tablet |

| CITIC Futures Infinite Easy | ✔ | PC, laptop, tablet |

| Polestar 9.5 | ✔ | PC, laptop, tablet |

| CITIC Polestar 9.3 | ✔ | PC, laptop, tablet |

| Qianlong Option | ✔ | PC, laptop, tablet |

| Huidian Stock Options Professional Investment System | ✔ | PC, laptop, tablet |

| CITIC Futures-Xin eLu | ✔ | Mobile |

| CITIC Futures-Trading Edition | ✔ | Mobile |