31FX

United Kingdom

United Kingdom

Time Machine

Check whenever you want

Download App for complete information

Exposure

No Data

31FX · Company Summary

| 31FX Review Summary | |

| Founded Year | 2019 |

| Registered Country | United Kingdom |

| Regulation | No Regulation |

| Market Instruments | Forex and CFDs |

| Demo Account | ✔ |

| Leverage | Ranges from 1:100 (Basic, Bronze) to 1:1000 (Diamond) |

| Spread | From 0.1 pips |

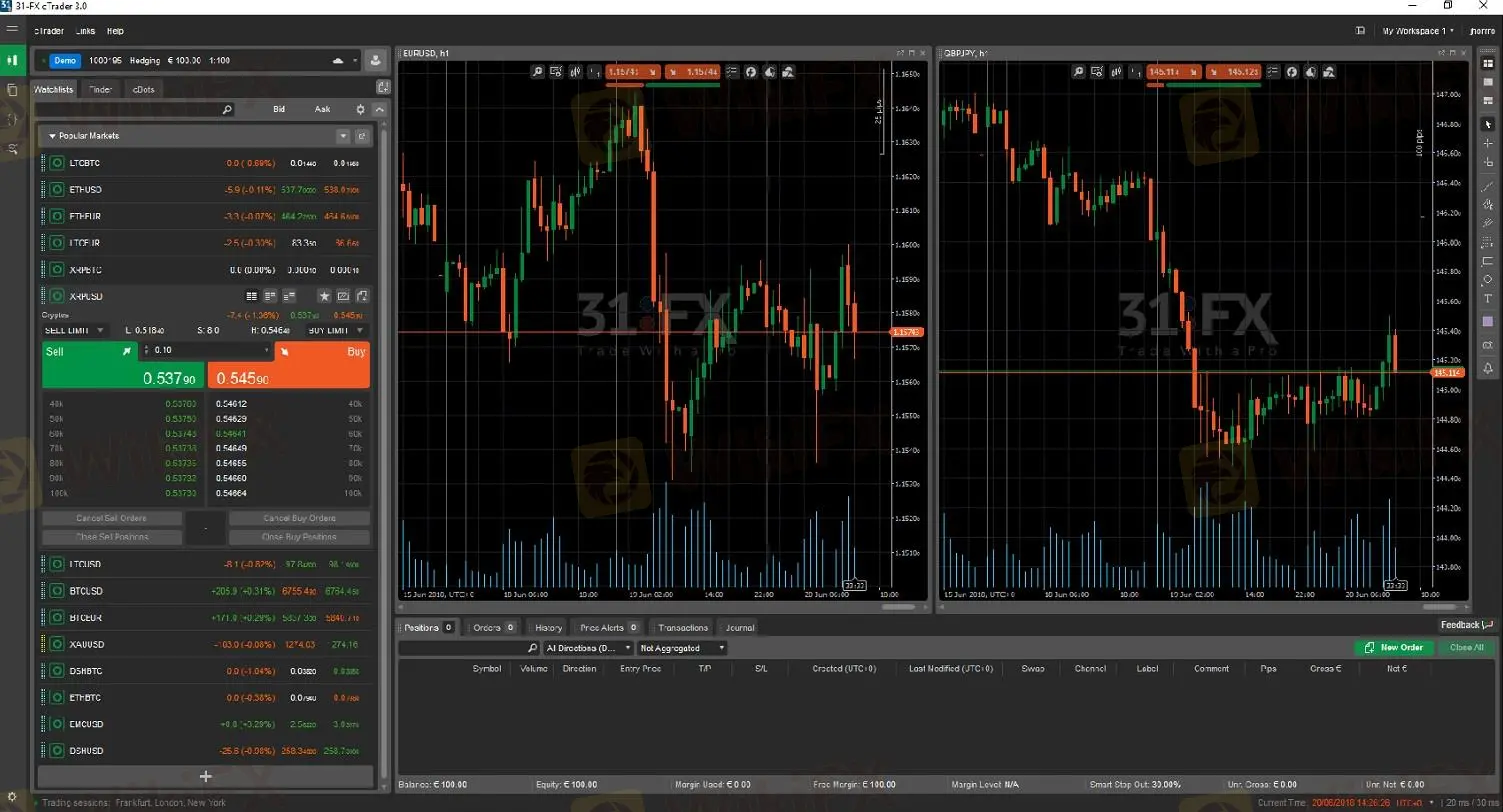

| Trading Platforms | Web and Mobile Platform |

| Minimum Deposit | €500 |

| Customer Support | Phone: +442080898655 |

| Email: support@31fx.co | |

31FX Information

31FX is an unregulated UK-based Forex and CFD broker. It offers all kinds of live accounts with flexible leverage ratios. The minimum deposit requires €500 and the spread is from 0.1 pips.

Pros & Cons

31FX offersover 100 countries. The broker offers a variety of account types, with spreads starting at 0.1 pip and high leverage up to 1:1000 in the Diamond account. Moreover, all accounts support Expert Advisors. However, the absence of regulation raises concerns about fund security and trading fairness and it is not regulated well.

| Pros | Cons |

| Variety of Account Types | No Regulation |

| Competitive Spreads Starting at 0.1 pip | High Deposit for Certain Accounts |

| High Maximum Leverage up to 1:1000 on the Diamond Account | Lack of Client Fund Protection |

| Support for Expert Advisors across All Account Types | Limited Transaction Methods |

| Youtube Tutorials | Limited Customer Support Channels |

Is 31FX Legit?

As it does not operate their business under regulatory frameworks, traders are more prone to be scammed.

What Can I Trade on 31FX?

31FX trades on major currency pairs, and minor and exotic pairs. For CFD trading, 31FX allows trading in the Dow Jones, NASDAQ, and FTSE 100. They also provides Commodity CFDs, including gold, silver, oil, and natural gas.

Account Type

This broker offers six distinctive trading accounts:

| Account Type | Minimum Deposit |

| Basic | €500 |

| Bronze | €5,000 |

| Silver | €25,000 |

| Gold | €50,000 |

| Platinum | €100,000 |

| Diamond | €150,000 |

Leverage

31FX provides a variety of leverage options across its account types:

| Account Type | Maximum Leverage |

| Basic | 1:100 |

| Bronze | 1:100 |

| Silver | 1:200 |

| Gold | 1:400 |

| Platinum | 1:500 |

| Diamond | 1:1000 |

Spreads & Commissions

31FX offers specific spreads and commissions for each accounts.

| Account Type | Minimum Spread | Commissions |

| Basic | 0.1 pips | $12 per lot |

| Bronze | $10 per lot | |

| Silver | $6 per lot | |

| Gold | $2 per lot | |

| Platinum | None | |

| Diamond | None |

Trading Platform

31FX only offers a web-based trading platform. For novices, they should register demo accounts to get familiar with their trading platform.

Deposit & Withdrawal

For deposit and withdrawal methods, 31FX accepts bank transfers and credit/debit cards.

Customer Support

31FX provides customer support to its clients via a contact number and email. You can call the support team at +442080898655 send their queries to support@31fx.co for email support.

The Bottom Line

Overall, 31FX offers various tradable products with diverse account types, low spreads and high leverage. However, there are problems including its unregulated status and inaccessible website.

FAQs

Is 31FX regulated?

No.

Does 31FX offer demo accounts?

Yes.

Does 31FX require the minimum deposit.

Yes. It requires at least €500.

News

No Data