Company Summary

Currently, the official website of Varna Trade(https://varnatradefx.com/en/index) is inaccessible.

| Varna Trade Review Summary | |

| Founded | 2011 |

| Registered Country/Region | United States |

| Regulation | Unregulated |

| Market Instruments | Forex, Precious Metals, Crude Oil, Indices, Cryptocurrencies, CFD Contracts |

| Demo Account | × |

| Leverage | 1:100 - 1:500 |

| Spread | From 0 pips |

| Trading Platform | ST5 |

| Min Deposit | Not mentioned |

| Customer Support | Phone: Not provided |

| Email: support@varnatradefx.com | |

| 24/7 Online Chat: No | |

| Physical Address: Empire State Building, New York | |

Varna Trade Information

Varna Trade is a 2011-founded trade platform. Forex, precious metals, crude oil, indices, cryptocurrencies, and CFD contracts are among the extensive range of assets the platform provides for trading. Still, it's unregulated. Varna Trade uses the ST5 trading software and provides several account kinds but no demo account.

Pros and Cons

| Pros | Cons |

| Offers many asset (Forex, Precious Metals, Crude Oil, Indices, Cryptos) | Unregulated |

| High leverage options (up to 1:500) | No demo account available |

| Limited customer support (No phone or live chat) |

Is Varna Trade Legit?

Varna Trade is unregulated now.

What Can I Trade on Varna Trade?

Varna Trade offers forex, precious metals, crude oil, indices, cryptocurrencies, and CFD contracts.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Precious Metals | ✔ |

| Crude Oil | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| CFD Contracts | ✔ |

Account Types

3 account forms are offered by Varna Trade: Financial STP, Finance, and Comprehensive. There is no available demo account.

| Account Name | Details |

| Comprehensive Account | CFD-focused trading experience |

| Finance Account | Forex, commodities, and cryptocurrencies |

| Financial STP Account | Optimized for trade volume and efficiency |

Leverage

Varna Trade offers leverage from 1:100 to 1:500.

Varna Trade Fees

Varna Trade offers spreads starting from 0 pips. However, the exact commission is not mentioned.

| Account Type | Spread | Commission |

| Comprehensive Account | From 0 pips | Not specified |

| Finance Account | From 0 pips | Not specified |

| Financial STP Account | From 0 pips | Not specified |

Trading Platform

Varna Trade uses the ST5 trading platform.

| Trading Platform | Supported | Available Devices | Suitable for |

| ST5 Platform | ✔ | Desktop (Windows, macOS), | Experienced traders seeking advanced tools |

| ST5 Platform | ✔ | Mobile (iOS, Android) | Traders on-the-go, not recommended for beginners |

| MT4 | × | ||

| MT5 | × |

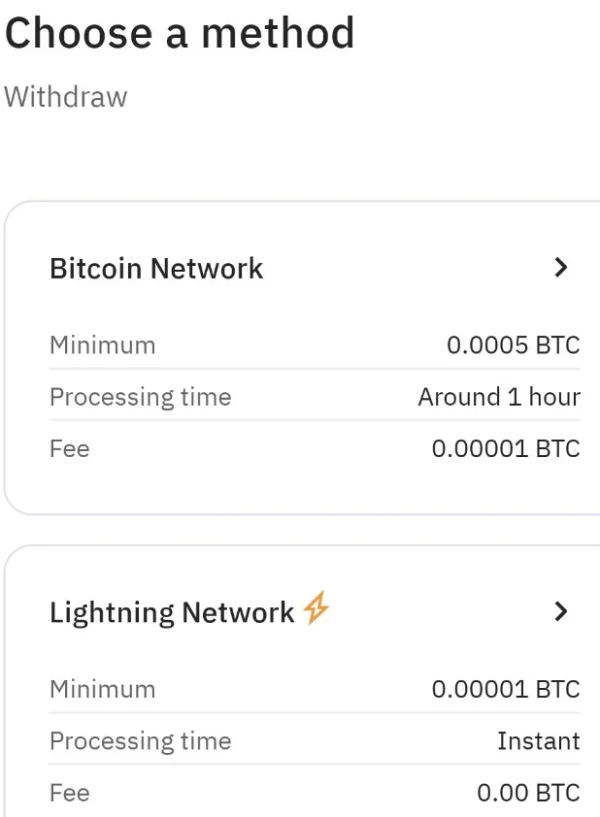

Deposit and Withdrawal

Varna Trade does not mention specific information about deposit and withdrawal.

Wenner

Kazakhstan

Varna Trade is fantastic for traders who want to learn and grow! They have an extensive range of education resources that are easy to understand and engaging. Plus, their account types are tailored to suit different traders' needs and preferences.

Positive

tanbao

South Africa

Good broker, low spreads (consistently) compared to other brokers, helpful assistance when required 24/7. Client platform good and easy to use. Would recommend highly to other traders thank u :)

Positive

JackieSmith

Nigeria

I've been using Varna Trade for a few months now and I must say, it's been a really solid experience for the most part. Firstly, the trading platform is pretty impressive. It’s intuitive, feature-rich, and I’ve had almost zero downtime during my trading hours. If stability and usability are important to you, Varna definitely delivers in this area. One thing that I particularly appreciate about Varna Trade is their withdrawal process, it’s quick and straightforward. No unnecessary waiting time or hidden extra fees.

Positive

FX1524107455

United States

Competitive spreads were another surprise package. When working with the GBP/JPY pair, I noticed their spreads were constrained - talking numbers, typically around 1.3 to 1.7 during peak trading hours. Nice, right? The trading signals from Varna Trade lighted my way on numerous trades. One standout was a bearish move on the AUD/CAD pair, which their signals succeeded in predicting. Quick on my feet (and thanks to swift order execution), I was able to short my position and wasn't that a profit party!

Positive