Company Summary

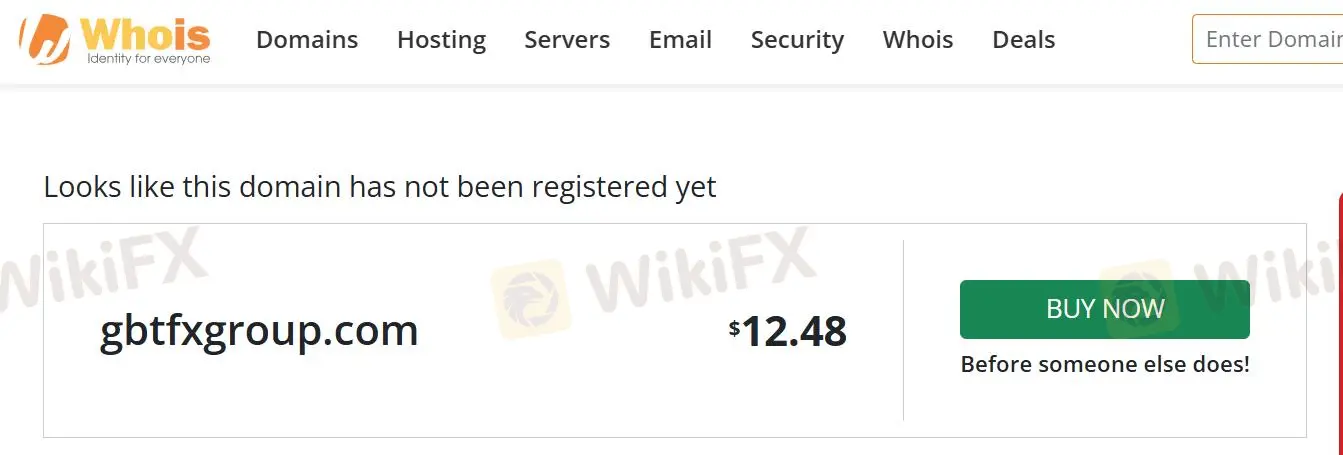

Note: GBT's official website: https://gbtfxgroup.com is normally inaccessible.

GBT Information

GBT is an unregulated brokerage company registered in the United States. While the broker's official website has been closed, so traders cannot obtain more security information.

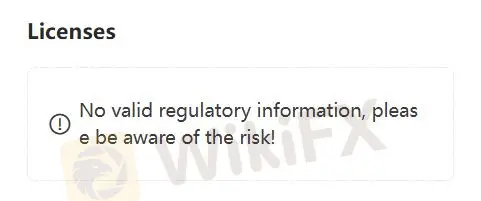

Is GBT Legit?

GBT is not regulated, which will increase trading non-compliance and reduce traders investment security. Caution is advised when dealing with the company.

After a Whois query, we found that this company's domain name is for sale, which shows that GBT has not registered it securely.

Downsides of GBT

- Unavailable Website

The website of GBT is inaccessible, raising concerns about its reliability and accessibility.

- Lack of Transparency

Since GBT does not explain more transaction information, especially regarding fees and services, this will bring huge risks and reduce transaction security.

- Regulatory Concerns

Unregulated GBT is less safe than a regulated broker.

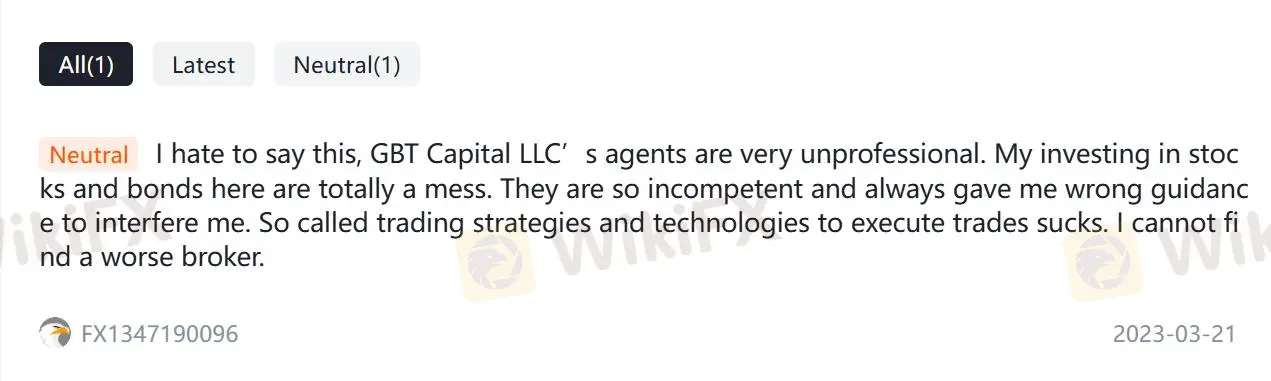

- Neutral Comments

According to a report on WikiFX, a user means the brokers of the brokerage firm are not professional enough and provide wrong judgments.

Conclusion

GBT Since the official website cannot be opened, traders cannot get more information about security services. In addition, the unregulated status and unregistered domain name indicate that the broker's trading risks are high. It is advisable to choose regulated brokers with transparent operationsto ensure the safety of your investments and compliance with legal standards. Traders can learn more about other brokers through WikiFX. Information improves transaction security.