Company Summary

| QF Markets Review Summary | |

| Founded | 2022 |

| Registered Country/Region | Marshall Islands |

| Regulation | FSCA (Suspicious clone) |

| Market Instruments | Forex, Commodities, Indices, Cryptocurrencies, Shares |

| Demo Account | ✔ |

| Trading Platform | MT5 |

| Leverage | Up to 1:2000 |

| Spread | From 1.5 pips (Standard account) |

| Min Deposit | $5 |

| Customer Support | Emaill: support@qfmarkets.com |

| Live Chat: 7/24 | |

| Instagram: https://www.instagram.com/qfmarkets_global/ | |

| Physical Address: 59, Agiou Athanasiou, 4102, Limassol | |

| Region Restrictions | US, Canada, Syria, North Korea and Iran |

QF Markets is a broker registered in the Marshall Islands in 2022. QF Markets provides five types of trading instruments through the MetaTrader 5 platform, with a minimum deposit requirement of $5 and leverage reaching up to 1:2000. In addition, the company does not offer its services to residents of the United States, Canada, Syria, North Korea, and Iran. Most importantly, this broker operates without legitimate regulation and possesses only a cloned license.

Pros and Cons

| Pros | Cons |

| Multiple account types | No info on fees |

| Comprehensive customer service | Regional restrictions |

| Multiple trading choices | Suspicious clone FSCA license |

| Demo accounts | |

| MT5 support |

Is QF Markets Legit?

QF Markets lacks legal regulation and its license is a suspicious clone. The license, which bears the number 46087 and was issued by the Financial Sector Conduct Authority (FSCA) in South Africa, actually belongs to AFN FINANCIAL SERVICES (PTY) LTD. This does not match the name of QF Markets. Consequently, it is confirmed to be a cloned license, and you should not place your trust in it.

| Regulatory Status | Suspicious Clone |

| Regulated by | Financial Sector Conduct Authority (FSCA) |

| Licensed Institution | AFN FINANCIAL SERVICES (PTY) LTD |

| Licensed Type | Financial Service Corporate |

| Licensed Number | 46087 |

What Can I Trade on QF Markets?

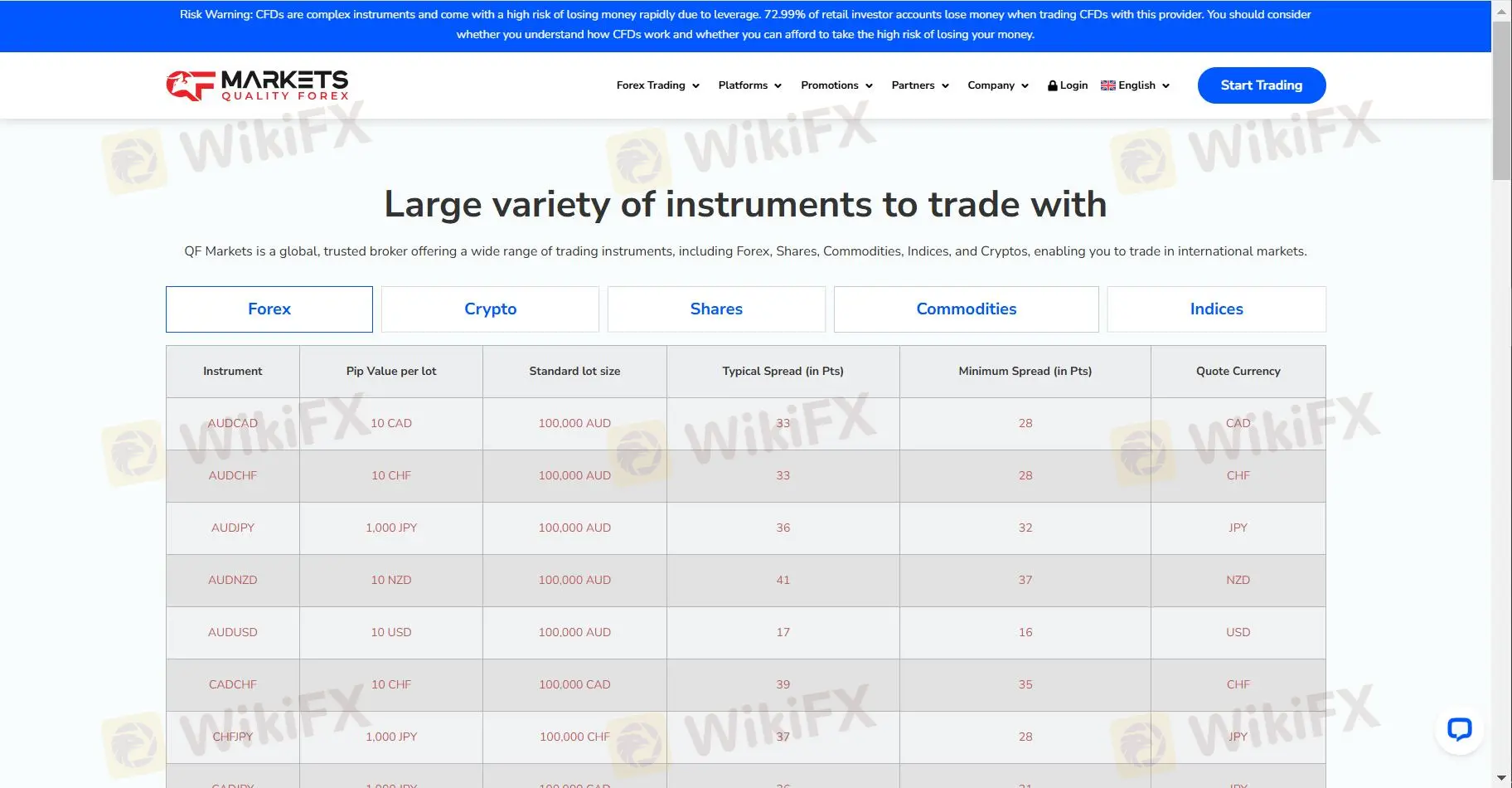

QF Markets offers five types of trading instruments, and below is the specific information on each:

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDUSD...

Cryptocurrencies: BTCUSD, DASHUSD, ETHUSD, EOSUSD, IOTAUSD...

Shares: ALIBABA, AMAZON, APPLE, АT&T, BNK-AMER...

Commodities: XAUUSD, XAGUSD, XPTUSD, UKOIL, USOIL...

Indices: U30USD, NASUSD, SPXUSD, 100GBP...

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Stocks | ✔ |

| Futures | ❌ |

| Bonds | ❌ |

| Options | ❌ |

Account Type/Fees

QF Markets offers four types of accounts: Cent, Standard, Premium, and Raw Spread, each with varying minimum deposits ranging from $ 5 to $500. Additionally, the Cent, Standard, and Premium accounts include a swap-free Islamic account option, while the Raw Spread account does not.

| Account Type | Cent Account | Standard | Premium | Raw Spread |

| Min Deposit | USD 5 | USD 5 | USD 250 | USD 500 |

| Max Leverage | 1:2000 | 1:2000 | 1:2000 | 1:2000 |

| Spread | From 1.8 pips | From 1.5 pips | From 1 pip | From 0 pips |

| Swap-free Islamic Account Option | ✔ | ✔ | ✔ | ❌ |

| 0% Fees on Deposits & Withdrawals | ❌ | ✔ | ✔ | ✔ |

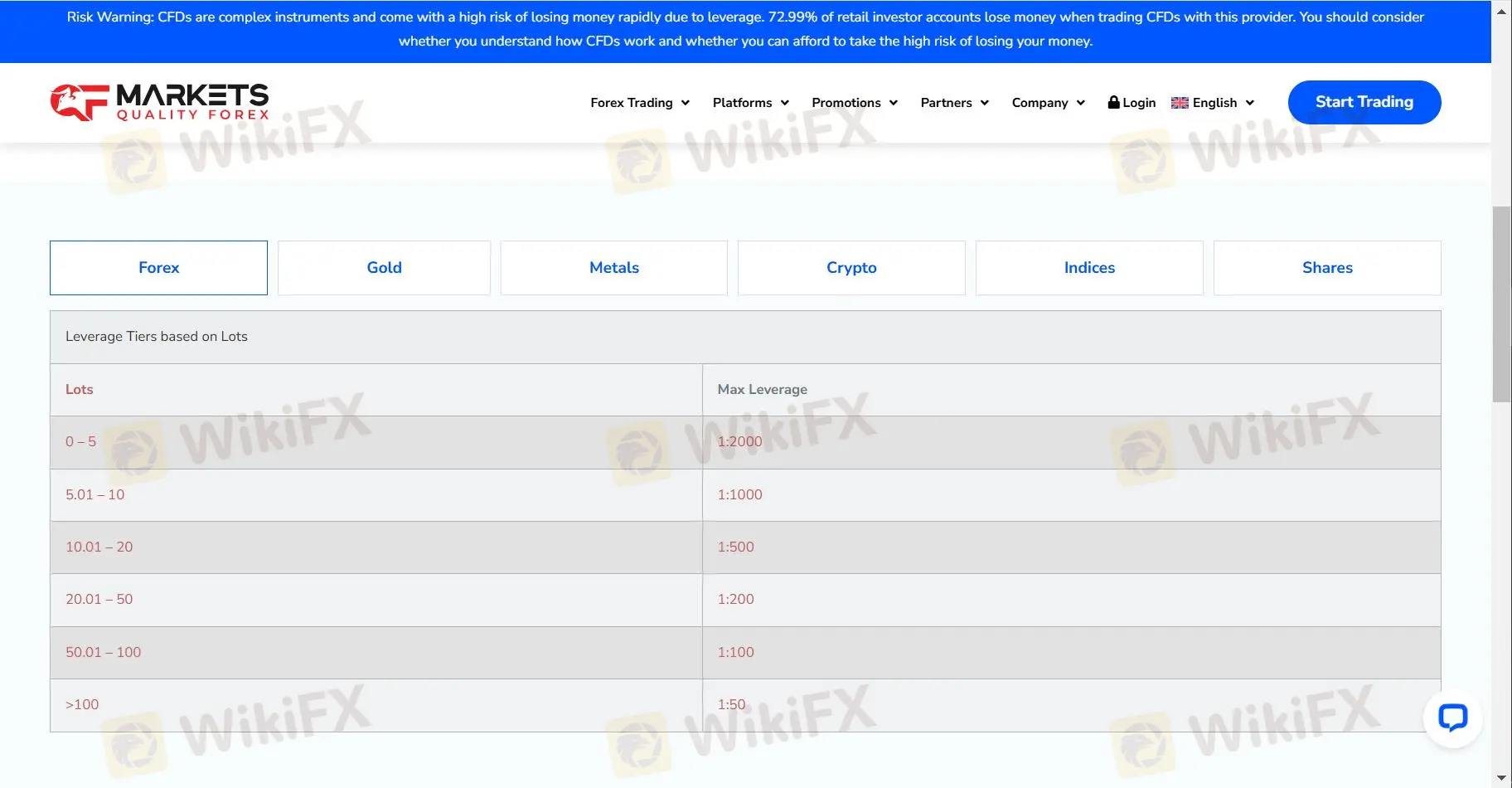

Leverage

QF Markets offers dynamic leverage based on the trading tool types and trading lots chosen, with a maximum leverage that can reach up to 1:2000. This extremely high leverage level entails significant risks, and you should exercise caution as the broker lacks legal regulation.

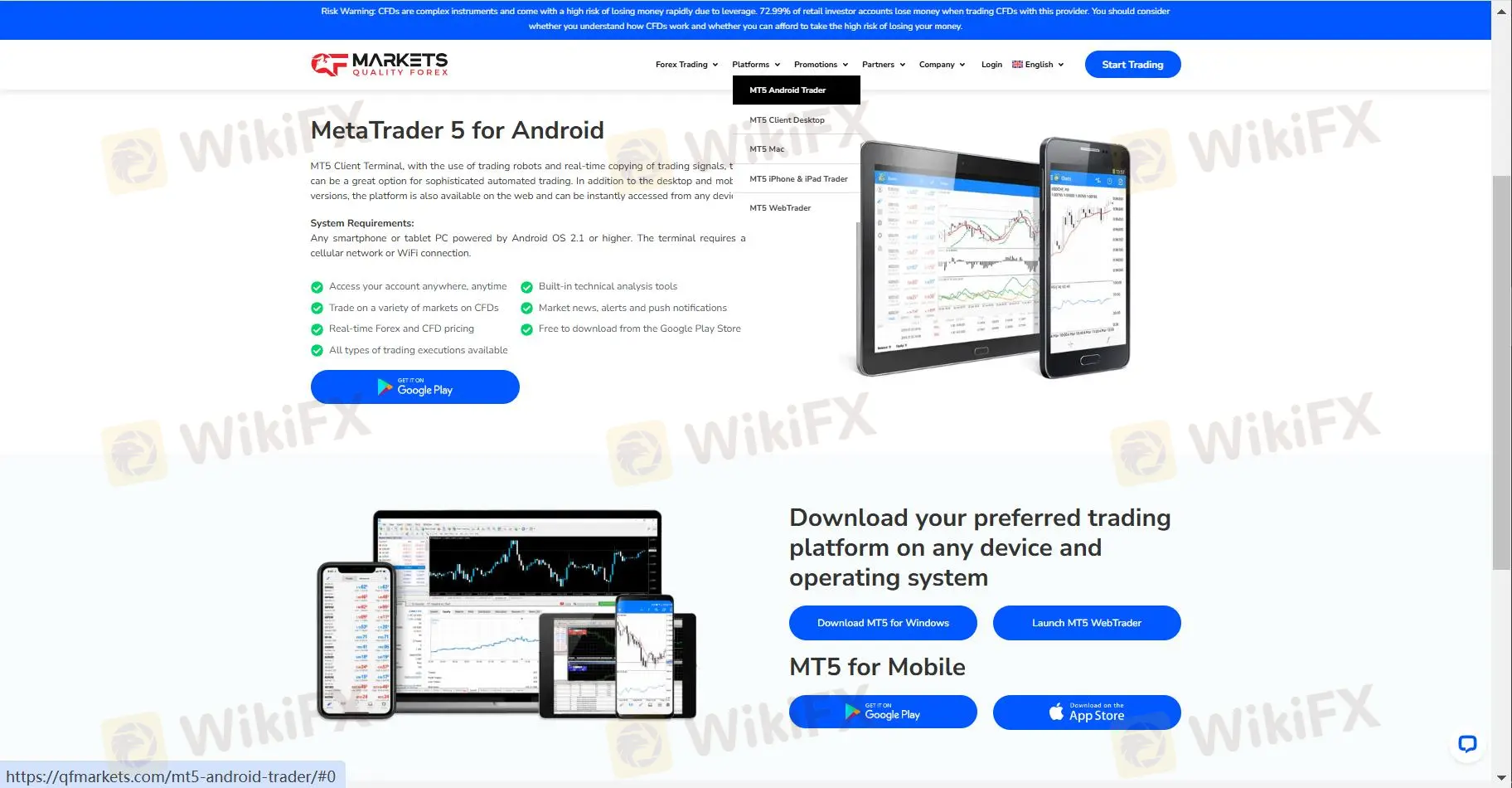

Trading platform

QF Markets supports trading through the MetaTrader 5 (MT5) platform, which offers advanced trading robots and real-time copying of trading signals, making it a great option for sophisticated automated trading. In addition to desktop, mobile phone, and Pad versions, the platform is also accessible via the web.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ❌ | / | Beginners |

| MT5 | ✔ | Computer, phone and Pad | Experienced traders |

| cTrader | ❌ | / | Experienced traders |

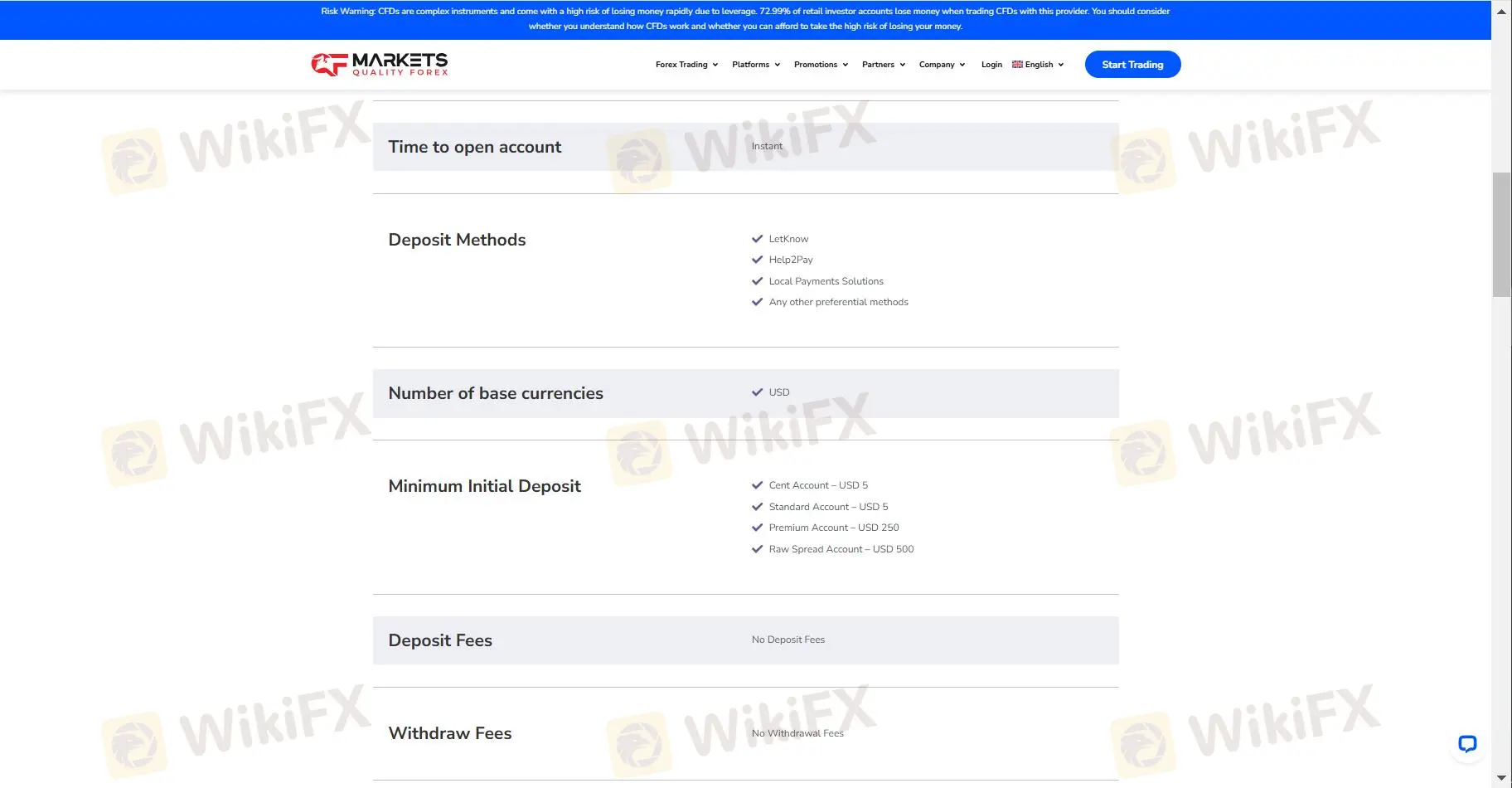

Deposit and Withdrawal

QF Markets supports deposits through LetKnow, Help2Pay, Local Payments Solutions, and other preferential methods. However, the withdrawal method is not specifically mentioned. It is worth noting that the broker does not charge any fees for deposits and withdrawals, except for the Cent account.

Samaneh️

Germany

This broker charges less money transfer fees than other brokers and this is one of the reasons why I like this broker.

Positive

FX1293507245

Germany

Good support, low spread, real ECN Accounts and...

Positive

Reza1001

Netherlands

Qf markets is one of the best broker. raw spread account has a low sperad between other brokers and you can have a good trade in news time

Positive

FX3944310955

Germany

this is the best broker that I have ever seen you can trade all of the CFD's things in Financial markets

Positive

GALIH7025

Indonesia

The broker is very good and trustworthy

Positive

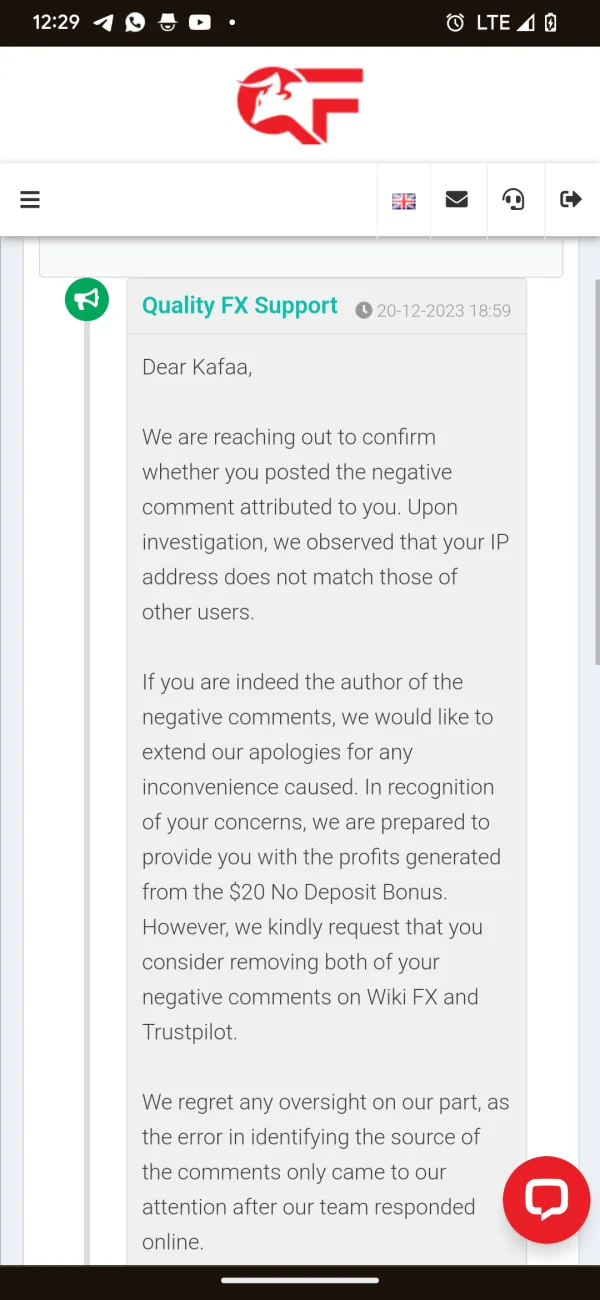

Kfbika

Indonesia

Hello, previously what happened yesterday was a misunderstanding, QF Markets has investigated and I have been declared not to have violated IP regulations. And QF Markets has allowed me to withdraw funds from the NDB 20$ program . I confirm that this broker is legit and safe 👍 sorry i cannot delete or edit my previous comment

Positive