Company Summary

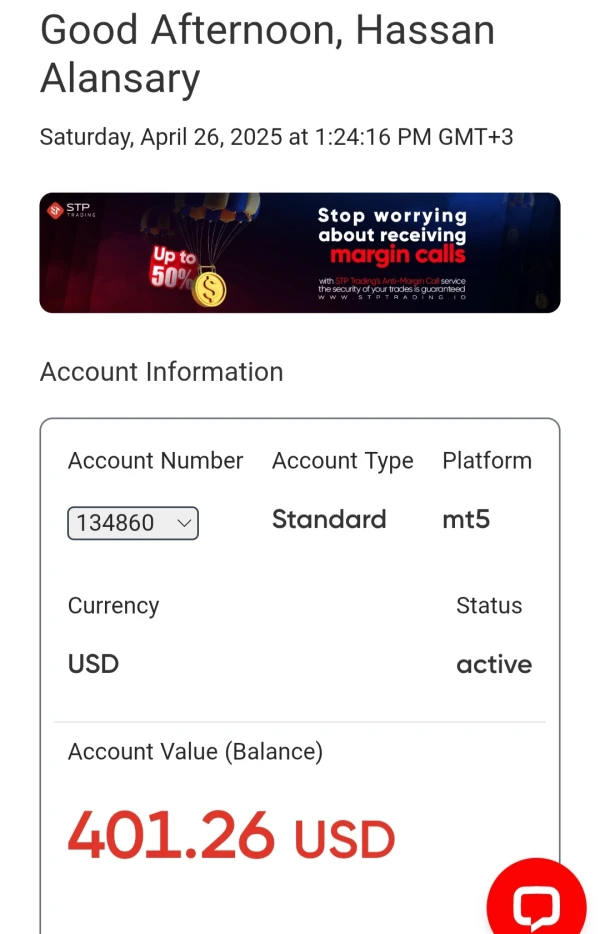

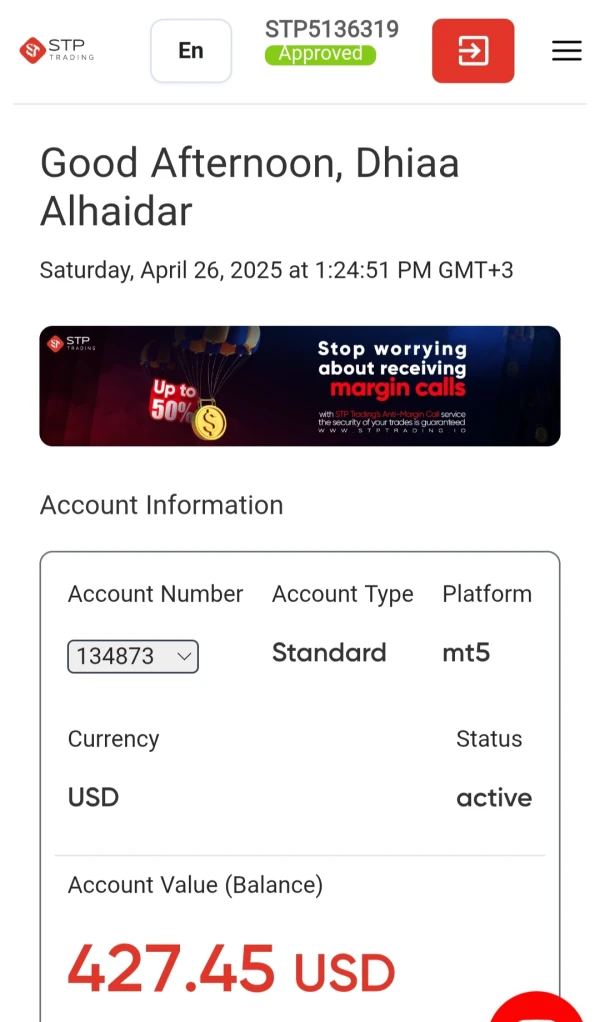

| STP Trading Review Summary | |

| Registered On | 2022-08-03 |

| Registered Country/Region | Saint Lucia |

| Regulation | Unregulated |

| Market Instruments | Forex, Energy, Indices, Metal, Crypto |

| Demo Account | ✅ |

| Leverage | Up to 1:300 |

| Spread | 0 Spreads on EURUSD |

| Trading Platform | MT5 (Mobile & Desktop, Web) |

| Min Deposit | $10 |

| Customer Support (24/7) | +44 121 288 7600 |

| info@stptrading.io | |

| Live Chat | |

| Telegram, WhatsApp, YouTube, Instagram, Twitter, Facebook | |

STP Trading Information

STP Trading directly connects banks and traders, with trading commissions as its main source of income. The platform offers a variety of trading products covering forex, energy, indices, metals, cryptocurrencies, and other fields, and supports the MetaTrader 5 (MT5) trading platform, which is compatible with multiple platforms such as Windows, MacOS, iOS, and Android.

Pros and Cons

| Pros | Cons |

| Islamic account available | Unregulated |

| 0 Spreads on EURUSD | High initial deposit for Zero Prime account ($3,000) |

| MT5 available | No specific deposit/withdrawal information |

| First deposit bonus (up to $1,000) | |

| 24/7 customer service |

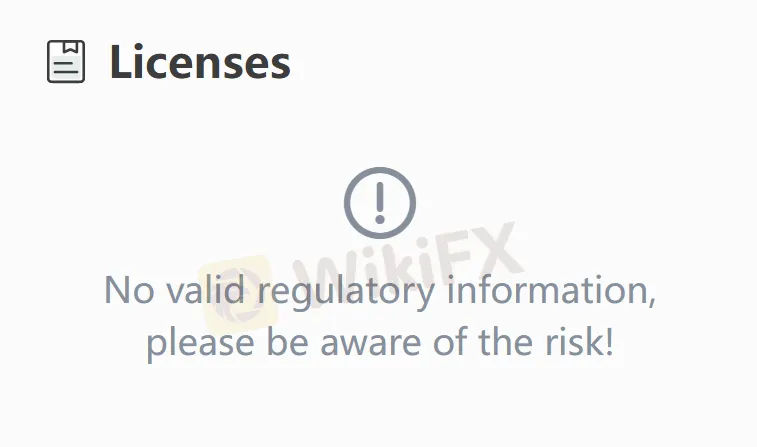

Is STP Trading Legit?

STP Trading uses the NDD model but is not strictly regulated by authoritative financial institutions. When choosing a trading platform, regulatory qualifications are an important criterion for measuring the platform's legitimacy and security.

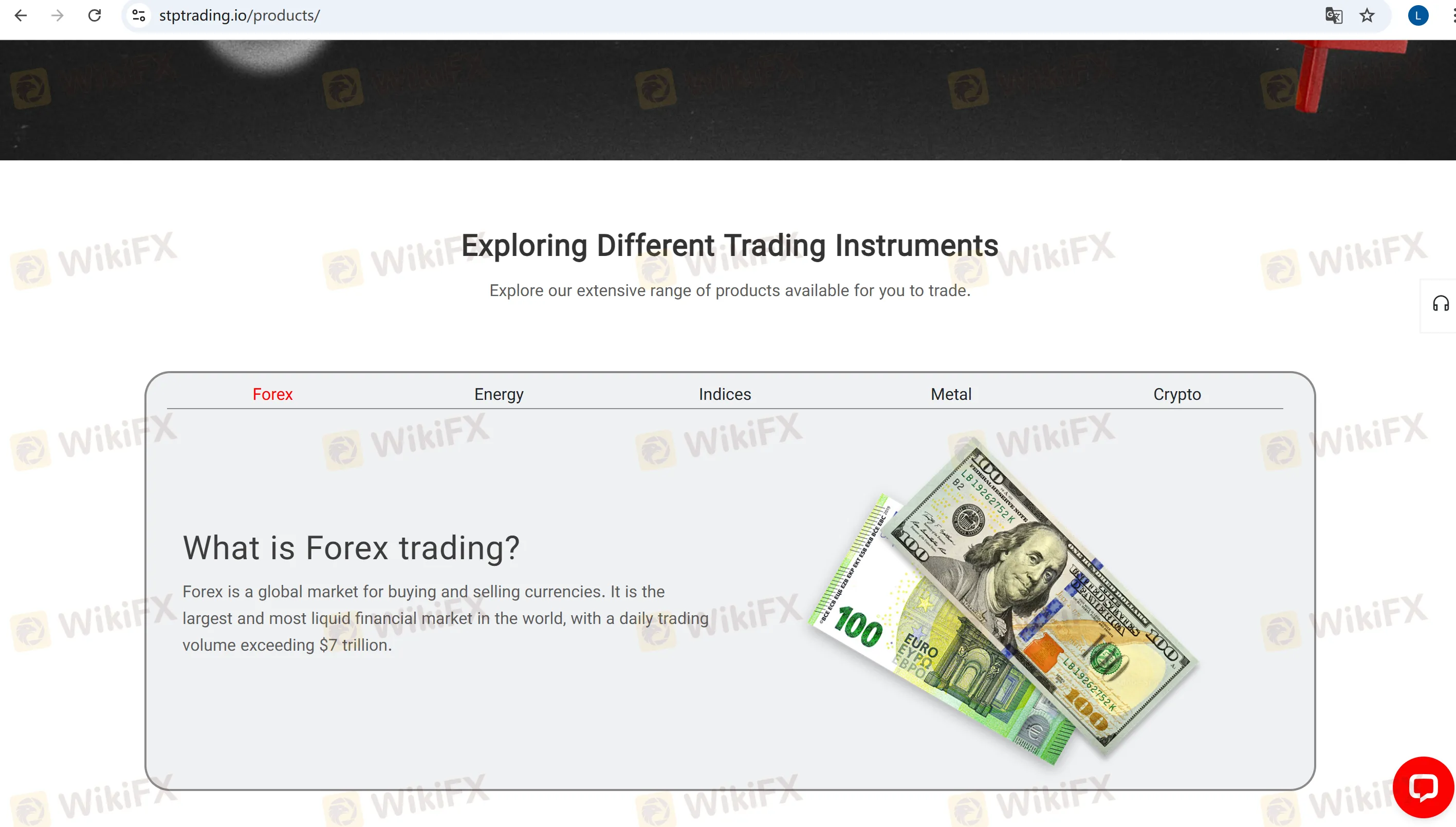

What Can I Trade on STP Trading?

| Tradable Instruments | Supported |

| Forex | ✔ |

| Energy | ✔ |

| Indices | ✔ |

| Metal | ✔ |

| Crypto | ✔ |

| Shares | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

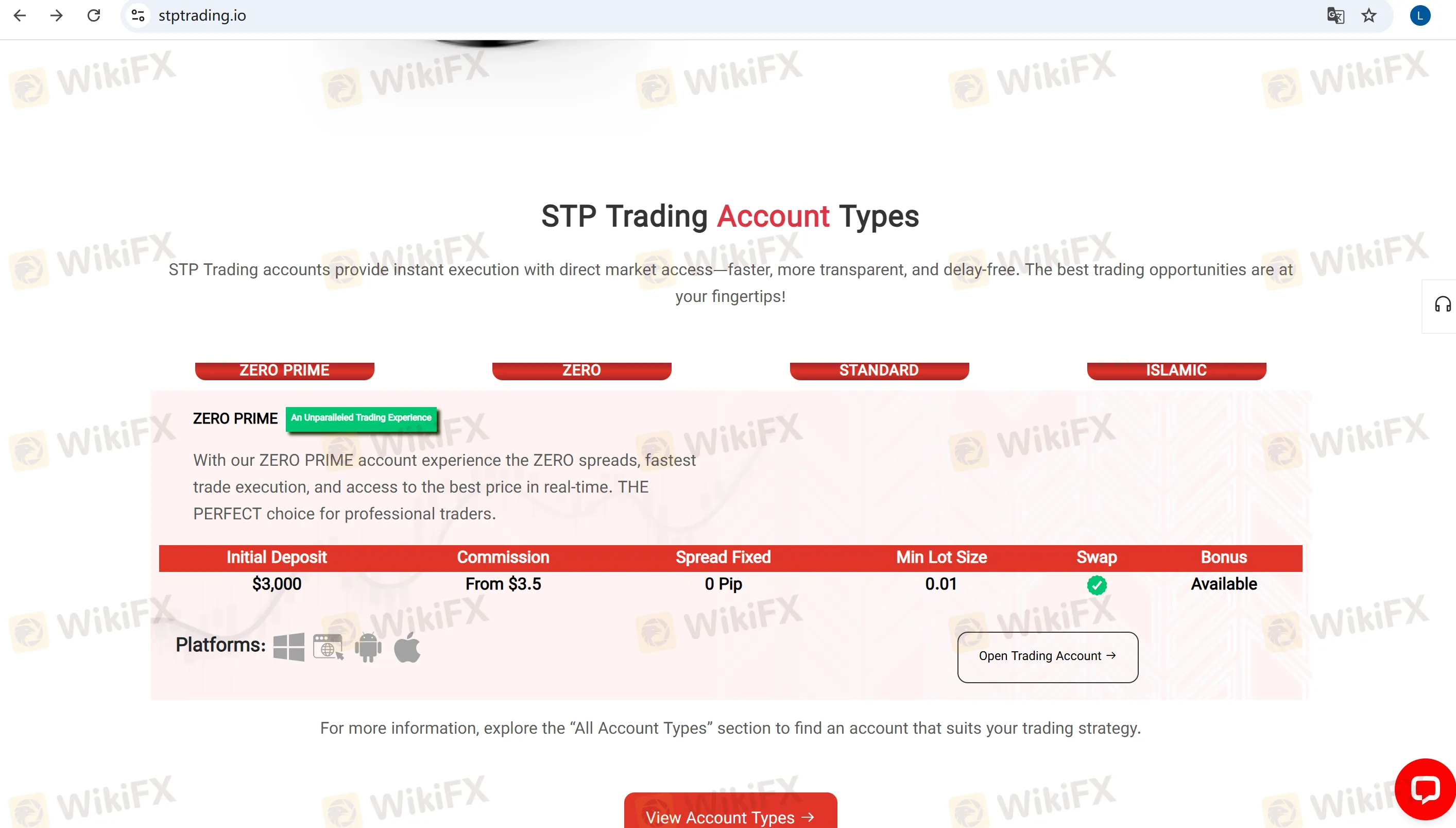

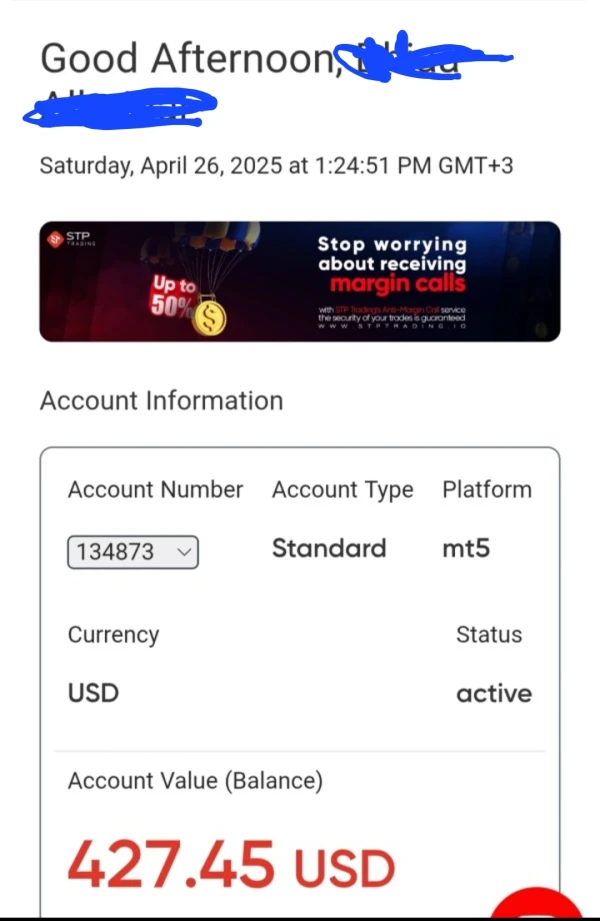

Account Type

| Account Type | ZERO PRIME | Standard | Standard | ISLAMIC |

| Initial Deposit | $3,000 | $1000 | $10 | $10 |

| Spreads | 0 Pip (Fixed) | From 0.2 pips | From 0.4 pips | From 1.3 pips |

| Maximum Leverage | 1:300 | 1:300 | 1:300 | 1:300 |

| Commossion | From $3.5 | $5 | $6 | ❌ |

| Min Lot Size | 0.01 | 0.01 | 0.01 | 0.01 |

| Swap | ✔ | ✔ | ✔ | ❌ |

| Bonus | Available | Available | Available | Available |

STP Trading Fees

The spreads vary by product and account type. The fixed spread starts from 0 pips (ZERO PRIME). Except for the ISLAMIC account, all other accounts charge a commission ranging from $3.5 to $6 per lot.

Leverage

The platform offers a maximum leverage of 1:300. High leverage is suitable for experienced traders who can assume risks.

Trading Platform

It uses the MetaTrader 5 (MT5) trading platform, which has advanced functions and advanced order types, supports trading automation (EA), and can be used on multiple platforms such as Windows, MacOS, iOS, and Android. It also provides web-based trading without the need for downloading.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Windows、MacOS、iOS、Android, Web | Experienced Tradrs |

Bonus

The platform offers a 20% withdrawable welcome bonus on the first deposit, up to $1,000. This bonus can be used for trading and the profits can be withdrawn, providing additional financial support to investors.

ploukl

India

They charged me $400 for a swap on a trade I closed the same day. Then they said we didn't take the money and LP took it so we won't return it. Overall, this broker is irresponsible, and they might also take your money, saying that it wasn’t taken by them, but by the LP. it is very shameful that your money is stolen by this broker, and they claim that the LP stole your money and it has nothing to do with the broker. Even if the LP stole your money, the broker must give you your money Because it is the broker who chooses the LP, not the trader

Exposure

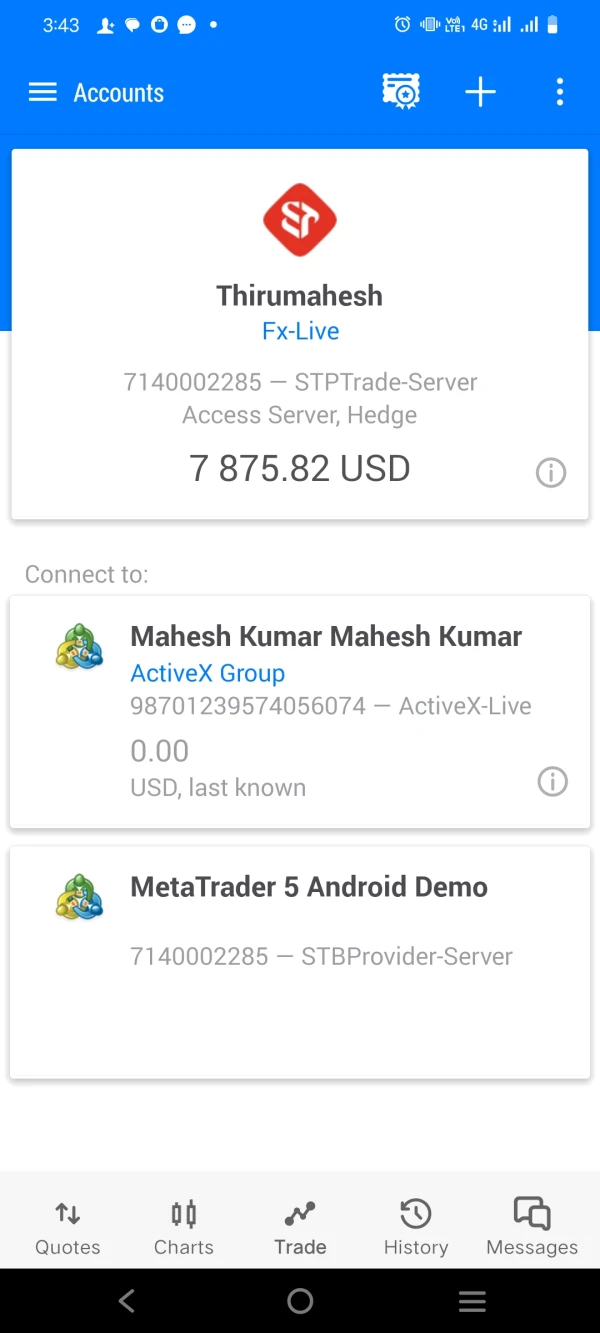

FX6283659552

India

My name thirumahesh I Have an account in vorbex. Australia past six months I used stp trading platform meta5 my balance is 8725$ but this company not give withdrawal i want 2500$ but not responding this company Vorbex and STP

Exposure

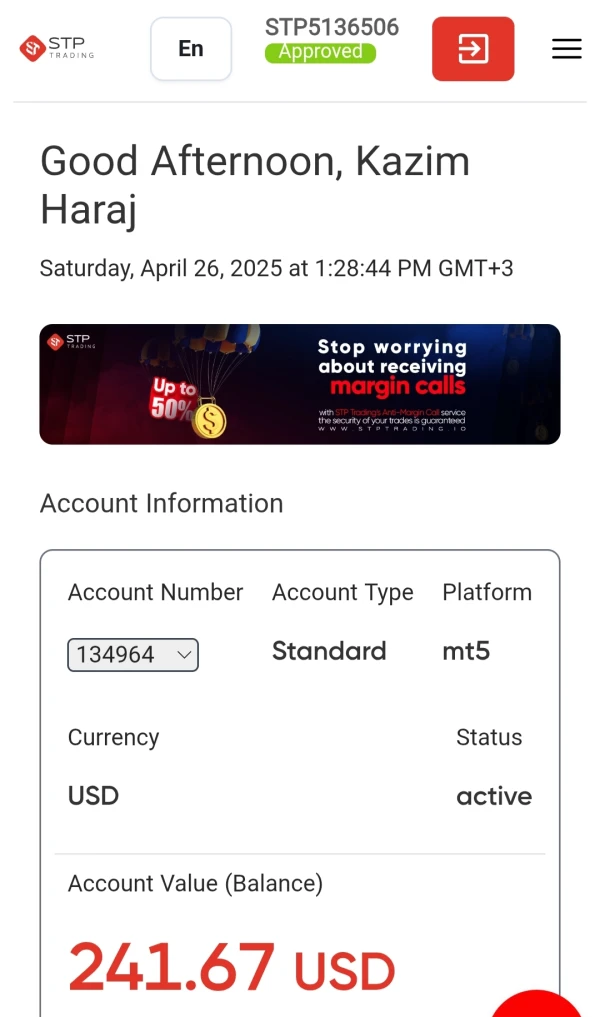

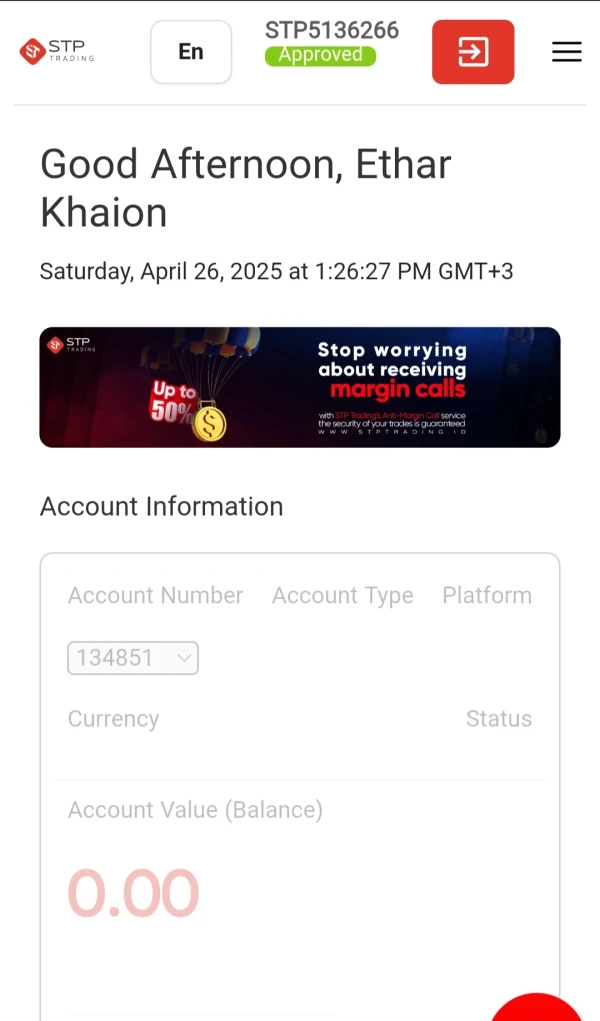

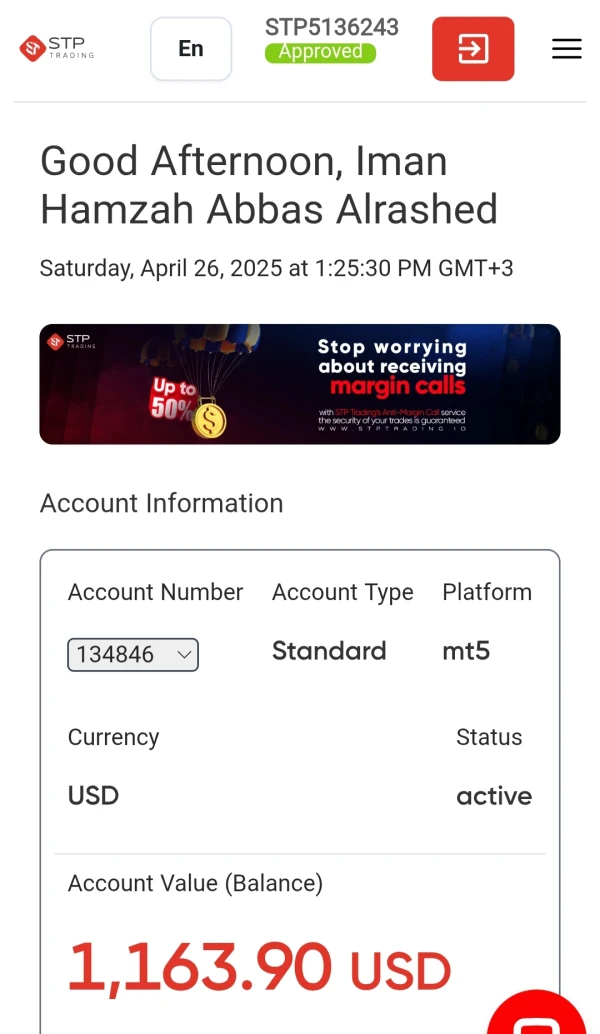

FX2728586185

Iraq

My clients cannot withdraw their deposits, they have even taken the initial deposit.

Exposure

FX9290534162

Oman

🌼🍁 and during this time I have been able to make good profits. The deposit and withdrawal process has always been smooth and convenient for me. Withdrawals were completed within a few hours, and overall I had a satisfying experience. I appreciate their professional team and good support. It would be even better if they could

Positive

FX1880702998

Oman

I have been holding a zero prime account with stp trading for over 6 months. What is of vital importance to me as a scalper is the execution speed. Fortunately, there is no difference between the ask price and the executed price with this broker, even during times of strong market volatility. Spreads on major currency pairs are quite competitive and I did not see any manipulation on the charts. The deposit and withdrawal process via crypto was also very fast, taking less than 2 hours. I hope this quality of service continues.

Positive

FX8259121372

Oman

Been trading with this broker for a while now. Fast execution, reliable withdrawals, and helpful support team. Definitely recommend

Positive

FX2209933699

Romania

In terms of spreads and order execution, it's truly excellent. I trade with a standard account and I'm very satisfied so far.

Positive

FX5090094072

Turkey

I am satisfied with this broker because of the good services and support they provide.

Positive

FX5627010552

Turkey

The broker is highly reputable and trustworthy, offering excellent and useful services, with fast deposit and withdrawal, and great speed in executing positions.

Positive

swear

Oman

i really appreciate this broker i am trader with 15 years experience. i love this broker so much and i am working with them for almost 2 years and i really love their spreads.

Positive

FX7248295142

United Kingdom

They have the best accounts with the tight spreads, but the minimum deposit for ECN account is too high!

Positive

FX5090094072

Turkey

I’ve been satisfied with this broker so far; everything has gone smoothly, and their services are good as well. I hope they continue this way

Positive

FX3532627788

France

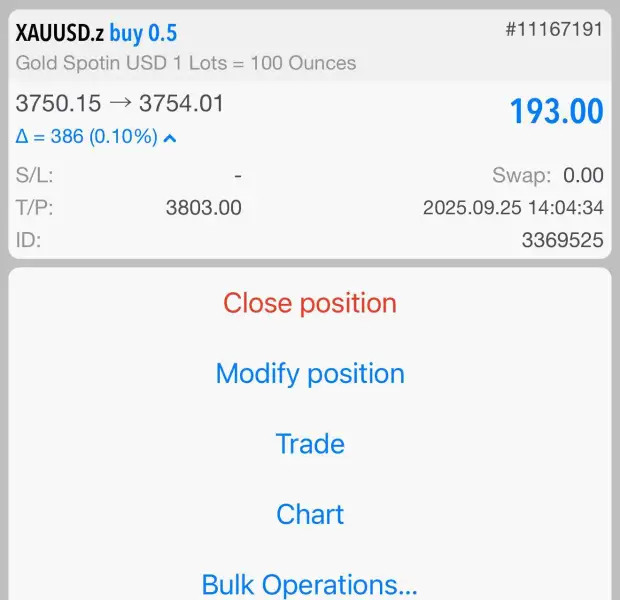

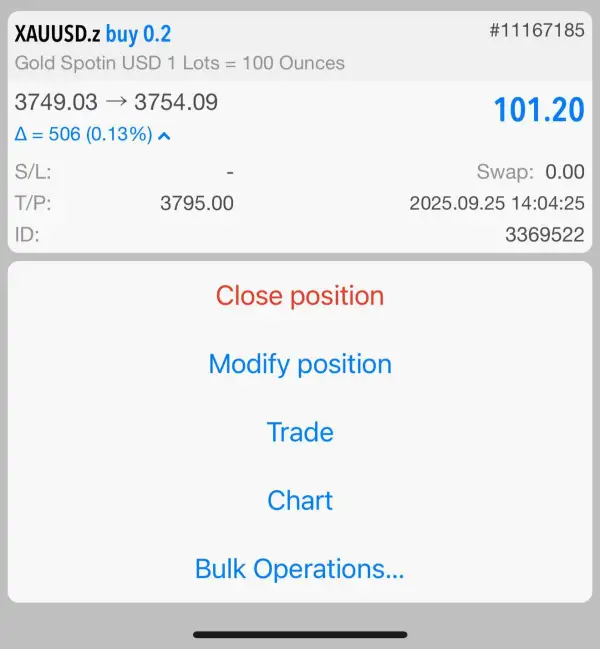

I have been working with the broker for a year. Anti margin call service helped me get out of danger, but I applied twice, it was only executed once, but I was able to save my account by hedging.

Neutral

noof

Romania

I have been trading with STP Trading for three years, and overall, the broker has been excellent, especially in terms of withdrawals. However, I kindly request you to review the technical support services, improve them further, and speed up the process.

Positive

taloot

United States

I have been trading with STP Trading for three years. The thing I like most about them is the Anti Margin Call service, which helped save my account when it was approaching the margin level, as they offered me the option to deposit an additional amount to help protect my account. However, despite this excellent service, I wish there could be some adjustments to the withdrawal policy

Positive

FX2716910174

Oman

their support is decent, the withdrawals could be faster!! but the deposit process is instant, they could use a better regulation🌟

Neutral

FX5090094072

Turkey

I’ve been working with this broker for a while now, and I’m really satisfied. The spreads, especially for gold, are competitive, and order execution is fast. Withdrawals have been smooth and hassle-free. One thing I really liked is their attractive bonuses, which are great for getting started. Their support team is always responsive and professional. If you’re looking for a reliable broker with good conditions, I highly recommend giving them a try.🥰🥰😀

Positive

omar9326

United Arab Emirates

i made IB .. then one of my client under my IB he did deposit.. and trading as well .. i received 0.04 $ only.. when i asked the support to fix this issue.. they replay this client is not under your IB when i send screenshot with all the a proofs to them.. and trade history.. they didnt replay anything .. be carful stay away

Exposure

FX3650121676

Iran

I deposited $1005 and opened a trade with 0.6 lot on xauusd and closed with $454 profit. The broker closed my cabin and account and then deposited $949 for me Because my account was blocked, I only have photos from the journal I have a video from the support chat that could not be posted here you In Telegram support It has been sent to your Telegram support It has been sent to your Telegram support

Exposure

Usman Abubakarr

South Africa

Spreads aren't too bad, and the fees are low... But what really stands out are the trading signals. They're spot on and super helpful!

Positive

shriy

Cambodia

STP Trading has been quite reliable for my trading needs. Quick payouts and the professional level of trading they offer are notable. However, I do wish the bonuses lasted a bit longer.

Positive

Segun Ogundele

Morocco

STP Trading is very easy to trade and we can set stop loss target in chat that was very useful for me.

Positive

Steve Wong

Singapore

STP Trading's got some solid execution skills, even with limit orders. I mean, just last week, I scored some nice gains on gold. I've been shorting it since Monday, and it's been paying off. I went ahead and requested a withdrawal, fingers crossed it shows up in my wallet soon so I can spend it. Hopefully, I'll be able to keep trading with this broker for a long time to come. Oh, and just for the record, I've been trading online for two years.

Positive