Company Summary

Abstract

| Aspect | Information |

| Registered Country/Area | United States |

| Founded Year | 1-2 years |

| Company Name | SWIFT-COIN |

| Regulation | Unregulated |

| Minimum Deposit | $250 |

| Maximum Leverage | Approximately 1:20 to 1:50 |

| Spreads | 0.1% to 0.2% |

| Trading Platforms | Coinbase, Binance, Kraken, Huobi Global, KuCoin |

| Tradable Assets | Cryptocurrencies, Fiat Currencies, Commodities |

| Account Types | Permanent Plan, Platinum Plan, Gold Plan, Silver Plan, Regular Plan |

| Demo Account | Not mentioned |

| Islamic Account | Not mentioned |

| Customer Support | Email: admin@swift-coin.online Physical Address: 4651 Westport Dr Mechanicsburg, PA, 17055-4843, United States |

| Payment Methods | Bank transfers, credit cards, debit cards, cryptocurrencies |

| Educational Tools | Not mentioned |

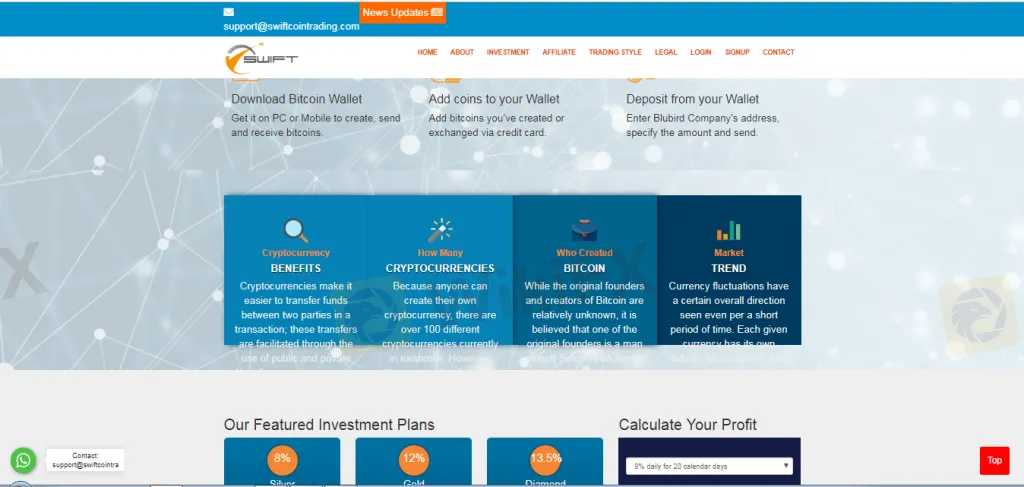

Overview of SWIFT-COIN

SWIFT-COIN is an unregulated trading platform based in the United States, operating for 1-2 years. It offers various trading options, including spot trading against cryptocurrencies and fiat currencies, margin trading, futures trading, and options trading. Traders can access different account types, ranging from the Permanent Plan for high-capital traders to the Regular Plan for those with smaller initial investments. Leverage ratios typically range from 1:20 to 1:50, allowing traders to control larger positions. SWIFT-COIN charges spreads of approximately 0.1% to 0.2% and commissions around 0.05% to 0.1%, resulting in total transaction costs. The platform requires a minimum deposit of $250, and deposit and withdrawal methods include bank transfers, credit cards, debit cards, and cryptocurrencies. Popular trading platforms for SWIFT-COIN include Coinbase, Binance, Kraken, Huobi Global, and KuCoin. Customer support is available via email, and the company is located at 4651 Westport Dr Mechanicsburg, PA, 17055-4843, United States. However, it is essential to note that SWIFT-COIN operates without established regulatory oversight, which carries inherent risks for traders.

Pros and Cons

SWIFT-COIN presents several advantages and disadvantages for potential traders. On the positive side, it offers a diverse array of trading options, various account types, and leverage choices. Additionally, it is accessible with a reasonable minimum deposit and can be accessed through well-known trading platforms. Moreover, customer support is available via email. However, it's essential to note the absence of regulatory oversight, the unavailability of the main website at times, and the associated costs of trading, including spreads, commissions, and fees. Furthermore, there may be varying fees depending on the chosen trading platform, and there's no mention of phone or live chat support.

| Pros | Cons |

| Offers a range of trading options | Operates without regulatory oversight |

| Provides various account types | Main website is currently unavailable |

| Offers leverage options | Costs involved in trading (spreads, commissions, fees) |

| Accessible with a minimum deposit | Fees associated with deposits and withdrawals |

| Can be accessed through popular platforms | Varying fees on different platforms |

| Email customer support available | No mention of phone or live chat support |

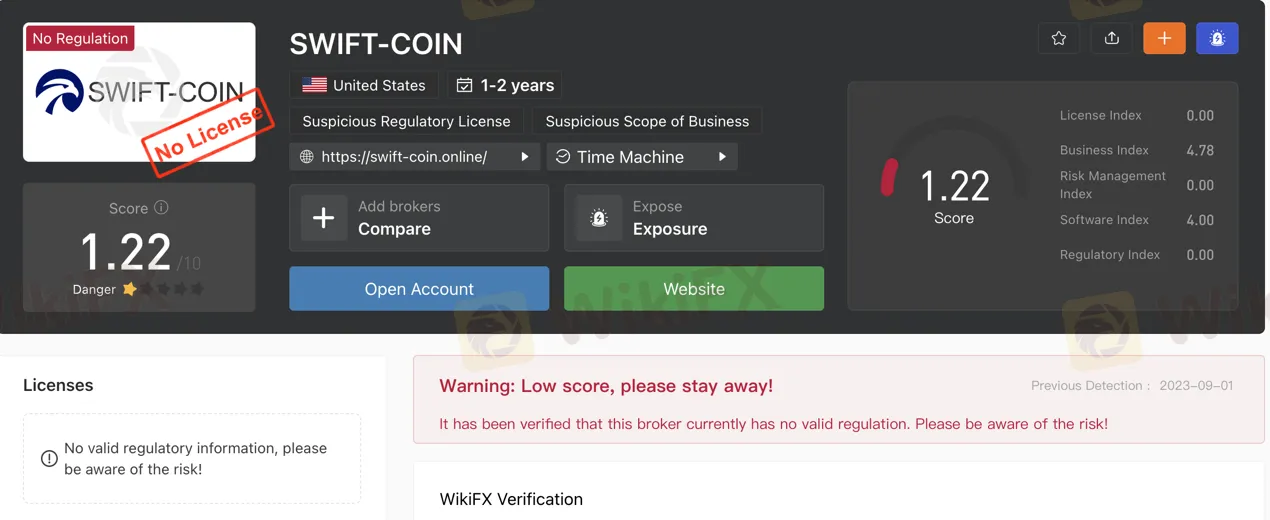

Is SWIFT-COIN Legit?

SWIFT-COIN operates without any established regulatory oversight, as confirmed through verification. It is crucial to exercise caution and acknowledge the inherent risks associated with trading through an unregulated broker.

Market Instruments

SPOT TRADING

SWIFT-COIN offers spot trading options against various cryptocurrencies like Bitcoin and Ethereum. Additionally, it supports trading against fiat currencies, such as the US dollar and the euro, as well as commodities like gold and oil.

MARGIN TRADING

SWIFT-COIN allows traders to engage in margin trading, enabling them to leverage borrowed funds for larger SWIFT-COIN positions. However, it's important to note that margin trading carries inherent risks, as it can amplify both gains and losses.

FUTURES TRADING

At SWIFT-COIN, traders can engage in futures trading to speculate on SWIFT-COIN's future price movements through futures contracts. These contracts involve agreements to buy or sell SWIFT-COIN at a predetermined price on a specified date, providing opportunities to hedge against price volatility or make speculative investments.

OPTIONS TRADING

SWIFT-COIN provides options trading facilities where traders can buy or sell options contracts based on their predictions of SWIFT-COIN's future price. These contracts grant the buyer the right, but not the obligation, to buy or sell SWIFT-COIN at a specified price on a predetermined date. Options trading can serve as a risk management tool or a means to enhance potential profits.

Pros and Cons

| Pros | Cons |

| Offers spot trading in cryptocurrencies, fiat currencies, and commodities | Margin trading carries inherent risks |

| Enables margin trading for leveraging funds | Futures and options trading involve complex agreements |

| Provides opportunities for hedging and speculation | Trading futures and options can lead to potential losses |

Account Types

PERMANENT PLAN

SWIFT-COIN offers a Permanent Plan with a minimum deposit ranging from $50,000 to an unlimited amount. This plan is designed for high-capital traders, providing them with substantial investment opportunities.

PLATINUM PLAN

The Platinum Plan at SWIFT-COIN requires a minimum deposit of $35,000. It caters to traders with a significant capital base, offering them access to exclusive features and services.

GOLD PLAN

SWIFT-COIN's Gold Plan necessitates a minimum deposit of $21,000. This plan is suitable for traders who want to engage with a substantial capital but may not require the highest investment tier.

SILVER PLAN

The Silver Plan at SWIFT-COIN comes with a minimum deposit requirement of $5,000. It offers an intermediate option for traders looking to invest with moderate capital.

REGULAR PLAN

SWIFT-COIN's Regular Plan is accessible with a minimum deposit of $250, making it the most budget-friendly option for traders who prefer to start with a smaller initial investment.

Pros and Cons

| Pros | Cons |

| Diverse range of account options | High minimum deposit for some plans |

| Catering to traders with varying capital | Limited accessibility for low-budget traders |

| Provides exclusive features and services | Potential restrictions based on account type |

Leverage

The leverage available for SWIFT-COIN varies depending on the trading platform. However, it is typically around 1:20 to 1:50. This means that you can control a position worth 20 to 50 times your initial investment.

Spreads & Commissions

The spread for SWIFT-COIN is typically around 0.1% to 0.2%. The commission is typically around 0.05% to 0.1%. So, if you buy 10 SWIFT-COIN at a price of $100 per SWIFT-COIN, you would pay a spread of $1 and a commission of $0.50. So, your total cost would be $101.50.

Minimum Deposit

SWIFT-COIN maintains a minimum deposit requirement of $250 for traders, offering an accessible entry point for those looking to start trading on the platform.

Deposit & Withdraw

The deposit and withdrawal methods for SWIFT-COIN vary depending on the exchange or trading platform. However, the most common methods are bank transfers, credit cards, debit cards, and cryptocurrencies. The fees for depositing and withdrawing SWIFT-COIN typically range from 2% to 4%. For example, Coinbase charges a 2.5% fee for depositing SWIFT-COIN with a credit card, and a 0.1% fee for withdrawing SWIFT-COIN to a bank account.

Pros and Cons

| Pros | Cons |

| Multiple deposit and withdrawal methods | Fees ranging from 2% to 4% can be relatively high |

| Common methods include bank transfers, credit cards, debit cards, and cryptocurrencies | Fees for specific transactions may vary by platform |

| Provides options in choosing payment methods | Some platforms may have higher fees than others |

Trading Platforms

The most popular trading platforms for SWIFT-COIN are Coinbase, Binance, Kraken, Huobi Global, and KuCoin. The fees for trading SWIFT-COIN on these platforms range from 0.10% to 0.50%.

Pros and Cons

| Overall Pros | Overall Cons |

| Accessible through popular platforms | Varying trading fees on different platforms |

| Availability on well-known exchanges | Fees for trading SWIFT-COIN can be relatively high |

| Multiple platform options for trading SWIFT-COIN |

Customer Support

SWIFT-COIN's customer support can be reached via email at admin@swift-coin.online. The company's physical address is 4651 Westport Dr Mechanicsburg, PA, 17055-4843, United States.

Conclusion

In conclusion, SWIFT-COIN presents both advantages and disadvantages. On the positive side, it offers a range of market instruments, including spot, margin, futures, and options trading. Additionally, it provides various account types to accommodate traders with different capital levels and offers leverage options of 1:20 to 1:50. However, it is important to exercise caution as SWIFT-COIN operates without established regulatory oversight, posing inherent risks for traders. The platform's spreads and commissions are relatively low, but there are fees associated with depositing and withdrawing funds, which can vary. SWIFT-COIN supports common deposit and withdrawal methods, and customer support is accessible through email. Traders should carefully consider these factors before engaging with SWIFT-COIN, keeping in mind the absence of regulatory protections.

FAQs

Q: Is SWIFT-COIN a legitimate platform?

A: SWIFT-COIN operates without regulatory oversight, so caution is advised due to inherent trading risks.

Q: What trading options does SWIFT-COIN offer?

A: SWIFT-COIN provides spot, margin, futures, and options trading against various assets.

Q: What are the different account types on SWIFT-COIN?

A: SWIFT-COIN offers Permanent, Platinum, Gold, Silver, and Regular Plans to cater to traders with varying capital levels.

Q: What is the leverage available on SWIFT-COIN?

A: Leverage on SWIFT-COIN typically ranges from 1:20 to 1:50.

Q: What are the fees on SWIFT-COIN?

A: SWIFT-COIN charges spreads of 0.1% to 0.2% and commissions of 0.05% to 0.1%. Deposit and withdrawal fees range from 2% to 4%.

Q: Which trading platforms are popular for SWIFT-COIN?

A: Popular SWIFT-COIN trading platforms include Coinbase, Binance, Kraken, Huobi Global, and KuCoin.