No data

Do you want to know which is the better broker between Plus500 and Hantec ?

In the table below, you can compare the features of Plus500 , Hantec side by side to determine the best fit for your needs.

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of plus500, hantec lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Plus500 Review Summary of 10 Points | |

| Founded | 2008 |

| Headquarters | Israel |

| Regulation | FCA, CySEC, ASIC, FMA, MAS |

| Market Instruments | forex, cryptocurrencies, stocks, indices, commodities, and options |

| Demo Account | Available |

| Leverage | 1:30 (forex), 1:20 (indices), 1:10 (commodities), 1:2 (cryptocurrencies), 1:5 (stocks) |

| EUR/USD Spread | 0.5 pips |

| Trading Platforms | own proprietary trading platform (desktop, web, and mobile) |

| Minimum deposit | $/€/£100 |

| Customer Support | 24/7 email, WhatsApp and live chat |

Plus500 is an online trading platform that offers Contracts for Difference (CFDs) on a range of financial instruments including stocks, forex, commodities, cryptocurrencies, options, and indices. The platform was founded in 2008 and is headquartered in Israel, with additional offices in the UK, Cyprus, Australia, and Singapore. Plus500 is authorized and regulated by several financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, and the Australian Securities and Investments Commission (ASIC) in Australia. The platform is available in more than 50 countries and supports over 30 languages.

Plus500 is a CFD (Contracts for Difference) broker, which means that it offers trading on derivatives based on various financial assets without actually owning the underlying assets. Traders can speculate on the price movements of assets such as stocks, forex, commodities, cryptocurrencies, and indices without having to buy or sell the assets themselves. As a CFD broker, Plus500 allows traders to take both long and short positions, and offers leverage which can increase potential profits (and losses).

Plus500 is a good option for traders looking for a user-friendly platform to trade a wide range of markets and instruments, with competitive spreads and no commissions.

However, traders who require advanced charting tools, educational resources, and alternative trading platforms may need to consider other brokers.

| Pros | Cons |

| • Simple and easy-to-use trading platform | • Limited product offering |

| • Commission-free trading | • Limited research and educational tools |

| • Tight spreads | • No support for MetaTrader platform |

| • Negative balance protection | • Limited customer support options |

| • Regulated by reputable financial authorities | • No phone support |

| • Free demo account | • Withdrawal fees for some payment methods |

| • Limited trading tools and features |

Note that the information presented in the table is based on general observations and may vary depending on individual circumstances and preferences.

There are many alternative brokers to Plus500, and the best one for you will depend on your individual trading needs and preferences. Here are some popular alternatives to Plus500:

eToro: eToro is a social trading platform that allows you to copy the trades of other traders. It offers a wide range of trading instruments and has a user-friendly platform.

IG: IG is a well-established broker that offers a wide range of trading instruments, including forex, stocks, and commodities. It also offers a range of educational resources and has a user-friendly platform.

XM: XM is a popular broker that offers competitive spreads and a range of trading instruments, including forex, stocks, and commodities. It also offers a range of educational resources and has a user-friendly platform.

Pepperstone: Pepperstone is a popular broker that offers competitive spreads and a range of trading instruments, including forex, stocks, and commodities. It also offers a range of educational resources and has a user-friendly platform.

IC Markets: IC Markets is a popular broker that offers competitive spreads and a range of trading instruments, including forex, stocks, and commodities. It also offers a range of educational resources and has a user-friendly platform.

It's important to do your own research and compare the features and fees of different brokers before making a decision.

Plus500 is considered legitimate as it is authorized and regulated by several top-tier financial authorities, including the UK's Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC). Plus500 is also publicly traded on the London Stock Exchange, which provides additional transparency and accountability. The broker has been in operation since 2008 and has a large and established customer base. However, it is worth noting that no broker is entirely risk-free, and traders should always do their own due diligence before depositing funds with any broker.

Plus500 takes several measures to ensure the safety and protection of its clients, and the fact that it is a regulated broker provides additional reassurance to clients. Here is a table outlining how Plus500 protects its clients:

| Protection Measure | Detail |

| Segregated Funds | Client funds are kept separate from company funds |

| Negative Balance Protection | Clients can't lose more than their account balance |

| Risk Management Tools | Stop loss, limit order and other tools to help manage risk |

| Account Verification | Rigorous account verification process to prevent fraud and unauthorized access |

| SSL Encryption | Secure Socket Layer (SSL) encryption used for all communication and data transfer |

| Regulatory Oversight | Regulated by multiple reputable financial authorities |

| Investor Compensation Fund | Eligible clients may receive compensation in the event of insolvency or bankruptcy |

Note: This table provides a brief overview of Plus500's client protection measures and is not exhaustive. Clients should always refer to Plus500's official website and legal documents for complete and up-to-date information.

Overall, Plus500 appears to be a reliable broker with a strong emphasis on client protection. The company is regulated by multiple reputable financial authorities, has a robust risk management system in place, and offers negative balance protection to clients. Plus500 also uses encryption technology to protect clients' personal and financial information.

However, it is important to note that no broker is completely risk-free, and clients should always carefully consider their investment goals and risk tolerance before trading with any broker.

Plus500 offers a wide range of trading instruments including:

Forex pairs - major, minor, and exotic currency pairs

Stocks - CFDs on stocks from various international markets

Indices - CFDs on major stock indices like S&P 500, Nasdaq, FTSE 100, and more

Commodities - CFDs on precious metals, energies, and agricultural products

Cryptocurrencies - CFDs on popular digital currencies like Bitcoin, Ethereum, Litecoin, and more

Plus500 offers two types of accounts: a live trading account and a demo account.

The live trading account requires a minimum deposit of $100 and provides access to real-time market prices and trading in over 2,000 instruments. Traders can use leverage of up to 1:30 for retail clients and up to 1:300 for professional clients. The live account offers various features such as stop loss, take profit, and guaranteed stop loss orders. There are no commissions charged on trades. Instead, the company earns money through the bid-ask spread.

The demo account is free and allows traders to practice trading using virtual funds with access to the same trading instruments as the live account. It is a great way for traders to learn how the platform works, practice trading strategies, and get familiar with trading instruments before investing real money. The demo account is available for unlimited time and can be used to test new trading strategies without the risk of losing real money.

Plus500 offers leverage for different financial instruments. The maximum leverage offered depends on the instrument and the jurisdiction where the trader is located. In general, the leverage for forex trading can be up to 1:30 for retail clients in the European Union, and up to 1:300 for professional clients.

For other instruments, such as stocks, commodities, and cryptocurrencies, the leverage can vary between 1:5 and 1:30 for retail clients, and up to 1:300 for professional clients.

It's important to note that higher leverage can amplify both profits and losses, and traders should use it with caution and proper risk management.

Plus500 offers floating spreads on all trading instruments, meaning the spreads can fluctuate based on market conditions. The spreads can start from as low as 0.5 pips for major currency pairs like EUR/USD. Plus500 does not charge any commission on trades, and their revenue comes solely from the spreads offered.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| Plus500 | 0.5 pips | No |

| eToro | 1.0 pips | No |

| IG | 0.75 pips | Yes |

| XM | 1.6 pips | No |

| Pepperstone | 0.16 pips | Yes |

| IC Markets | 0.1 pips | Yes |

Note that spreads and commissions are subject to change and can vary depending on the account type, trading platform, and other factors. Traders should always check the broker's website for the most up-to-date and accurate information.

The Plus500 trading platform is an in-house developed web-based platform that can be accessed directly from the Plus500 website. The platform is user-friendly and intuitive, making it easy for traders to navigate and trade various financial instruments. It is also available in several languages.

The Plus500 trading platform offers several advanced features, including price alerts, real-time charts, and technical analysis tools. The platform also includes a demo account that traders can use to practice trading without risking any real money.

Overall, the Plus500 trading platform is well-designed and functional, but it may lack some of the advanced features found in other trading platforms. See the trading platform comparison table below:

| Broker | Trading Platforms |

| Plus500 | Plus500 WebTrader, Plus500 Windows Trader, Plus500 mobile app |

| eToro | eToro WebTrader, eToro mobile app |

| IG | IG Trading Platform, IG mobile app |

| XM | MetaTrader 4, MetaTrader 5, XM WebTrader, XM mobile app |

| Pepperstone | MetaTrader 4, MetaTrader 5, cTrader, Pepperstone mobile app |

| IC Markets | MetaTrader 4, MetaTrader 5, cTrader, IC Markets mobile app |

Plus500 offers several deposit and withdrawal methods, including:

Credit/debit card (Visa or Mastercard)

PayPal

Bank transfer

Electronic wallets (Skrill, Neteller)

It's worth noting that the availability of certain payment methods may vary depending on your location.

Plus500 does not charge deposit or withdrawal fees, but some payment providers may charge transaction fees, which should be checked with the provider directly. Plus500 also requires users to withdraw funds using the same payment method that was used for depositing funds, up to the deposited amount. Any excess profits can be withdrawn using any other payment method supported by Plus500.

The minimum deposit requirement for Plus500 varies depending on the jurisdiction and the account type. In general, the minimum deposit ranges from $100 to $1,000. For example, in the UK, the minimum deposit is £100. In Australia, it is AUD 100, and in the EU, it is €100. It is recommended to check the specific minimum deposit requirement for your country and account type on the Plus500 website.

| Plus500 | Most other | |

| Minimum Deposit | $/€/£100 | $/€/£100 |

To withdraw funds from Plus500, you need to follow these steps:

Step 1: Log in to your Plus500 account and click on the “Funds Management” tab.

Step 2: Click on “Withdrawal” and select your preferred withdrawal method.

Step 3: Enter the amount you wish to withdraw and any additional information required for the withdrawal method you have chosen.

Step 4: Click on “Submit” to initiate the withdrawal process.

It is worth noting that Plus500 may require additional documentation or information to verify your identity before processing your withdrawal request. The processing time for withdrawals may also vary depending on your chosen withdrawal method.

Plus500 charges overnight funding fees for holding positions overnight. There are no fees for deposits and withdrawals, and inactivity fees only apply after three months of inactivity.

The overnight funding fee is a cost incurred for holding positions overnight and can be a credit or debit to your account depending on the direction of the position and the prevailing interest rates. The funding rate varies based on the instrument traded.

It is important to note that Plus500 may also charge additional fees for certain actions like guaranteed stop-loss orders or currency conversions.

Overall, while the fees for Plus500 are relatively low, traders should be aware of the potential for higher overnight funding fees, as well as any additional fees that may apply for certain actions.

See the fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| Plus500 | Free | $5-$10 | $10/month |

| eToro | Free | $5 | $10/month |

| IG | Free | Free | $18/month |

| XM | Free | Free | $5/month |

| Pepperstone | Free | Free | $0 |

| IC Markets | Free | $3.5 | $0 |

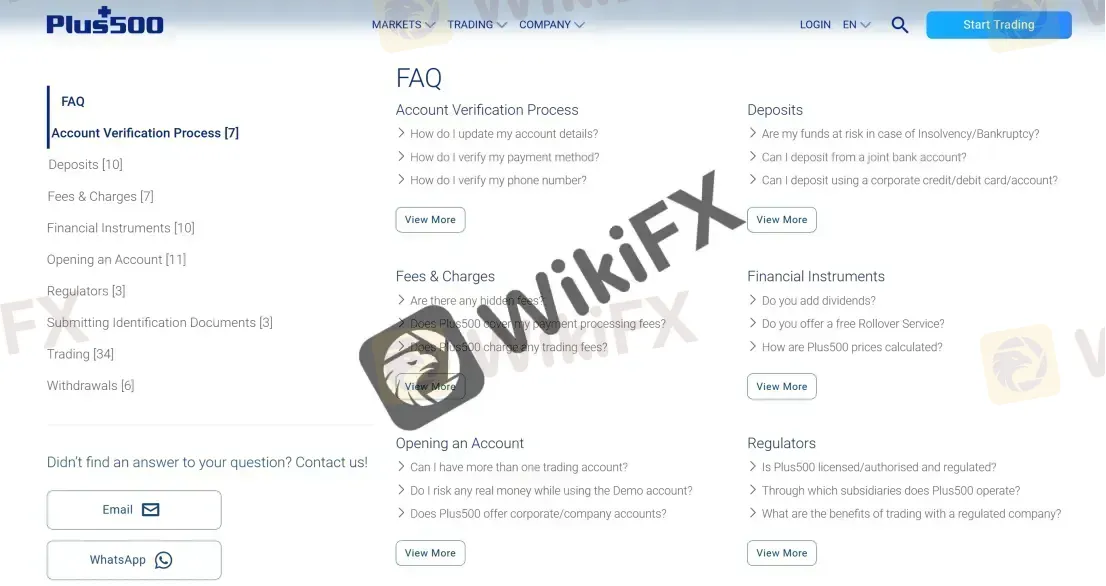

Plus500 offers customer service through email, WhatsApp and live chat. The live chat is available 24/7, while email and WhatsApp support is available during business hours. Plus500 also provides an extensive FAQ section on their website, which covers many commonly asked questions about their services and trading platform.

You can also follow Plus500 on some social networks such as Facebook, Twitter and Instagram.

Overall, Plus500's customer service is considered to be adequate, with prompt responses and helpful support staff. However, some users have reported difficulty reaching support during busy times or experiencing long wait times for responses to their queries.

| Pros | Cons |

| • 24/7 customer support via live chat | • No phone support available |

| • Multilingual support | • Sometimes response is not prompt |

| • User-friendly help center and FAQ section |

Note: These pros and cons are subjective and may vary depending on the individual's experience with Plus500's customer service.

Plus500 provides an educational section on their website, which includes video tutorials, a demo account, and a FAQ section. The educational resources cover topics such as trading basics, technical analysis, and risk management. However, the educational content is relatively limited compared to some other brokers and may not be sufficient for beginners looking to learn about trading.

Overall, Plus500 is a reputable and reliable online broker that offers a user-friendly trading platform, competitive spreads, and a wide range of trading instruments. It has a strong regulatory framework and offers various measures to protect its clients. Plus500 also provides excellent customer service with a 24/7 support team available via live chat.

However, Plus500 does have some drawbacks, such as limited educational resources, lack of a dedicated account manager, and a relatively high inactivity fee. Additionally, the broker's trading platform may not be suitable for advanced traders who require advanced charting tools and features.

In summary, Plus500 is an excellent option for beginner traders who are looking for a straightforward and easy-to-use trading platform with a low minimum deposit requirement. It is also a good choice for experienced traders who prioritize a strong regulatory framework and reliable customer service over advanced trading features.

| Q 1: | Is Plus500 regulated? |

| A 1: | Yes. Plus500 is regulated by FCA, CySEC, ASIC, FMA, and MAS. |

| Q 2: | Does Plus500 offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does Plus500 offer industry-standard MT4 & MT5? |

| A 3: | No. Instead, Plus500 offers its own proprietary trading platform (desktop, web, and mobile). |

| Q 4: | What is the minimum deposit for Plus500? |

| A 4: | The minimum initial deposit to open an account is $/€/£100. |

| Q 5: | Is Plus500 a good broker for beginners? |

| A 5: | Yes. Plus500 is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| Hantec Review Summary in 10 Points | |

| Founded | 1990 |

| Registered Country/Region | Australia |

| Regulation | ASIC, VFSC (offshore) |

| Market Instruments | Forex, Commodities, Stocks & Indices |

| Demo Account | Available |

| Leverage | 1:400 |

| EUR/USD Spread | 0.6 pips |

| Trading Platforms | MT4 |

| Minimum deposit | $0 |

| Customer Support | 24/5 live chat, email |

Hantec is a brokerage firm that provides online trading services for various financial instruments, including forex, stocks, indices, CFDs, and commodities. The company was founded in 1990 and is headquartered in Hong Kong, with additional offices in mainland China, Taiwan, and the United Kingdom. Hantec is regulated by the Australian Securities & Investments Commission (ASIC) and is also offshore regulated by the Vanuatu Financial Services Commission (VFSC). The company offers various account types and MT4 trading platform, as well as educational resources and 24-hour customer support services.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

When it comes to brokers, Hantec Markets stands out as a well-established, reliable option. It is regulated by Australia Securities & Investment Commission (ASIC). The site facilitates trade in a wide variety of instruments. Customized offering that includes the industry-standard MT4 trading platform, extensive educational resources, and in-depth market analysis suitable for both novices and seasoned traders.

However, the lack of transparency on trading conditions and deposit/withdrawal, as well as reports of withdrawal issues in the past, are potential drawbacks to consider. Ultimately, it is important for traders to thoroughly research and evaluate any potential broker before investing their funds.

| Pros | Cons |

| • ASIC Regulation | • Offshore regulated by VFSC |

| Wide range of trading assets | • Clients from USA, Canada, Hong Kong, Macau, Iran and North Korea are not accepted |

| • Free demo account | • Reports of difficulty with withdrawals |

| • Low spreads | • Limited information on trading conditions and deposit/withdrawal |

| • No minimum deposit requirement | |

| • MT4 supported | |

| • Rich educational resources | |

| • Provides 24-hour customer support |

Is Hantec Safe or Scam?

Being regulated by Australia Securities & Investment Commission (ASIC, License No. 326907) and offshore regulated by Vanuatu Financial Services Commission (VFSC, License No. 40318), Hantec appears to be a legitimate broker which has been in operation for several years. However, it's important to note that offshore regulation may not provide the same level of protection as other major regulatory bodies. It is also important to exercise caution and do thorough research before investing with any broker.

The main financial instruments offered by Hantec to investors are Forex, Stocks, Indices, CFDs, and Commodities. Forex trading is available in major, minor, and exotic currency pairs. Investors can also trade Stocks from some of the largest corporations in the world. Hantec offers CFDs on Indices and precious metals such as Gold and Silver, as well as energy commodities such as Brent and WTI crude oil. Overall, Hantec offers a diverse range of financial instruments to its clients to trade on its platform.

EURUSD, buy at 1.09721 and sell at 1.09715, calculate the spread

Hantec offers demo accounts to new traders who want to practice trading without risking their own money. The demo account is free for 30 days and comes with $50,000 in virtual funds to help traders get familiar with the platform and practice their strategies.

On the other hand, live accounts are designed for experienced traders who want to trade with real money. It seems that only one Standard live account type offered, but there is no minimum deposit requirement.

Hantec offers leverage up to 1:400, which is a high level of leverage compared to some other brokers. This means that traders can open larger positions with a smaller amount of capital, which can potentially lead to higher profits.

However, it is important to keep in mind that higher leverage also increases the potential risks and losses. Traders should ensure they have a good understanding of the risks involved in trading with high leverage and use risk management tools such as stop loss orders to help limit their potential losses.

While Hantec's website does not provide specific information about spreads and commissions, it is possible to calculate the spread for the EUR/USD pair based on the market instruments offered. The calculated spread is 0.6 pips, which is considered relatively low compared to other brokers in the industry.

It is important for potential investors to consider that the lack of transparency on spreads and commissions may be a red flag and they should inquire about these fees before deciding to open an account with Hantec.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| Hantec | 0.6 pips | Not disclosed |

| AETOS | 1.8 pips | No commission |

| Darwinex | 0.5 pips | $6 per lot |

| Equiti | 0.6 pips | Not disclosed |

Note: Spreads can vary depending on market conditions and volatility.

Hantec offers the widely popular MetaTrader 4 (MT4) platform for both PC and mobile. The MT4 platform offers advanced charting and analysis tools, customizable indicators, and a variety of order types to cater to the trading strategies of different traders. The platform also supports automated trading through the use of Expert Advisors (EAs) and offers a user-friendly interface that is easy to navigate. The mobile version of the MT4 platform allows traders to access their accounts and trade on-the-go, providing flexibility and convenience.

Overall, the MT4 platform is a reliable and robust trading platform that is well-suited for traders of all levels of experience.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| Hantec | MT4 |

| AETOS | MT4 |

| Darwinex | MT4 |

| Equiti | MT4, EquitiGO app |

Note: Some brokers may offer additional trading platforms not listed in this table.

Hantec offers online payment platforms that allow customers to deposit funds using a bank card or credit card with the UnionPay logo. However, customers must have gone through the necessary formalities for online transfer business at the card-issuing bank.

| Hantec | Most other | |

| Minimum Deposit | $0 | $100 |

To withdraw funds, customers must have a transaction margin equal to or greater than 50% of their total deposit. If not, Hantec will charge a 5% administrative fee. The withdrawal processing takes 2-5 working days depending on the bank.

See the deposit/withdrawal fee comparison table below:

| Broker | Deposit Fees | Withdrawal Fees |

| Hantec | N/A | N/A |

| AETOS | Free | $5 for bank transfer, free for others |

| Darwinex | Free | free for first monthly withdrawal, then $1 per withdrawal |

| Equiti | Free | free for debit/credit card, $15 for bank transfer |

You can reach out to Hantec Markets' support staff 24/5 via a variety of channels, including live chat, email, phone callback, and an FAQ section. The service is available during business hours from 8:00 a.m. on Monday to 7:00 a.m. on Saturday, Beijing Time. The FAQ section covers a range of topics, providing customers with helpful answers to common questions. Additionally, customers can follow Hantec on LinkedIn for updates and news.

Overall, Hantec appears to prioritize customer service and provides multiple ways for customers to seek help or information.

| Pros | Cons |

| • 24-hour customer support via live chat | • No 24/7 support |

| • Callback service available upon request | • No phone support |

| • Comprehensive FAQ section available | • Limited social networks support |

Note: This table is based on publicly available information and may not reflect the complete picture of Hantec's customer service. It is always recommended to conduct further research and due diligence before choosing a broker.

As with any investment, it's important to exercise caution when choosing a broker, including Hantec. While there have been some reports of difficulties with withdrawals, these issues appear to have been resolved. It's important to do your research and take precautions when investing. You can use our platform to access information about brokers before making a decision. If you encounter fraudulent brokers or have been a victim of one, please report it in the Exposure section. Our team of experts will do everything possible to help resolve the problem for you.

Hantec's education section offers a wealth of resources for investors, providing them with the knowledge they need to make informed trading decisions. The free resources include detailed e-books on foreign exchange, daily/weekly marketing research reports, and a financial calendar to help investors stay up to date on market events. Hantec also offers professional market analysis, online foreign exchange courses, and webinars, which can be a great way for traders of all levels to improve their skills and knowledge. With Hantec's education resources, investors can learn how to navigate the markets, develop trading strategies, and make informed investment decisions.

In total, Hantec is a well-regulated broker that offers a range of financial instruments and MT4 trading platform, as well as rich educational resources for traders of all levels. The broker's leverage options are attractive, but caution should be exercised due to reports of hard-to-withdraw funds. Overall, Hantec is a reputable broker with both positive and negative aspects, and investors should carefully consider their needs and preferences before opening an account.

| Q 1: | Is Hantec regulated? |

| A 1: | Yes. It is regulated by Australia Securities & Investment Commission (ASIC) and offshore regulated by Vanuatu Financial Services Commission (VFSC). |

| Q 2: | At Hantec, are there any regional restrictions for traders? |

| A 2: | Yes. Hantec does not offer its services to residents of certain jurisdictions including USA, Canada, Hong Kong, Macau, Iran and North Korea. |

| Q 3: | Does Hantec offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does Hantec offer the industry-standard MT4 & MT5? |

| A 4: | Yes. It supports MT4. |

| Q 5: | What is the minimum deposit for Hantec? |

| A 5: | There is no minimum initial deposit requirement. |

| Q 6: | Is Hantec a good broker for beginners? |

| A 6: | Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 platform. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive plus500 and hantec are, we first considered common fees for standard accounts. On plus500, the average spread for the EUR/USD currency pair is -- pips, while on hantec the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

plus500 is regulated by ASIC,FSA,CYSEC,FCA,FMA,MAS. hantec is regulated by ASIC,VFSC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

plus500 provides trading platform including -- and trading variety including --. hantec provides trading platform including -- and trading variety including --.