No data

Do you want to know which is the better broker between Matsui and ActivTrades ?

In the table below, you can compare the features of Matsui , ActivTrades side by side to determine the best fit for your needs.

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of matsui, activtrades lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Aspect | Information |

| Registered Country/Area | Japan |

| Founded year | 2005 |

| Company Name | Matsui Securities Co., Ltd. |

| Regulation | Regulated in Japan |

| Minimum Deposit | Not specified |

| Maximum Leverage | Not specified |

| Spreads | Not specified |

| Trading Platforms | Japanese Equity App, U.S. Stocks App, Investment Trust App, Forex App, Futures OP App, Netstock High Speed, FX Trader Plus |

| Tradable assets | Japanese stocks, US stocks, mutual funds, FX, futures/options, NISA/Tsumitate NISA, iDeCo, Japanese equities products, MMF, ETFs/REITs |

| Account Types | Not specified |

| Demo Account | Not specified |

| Customer Support | Email: kouza-kaisetsu@matsui.co.jp |

| Payment Methods | Netlink Deposit, Deposit Transfer, Time Deposit, Bank Transfer Deposit |

| Educational Tools | “Learn to Invest” program |

Matsui Securities Co., Ltd. is a regulated brokerage firm based in Japan. It holds a Retail Forex License and operates under the jurisdiction of the Kanto Local Finance Bureau. The company has been in operation for 15-20 years and has a good capital ratio, indicating its financial stability. Matsui Securities has established partnerships with various financial institutions, including NatWest, XTX Markets, Deutsche Bank AG, HSBC, Morgan Stanley, and others.

Matsui Securities offers a range of investment products and services. It provides access to the Japanese stock market, allowing investors to trade stocks listed on Japanese exchanges in real-time. Additionally, the company offers the opportunity to trade US stocks, mutual funds, foreign exchange, futures, options, NISA/Tsumitate NISA accounts, iDeCo retirement savings plans, Japanese equities products, money market funds, and ETFs/REITs.

To open an account with Matsui Securities, interested individuals can visit the company's website and follow the account opening process. The brokerage charges fees and commissions based on the specific trading services and products used. Deposit and withdrawal options are available through methods such as Netlink Deposit, Deposit Transfer, Time Deposit, and Bank Transfer Deposit.

Matsui Securities provides a range of trading platforms, including smartphone apps dedicated to Japanese stocks, US stocks, investment trusts, and forex trading. It also offers platforms for futures and options trading, as well as PC/tablet-based platforms for comprehensive trading features.

Overall, Matsui Securities Co., Ltd. is a regulated brokerage firm in Japan, offering a variety of investment options and trading services to investors.

Matsui Securities Co., Ltd is a financial institution that offers a range of investment services in Japan. While Matsui Securities has certain advantages, it also has some limitations to consider. On the positive side, Matsui Securities is regulated by the Financial Services Agency, ensuring compliance with financial regulations. Additionally, the company holds a Retail Forex License and provides access to Japanese and US stocks, facilitating diversification. Matsui Securities also offers tax-advantaged investment accounts, such as NISA and iDeCo, and various deposit and withdrawal options. However, it is important to note that the company has limited information available on its website and email address, and there is a lack of transparency regarding fees, commissions, and withdrawal details. The contact options are limited to email, and there is limited information about customer support. The company's trading platforms and capital ratio also have limited details. To summarize, while Matsui Securities offers certain benefits, prospective customers should carefully evaluate its limitations before making investment decisions.

| Pros | Cons |

| Regulated by the Financial Services Agency in Japan | Limited information available about the company's website and email address |

| Holds a Retail Forex License | No information provided about the expiry date of the license |

| Offers access to Japanese and US stocks | Lack of transparency regarding fees and commissions for different services |

| Provides tax-advantaged investment accounts (NISA and iDeCo) | Limited contact options (only email provided) |

| Wide range of Japanese equities products and trading services | No information about withdrawal fees and limits |

| Various deposit and withdrawal options | Limited details about the trading platforms offered |

Based on the information provided, Matsui Securities Co., Ltd. (松井証券株式会社) is regulated by the Financial Services Agency in Japan. It holds a Retail Forex License and is regulated under the jurisdiction of the Kanto Local Finance Bureau (関東財務局長(金商)第164号). The effective date of the license is September 30, 2007.

However, there is no information available regarding the expiry date, website, or email address of Matsui Securities Co., Ltd. The company's address is located in Chiyoda-ku, Tokyo, at 1-4 Kojimachi. The phone number provided for the licensed institution is 0352160606.

Japanese stocks:

Matsui Securities provides investors with access to the Japanese stock market, allowing them to trade stocks listed on Japanese exchanges through spot trading. This enables investors to buy and sell shares of Japanese companies in real-time, taking advantage of market movements.

US stocks:

In addition to Japanese stocks, Matsui Securities also offers investors the opportunity to trade US stocks. This means that investors can access major US stock exchanges and trade shares of American companies, providing diversification and exposure to international markets.

Mutual fund:

Matsui Securities offers mutual funds as an investment option. Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. By investing in a mutual fund, investors can gain exposure to a wide range of securities, managed by professional fund managers.

FX (Foreign Exchange):

Matsui Securities facilitates foreign exchange trading, allowing investors to trade currencies. Foreign exchange trading involves buying and selling different currencies with the aim of profiting from fluctuations in exchange rates. This service provides opportunities for investors to engage in currency speculation and hedge against foreign exchange risks.

Futures/Options:

Matsui Securities offers futures and options trading. Futures contracts are agreements to buy or sell assets at a predetermined price and date in the future, while options contracts provide the right, but not the obligation, to buy or sell assets. These derivative instruments allow investors to speculate on price movements and manage risk in various financial markets.

NISA/Tsumitate NISA:

Matsui Securities provides the NISA (Nippon Individual Savings Account) and Tsumitate NISA services. These are tax-advantaged investment accounts in Japan that encourage long-term investing by offering tax exemptions on capital gains and dividends. Investors can contribute to these accounts annually and invest in various financial products.

iDeCo:

Matsui Securities offers the Individual Defined Contribution Pension (iDeCo) system. iDeCo is a retirement savings plan in Japan that provides tax advantages for individuals. It allows investors to contribute a portion of their income towards retirement and invest in a range of financial instruments, aiming to grow their retirement savings.

Japanese equities Products and trading services:

Matsui Securities provides a wide array of Japanese equities products and trading services. This includes offerings such as initial public offerings (IPOs) and public offerings (POs), which allow investors to participate in the primary market and buy shares of newly listed companies. Additionally, the company provides stock lending services, off-auction distribution, PTS (Proprietary Trading System) for alternative trading, and other services related to Japanese equities.

MMF (Money Market Funds):

Matsui Securities offers money market funds, which are low-risk investment vehicles that invest in short-term, highly liquid assets such as Treasury bills, commercial paper, and certificates of deposit. Money market funds provide investors with a relatively stable investment option and easy access to cash.

ETFs/REITs:

Matsui Securities offers exchange-traded funds (ETFs) and real estate investment trusts (REITs). ETFs are investment funds that trade on stock exchanges, tracking the performance of a specific index or sector. REITs, on the other hand, allow investors to pool their money to invest in a portfolio of income-generating real estate properties. These investment options provide diversification and exposure to different asset classes.

| Pros | Cons |

| Access to Japanese stock market | Limited information about the company's website and email address |

| Facilitates foreign exchange trading | No information provided about fees and commissions |

| Offers iDeCo retirement savings plan | Limited contact options (only email provided) |

| Provides NISA and Tsumitate NISA services | Limited information about the company's capital ratio and influence |

To open an account with Matsui Securities, you can follow these steps:

Visit the Matsui Securities website and click on the “口座開設(無料)account opening” link, which means “Account Opening (Free)”.

2. Depending on your customer type, choose the appropriate option. Matsui Securities offers account opening for private customers, minors, and corporate customers.

3. On the website, you can find a flowchart explaining the steps involved in the account opening process. This will give you an overview of the entire procedure.

4. If you are interested in opening a NISA account, there is a separate section where you can check the process specific to NISA accounts.

5. Prepare the necessary documents for account verification, such as your My Number verification documents and separate identity verification documents.

6. In Step 1 of the application process, you will be prompted to select the application method. Follow the instructions provided on the website.

7. In Step 2, you will need to register your email address as part of the application process.

8. Once you complete Step 3, your email address registration will be considered completed, and the application process will be finished online. You will be able to start trading within as little as three days.

9. Alternatively, you can choose to apply by mailing the application form provided by Matsui Securities. In this case, the process may take around one week.

10. Matsui Securities will send you the necessary application form based on the information you have entered during the online application process.

Physical Trading: The commission for physical trading is determined by the total daily contract price of the exchange and PTS trading. The fee is fixed within certain ranges based on the total daily contract price, irrespective of the trading volume.

Japanese Stocks Spot Trading: The fees for spot trading and margin trading are determined by the total contract price for one day. The fees are fixed and do not depend on the trading frequency. There are different fee tiers based on the total contract price, ranging from 0 yen to 100,000 yen for individuals aged 26 and above.

Margin Trading: Margin trading fees depend on the total contract price for one day. There are different fee tiers based on the total contract price, ranging from 0 yen to 100,000 yen for individuals aged 26 and above. There are also specific commission systems for margin trading with a NISA account, trading less than one unit of shares, buying off-auction shares, and telephone transactions.

Improvement Success Fee: When the contract price improves, an improvement success fee is charged, which is calculated as 30% (33% including tax) of the improved contract price. There is no minimum commission for this fee.

IPO and PO: There is no purchase fee for IPO (Initial Public Offering) and PO (Public Offering/Secondary Offering). However, a fee will be charged at the time of sale.

Off-Auction Distribution: There is no purchase fee for off-auction distribution, but a fee will be charged at the time of sale.

Fractional Shares: A fee of 0.5% (0.55% including tax) of the contract price is charged for fractional shares. There is no minimum commission for this fee, and transactions over the phone have a different fee structure.

Profit and Loss Accounting Support Service: A fee of 2 times (2.2 times including tax) the contract price is charged for the Profit and Loss Accounting Support Service. The minimum fee is 4,950 yen (tax included).

US Stocks: Trading fees for US stocks are determined based on the contract price per trade. The fee is 0.45% (0.495% including tax) of the contract price, with a minimum fee of USD 0 and a maximum fee of 20 USD (22 USD including tax).

Mutual Fund: There is no purchase fee for mutual funds.

FX: There is no commission fee for FX trading.

Futures and Options Trading: Fees for futures and options trading vary depending on the specific contracts. The fees are calculated based on the contract price and range from 0.04% to 1.5% (including tax), with minimum fees ranging from 1,100 yen to 11,000 yen (tax included).

NISA/Tsumitate NISA: There is no trading commission fee for NISA and Junior NISA accounts. There is also no purchase fee for investment trusts within these accounts.

Telephone Transaction Fee: A fee is charged for each contract in telephone transactions. The fees vary depending on the type of transaction, such as Japanese stocks, improvement success fee, fractional shares, and futures and options trading.

| Pros | Cons |

| Transparent fee structure for physical trading, Japanese stocks spot trading, and margin trading | Lack of information about fees for specific types of transactions |

| No commission fee for FX trading | Limited details about fees for IPO and off-auction distribution |

| No purchase fee for mutual funds | Lack of information about trading commission fees for NISA and telephone transactions |

| Reasonable fee tiers based on the total contract price for various trading services | No information about fees for profit and loss accounting support service |

| No minimum commission for improvement success fee | Limited details about fees for futures and options trading |

Deposit and withdrawal options at Matsui Securities are available to investors through four different methods: Netlink Deposit, Deposit Transfer, Time Deposit, and Bank Transfer Deposit. These options allow for transactions without any additional charges.

Net Link Deposit is a service that facilitates real-time transfers from a bank account to a securities account. It can be accessed through various platforms such as the customer site, smartphone site, Japan stock app, and stock touch. The service is available during specified hours, and it supports transactions with multiple financial institutions including Japan Post Bank, Mizuho Bank, Bank of Mitsubishi UFJ, and Sumitomo Mitsui Banking Corporation.

Raku-Raku Transfer Deposit enables instant transfers and deposits to a securities account by establishing an account transfer contract with a partnering financial institution. This service can be accessed through the customer site, smartphone site, Japan stock app, and stock touch. The supported financial institutions include Mizuho Bank, Mitsubishi UFJ Bank, Sumitomo Mitsui Banking Corporation, and Japan Post Bank. The transfer deposit limit ranges from 10,000 yen to less than 100 million yen.

For recurring deposits, investors can opt for the Regular Deposit service. This service automatically withdraws a specified amount from a linked financial institution account on the 27th of each month (or the next business day if it falls on a holiday) and deposits it into the securities account five business days later. Account registration for withdrawal needs to be completed at least 8 business days before the withdrawal date. Various platforms such as the customer site, investment trust customer site, and investment trust app support recurring deposits, and investors can choose from over 100 available financial institutions across Japan.

Bank Transfer Deposit allows customers to transfer funds from an ATM or a counter of a financial institution to a dedicated bank account specified by Matsui Securities. This method ensures secure transactions by utilizing the established banking infrastructure.

In terms of withdrawals, Matsui Securities offers two options. Withdrawals made after the next business day are free of charge, while instant withdrawals incur a procedure fee of 300 yen (including tax). The timing of reflection and withdrawal limits depend on the reception time and vary between next business day and immediate availability. The withdrawal minimum amount is 1,000 yen for withdrawals after the next business day and 10,000 yen or more for instant withdrawals. Customers can make up to 5 instant withdrawals per day, with a maximum limit of 2 million yen per day.

| Pros | Cons |

| Multiple deposit methods available (Netlink, Raku-Raku, etc.) | Limited information about withdrawal processing times and limits |

| Automatic recurring deposit option available | Instant withdrawals incur a procedure fee |

| No additional charges for deposit and withdrawal transactions | Limited details about the withdrawal minimum amount |

| Wide range of supported financial institutions | Limited number of instant withdrawals allowed per day |

Matsui Securities offers a range of trading platforms tailored to meet various investment needs. These platforms are designed to provide essential functions and features for trading. Let's explore each platform briefly:

JAPANESE EQUITY APP: Matsui Securities' Japanese Equity App is a smartphone application that focuses on Japanese stock trading. It offers users access to market price information, charts, news reports, order placement, stock search, corporate information, IPO information, shareholder benefits, and a personalized user page. The app boasts a user-friendly interface and comprehensive features, allowing users to gather information and execute trades with ease.

U.S. STOCKS APP: The U.S. Stocks App by Matsui Securities is dedicated to trading U.S. stocks. It provides real-time stock price information, charts, news reports, order placement, stock search, and a personalized user page. The app is designed to be easily understandable, making it suitable for users who are new to trading U.S. stocks. It ensures a confident trading experience with its user-friendly interface.

INVESTMENT TRUST APP: Matsui Securities' Investment Trust App offers all the necessary functions for investing in mutual funds. Users can access market price information, place orders, search for funds, and manage their investments through their personalized user page. The app allows beginners to start their investment journey with ease, as it enables investing in funds starting from 100 yen.

FOREX APP: The Forex App provided by Matsui Securities caters specifically to trading in the foreign exchange market. It offers market price information, charts, news reports, and order placement features. The app also includes a personalized user page for managing trades. Notably, it incorporates features like “Speed Order” for quick order placement and “Chart Speed Order” for placing orders while viewing the chart.

FUTURES OP APP: Matsui Securities' Futures OP App supports futures and options trading. It provides market price information, charts, news reports, order placement, stock search, and a personalized user page. The app is designed with an intuitive and user-friendly interface, allowing users to easily gather information and execute trades.

For PC/tablet: In addition to the mobile trading platforms, Matsui Securities also offers a computer-based platform called “Netstock High Speed” and the “FX Trader Plus” platform exclusively for Forex trading. These platforms provide features for checking exchange rates, charts, order placement, and analysis.

| Pros | Cons |

| Multiple specialized apps for different types of trading | Limited information available about platform features |

| User-friendly interfaces for ease of use | Lack of transparency regarding platform fees and charges |

| Access to real-time market price information, charts, and news reports | Limited customization options for personalized user experience |

| Order placement and stock search functionalities | Insufficient information about available analysis and research tools |

| Personalized user pages for managing investments and trades | Limited information about customer support and assistance |

| “Speed Order” and “Chart Speed Order” features for quick trading | No information about platform compatibility with different operating systems |

| Computer-based platforms for desktop and tablet users with additional features | Limited details about the platform's security measures and data protection |

Matsui provides a range of educational resources to support individuals who are interested in learning about investment and Japanese stocks. One such resource is the “Learn to Invest” program, which caters to beginners looking to understand the basics of investing. The program covers topics such as the fundamentals of Japanese stocks, the first installment investment process, and information about seminars that delve deeper into investment strategies. Another valuable resource offered by Matsui is the contribution of Mr. Takeuchi, who shares his expertise through the “Let's Learn about Investment” initiative. This initiative provides insights into various aspects of investment, including how to choose suitable stocks for investment. Matsui also emphasizes the importance of integrating investment knowledge into one's lifestyle, offering resources that demonstrate how to incorporate investment practices seamlessly. Additionally, the company introduces first-time shareholder benefits, enabling individuals to explore the perks of owning stocks for the first time. For those seeking information on specific brands or stores, Matsui provides resources that highlight the company names associated with various investment opportunities. Moreover, Matsui emphasizes the appeal of high dividend stocks, providing insights and guidance on how to identify these potential investments. Lastly, Matsui offers a Q&A section specifically tailored to investment beginners, providing a simple and comprehensive collection of commonly asked questions to support their learning journey.

Matsui Securities provides customer support services through different channels based on the account holders' status. For individuals who already have an account with Matsui Securities, they can enjoy free customer support by calling the dedicated hotline at 0120-953-006 or using IP phone at 03-6387-3666. The customer support service is available on weekdays from 8:30 to 17:00.

For those who do not have a Matsui Securities account, there is a separate hotline at 0120-021-906, and an alternative contact number for IP phone users at 03-6387-3601. This customer support service is also available on weekdays from 8:30 to 17:00.

To learn more about the stock trading consultation services provided by Matsui Securities, individuals can contact kouza-kaisetsu@matsui.co.jp for further information.

Matsui Securities Co., Ltd. is a regulated company in Japan, holding a Retail Forex License under the jurisdiction of the Kanto Local Finance Bureau. While it has a good overall score, there are some disadvantages to consider. The lack of available information regarding the expiry date, website, and email address raises concerns about transparency and communication. Additionally, the absence of specific details about fees and commissions may make it difficult for potential clients to assess the costs associated with trading. However, Matsui Securities provides a variety of market instruments, including access to Japanese and US stocks, mutual funds, foreign exchange trading, futures/options, tax-advantaged accounts, and Japanese equities products. The company offers a range of trading platforms, tailored to different investment needs. It is important for individuals considering Matsui Securities to conduct further research and carefully evaluate the available information before making a decision.

Q: Is Matsui Securities Co., Ltd. regulated?

A: Yes, Matsui Securities Co., Ltd. is regulated by the Financial Services Agency in Japan and holds a Retail Forex License.

Q: What is the capital ratio of Matsui Securities?

A: Matsui Securities has a great capital ratio, indicating its financial strength and stability.

Q: How many brokers does Matsui Securities compare to?

A: Matsui Securities compares to three brokers.

Q: What are the market instruments offered by Matsui Securities?

A: Matsui Securities offers Japanese stocks, US stocks, mutual funds, FX (Foreign Exchange), futures/options, NISA/Tsumitate NISA, iDeCo, MMF (Money Market Funds), and ETFs/REITs.

Q: How can I open an account with Matsui Securities?

A: To open an account with Matsui Securities, you can visit their website and follow the account opening process specific to your customer type. The process can be completed online or through mailing the application form.

Q: What are the fees and commissions associated with trading on Matsui Securities?

A: The fees and commissions vary depending on the type of trading. For example, Japanese stocks spot trading and margin trading have fixed fees based on the total contract price. FX trading has no commission fees. It is recommended to refer to Matsui Securities' fee schedule for detailed information.

Q: What deposit and withdrawal options are available at Matsui Securities?

A: Matsui Securities offers Netlink Deposit, Deposit Transfer, Time Deposit, and Bank Transfer Deposit options for transactions without additional charges.

Q: What are the trading platforms provided by Matsui Securities?

A: Matsui Securities offers various trading platforms, including the Japanese Equity App, U.S. Stocks App, Investment Trust App, Forex App, Futures OP App, as well as PC/tablet platforms like “Netstock High Speed” and “FX Trader Plus.”

Q: What educational resources does Matsui Securities provide?

A: Matsui Securities offers educational resources, including the “Learn to Invest” program, to support individuals interested in learning about investment and Japanese stocks.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| ActivTrades Review Summary in 10 Points | |

| Founded | 2001 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA |

| Market Instruments | forex, shares, indices, ETFs, commodities, bonds, and spread betting |

| Demo Account | Available |

| Leverage | 1:30 for retail, 1:400 for pro |

| EUR/USD Spread | From 0.5 pips |

| Trading Platforms | ActivTrader, MT4, MT5 |

| Minimum deposit | $500 |

| Customer Support | 24/5 multilingual live chat, phone, email |

Founded in 2001, ActivTrades is a brokerage firm, headquartered in London, with offices in Milan, Nassau, and Sofia. It initially focused on the forex business and then gradually expanded its product ranges, providing trading conditions and service support for clients in more than 140 countries. The company is regulated by the Financial Conduct Authority (FCA) and offers a range of trading instruments, including forex, commodities, indices, shares, and cryptocurrencies.

ActivTrades also provides its clients with a variety of trading platforms, including the popular MetaTrader 4 and 5 platforms, as well as its proprietary platform, ActivTrader. The broker aims to provide its clients with a safe and transparent trading environment, offering segregated accounts, negative balance protection, and a range of educational resources.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

ActivTrades offers a good range of trading instruments, is regulated by a reputable financial authority, and offers various account types with negative balance protection and segregated accounts.

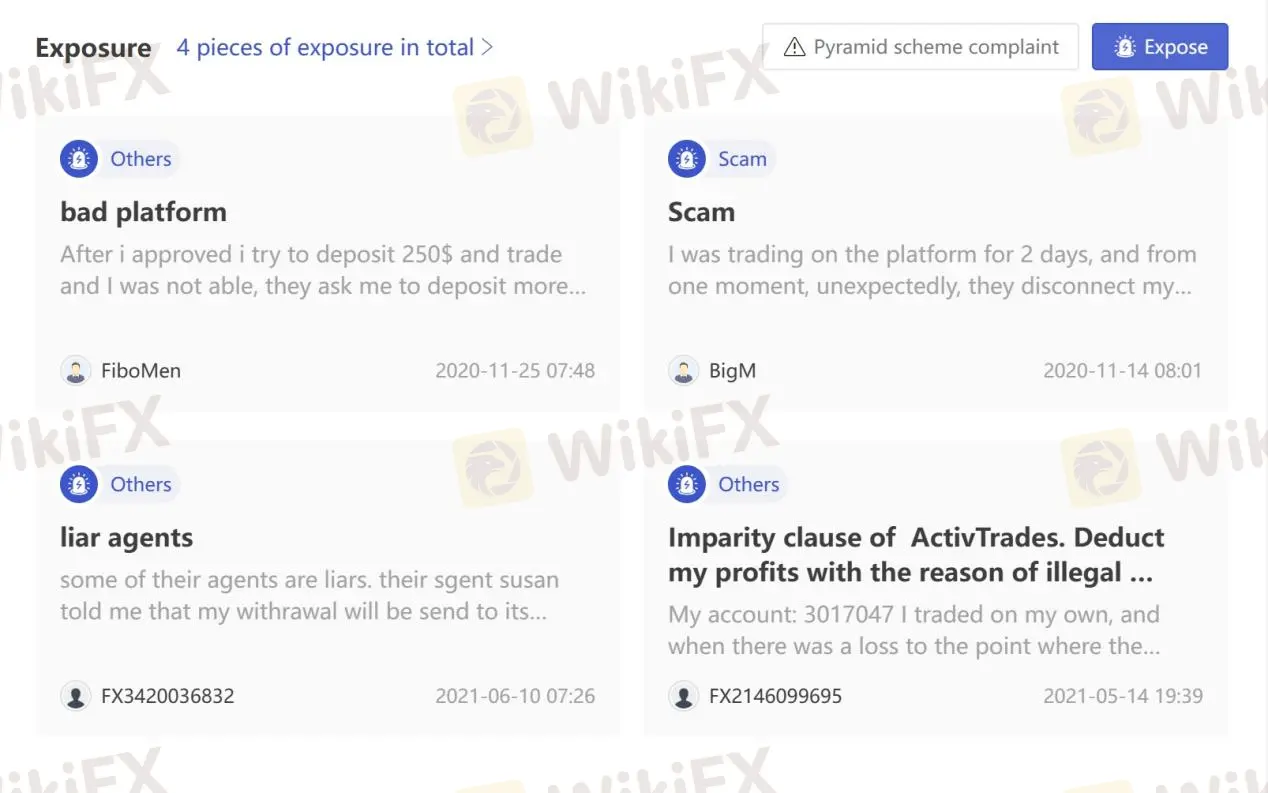

However, some clients have reported issues with trading platform stability. It's important for potential clients to carefully consider their trading needs and preferences before choosing ActivTrades as their broker.

| Pros | Cons |

| • Regulated by FCA | • SCB license is offshore |

| • Segregated accounts and Negative Balance Protection | • Negative reviews from clients |

| • Wide range of trading products | • High minimum deposit requirement |

| • Demo and Islamic accounts offered | • Fees charged for Credit/Debit card deposits |

| • Variety of trading platforms including MetaTrader and ActivTrader | |

| • Free educational resources and market analysis | |

| • Multiple funding options | |

| • 24/5 multilingual customer support |

There are many alternative brokers to ActivTrades depending on the specific needs and preferences of the trader. Some popular options include:

Darwinex - a regulated broker that offers unique social trading features, with a focus on transparency and competitive pricing.

Dukascopy - a Swiss-based broker that provides excellent trading technology, including a proprietary trading platform, but it has high account minimums and limited product offerings.

Hantec Markets - a UK-based broker that offers a user-friendly trading platform and competitive pricing, but its educational resources are limited compared to some other brokers.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

ActivTrades is a regulated broker by the Financial Conduct Authority (FCA) and and has been in operation for several years, which are positive aspects in terms of its reliability and security. The fact that they offer segregated accounts and negative balance protection adds an extra layer of protection for its clients. However, negative reviews from clients suggest that there may be issues with their trading platform.

Based on the information available, ActivTrades appears to be a reliable and trustworthy broker. However, as with any investment, there is always some level of risk involved, and it is important for traders to do their own research and carefully consider their options before investing.

At ActivTrades, you can trade over 1,000 different CFD instruments across 7 asset classes, including forex, shares, indices, ETFs, commodities, bonds, and spread betting. This provides clients with a diversified portfolio and the opportunity to trade a range of different assets.

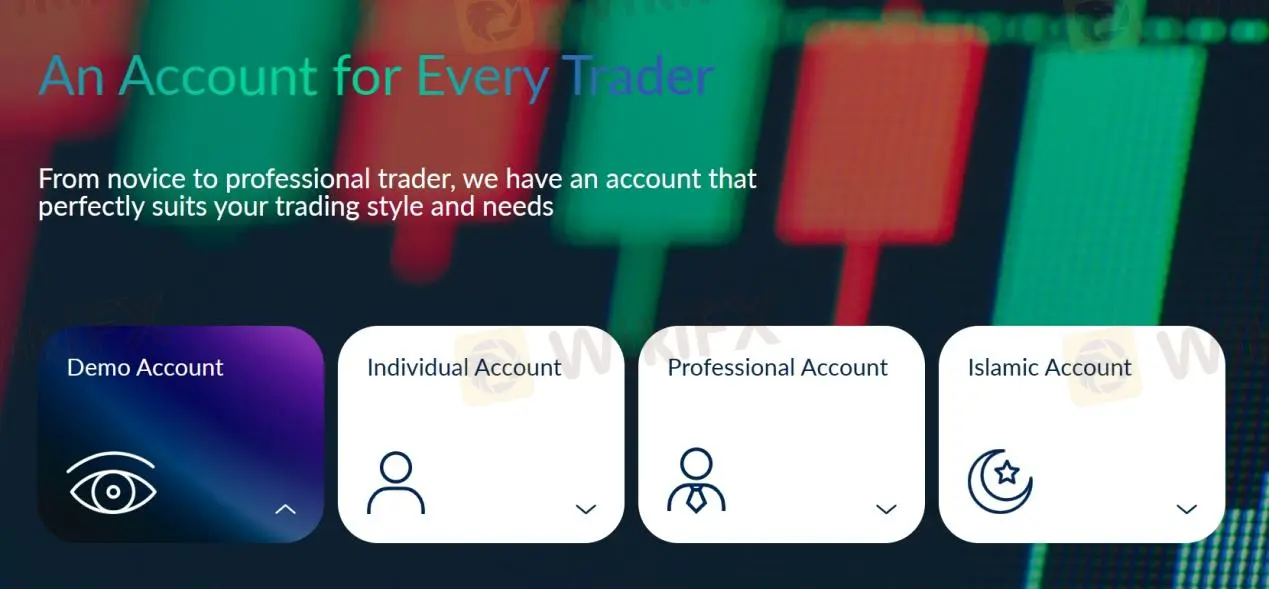

Traders can open either an Individual Account (which allows them to trade small and micro lots) or a Professional Account (minimum financial portfolio size of $500,000, Dedicated Account Manager) with ActivTrades. Beginner traders can test out the trading interface and get a feel for how the broker works with a free demo account. People who adhere to Sharia law can choose from two more account options: an Islamic (Swap-Free) Account.

Leverage is capped at 1:30 in line with the EMSA regulations, the maximum leverage is 1:30 for currency pairs, 1:20 for indices and shares, 1:10 for commodities and 1:5 for cryptocurrencies. While only the Pro account holders can enjoy the maximum leverage of 1:400.

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

ActivTrades' currency spreads begin at 0.5 pips, and its spreads on indices and financial CFDs are also 0.5 pips, both of which are competitively cheap.

It's also important to note that this is not a situation that can be fixed overnight (the underlying Futures price already accounts for the adjustment). Commissions for trading shares as CFDs begin at €1 per side, whereas spread betting on shares incurs no fees beyond 0.10% of the transaction value.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission (per lot) |

| ActivTrades | 0.5 pips | €1 |

| Darwinex | 0.0 pips | €4.5 |

| Dukascopy | 0.2 pips | $7.0 |

| Hantec Markets | 1.2 pips | $6.0 |

Note: Spreads can vary depending on market conditions and volatility.

ActivTrades also stands out due to its platform selection, which features not only the company's proprietary platform - ActivTrader but also the popular MT4 and MT5 platforms, as well as a set of unique Add-Ons.

• Web Trading

The ActiveTrades trading platform is web-based, allowing trades to be made directly in the browser; it also has a dedicated app for the iPhone and iPad. The platform has an easy-to-use design but advanced functionality, such as access to more than 90 technical analysis indicators, for seasoned traders of all trading types.

• ActivTrader

The upgraded ActivTrader platform incorporates cutting-edge tools and features to provide a revolutionary trading environment. You can gain exposure to the Forex, Commodities, Financial & Indices, Shares, and Exchange-Traded Funds markets and trade over a thousand CFDs.

• MetaTrader4

ActivTrades' desktop trading platform MT4 is available to those who prefer a more traditional trading experience. In addition, the technology has been upgraded in accordance with the firm's security standards, and the use of sophisticated charts has made it possible to automate the tactics using EAs.

• MetaTrader5

New and improved features take online trading to a whole new level in MetaTrader5. More than 450 CFDs on equities with diverse characteristics and the option to auto-trade are available on the platform, and trading statements are seamlessly integrated.

Overall, ActivTrades' trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders. See the trading platform comparison table below:

| Broker | Trading Platforms |

| ActivTrades | MetaTrader 4, MetaTrader 5, ActivTrader |

| Darwinex | MetaTrader 4, DARWINEX WEBTRADER |

| Dukascopy | JForex, WebTrader, MT4, MT5 |

| Hantec Markets | MetaTrader 4 |

Note: Some brokers may offer additional trading platforms or versions, but this table includes the most commonly used ones.

In addition to the robust platform itself, a plethora of utility extensions is available to further develop trading functionalities and automation features, as well as to provide decision-making and signaling instruments. The term “indicators” can refer to a wide variety of tools, from those used for making decisions to those used for trading.

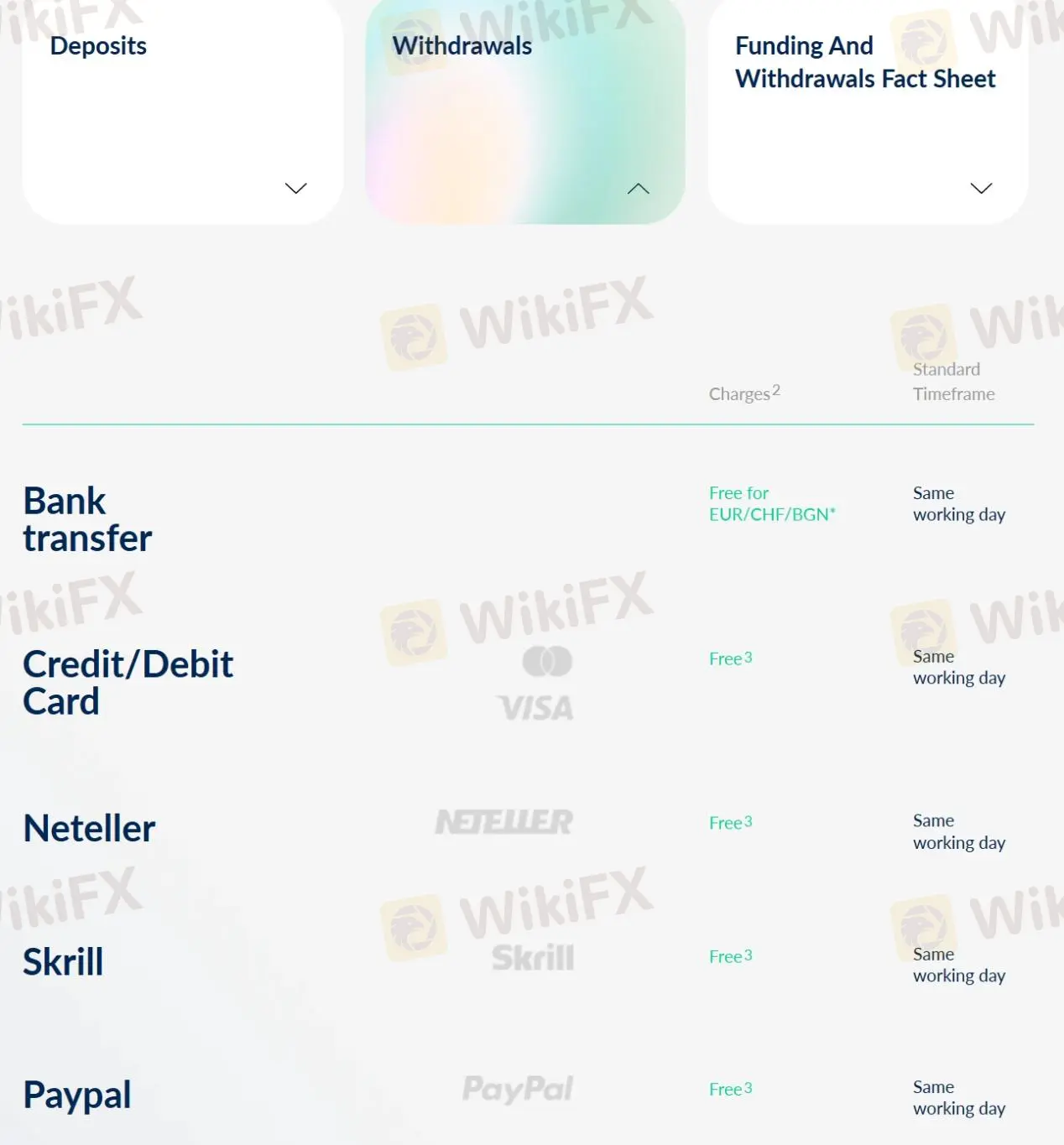

ActivTrades accepts deposits via Bank Transfers, Credit/Debit cards, Neteller, Skrill, Sofort, and PayPal, while only Sofort is excluded from withdrawal methods.

Base Currencies:

EUR, USD, GBP or CHF

The minimum deposit is as high as $500.

| ActivTrades | Most other | |

| Minimum Deposit | $500 | $100 |

Deposits via credit/debit card UK&EEA are charged 0.5% fees, while credit/debit card non-EEA are charged 1.5% fees. Other deposits and all withdrawals are free of charge.

Most deposits are said to take 30 minutes (except for Bank Transfer deposits are processed on the same working day), while all withdrawals can be processed on the same working day.

More details can be found in the table below:

| Payment Options | Fee | Processing Time | ||

| Deposit | Withdraw | Deposit | Withdraw | |

| Bank Transfer | Free | Free for EUR/CHF/BGN | Same working day | Same working day |

| Credit/Debit card | 0.5% (UK & EEA), 1.5% (non EEA) | Free | 30 minutes | |

| Neteller | Free | |||

| Skrill | ||||

| PayPal | ||||

| Sofort | / | / | ||

See the deposit & withdrawal fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee |

| ActivTrades | Varies depending on method | Free |

| Darwinex | Free | Free |

| Dukascopy | Free | Varies depending on method |

| Hantec Markets | Free | Free |

Note: Fees and charges are subject to change. This table is only for informational purposes and may not reflect the latest fee structure of the brokers mentioned. It is recommended to always check with the brokers directly for the latest fees and charges.

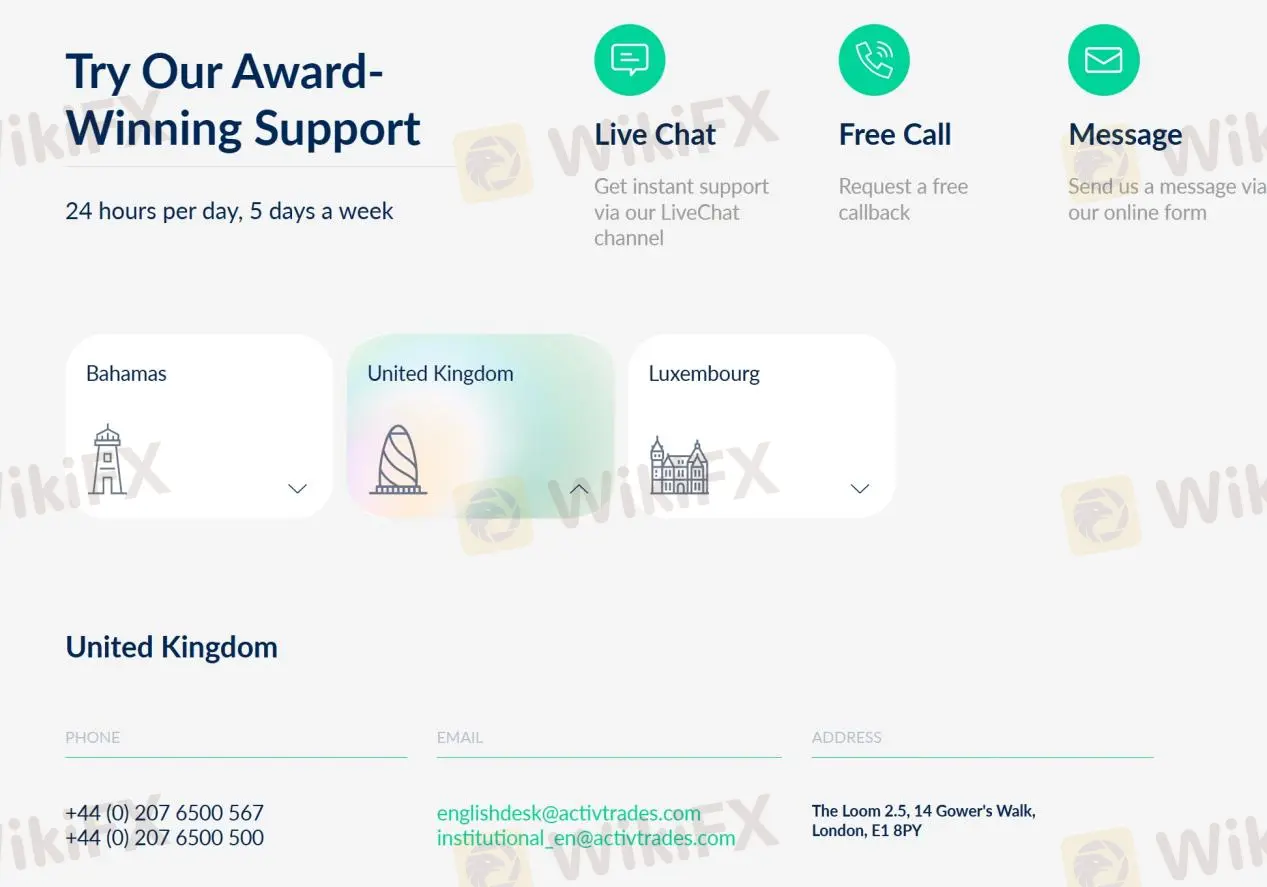

ActivTrades offers 24/5 multilingual customer service via live chat, telephone: +44 (0) 207 6500 567, +44 (0) 207 6500 500, email: englishdesk@activtrades.com, institutional_en@activtrades.com, request a callback, or messaging online. Help Center is also available. You can also follow this broker on social networks such as Twitter, Facebook, Instagram and YouTube. Company address: The Loom 2.5, 14 Gower's Walk, London, E1 8PY.

Overall, ActivTrades' customer service is considered reliable and responsive, with various options available for traders to seek assistance.

| Pros | Cons |

| • 24/5 multilingual live chat | • No 24/7 customer support |

| • Multi-channel support | |

| • Help Center offered | |

| • Updated social media |

Note: These pros and cons are subjective and may vary depending on the individual's experience with ActivTrades' customer service.

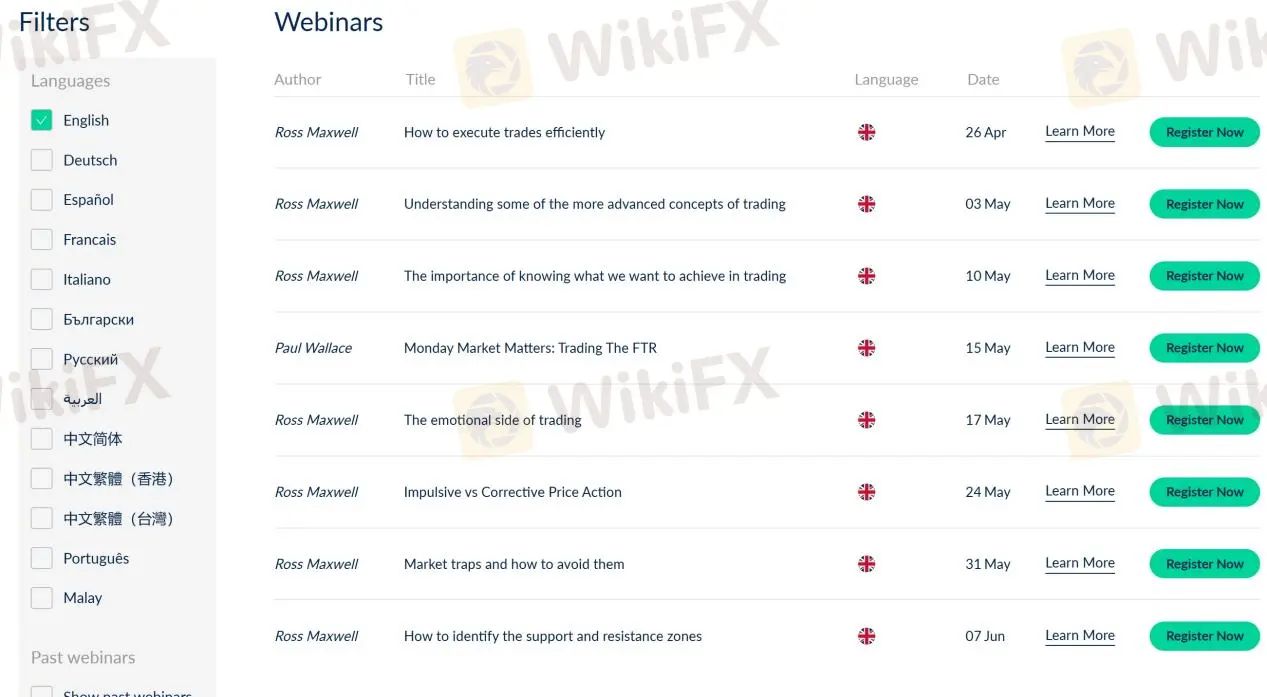

ActivTrades provides comprehensive educational resources organized by subject, including webinars, seminars, manuals, news & analysis. In addition, you get access to a demo account, robust analytical and technical analysis tools within the platforms and exclusive add-ons that will help you study and trade more effectively.

On our website, you can see that some users have reported scams. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

As a whole, ActivTrades is a regulated broker that provides a wide range of trading instruments and platforms. The company offers several account types and has competitive trading fees with low spreads. The broker also provides negative balance protection and segregated client accounts.

However, ActivTrades has some negative reviews from clients regarding trading platform. Additionally, the broker charges deposit fees for some payment methods. Overall, ActivTrades may be a good option for experienced traders who prioritize low trading fees and a variety of trading instruments.

| Q 1: | Is ActivTrades regulated? |

| A 1: | Yes. It is regulated by FCA. |

| Q 2: | Does ActivTrades offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does ActivTrades offer the industry-standard MT4 & MT5? |

| A 3: | Yes. Both MT4 and MT5 are available. |

| Q 4: | What is the minimum deposit for ActivTrades? |

| A 4: | The minimum initial deposit with ActivTrades is $500. |

| Q 5: | Is ActivTrades a good broker for beginners? |

| A 5: | Yes. ActivTrades is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 and MT5 platforms. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive matsui and activtrades are, we first considered common fees for standard accounts. On matsui, the average spread for the EUR/USD currency pair is -- pips, while on activtrades the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

matsui is regulated by FSA. activtrades is regulated by FCA,SCB.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

matsui provides trading platform including -- and trading variety including --. activtrades provides trading platform including -- and trading variety including --.