No data

Do you want to know which is the better broker between ActivTrades and MiTRADE ?

In the table below, you can compare the features of ActivTrades , MiTRADE side by side to determine the best fit for your needs.

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of activtrades, mitrade lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| ActivTrades Review Summary in 10 Points | |

| Founded | 2001 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA |

| Market Instruments | forex, shares, indices, ETFs, commodities, bonds, and spread betting |

| Demo Account | Available |

| Leverage | 1:30 for retail, 1:400 for pro |

| EUR/USD Spread | From 0.5 pips |

| Trading Platforms | ActivTrader, MT4, MT5 |

| Minimum deposit | $500 |

| Customer Support | 24/5 multilingual live chat, phone, email |

Founded in 2001, ActivTrades is a brokerage firm, headquartered in London, with offices in Milan, Nassau, and Sofia. It initially focused on the forex business and then gradually expanded its product ranges, providing trading conditions and service support for clients in more than 140 countries. The company is regulated by the Financial Conduct Authority (FCA) and offers a range of trading instruments, including forex, commodities, indices, shares, and cryptocurrencies.

ActivTrades also provides its clients with a variety of trading platforms, including the popular MetaTrader 4 and 5 platforms, as well as its proprietary platform, ActivTrader. The broker aims to provide its clients with a safe and transparent trading environment, offering segregated accounts, negative balance protection, and a range of educational resources.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

ActivTrades offers a good range of trading instruments, is regulated by a reputable financial authority, and offers various account types with negative balance protection and segregated accounts.

However, some clients have reported issues with trading platform stability. It's important for potential clients to carefully consider their trading needs and preferences before choosing ActivTrades as their broker.

| Pros | Cons |

| • Regulated by FCA | • SCB license is offshore |

| • Segregated accounts and Negative Balance Protection | • Negative reviews from clients |

| • Wide range of trading products | • High minimum deposit requirement |

| • Demo and Islamic accounts offered | • Fees charged for Credit/Debit card deposits |

| • Variety of trading platforms including MetaTrader and ActivTrader | |

| • Free educational resources and market analysis | |

| • Multiple funding options | |

| • 24/5 multilingual customer support |

There are many alternative brokers to ActivTrades depending on the specific needs and preferences of the trader. Some popular options include:

Darwinex - a regulated broker that offers unique social trading features, with a focus on transparency and competitive pricing.

Dukascopy - a Swiss-based broker that provides excellent trading technology, including a proprietary trading platform, but it has high account minimums and limited product offerings.

Hantec Markets - a UK-based broker that offers a user-friendly trading platform and competitive pricing, but its educational resources are limited compared to some other brokers.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

ActivTrades is a regulated broker by the Financial Conduct Authority (FCA) and and has been in operation for several years, which are positive aspects in terms of its reliability and security. The fact that they offer segregated accounts and negative balance protection adds an extra layer of protection for its clients. However, negative reviews from clients suggest that there may be issues with their trading platform.

Based on the information available, ActivTrades appears to be a reliable and trustworthy broker. However, as with any investment, there is always some level of risk involved, and it is important for traders to do their own research and carefully consider their options before investing.

At ActivTrades, you can trade over 1,000 different CFD instruments across 7 asset classes, including forex, shares, indices, ETFs, commodities, bonds, and spread betting. This provides clients with a diversified portfolio and the opportunity to trade a range of different assets.

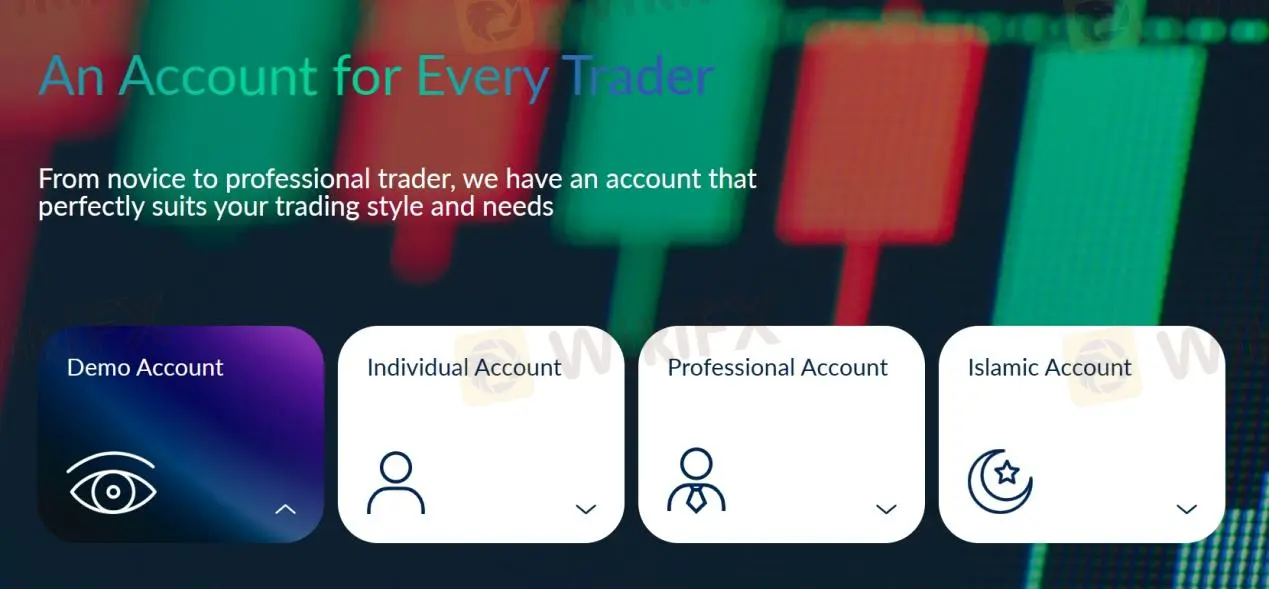

Traders can open either an Individual Account (which allows them to trade small and micro lots) or a Professional Account (minimum financial portfolio size of $500,000, Dedicated Account Manager) with ActivTrades. Beginner traders can test out the trading interface and get a feel for how the broker works with a free demo account. People who adhere to Sharia law can choose from two more account options: an Islamic (Swap-Free) Account.

Leverage is capped at 1:30 in line with the EMSA regulations, the maximum leverage is 1:30 for currency pairs, 1:20 for indices and shares, 1:10 for commodities and 1:5 for cryptocurrencies. While only the Pro account holders can enjoy the maximum leverage of 1:400.

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

ActivTrades' currency spreads begin at 0.5 pips, and its spreads on indices and financial CFDs are also 0.5 pips, both of which are competitively cheap.

It's also important to note that this is not a situation that can be fixed overnight (the underlying Futures price already accounts for the adjustment). Commissions for trading shares as CFDs begin at €1 per side, whereas spread betting on shares incurs no fees beyond 0.10% of the transaction value.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission (per lot) |

| ActivTrades | 0.5 pips | €1 |

| Darwinex | 0.0 pips | €4.5 |

| Dukascopy | 0.2 pips | $7.0 |

| Hantec Markets | 1.2 pips | $6.0 |

Note: Spreads can vary depending on market conditions and volatility.

ActivTrades also stands out due to its platform selection, which features not only the company's proprietary platform - ActivTrader but also the popular MT4 and MT5 platforms, as well as a set of unique Add-Ons.

• Web Trading

The ActiveTrades trading platform is web-based, allowing trades to be made directly in the browser; it also has a dedicated app for the iPhone and iPad. The platform has an easy-to-use design but advanced functionality, such as access to more than 90 technical analysis indicators, for seasoned traders of all trading types.

• ActivTrader

The upgraded ActivTrader platform incorporates cutting-edge tools and features to provide a revolutionary trading environment. You can gain exposure to the Forex, Commodities, Financial & Indices, Shares, and Exchange-Traded Funds markets and trade over a thousand CFDs.

• MetaTrader4

ActivTrades' desktop trading platform MT4 is available to those who prefer a more traditional trading experience. In addition, the technology has been upgraded in accordance with the firm's security standards, and the use of sophisticated charts has made it possible to automate the tactics using EAs.

• MetaTrader5

New and improved features take online trading to a whole new level in MetaTrader5. More than 450 CFDs on equities with diverse characteristics and the option to auto-trade are available on the platform, and trading statements are seamlessly integrated.

Overall, ActivTrades' trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders. See the trading platform comparison table below:

| Broker | Trading Platforms |

| ActivTrades | MetaTrader 4, MetaTrader 5, ActivTrader |

| Darwinex | MetaTrader 4, DARWINEX WEBTRADER |

| Dukascopy | JForex, WebTrader, MT4, MT5 |

| Hantec Markets | MetaTrader 4 |

Note: Some brokers may offer additional trading platforms or versions, but this table includes the most commonly used ones.

In addition to the robust platform itself, a plethora of utility extensions is available to further develop trading functionalities and automation features, as well as to provide decision-making and signaling instruments. The term “indicators” can refer to a wide variety of tools, from those used for making decisions to those used for trading.

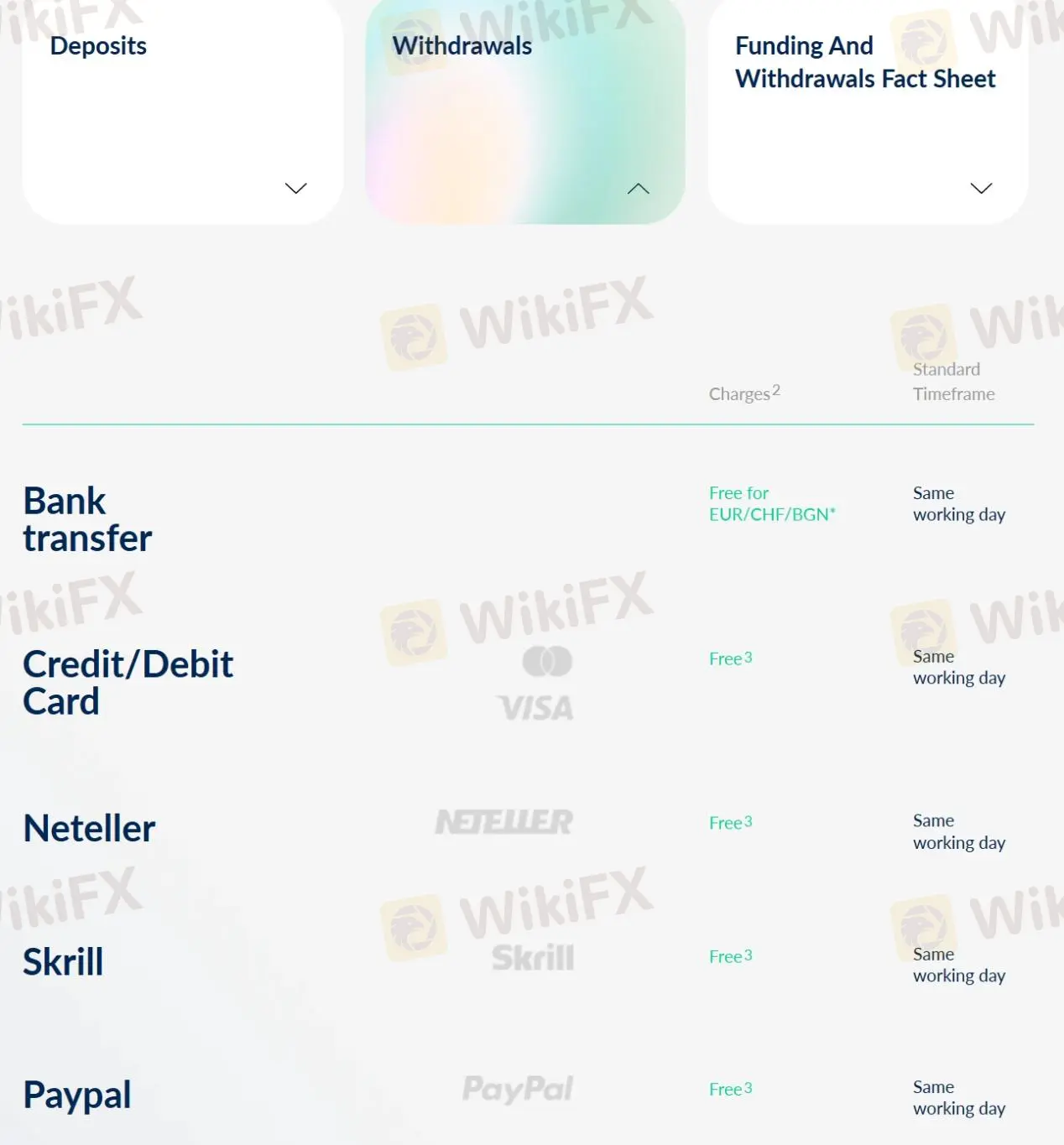

ActivTrades accepts deposits via Bank Transfers, Credit/Debit cards, Neteller, Skrill, Sofort, and PayPal, while only Sofort is excluded from withdrawal methods.

Base Currencies:

EUR, USD, GBP or CHF

The minimum deposit is as high as $500.

| ActivTrades | Most other | |

| Minimum Deposit | $500 | $100 |

Deposits via credit/debit card UK&EEA are charged 0.5% fees, while credit/debit card non-EEA are charged 1.5% fees. Other deposits and all withdrawals are free of charge.

Most deposits are said to take 30 minutes (except for Bank Transfer deposits are processed on the same working day), while all withdrawals can be processed on the same working day.

More details can be found in the table below:

| Payment Options | Fee | Processing Time | ||

| Deposit | Withdraw | Deposit | Withdraw | |

| Bank Transfer | Free | Free for EUR/CHF/BGN | Same working day | Same working day |

| Credit/Debit card | 0.5% (UK & EEA), 1.5% (non EEA) | Free | 30 minutes | |

| Neteller | Free | |||

| Skrill | ||||

| PayPal | ||||

| Sofort | / | / | ||

See the deposit & withdrawal fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee |

| ActivTrades | Varies depending on method | Free |

| Darwinex | Free | Free |

| Dukascopy | Free | Varies depending on method |

| Hantec Markets | Free | Free |

Note: Fees and charges are subject to change. This table is only for informational purposes and may not reflect the latest fee structure of the brokers mentioned. It is recommended to always check with the brokers directly for the latest fees and charges.

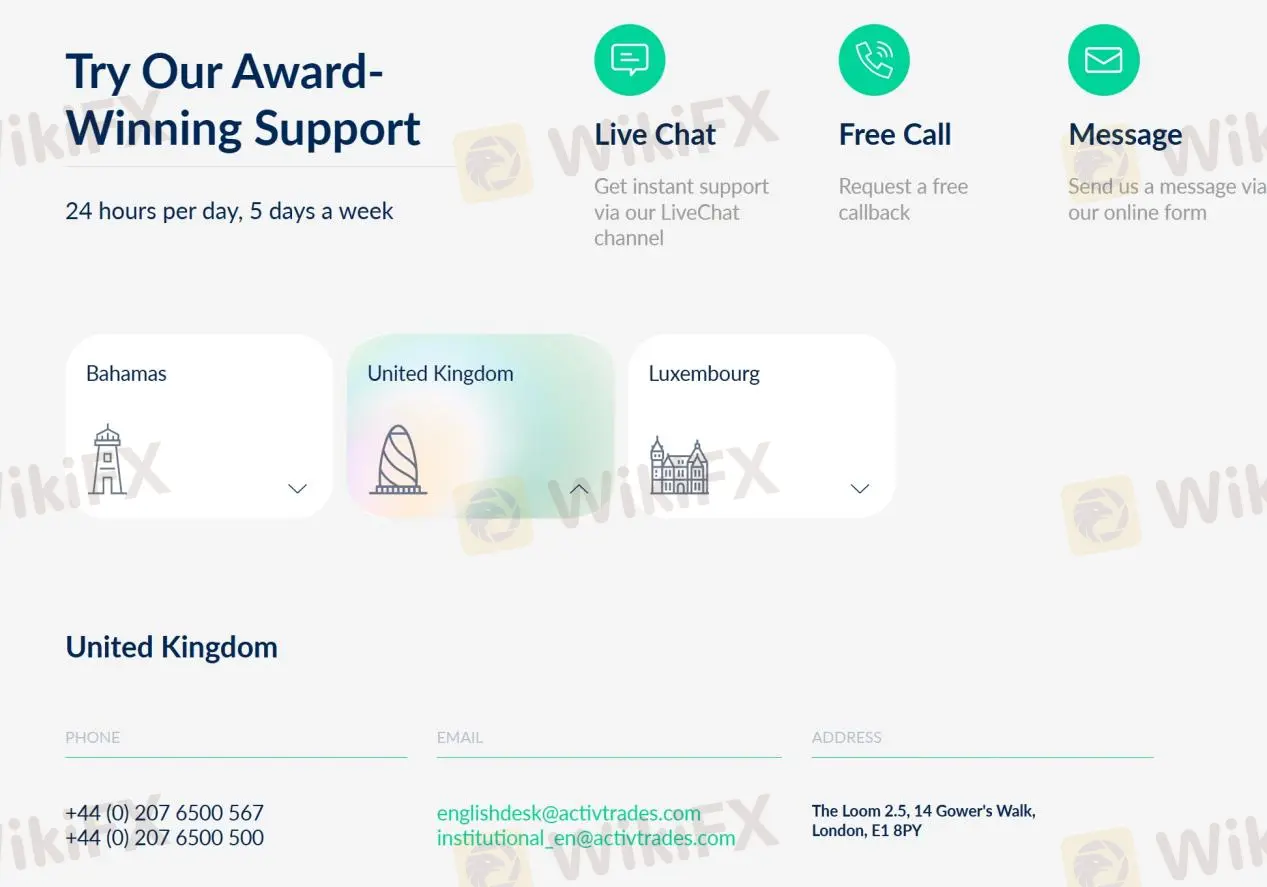

ActivTrades offers 24/5 multilingual customer service via live chat, telephone: +44 (0) 207 6500 567, +44 (0) 207 6500 500, email: englishdesk@activtrades.com, institutional_en@activtrades.com, request a callback, or messaging online. Help Center is also available. You can also follow this broker on social networks such as Twitter, Facebook, Instagram and YouTube. Company address: The Loom 2.5, 14 Gower's Walk, London, E1 8PY.

Overall, ActivTrades' customer service is considered reliable and responsive, with various options available for traders to seek assistance.

| Pros | Cons |

| • 24/5 multilingual live chat | • No 24/7 customer support |

| • Multi-channel support | |

| • Help Center offered | |

| • Updated social media |

Note: These pros and cons are subjective and may vary depending on the individual's experience with ActivTrades' customer service.

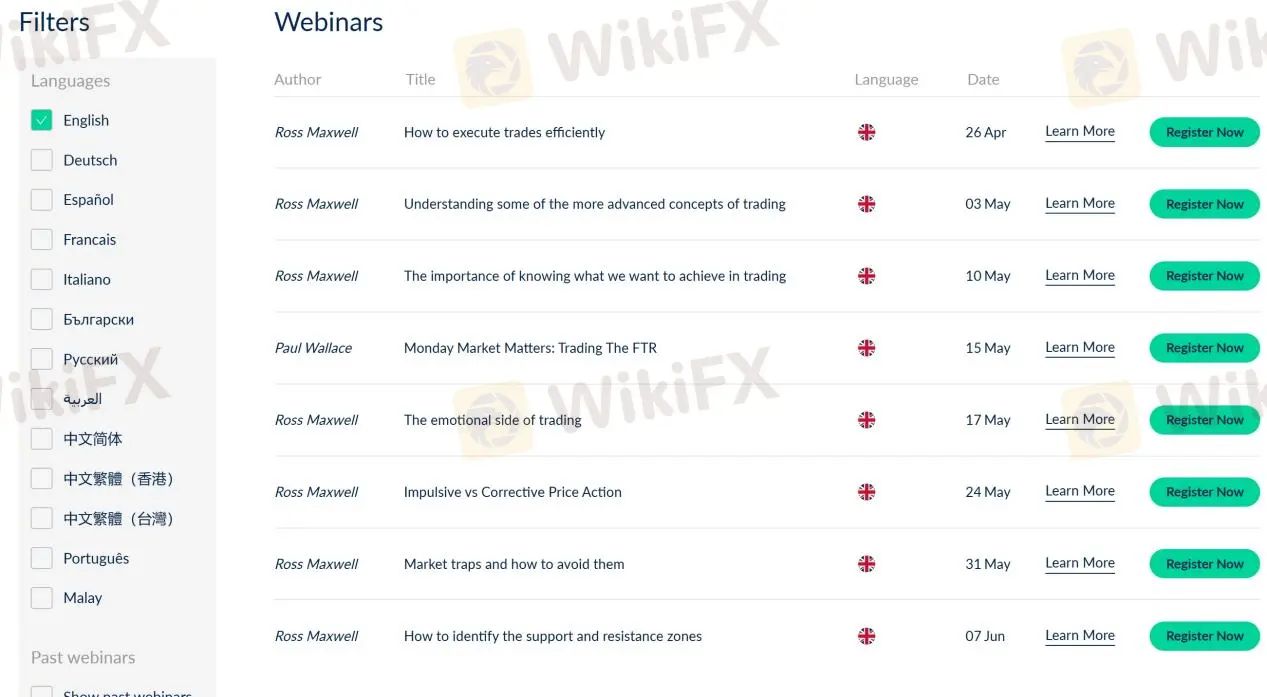

ActivTrades provides comprehensive educational resources organized by subject, including webinars, seminars, manuals, news & analysis. In addition, you get access to a demo account, robust analytical and technical analysis tools within the platforms and exclusive add-ons that will help you study and trade more effectively.

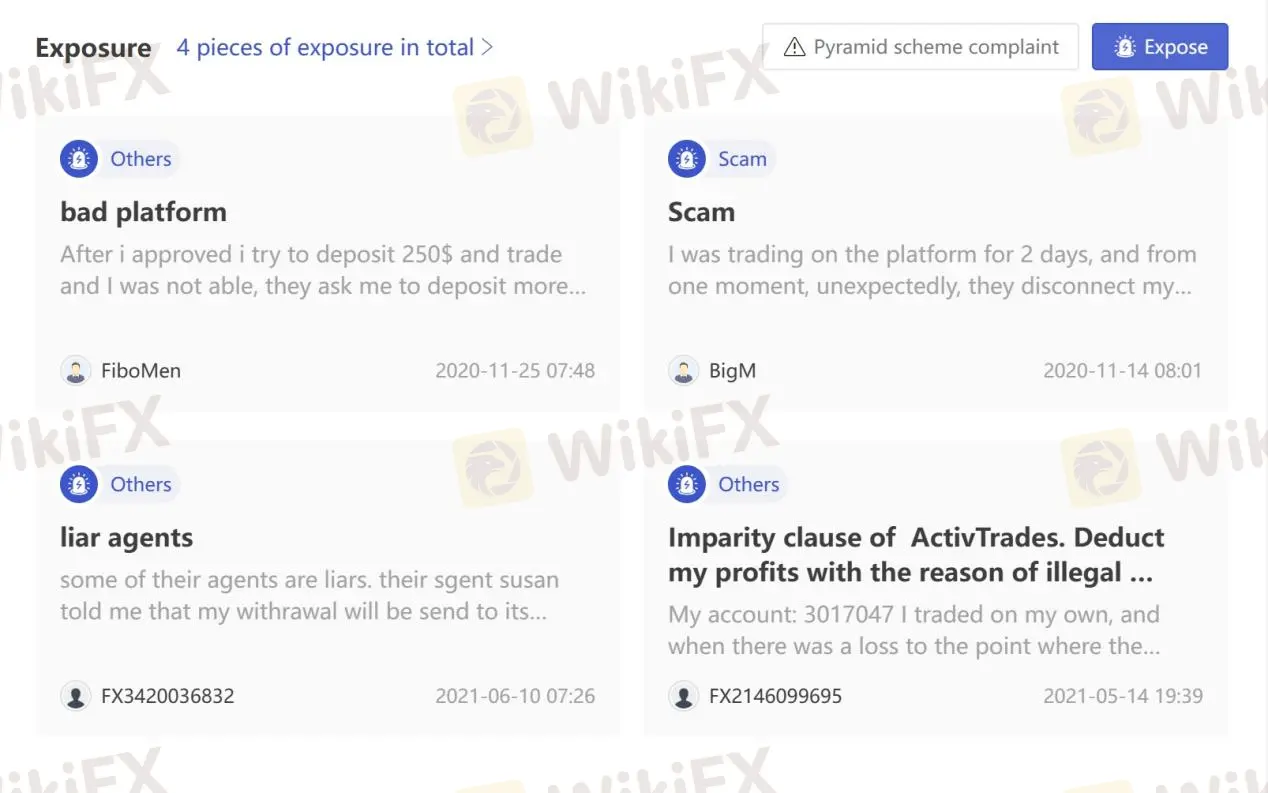

On our website, you can see that some users have reported scams. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

As a whole, ActivTrades is a regulated broker that provides a wide range of trading instruments and platforms. The company offers several account types and has competitive trading fees with low spreads. The broker also provides negative balance protection and segregated client accounts.

However, ActivTrades has some negative reviews from clients regarding trading platform. Additionally, the broker charges deposit fees for some payment methods. Overall, ActivTrades may be a good option for experienced traders who prioritize low trading fees and a variety of trading instruments.

| Q 1: | Is ActivTrades regulated? |

| A 1: | Yes. It is regulated by FCA. |

| Q 2: | Does ActivTrades offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does ActivTrades offer the industry-standard MT4 & MT5? |

| A 3: | Yes. Both MT4 and MT5 are available. |

| Q 4: | What is the minimum deposit for ActivTrades? |

| A 4: | The minimum initial deposit with ActivTrades is $500. |

| Q 5: | Is ActivTrades a good broker for beginners? |

| A 5: | Yes. ActivTrades is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 and MT5 platforms. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| Feature | Information |

| Registered Country/Region | Australia |

| Regulation | ASIC |

| Market Instrument | Forex, Commodities, Major Indices, Shares |

| Account Type | demo account and live account |

| Demo Account | yes |

| Maximum Leverage | 1:200 |

| Spread (EURUSD) | From 1 pip |

| Commission | $0 |

| Trading Platform | WebTrader and Mitrade Mobile App |

| Minimum Deposit | N/A |

| Deposit & Withdrawal Method | Visa/MasterCard, Online Banking, e-Wallets, ATM Cards, QR Code Payments, and Bank Transfers |

MiTRADE, based in Australia and regulated by ASIC, offers a range of features and services to its clients. The broker provides a proprietary trading platform that allows traders to access the financial markets with competitive spreads starting from 0.0 pips. Tradable assets include forex, indices, shares, and commodities, providing opportunities for diversification. MiTRADE offers both demo and live accounts, catering to traders of all levels. For those seeking an Islamic account, MiTRADE provides that option as well. Customer support is available 24/5 through various channels, including email, live chat, telephone, and social media platforms. Payment methods are diverse, including Visa/Mastercard, online banking, e-wallets, ATM cards, QR code payment, and bank transfer. Additionally, MiTRADE offers a rich selection of educational tools, encompassing trading knowledge, risk management, real-time strategies, and analysis.

Here is the home page of this brokers official site:

MiTRADE is a broker that operates under the regulation of the Australian Securities and Investments Commission (ASIC). This regulatory body ensures that MiTRADE complies with the necessary standards and guidelines to provide a safe and transparent trading environment for its clients. The ASIC regulation helps to protect the interests of traders and promotes fair practices in the financial industry. By being regulated by ASIC, MiTRADE demonstrates its commitment to maintaining high standards of professionalism and adhering to regulatory requirements.

MiTRADE offers several advantages, including regulation by ASIC and a wide range of tradable assets and services. They also provide a demo account for traders to practice their strategies. Additionally, the broker offers diverse payment methods, allowing for convenient transactions. However, there are some drawbacks to consider. The trading platform provided by MiTRADE is considered weak, which may impact the overall trading experience. Moreover, there is limited information available regarding leverage and minimum deposit requirements. Traders should be aware that overnight fees are charged, which can affect their trading costs. Additionally, it's important to note that MiTRADE does not offer 24/7 customer support, which may be inconvenient for traders seeking immediate assistance outside of regular business hours.

| Pros | Cons |

| Regulation by ASIC | Weak trading platform |

| Wide range of tradable assets and services | Limited information on leverage and minimum deposit |

| Availability of demo account | Leverage not specific |

| Diverse payment methods | Overnight fees charged |

| No 24/7 customer support |

MiTRADE offers a wide range of products and services for traders. They provide access to various financial markets, including forex, indices, shares, and commodities. Traders can engage in forex trading, speculating on the price movements of different currency pairs. Additionally, they can trade popular indices, giving them exposure to the performance of a basket of stocks from specific markets. MiTRADE also offers the opportunity to trade shares, allowing clients to invest in individual company stocks. Moreover, traders can participate in commodity trading, taking positions on the price fluctuations of commodities such as gold, oil, and agricultural products.

In addition to these market offerings, MiTRADE provides valuable services to enhance traders' knowledge and skills. They offer educational resources, providing trading knowledge to help traders understand the markets better. This includes information on risk management, which is crucial for effective trading. Traders can access real-time strategies and analysis, enabling them to make informed trading decisions based on market trends and insights. With these products and services, MiTRADE aims to empower traders with the tools and knowledge they need to navigate the financial markets effectively.

MiTRADE offers two types of accounts for traders: a live account and a demo account. The live account is designed for real trading with actual funds, allowing traders to participate in the financial markets and execute trades using their own capital. The minimum deposit for opening a live account with MiTRADE is undisclosed. For specific information regarding the minimum deposit requirement, it is advisable to contact MiTRADE or visit their website. This broker offers USD or AUD as a base currency for their trading accounts.

On the other hand, the demo account is a simulated trading environment that provides users with virtual money to practice trading strategies and explore the platform's features. Each demo account is initialized with a generous amount of USD50,000 or AUD50,000 virtual money, enabling traders to gain hands-on experience without any financial risk. By offering both types of accounts, MiTRADE caters to both novice traders who want to learn and experienced traders who seek to execute live trades in the global markets.

To open an account with MiTRADE, you can follow a simple process:

Visit the MiTRADE website: Go to the official MiTRADE website using a web browser. Click on “Open Account” or “Register”: Look for the “Open Account” or “Register” button on the homepage or the main navigation menu.

2. Fill in the Registration Form: Provide the required information in the registration form. This usually includes personal details such as your name, email address, phone number, and country of residence. You may also need to create a username and password for your account.

3. Complete the Verification Process: MiTRADE may require you to verify your identity and address by submitting supporting documents. This could include a copy of your identification document (such as a passport or driver's license) and proof of address (such as a utility bill or bank statement).

4. Review and Agree to Terms and Conditions: Read through the terms and conditions of MiTRADE's services carefully. Make sure you understand and agree to the terms before proceeding.

5. Fund Your Account: Once your account is successfully registered and verified, you can proceed to fund your trading account. MiTRADE typically offers various deposit methods such as bank transfer, credit/debit card, or online payment systems. Choose the method that is most convenient for you and follow the instructions provided.

6. Start Trading: After your account is funded, you can access the MiTRADE trading platform using your login credentials. Explore the platform, familiarize yourself with its features, and start trading the available financial instruments, such as forex, indices, commodities, or cryptocurrencies.

MiTRADE offers trading leverage of up to 1:200. It is crucial to understand that high leverage can amplify both potential profits and risks. While it may be appealing to experienced traders who are familiar with managing leverage effectively, inexperienced traders are advised to exercise caution and carefully consider their risk tolerance. It is important to thoroughly educate oneself about the implications of trading with high leverage and implement appropriate risk management strategies to protect capital.

MiTRADE offers floating spreads for various trading instruments. The spread on the popular EURUSD currency pair starts from 1 pip, providing traders with a competitive option for trading this major pair. The EURGBP pair has a spread starting from 1.4 pips, while UKOIL and USOIL (Crude Oil) have spreads of approximately 0.06 pips, offering traders a tight spread option for energy commodities. For precious metals, the XAUUSD (Gold) pair has a spread starting from 0.44 pips, and the XAGUSD (Silver) pair has a spread starting from 0.3 pips. Notably, MiTRADE does not charge any commissions on trades, which can be advantageous for traders seeking cost-effective trading options. Traders should consider these spread details when evaluating trading costs and potential profitability on different instruments offered by MiTRADE.

MiTRADE does not charge any additional fees apart from overnight fees. Overnight fees, also known as swap fees or rollover fees, are charges applied when a position is held open overnight. These fees are associated with the cost of keeping positions open beyond the trading day and vary depending on the financial instrument and prevailing interest rates. It is important to note that MiTRADE does not charge any other fees such as deposit fees, withdrawal fees, or inactivity fees.

MiTRADE offers its own proprietary trading platform for clients, but it does not provide the popular MetaTrader 4 (MT4) or MetaTrader 5 (MT5) trading platforms. The proprietary platform is designed to meet the specific needs and preferences of MiTRADE's traders. The platform offers a user-friendly interface, providing access to real-time market data, charting tools, and a range of order types. It caters to the needs of both novice and experienced traders, offering a seamless trading experience across different devices.

Traders can fund MiTRADE via Visa/MasterCard, Online Banking, e-Wallets (Skrill, Momo, Zalo, Touch'n GO and Boost etc.), ATM Cards, QR Code Payments, and Bank Transfers. Online Banking deposits can be processed within 1 business day, while other deposits are generally instant. Please note that some deposit methods are only available in selected countries/regions.

MiTRADE accepts withdrawals with Bank Cards (3-5 business days) and Bank Accounts (within 3 business days). Please note that the processing time could vary among individual banks.

MiTRADE offers 24/5 customer support service with a team of dedicated professionals. They can be reached via email: cs@mitrade.com. You can also fill out the ‘contact us’ form on the brokers website, and a customer support specialist will attend to you as soon as possible. Mitrade is also available on social media: Instagram, Facebook, Twitter, YouTube and LinkedIn.

Traders can also visit the team at their offices:

• Mitrade Holding Ltd: 215-245 N Church Street, 2nd Floor, White Hall House, George Town, Grand Cayman, Cayman Islands;

• Mitrade Global Pty Ltd: Level 13, 350 Queen Street, Melbourne, VIC 3000, Australia;

• Mitrade International LtdSuite 707 & 708, 7th Floor, St James Court, St Dennis Street, Port Louis, Mauritius.

MiTRADE provides a range of educational resources to enhance traders' knowledge and skills. Their learning materials cover the basics of trading, offering educational content to help traders understand the fundamental concepts and strategies. MiTRADE also offers insightful market analysis and commentary to keep traders informed about the latest market trends and developments. Additionally, they have an academy section dedicated to providing comprehensive trading courses and tutorials, allowing traders to deepen their understanding of various trading techniques and tools.

Besides, MiTRADE also provides a blog section where traders can access a wealth of informative articles and blog posts. The blog covers a wide range of topics related to trading, including market analysis, trading strategies, risk management, and trading psychology

In conclusion, MiTRADE has both positive and negative aspects to consider. On the positive side, the broker is regulated by ASIC, ensuring a level of trust and security for traders. They offer a wide range of tradable assets and services, including forex, indices, shares, and commodities, catering to diverse trading preferences. The availability of a demo account allows users to practice and refine their trading strategies without risking real funds.

However, there are some negative aspects to be aware of. The trading platform offered by MiTRADE is considered weak, potentially limiting the advanced features and tools available for traders. Moreover, there is limited information provided regarding leverage and minimum deposit requirements, which may cause uncertainty for potential clients. Traders should also consider the overnight fees charged by the broker, as this can affect the overall trading costs. Lastly, the absence of 24/7 customer support may be a drawback for traders who require immediate assistance outside of regular business hours.

| Q 1: | Is MiTRADE regulated? |

| A 1: | Yes. MiTRADE is regulated by the ASIC under regulatory license number 398528. |

| Q 2: | At MiTRADE, are there any regional restrictions for traders? |

| A 2: | Yes. The information on MiTRADEs site is not intended for residents of the United States, Canada, Japan, New Zealand or use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. |

| Q 3: | Which live trading accounts does MiTRADE offer? |

| A 3: | MiTRADE offers one live account and a demo account to choose from. |

| Q 4: | Are there any fees for using the trading platform? |

| A 4: | MiTRADE is a commission-free trading platform. The main cost of trading comes from the low spreads it charges, which vary among different markets. |

| Q 5: | Is MiTRADE a good broker for beginners? |

| A 5: | Yes. MiTRADE is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive activtrades and mitrade are, we first considered common fees for standard accounts. On activtrades, the average spread for the EUR/USD currency pair is -- pips, while on mitrade the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

activtrades is regulated by FCA,SCB. mitrade is regulated by ASIC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

activtrades provides trading platform including -- and trading variety including --. mitrade provides trading platform including -- and trading variety including --.