No data

Do you want to know which is the better broker between instaforex and Ontega ?

In the table below, you can compare the features of instaforex , Ontega side by side to determine the best fit for your needs.

EURUSD: 0.5

XAUUSD: --

Long: -6.23

Short: 0.8

Long: -21.82

Short: -7.01

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of instaforex, ontega lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Registered in | Cyprus |

| Regulated by | CYSEC |

| Year(s) of establishment | 5-10 years |

| Trading instruments | currency pairs, stocks, indices, precious metals, energies, commodities, cryptocurrencies and futures |

| Minimum Initial Deposit | $1 |

| Maximum Leverage | 1:1000 |

| Minimum spread | 0.0 pips onwards |

| Trading platform | MT4, MT5 |

| Deposit and withdrawal method | Bank wire transfer and many other methods |

| Customer Service | Email/phone number/address/live chat/more |

| Fraud Complaints Exposure | No for now |

General information and regulations of InstaForex

InstaForex brand was founded in 2007 and claims to be the choice of more than 7 million brokers. InstaForex website may be very complex at first glance, but if you take a moment to look at it closely, you will find a wealth of content. The information bar on both sides of the page is full of attractive content, such as news, widgets, real-time charts, customer service and much more.

In the following article, we will analyze the features of this merchant in all its dimensions, providing you with easy and well-organized information. If you are interested, read on. Reading this article will take you approximately 7 minutes.

At the end of the article, we will also briefly extract the most significant advantages and disadvantages so that you can get an idea of the broker's features at a glance.

Market instruments

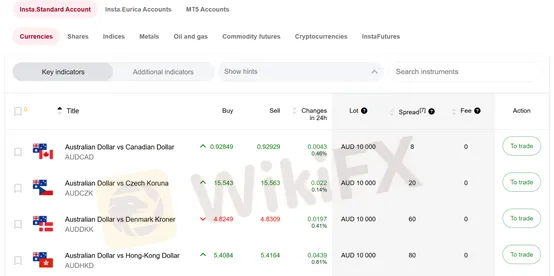

As we have said before, InstaForex web pages are very informative. On this trading products page you can see not only the trading products, but also the difference in commissions and spreads between different accounts. We can trade currency pairs, stocks, indices, precious metals, energies, commodities, cryptocurrencies and futures.

Spreads and commissions for trading with InstaForex

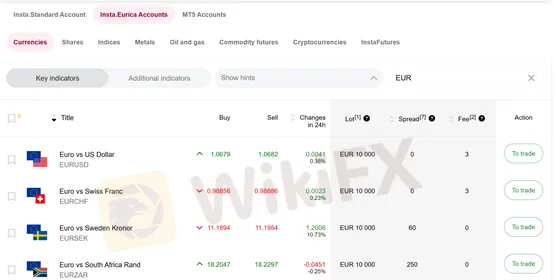

Let's take currency pairs as an example. Spreads and commissions vary on different accounts. On the MT5 and Standard accounts the spread is about 3 pips and there is no commission, while on the Eurica account the spread is 0 and the commission varies from 3-12 USD.

We can venture to conclude that Eurica is suitable for long-term traders who trade less frequently, while the other two accounts are suitable for short-term traders who trade more frequently.

Account Types for InstaForex

Demo account: InstaForex offers a demo account for testing a little on the financial market without the risk of losing money. Opening a demo account, according to the company, is as easy as ABC.

Live account: there are in total 4 types of accounts: insta standard, insta eurica, cent standard and cent eurica. The minimum deposit for opening an account at InstaForex is just 1 USD, and the trading conditions also seem to be quite favorable.

Trading platforms offered by InstaForex

As for trading platforms, clients can choose from the market leaders MetaTrader4 and MetaTrader5, which can be accessed from any device.

However, have you ever wondered or are you wondering which platform you should use? Our team has the corresponding article for your reference. The article details the similarities and differences between the two and gives specific advice.

https://www.wikifx.com/es/wikishow/202207208464173722.html

Leverage offered by InstaForex

InstaForex offers a maximum leverage of up to 1:1000, which is a generous offer and ideal for professional traders and scalpers. However, since leverage can magnify your profits, it can also result in a loss of capital, especially for inexperienced traders. Therefore, traders must choose the right amount according to their risk tolerance.

Deposit and withdrawal methods and fees

Unlike some brokers that lack information, InstaForex is very generous in providing information. If you carefully browse their website, you can find a wealth of information. As for deposits and withdrawals, InstaForex shows all methods, required fees and arrival times clearly on a single page.

Educational resources

InstaForex educational resources are extensive. Online charts, market analysis, Forex calculators, indicators, articles, questions and answers, glossary... Whether you choose InstaForex as your broker or not, you can make the most of the resources available here.

Customer support of InstaForex

Call back, live chat, WhatsApp, email...with numerous channels and 24/7 service, clients could get help whenever they have trading-related problem.

Here are more details about the customer service.

Languages: there are total sixteen languages on InstaForex website, which could meet the needs of most of its customers.

Service hours: 24/7

Phone: you could fill in a form, indicating your country, your preferred language and time, the team will call you whenever you want, and the service is totally free of charge.

Email: support@mail.instaforex.com

Social networks: Facebook, Twitter, YouTube, Telegram, Instagram

Users exposures on WikiFX

We have not received any reports of fraudulent activity at this time.

Advantages and disadvantages of InstaForex

Advantages:

Well regulated

MT4, MT5

Sufficient information

Educational resources

Many instruments available

Demo account

Disadvantages:

Low leverage

Frequent asked questions about InstaForex

Is this broker well regulated?

Yes, it is currently effectively regulated by CYSEC in Cyprus.

Does this broker offer MT4/MT5?

Yes, InstaForex offers both MT4 and MT5 for you to choose from.

| Company Name | Ontega |

| Headquarters | Cyprus |

| Regulations | Suspected Fake Clone |

| Market Instruments | Cryptocurrencies, Commodities, Indices, Shares, Currencies |

| Leverage | Varies (e.g., 1:200 for Forex, 1:10 for CFDs on Shares) |

| Commission Fee | Rollover fees |

| Minimum Deposit | $200 |

| Deposit/Withdraw Methods | VISA, MasterCard, Maestro, Skrill, Neteller, etc. |

| Trading Platforms | Web-based platform |

| Customer Support | Email, Telephone, WhatsApp |

| Educational Resources | N/A |

Ontega is a trading broker headquartered in Cyprus, with a focus on providing access to various financial markets. They offer an array of market instruments, including cryptocurrencies, commodities, indices, shares, and currencies, allowing traders to diversify their portfolios. The platform prides itself on its user-friendly approach, featuring a web-based trading platform that requires no installation, making it accessible from both desktop and mobile devices. Additionally, Ontega provides multiple customer support channels, including email, telephone, and WhatsApp, to assist traders with their inquiries and concerns.

Ontega's regulatory status has raised suspicions in the trading community as it lacks clear and established regulatory oversight from recognized financial authorities. Traders are encouraged to exercise caution when considering this platform due to the absence of a well-known regulatory body overseeing its operations. The lack of regulatory oversight can pose potential risks, as traders may not have the same level of protection and assurance as they would with brokers regulated by respected authorities.

Given the concerns surrounding Ontega's regulatory status and the absence of a verifiable track record with recognized regulators, potential investors and traders should conduct thorough research and exercise vigilance. It is crucial to prioritize safety and security when selecting a trading platform, and choosing a broker with a strong regulatory framework can provide an added layer of protection for traders' funds and interests.

Ontega offers a user-friendly one-click registration process, making it easy for traders to get started quickly. The platform's web-based nature eliminates the need for installations, ensuring accessibility across various devices. It provides a range of trading instruments, including cryptocurrencies, commodities, indices, shares, and currencies, catering to diverse trading preferences. Additionally, Ontega offers multiple customer support channels, such as email, telephone, and WhatsApp, providing options for assistance. Lastly, it provides a variety of leverage options, allowing traders to choose their preferred level of risk exposure.

Ontega's regulatory status raises concerns, as it lacks clear oversight from recognized financial authorities, potentially posing risks to traders. The absence of comprehensive educational resources is a drawback for those seeking in-depth learning materials. While the platform offers various customer support channels, the disclaimer regarding WhatsApp communication and potential third-party access to information may raise privacy concerns. Moreover, the 1:10 maximum leverage for CFDs on shares may limit trading flexibility for some investors. Lastly, the lack of transparency on fees beyond rollover fees could lead to uncertainty about the cost of trading.

| Pros | Cons |

| Easy one-click registration | Unclear regulatory status |

| Web-based platform | Limited educational resources |

| Diverse range of trading instruments | Privacy concerns with WhatsApp communication |

| Multiple customer support channels | 1:10 maximum leverage for CFDs on shares |

| Flexible leverage options | Lack of transparency on fees beyond rollover fees |

Ontega offers a diverse range of market instruments, providing traders with opportunities to diversify their portfolios and explore various asset classes. Among the options available are cryptocurrencies, including popular assets like Bitcoin and Ethereum. Cryptocurrencies have gained significant attention in recent years, offering traders the chance to speculate on the price movements of these digital assets, which can be highly volatile and present both potential rewards and risks.

In addition to cryptocurrencies, Ontega provides access to commodities, enabling traders to participate in the commodities market. This includes various commodities such as gold, oil, and agricultural products. Commodity trading can be appealing to investors seeking to hedge against inflation or capitalize on supply and demand dynamics in these markets. Ontega also offers indices, shares, and currencies for trading, allowing traders to engage in global financial markets and potentially benefit from price fluctuations in major stock indices, individual company shares, and currency pairs.

Opening an account with Ontega is a straightforward process that can be completed in a few simple steps.

Go to Ontega's official website to begin the account registration process.

Locate and click on the “Open an Account” or similar button on the website's homepage.

Provide your personal information, including your name, email address, and contact details, as requested in the registration form.

After completing the form, check your email inbox for a verification link from Ontega and click on it to confirm your email address.

Select the type of trading account you wish to open, taking into consideration your trading preferences and requirements.

Deposit the initial funds into your Ontega trading account using one of the supported payment methods to start trading.

Once these steps are completed, you'll have a fully registered Ontega trading account, ready to explore the platform's features and engage in online trading activities.

Ontega imposes fees primarily in the form of rollover fees, which can vary depending on the asset class being traded. For cryptocurrencies, traders should be aware of a 0.50% rollover fee, which is applied when positions are held overnight. This fee is a percentage of the position's value and is important to consider when planning long-term cryptocurrency trades.

In contrast, commodities, indices, shares, and currencies all incur a 0.015% rollover fee for positions held overnight. While these fees are relatively low compared to some other brokers, they can still accumulate over time for traders who frequently hold positions overnight.

Ontega offers a range of maximum leverage levels across different asset classes, catering to traders with varying risk appetites and strategies. In foreign exchange currency trading (Forex) and commodities trading, Ontega provides a maximum leverage of 1:200. This level of leverage allows traders to control a more substantial position size relative to their initial capital, potentially amplifying both profits and losses. While higher leverage can enhance the potential for significant gains, it also heightens the risk of substantial losses, making it crucial for traders to exercise prudent risk management practices.

For CFD trading on indices, Ontega offers a maximum leverage of 1:100, which still provides traders with considerable leverage to capitalize on price movements in these markets. However, CFD trading on shares is subject to a lower maximum leverage of 1:10, reflecting the higher risks associated with individual company stocks. In the cryptocurrency market, Ontega offers a maximum leverage of 1:2, highlighting the high volatility and risk inherent in the crypto space. Additionally, Ontega provides the option of 5 protected positions with a maximum leverage of 1:20, which can serve as a risk management tool to limit potential losses.

Ontega offers traders a user-friendly online trading platform with several notable features. One of its key advantages is the straightforward one-click registration process, allowing users to open an account swiftly within just 5 minutes. This simplicity can be appealing to new traders looking to get started quickly. Additionally, Ontega's web-based platform eliminates the need for installations or downloads, ensuring accessibility across various desktop and mobile devices.

Moreover, Ontega places a strong emphasis on the fusion of learning and trading, aiming to provide traders with valuable skills and knowledge. The platform offers a range of tools, including Stop Limit, Stop Loss, Trailing Stop, and Guaranteed Stop, along with free email and push notifications on market events, price alerts, and market updates. This suite of tools empowers traders to make informed decisions and manage their risk effectively. Furthermore, Ontega allows users to customize their platform settings, tailoring it to their preferences and risk management strategies. While these features may be appealing to traders seeking convenience and control, it's essential for individuals to conduct their due diligence and carefully assess Ontega's offering and suitability for their trading needs.

Ontega offers a variety of payment methods to cater to the diverse needs of its traders. These methods include well-known options such as VISA, MasterCard, and Maestro, providing a convenient way for users to deposit funds into their trading accounts using their credit or debit cards. This can be especially convenient for those who prefer traditional banking methods for financial transactions.

In addition to card payments, Ontega also supports electronic payment solutions like NETELLER and Skrill, which offer an added layer of security and flexibility for users. These e-wallet options can be particularly attractive to traders looking for fast and efficient ways to manage their funds. Furthermore, Ontega provides the option of Bank Transfers, ensuring that traders can initiate direct transfers from their bank accounts if they prefer this method.

Ontega provides multiple avenues for customer support, ensuring that traders have access to assistance when needed. They offer an email support option through Customer.Service@ontega.com, allowing users to reach out with their inquiries or concerns. Additionally, Ontega provides telephone support during specified operating hours from Monday to Friday, between 08:00 and 19:00 GMT+2. This direct phone support can be valuable for traders seeking immediate assistance and guidance with their trading-related issues.

For added convenience, Ontega also offers customer support via WhatsApp at +447520640100. While this channel provides a modern and efficient way to communicate with the support team, it's worth noting the company's disclaimer regarding potential third-party access to information during these WhatsApp communications. Traders should consider their privacy and take necessary precautions when using this platform.

Ontega is notably limited in terms of educational resources, which can be a drawback for traders, especially those who are new to the financial markets and seeking comprehensive educational materials. The platform does not offer a robust selection of tutorials, webinars, or educational articles that can assist traders in developing their skills and understanding market dynamics. As a result, individuals looking for in-depth educational resources may find Ontega lacking in this aspect, and they might need to seek supplementary learning materials from external sources to enhance their trading knowledge and proficiency.

In summary, Ontega is a trading platform that offers a user-friendly experience with one-click registration and a web-based interface, making it accessible across various devices. It provides a diverse range of trading instruments, including cryptocurrencies, commodities, indices, shares, and currencies, catering to different trading preferences. The broker also offers multiple customer support channels, ensuring assistance is readily available to traders. Moreover, Ontega offers flexible leverage options, allowing traders to customize their risk exposure.

However, it's essential to note the concerns raised about Ontega, primarily related to its regulatory status. The lack of clear oversight from recognized financial authorities can raise questions about the platform's trustworthiness and the level of protection it offers to traders. Additionally, the limited educational resources and potential privacy issues with WhatsApp communication are factors that traders should carefully consider when evaluating Ontega as a trading option. As with any trading platform, due diligence and thorough research are crucial to making informed decisions that align with individual trading needs and risk tolerance.

Q: Is Ontega a regulated broker?

A: Ontega's regulatory status is unclear, and it lacks oversight from recognized financial authorities.

Q: What types of market instruments can I trade on Ontega?

A: Ontega offers a range of market instruments, including cryptocurrencies, commodities, indices, shares, and currencies.

Q: How can I contact Ontega's customer support?

A: You can reach Ontega's customer support through email at Customer.Service@ontega.com, telephone, or WhatsApp during specified operating hours.

Q: What is the maximum leverage available on Ontega?

A: Ontega provides varying maximum leverage levels, such as 1:200 for Forex and commodities, 1:100 for CFDs on indices, 1:10 for CFDs on shares, and 1:2 for cryptocurrencies.

Q: Does Ontega offer educational resources for traders?

A: Ontega lacks comprehensive educational resources, and traders may need to seek external materials for in-depth learning about trading strategies and market analysis.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive instaforex and ontega are, we first considered common fees for standard accounts. On instaforex, the average spread for the EUR/USD currency pair is Fixed 2-7 pips, while on ontega the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

instaforex is regulated by CYSEC. ontega is regulated by VFSC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

instaforex provides trading platform including Standard Trading Accounts,Eurica Trading Accounts,ECN Trading Account,ECN Pro Trading Account,Scalping trading account and trading variety including --. ontega provides trading platform including -- and trading variety including --.