Let's start here

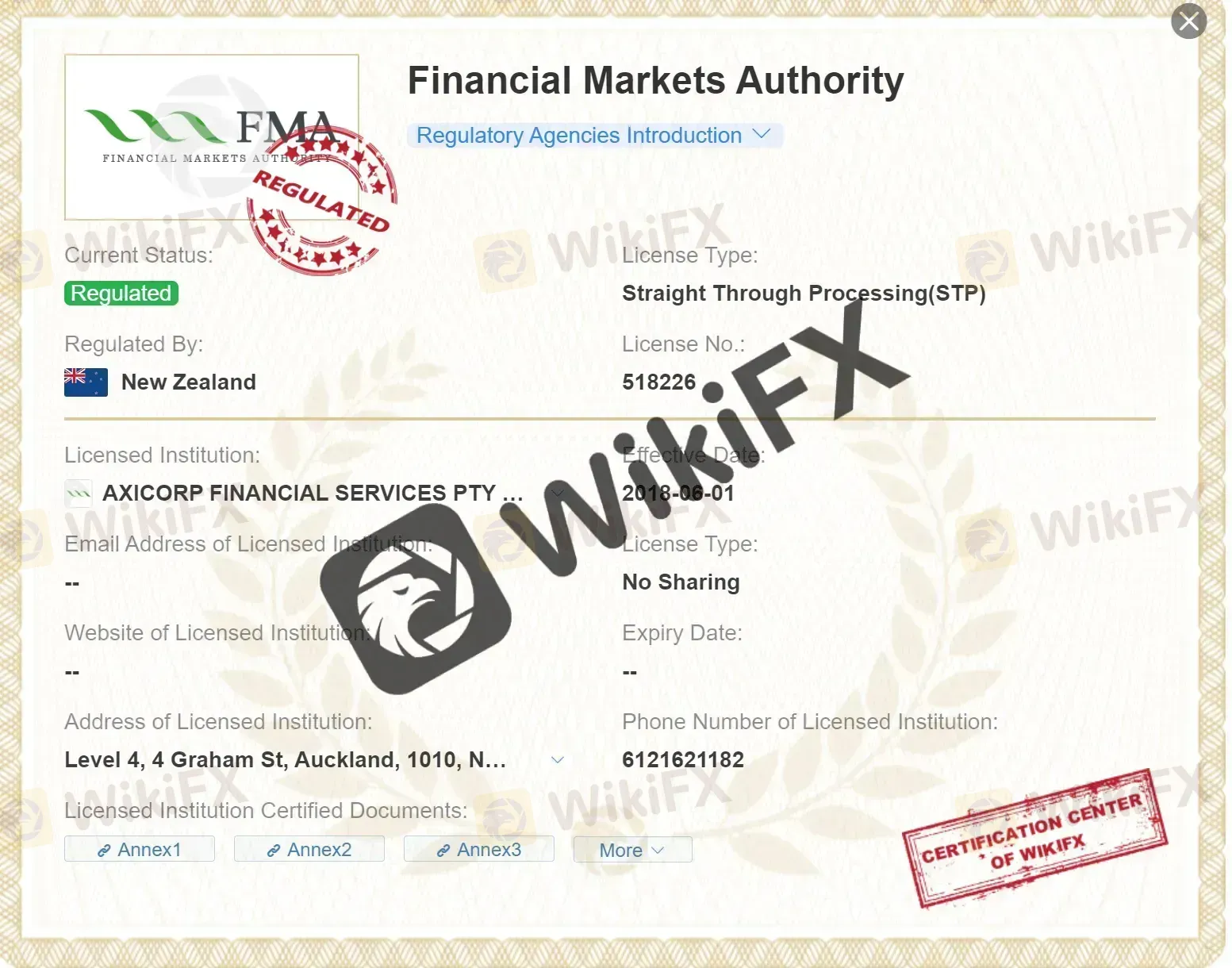

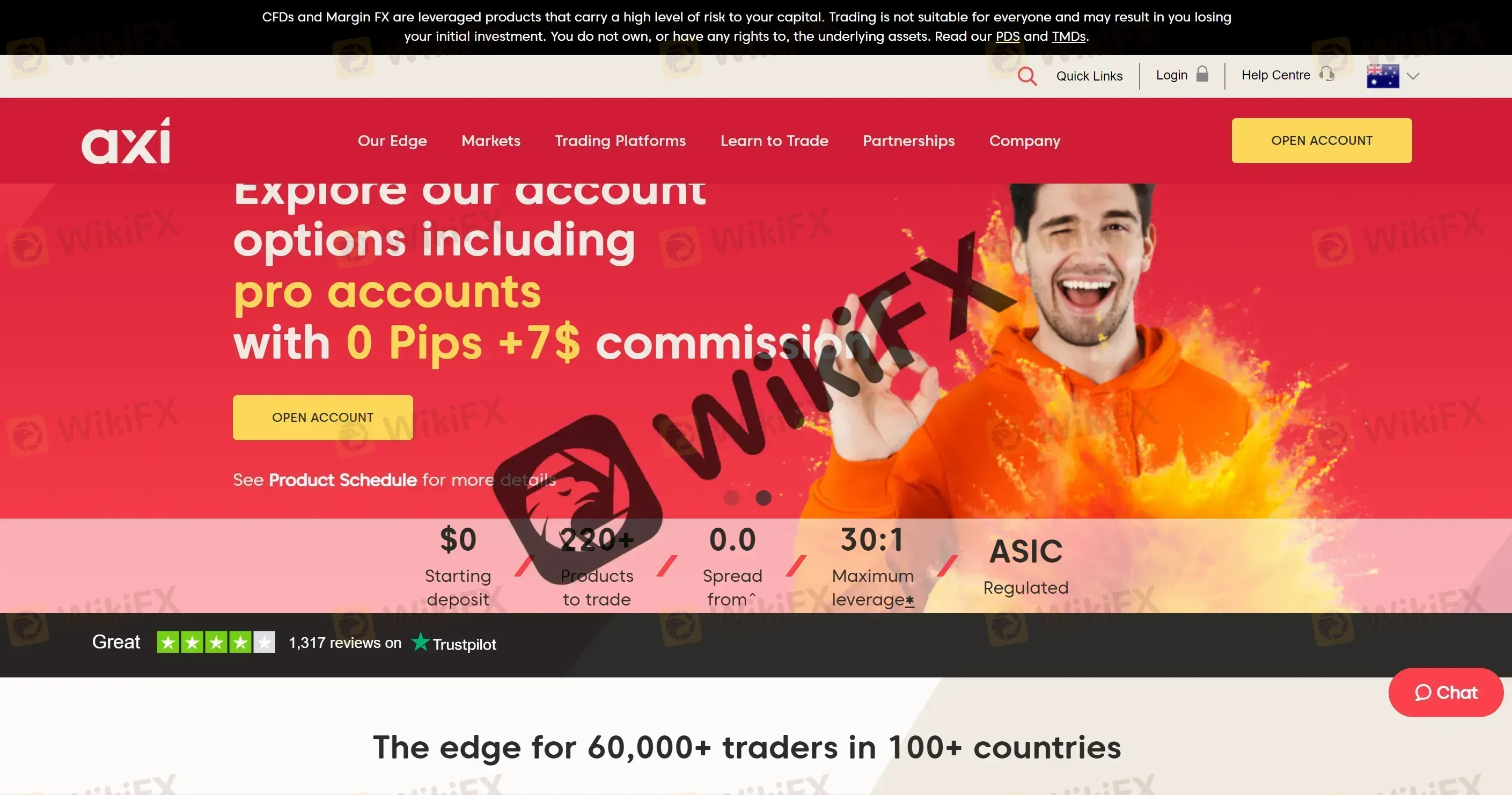

Axi's the real deal, all regulated, with a bunch of over 220 trading options, forex, CFDs for stocks, indices, commodities, and even cryptocurrencies – they're all on the menu. They start at a $0 deposit, offer competitive spreads from 0.0 pips on major currencies, and here is the cool part: using ECN execution for direct market orders. As for the platform, it's none other than the legendary MetaTrader 4. With a touch of pride, they claim to have served more than 600,000 traders across 100 countries. Want to see if Axi's trading environment lives up to its claims? Time for some exploration!

Pros & Cons

Taking a look at Axi, we spot its share of upsides and downsides. Let's start with the bright side, it's got the backing of multiple solid financial authorities, a bunch of instruments you can trade, and they let you practice with demo accounts. Plus, they've got this MT4 platform thing going and some handy tools to help you trade smarter. They even speak different languages for customer support, and moving money in and out is easy, with no extra charges from them.

Now, here's the catch: Axi only works with investors from Australia and New Zealand. And, well, there've been a few stories about people having trouble with their money or some shady stuff.

Axi Overview

What is Axi ?

Axi (formerly AxiTrader) was founded in 2007 in Sydney, Australia, and has since expanded its presence to include offices in other regions, including Europe and the Middle East. AxiTrader welcomes all kinds of traders. If you're new and want to start without spending much, the $0 minimum deposit and easy platform are great. If you're more experienced, you'll like the many options to trade, good spreads, and quick execution. And for those inclined towards advanced features, Axi's ECN system and MetaTrader 4 platform are a notable combination.

Is Axi legit?

Considering the pivotal aspect for brokers, that is regulation, it's indeed comforting to note that AxiTrader is under the oversight of regulatory bodies from four distinct nations. Among them, the UK's FCA and Australia's ASIC stand out as internationally acknowledged tier-1 regulatory authorities.

Advancing further, let's undertake a more detailed exploration of the regulatory licenses secured by Axi.

Axi's Australian entity, Axi FINANCIAL SERVICES PTY LTD, is regulated by ASIC under regulatory license number 318232, holding a license for Market Making (MM).

Notably, this license's credibility gains support from WikiFX's investigators. They physically traveled to the institution's registered address for thorough verification. At Level 10, 90 Arthur Street, North Sydney, NSW 2060, Australia, they found a functioning office, confirming the broker's operational status and significant scale. Behold, an image capturing the tangible office space of this company.

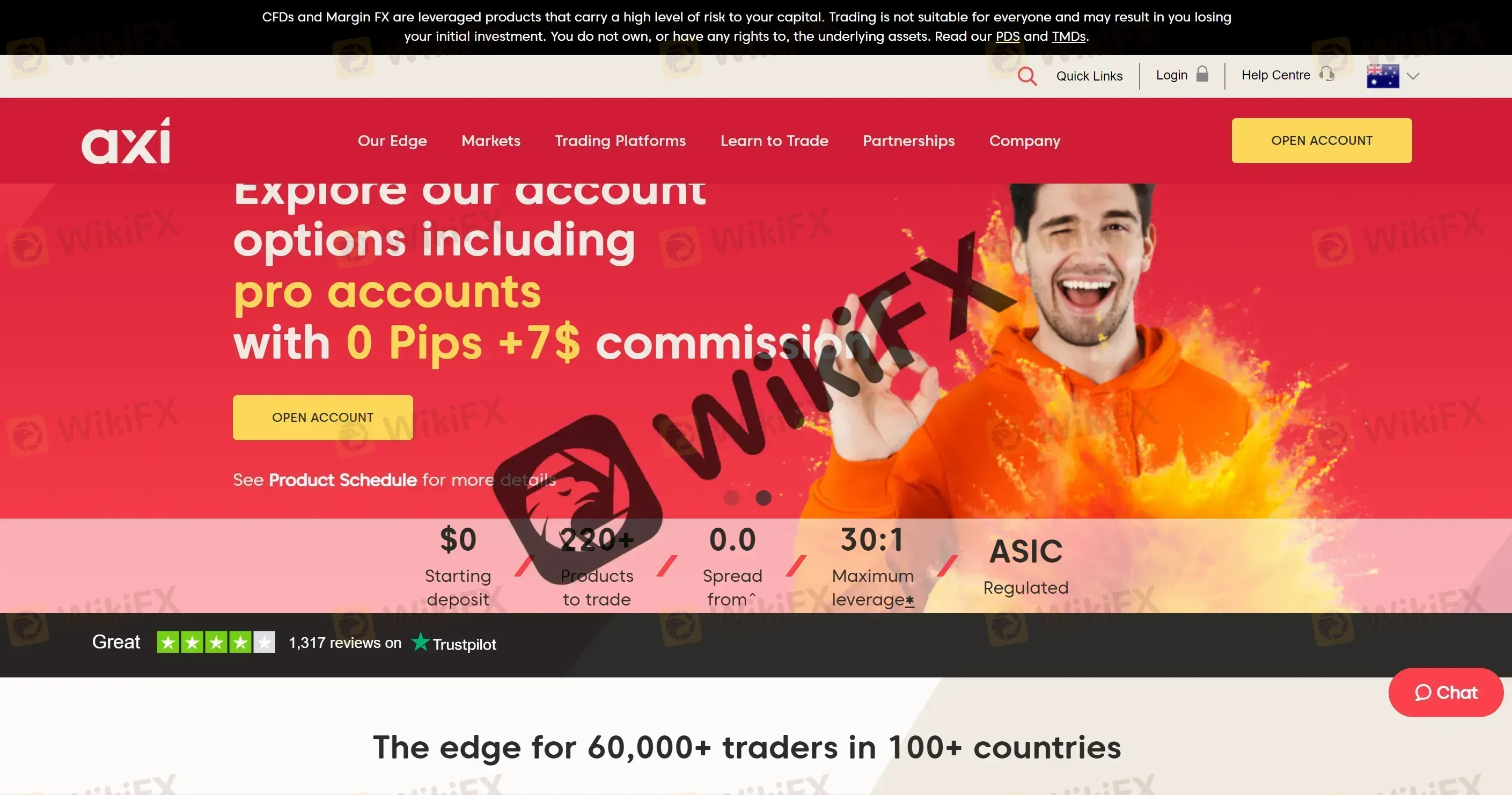

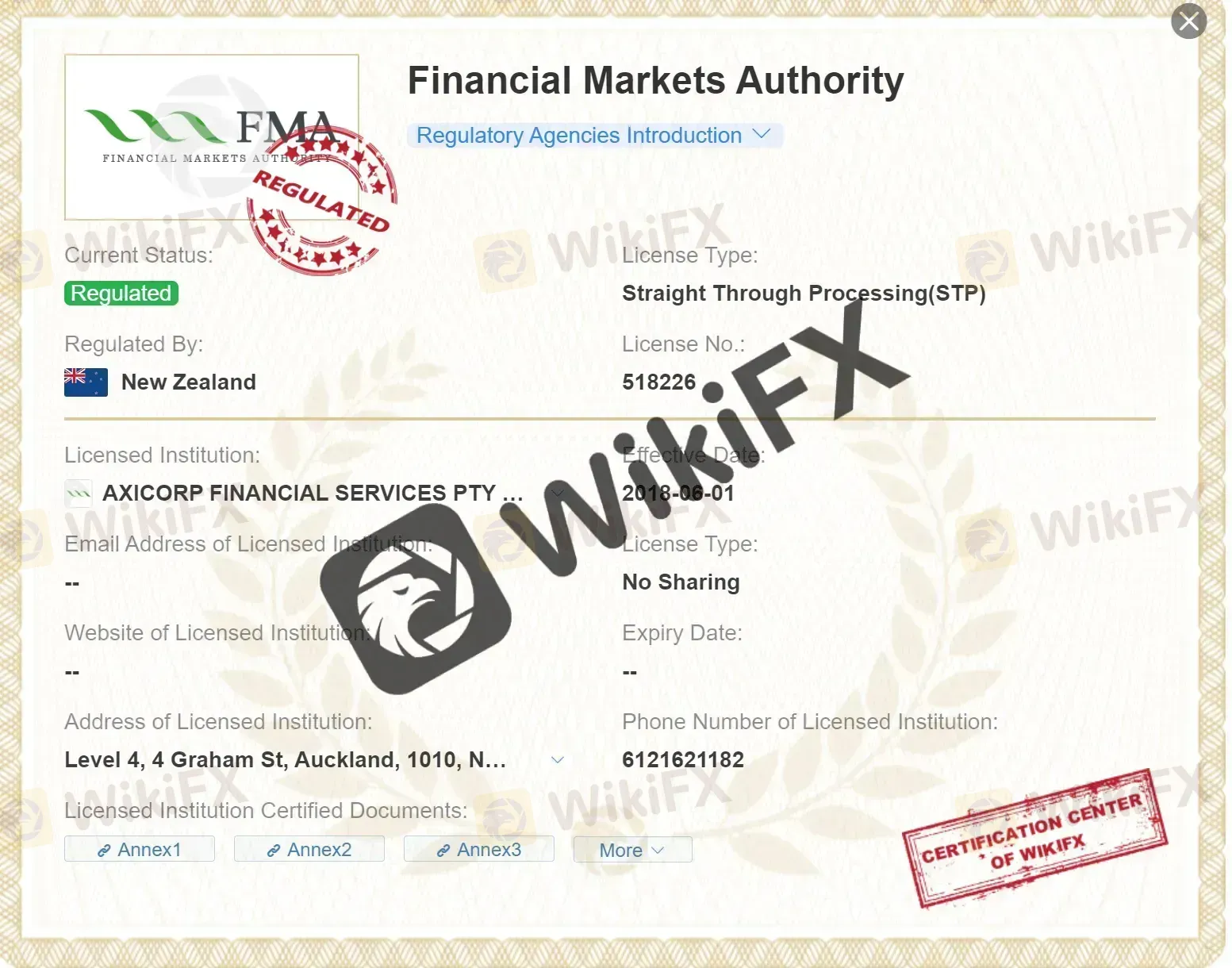

In addition to being regulated by ASIC, this entity is also regulated by the FMA in New Zealand, with regulatory number 518226, holding a license for Straight Through processing (STP).

Now, let's examine the third license. Axi's UK branch, known as Axi Financial Services (UK) Limited, is overseen by the FCA and has been granted regulatory license number 466201. This license permits them to engage in Market Making (MM) activities as well.

Lastly, Axi also follows regulations from the DFSA in the United Arab Emirates under regulatory number F003742, authorized for Retail Forex activities.

Market Instruments

Axi (formerly AxiTrader) gives you access to about 220 trading choices across 5 categories: forex, shares, indices, commodities, and cryptocurrencies. Yet, there are also other popular picks for trading, like ETFs, stocks, and options.

Account Types

AxiTrader offers three account types tailored to different trading needs, namely Standard, Pro, and Elite. The Standard Account has no setup cost and starts with spreads from 0.9 pips. The Pro Account tightens those spreads to 0.0 pips with a $7 round trip commission, while the Elite Account, designed for advanced traders, features 0.0 pips spreads and a reduced $3.50 round trip commission. All accounts support trading from 0.01 lots, mobile trading, and include MT4 NexGen. Leverage reaches up to 500:1, and you can choose base currencies among AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, and USD. For the Elite Account, a minimum deposit of USD 25,000 is required.

Demo Trading

Also, Axitrader gives users free demo accounts that last for 30 days and include $50,000 in virtual funds. Demo accounts offered by Axitrader shine in these areas:

Practice Trading: You get $50,000 in virtual money to practice trading however you like.

Personal Support: You'll have a dedicated Account Manager and support available 24/5 to help you.

Real-Time Info: You can see live spreads on the popular trading platform, MT4.

Live-Like Demo: The MetaTrader 4 Demo account mimics the real market, so you can practice effectively.

Switch to Real: When you're ready, you can turn your demo account into a real one by funding it.

Currency Options: You can choose your account's base currency from options like AUD, EUR, GBP, USD, CHF, and PLNX.

However, base currency cannot be changed once created.

Lastly, they even offer special Islamic trading accounts for Muslim traders that follow Shariah law.

Leverage

The leverage offered by AxiTrader is capped at 500:1. This means that traders can open positions with a much larger amount than their initial investment. However, high leverage can also lead to significant losses if the trade does not go as expected. Traders should exercise caution and use proper risk management strategies when trading with high leverage. Axi provides educational resources and tools to help traders understand the risks associated with leverage and how to manage them effectively.

Spreads & Commissions

Spreads and commissions with Axi are scaled with the accounts offered. Specifically, the spread starts from 0.4 pips on the Standard account, and 0.0 pips on the Pro and Elite account.

As for the commission, there is no commission on the Standard account, a commission of $7 round trip on the Pro account, and $3.5 round trip on the Elite account.

Below is a comparison table about spreads and commissions charged by different brokers:

Note: Spread and commission information is subject to change, and the above table reflects the data available at the time of writing. Please always check with the broker for the most up-to-date information.

Trading Platforms

Axi offers traders the popular MetaTrader 4 (MT4) platform for desktop, mobile, and web. MT4 is a widely used platform that offers a wide range of charting and technical analysis tools, customizable indicators, and the ability to use automated trading strategies through Expert Advisors (EAs). The MT4 platform is available for download on PC and Mac computers, as well as on mobile devices for both iOS and Android.

Additionally, Axi offers the MT4 WebTrader, which allows traders to access the platform directly from their web browser without the need for any downloads or installations.

Overall, the availability of MT4 on multiple devices and the option to use EAs makes it a popular choice among traders.

Trading Tools

There are a range of trading tools designed to enhance the trading experience for its clients. These include Myfxbook Autotrade, which allows traders to follow and copy the trades of successful traders, MT4 signals which provide real-time trade ideas and analysis, MT4 VPS hosting which offers a dedicated virtual private server to ensure optimal performance and minimal downtime.

Additionally, the broker offers a suite of calculators to help traders with their risk management and trade analysis, such as Profit/Loss Calculator, Pip calculator, and Currency converter. These trading tools can be very helpful for traders to better understand their trades and manage their risk effectively.

Deposits & Withdrawals

Axi minimum deposit vs other broker.

AxiTrader stands out from other brokers as they don't require any money to start trading. Here's why it matters:

Easy Access: With no minimum deposit, anyone can join and trade. You don't need a lot of money upfront.

Less Risk: Starting with $0 means you're not risking much. It's great for beginners or anyone cautious about investing.

You Decide: You're in control. You can put in as much as you're comfortable with.

No Pressure: You don't feel pushed to deposit a certain amount. It's more relaxed and beginner-friendly.

Learn and Experiment: You can try different strategies and learn without needing a big investment upfront.

Axi welcomes traders to fund their accounts through the following payment methods: credit/debit cards, POLi and Bank Transfers, Skrill, Neteller, Fasapay, POLi, Cryptos, with no fees charged by Axi for any payment method. However, traders should be aware that some international banking institutions may charge fees for transfers, for which Axi accepts no responsibility.

Please also note that payments to Axi via credit/debit cards may be viewed as a cash advance by some banks, potentially incurring additional fees. Deposits made via credit/debit cards and POLi are processed instantly, while bank transfer deposits and withdrawals can take 1-3 business days to be processed.

Remember, these fees can change and might be different based on how you're making the payment. To stay updated, it's a smart move to reach out to the broker and get the most recent fee details before you decide to deposit or withdraw any funds.

Customer Support

Axi's customer service is comprehensive and available 24/5 in multiple languages, with live chat, phone, email, WhatsApp, and a help center. This means that clients can easily get in touch with the Axi support team whenever they need assistance or have any questions. The availability of multiple communication channels ensures that clients can choose the most convenient way to contact support.

Additionally, the Help Center offers a range of resources and frequently asked questions that can help clients find answers to their questions quickly and efficiently.

Overall, Axi's customer service is considered reliable and responsive, with various options available for traders to seek assistance.

Education

Axi makes learning easy with a variety of educational resources. If you're using the MT4 platform, their step-by-step video tutorials are there to guide you. They also offer Free eBooks, covering everything from basics to advanced topics. Stay updated on market trends through the Axi Blog, which features expert insights and daily analysis. For structured learning, the Axi Academy provides courses on forex, technical analysis, and risk management. If you're diving into cryptocurrencies, the Crypto Glossary will help you grasp the terms.

Conclusion

All things considered, Axi is a well-regulated and reputable broker that offers a wide range of markets and instruments for trading, including forex, shares, indices, commodities, and cryptocurrencies. They also offer multiple account options, free demo accounts, and leverage up to 500:1. In addition, their MT4 trading platform is robust and feature-rich, with various tools and resources to support traders.

However, there have been reports of issues with withdrawals and scams. Overall, Axi is a good choice for experienced traders (Australian and New Zealand residents only) who are looking for a diverse range of trading opportunities and who prioritize a broker's reputation and regulation.

Frequently Asked Questions (FAQs)

Q1: Is AxiCorp regulated?

A1: Yes. It is regulated by Australia Securities & Investment Commission (ASIC).

Q2: Does Axi accept US investors?

A2: No, Axi does not accept US investors.

Q3: Does AxiCorp offer demo accounts?

A3: Yes, demo accounts are available.

Q4: Does Axi offer the industry-standard MT4 & MT5?

A4: Yes. Axi only supports MT4.

Q5: What is the minimum deposit for AxiCorp?

A5: There is no minimum initial deposit requirement.

Q6: Is AxiCorp a good broker for beginners?

A6: Yes. AxiCorp is a good choice for beginners because it is regulated well and offers various trading instruments with no minimum deposit requirement and competitive trading conditions on the leading MT4 platform. Also, it offers demo accounts that allow traders to practice trading without risking any real money.

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX