No data

Do you want to know which is the better broker between IG and CXC ?

In the table below, you can compare the features of IG , CXC side by side to determine the best fit for your needs.

EURUSD: -22.5

XAUUSD: 2.7

Long: -6.42

Short: 2.14

Long: -18.32

Short: 8.57

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of ig, cxc-markets lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Registered in | United Kingdom |

| Regulatory status | FCA, ASIC, FSA, NFA, FMA, MAS and DFSA |

| Year(s) of incorporation | More than 20 years |

| Market instruments | Currency pairs, indices, cryptocurrencies, stocks and commodities |

| Minimum initial deposit | $0 |

| Maximum leverage | 1:200 |

| Minimum spread | 1 pips for EURUSD |

| Trading platform | Intuitive web platform, MetaTrader 4, L2 dealer and mobile apps |

| Deposit and withdrawal methods | Credit/debit cards, bank transfer |

| Customer Service | E-mail/phone number/address/live chat |

| Fraud allegations | Yes |

Here is an official video from the company.

It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Pros:

Wide variety of markets and instrument options.

Intuitive and customizable trading platforms.

Access to advanced technical analysis and charting tools.

Multilingual, multi-channel customer service.

Demo account with virtual financing of $20,000.

There is no minimum deposit requirement for real accounts.

It offers leverage of up to 1:200.

Cons:

Fees and costs may not be clearly specified on the website.

Information on account types is limited.

There are not many educational resources available on the website.

The withdrawal of funds is not clearly specified.

The minimum transaction amount may be high for some markets.

No welcome bonuses or promotions are offered.

Credit card deposit fees can be high compared to other brokers.

| Dimension | Advantages | Disadvantages |

| Broker Model | IG offers tight spreads and fast execution due to its Market Making model. | As a counterparty to its clients' operations, IG has a potential conflict of interest that may lead to decisions that are not in the best interest of the clients. |

IG is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly to the market, IG acts as an intermediary and takes the opposite position to its clients. As such, it can offer faster order execution speed, tighter spreads and greater flexibility in terms of offering leverage. However, this also means that IG has a certain conflict of interest with their clients, as their profits come from the difference between the bid and ask price of assets, which could lead to them making decisions that are not necessarily in the best interest of their clients. It is important for traders to be aware of this dynamic when trading with IG or any other MM broker.

IG is a UK-registered company and regulated by multiple international financial bodies, including the FCA, ASIC, FSA, NFA, FMA, MAS and DFSA. It offers access to a wide variety of financial instruments, including currencies, indices, cryptocurrencies, stocks and commodities, with over 18,000 markets available. The company provides multiple trading platforms, including an intuitive web platform, MetaTrader 4, L2 dealer and mobile apps. It also offers multilingual customer support through various channels, including telephone, email, social media and online chat.

In the following article, we will analyze the characteristics of this broker in all its dimensions, offering you easy and well-organized information. If you are interested, read on.

| Advantages | Disadvantages |

| Wide variety of trading instruments | Too many instruments can be overwhelming for some |

| Possibility to diversify the investment portfolio | Increased knowledge and skill is required to operate |

| Opportunities to take advantage of different conditions | There may be more risk due to exposure to different markets |

| Access to a wide range of international markets | Increased complexity in position and risk management |

IG offers access to more than 17,000 markets, including currencies, indices, cryptocurrencies, stocks and commodities. This dimension is an advantage for traders as it provides them with a wide variety of instruments to trade and allows them to diversify their investment portfolio. In addition, this wide selection of instruments allows traders to take advantage of different market conditions and opportunities. However, a possible disadvantage of this dimension is that it can be overwhelming for some traders, as it requires greater knowledge and skill to trade in different markets. In addition, exposure to different markets can increase the risk of a portfolio, requiring more complex position and risk management.

| Advantages | Disadvantages |

| - Spreads are quite competitive. - Spreads can be viewed on the website. | - There is not much information available on commissions. - Costs may be higher in less liquid markets or with lower trading volume. |

In terms of costs, IG offers competitive and transparent spreads, with the average spread for EUR/USD being one pip. However, there is not much information available on commissions, which may create uncertainty for some traders. In addition, it is important to note that costs may be higher in less liquid markets or with lower trading volume. Overall, IG appears to offer a reasonable and competitive cost structure compared to other brokers.

IG's demo account is a very useful tool for beginner traders, as it allows them to trade in a safe and risk-free environment. With IG's virtual funding of $20,000, traders can practice and hone their trading skills without risking their capital. In addition, the IG demo account provides access to the trading platform and all the instruments and tools available in the live account, allowing traders to familiarize themselves with the platform and test different trading strategies. Overall, the IG demo account is an excellent tool for beginner traders to gain experience and confidence in trading before investing their own capital.

| Advantages | Disadvantages |

| No minimum deposit requirement | Lack of detailed information on account types on the website |

| Single account for all customers | It can be difficult for new customers to choose a suitable account without detailed information. |

| Access to all of IG's financial instruments |

IG offers a single live account for its clients without a minimum deposit requirement. However, there is not much information available on their website about account details such as spreads, commissions and margin requirements. This can make it difficult for new clients to choose the account that best suits their needs and preferences.

| Advantages | Disadvantages |

| Easy-to-use intuitive web platform | Web platform may be less customizable than other platforms |

| Offering MetaTrader 4, a popular and well-known platform | MetaTrader 5, the latest version of the platform, is not offered. |

| L2 Dealer offers a wide range of advanced tools and functionalities for experienced traders. | L2 Dealer can be more complicated for beginner traders |

| Mobile apps available for iOS and Android | Mobile apps may be less customizable than the web platform |

| Wide selection of platforms to meet the needs of different types of traders | No proprietary trading platform exclusive to IG is offered. |

IG offers a variety of trading platforms to meet the needs of different types of traders. The web-based platform is intuitive and easy to use, although it may be less customizable than other platforms. They also offer MetaTrader 4, a popular and well-known platform in the forex industry. For experienced traders, L2 Dealer offers a wide range of advanced tools and functionalities. However, this platform can be more complicated for beginner traders. Mobile apps are available for iOS and Android, allowing traders to trade on the go. Overall, the selection of platforms offered by IG is an advantage for traders, although some may find the lack of an IG-exclusive trading platform a disadvantage.

| Advantages | Disadvantages |

| Allows traders to increase their earning potential with limited capital | Leverage also increases the risk of significant losses |

| Possibility of accessing larger markets without having to deposit large amounts of capital | Novice traders may have difficulty understanding and managing leverage properly. |

| Opportunity to diversify the investment portfolio by trading in several markets with different levels of leverage | Leverage can increase psychological pressure on traders, which can affect their decision making. |

| Facilitates the possibility of profiting from small market movements | Traders can lose more than what they initially invested if they do not properly manage leverage and the associated risks. |

As for the maximum leverage dimension at IG, the company offers a maximum leverage of up to 1:200. This means that traders can open positions that are 200 times larger than their available capital. Leverage can be a powerful tool for experienced traders, as it allows them to earn higher profits with limited capital. However, it can also significantly increase the risk of loss and it is important that traders fully understand the risks and limitations of leverage before using it. Overall, IG's maximum leverage is comparable to that of other online brokers and may be suitable for those seeking greater buying power in the market.

| Advantages | Disadvantages |

| Wide variety of deposit methods | No detailed information on withdrawals is provided |

| No minimum deposit required | Commissions on credit card deposits |

| Free deposits with Visa and Mastercard debit cards | There are no other methods such as skrill, neteller, perfect money, etcetera. |

| Bank transfers accepted |

IG offers several methods for depositing funds, including debit and credit cards, as well as wire transfers to your HSBC and Standard Chartered Bank accounts. No minimum deposit is required and debit card deposits are free of charge. However, fees of 1% are charged on Visa deposits and 0.5% on Mastercard deposits. Unfortunately, there is no detailed information on withdrawal of funds, which may be a drawback for some customers. Overall, the variety of deposit options is positive, although the costs associated with credit card deposits should be carefully considered.

Unlike other online brokers, IG seems to offer a limited amount of educational resources on its website. Although a news and analysis section can be found, as well as an economic calendar, there are not many online resources to help traders learn and improve their trading skills. It is important to note that despite this, IG has a long history and experience in the financial market, which can be of great help to experienced traders looking for a reliable and solid platform to conduct their trades. However, for new and inexperienced traders, they may need to seek additional educational resources elsewhere to enhance their understanding of the financial markets and develop effective trading skills.

Customer service is an important dimension for any business and in the case of IG, this company offers a variety of options for contacting them. Customers can communicate via phone, email, social media and online chat, which offers great flexibility and convenience for users. In addition, customer service is available in multiple languages, which is a great advantage for international customers. Overall, IG seems to have placed adequate emphasis on customer service, which is important to ensure customer satisfaction and maintain a good reputation in the financial market.

In conclusion, IG is a well-established and regulated trading platform that offers a wide variety of financial instruments, an intuitive web platform and access to MetaTrader 4 and L2 Dealer. Although its demo account offers generous virtual funding, information on live accounts is limited. Multilingual customer service is available through multiple channels. However, the lack of educational resources and limited information on withdrawals are areas where they could improve. Overall, IG is a solid choice for traders looking for a regulated platform with a wide selection of instruments and a reliable trading platform.

Question: What is the minimum deposit required to open an account with IG?

Answer: There is no minimum deposit requirement to open an account with IG.

Question: What deposit methods are accepted on IG?

Answer: IG accepts deposits through debit cards, credit cards and bank transfers.

Question: What is the maximum leverage offered by IG?

Answer: IG offers a maximum leverage of up to 1:200 on certain financial instruments.

Question: How can I contact IG customer service?

Answer: You can contact IG customer service by phone, email, online chat or social media.

Question: What trading platforms does IG offer?

Answer: IG offers an intuitive web platform, MetaTrader 4, L2 Dealer and mobile applications.

Question: What is the average spread for EUR/USD at IG?

Answer: The average spread for EUR/USD is one pip.

Question: Does IG offer educational resources for traders?

Answer: They offer a variety of live webinars and educational content on their YouTube channel.

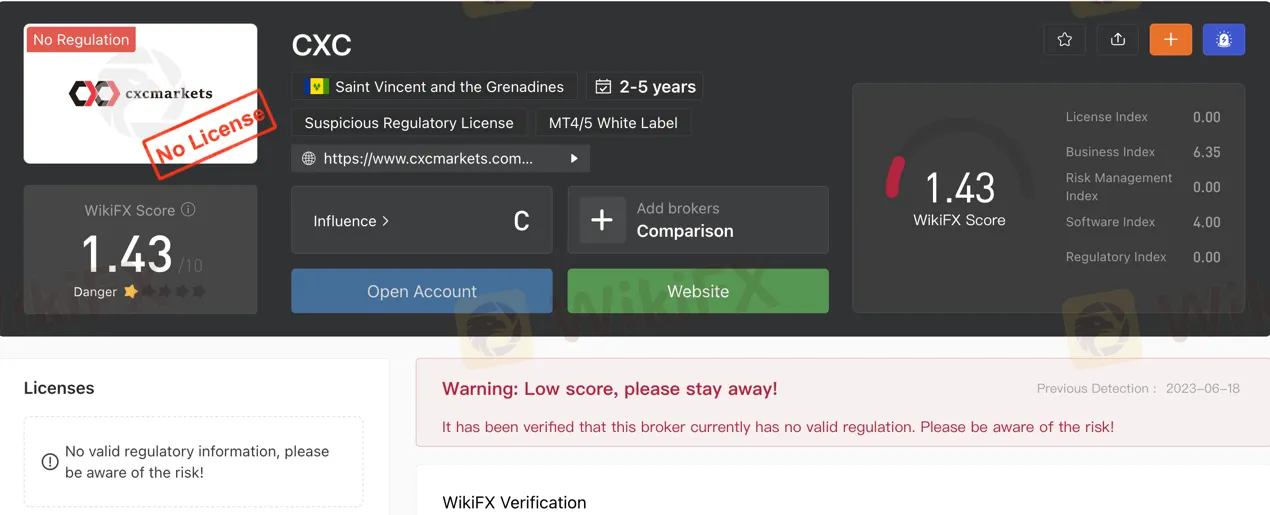

| Aspect | Information |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded Year | 2-5 years |

| Company Name | CXCMarkets Group |

| Regulation | No valid regulatory information, please be aware of the risk! |

| Minimum Deposit | $100 for Micro account |

| Maximum Leverage | Up to 1:1000 |

| Spreads | Micro Account: From 1.3 pips, Zero Account: From 0 pips, Standard Account: From 1.3 pips |

| Trading Platforms | MetaTrader 4, Web Trader |

| Tradable Assets | Forex currency pairs, precious metals, cryptocurrencies, stock index CFDs |

| Account Types | Micro Account, Zero Account, Standard Account |

| Demo Account | Available |

| Islamic Account | Not specified |

| Customer Support | Online support available 24/7 in multiple languages; Email support |

| Payment Methods | Bank cards, Bitwallet (including Bitcoin, Litecoin, Ripple) |

CXC is a trading platform known as CXCMarkets and Tech-FX, which recently underwent a brand merger and upgrade. However, it's important to note that CXC is not regulated by any financial regulatory authority, which means there is no government oversight or customer protection. This lack of regulation poses a higher risk of fraud or financial losses for traders.

CXC offers a range of market instruments, including forex currency pairs, precious metals, cryptocurrencies, and stock index CFDs. Forex currency pairs allow traders to speculate on exchange rate fluctuations, while precious metals and cryptocurrencies provide opportunities to benefit from price movements and global events. Stock index CFDs offer exposure to broader market trends.

CXC provides different account types, such as the Micro Account, Zero Account, and Standard Account, each with its own features and benefits. The leverage offered by CXC is up to 1:1000, allowing traders to control larger positions with a smaller initial investment. Spreads and commissions vary across account types, and the minimum deposit starts at $100 for the Micro Account.

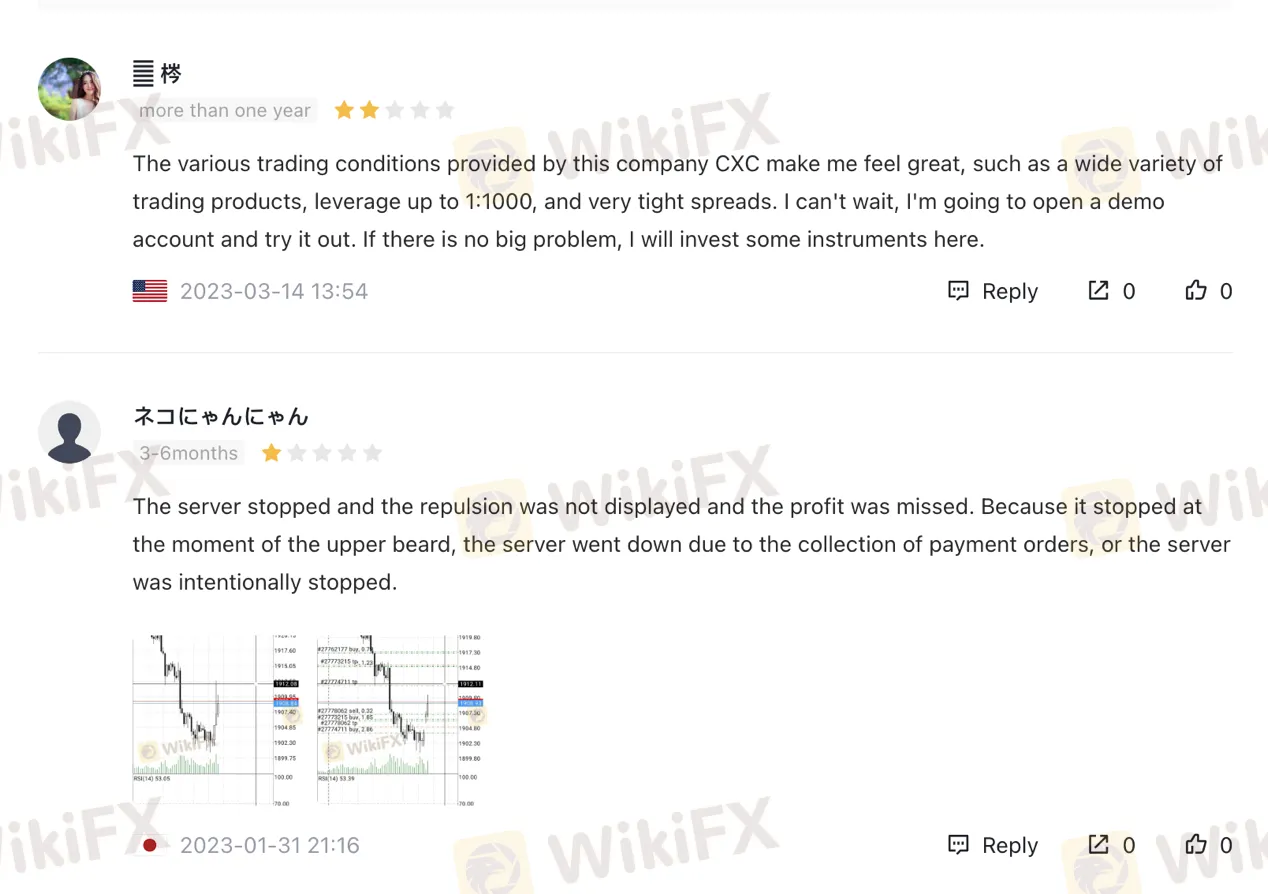

CXC offers the MetaTrader 4 platform and a web trader platform for trading activities. Customer support is available online through email, but no telephone number is provided for inquiries. Reviews about CXC are mixed, with some users expressing satisfaction with trading conditions and others reporting server issues and problems with payments.

In conclusion, CXC is an unregulated trading platform that offers various market instruments and account types. Traders should be cautious due to the lack of regulation and the associated risks. It's advisable to consider other factors and conduct thorough research when evaluating a broker.

CXC, operating as CXCMarkets and Tech-FX, presents a range of pros and cons for potential traders to consider. On the positive side, CXC offers a diverse selection of market instruments and different account types, along with leverage of up to 1:1000. Traders can access MetaTrader 4 and a web trader platform, benefiting from online customer support available around the clock. Additionally, CXC provides various deposit and withdrawal methods, accommodating different trader preferences. However, there are significant drawbacks to consider. Notably, CXC lacks regulation from any financial authority, increasing the risk of fraud or financial losses. Additionally, the absence of an official website raises transparency concerns, limiting access to essential information. Mixed user reviews and a suspicious regulatory license further contribute to the overall evaluation of CXC's potential as a reliable broker.

| Pros | Cons |

| Offers a variety of market instruments | Not regulated by any financial regulatory authority |

| Different account types available | Higher risk of fraud or financial losses |

| Leverage of up to 1:1000 | Limited deposit and withdrawal options |

| Customer support available in multiple languages | No official website available |

| Online customer support available 24/7 | No telephone customer support |

| Provides access to MetaTrader 4 platform | Mixed user reviews |

| Offers a web trader platform for browser-based trading | Lack of transparency due to no regulatory information |

CXC. is not regulated by any financial regulatory authority. This means that there is no government agency that oversees CXC.'s activities or protects its customers. As a result, there is a higher risk of fraud or other financial losses when trading with CXC.

CXC Markets is a trading platform that offers a variety of market instruments for investors. These instruments include forex currency pairs, precious metals, cryptocurrencies, and stock index CFDs.

FOREX CURRENCY PAIRS: CXC Markets provides trading services for forex currency pairs. Forex, also known as foreign exchange, involves the buying and selling of different currencies. Traders can speculate on the exchange rate fluctuations between currency pairs, such as EUR/USD or GBP/JPY. The forex market is known for its high liquidity and round-the-clock trading, allowing investors to take advantage of global economic trends.

PRECIOUS METALS: CXC Markets also offers trading opportunities in precious metals. Precious metals, including gold, silver, platinum, and palladium, are valued for their rarity and industrial uses. Traders can speculate on the price movements of these metals, taking advantage of market fluctuations and global events that impact supply and demand. Precious metals are often considered a safe haven investment during times of economic uncertainty.

CRYPTOCURRENCY: CXC Markets enables trading in cryptocurrencies, which are digital or virtual currencies. Cryptocurrencies like Bitcoin, Ethereum, and Litecoin have gained significant popularity in recent years. Traders can participate in the price movements of cryptocurrencies, taking advantage of their volatility. Cryptocurrency markets operate 24/7 and provide opportunities for both short-term trading and long-term investment.

STOCK INDEX CFD: CXC Markets offers trading in stock index contracts for difference (CFD). A stock index represents the performance of a group of stocks from a specific market or sector. With stock index CFDs, traders can speculate on the price movements of the entire index without owning the underlying assets. This allows for greater ability to take both long and short positions. Stock index CFDs provide exposure to broader market trends and are popular among traders seeking diversification.

| Pros | Cons |

| Offers diverse market instruments | Not regulated by any financial regulatory authority |

| Access to forex currency pairs | Higher risk of fraud or financial losses |

| Availability of precious metals trading | Limited information on risk management and regulatory index |

| Enables trading in cryptocurrencies | Lack of transparency due to no regulatory information |

| Offers stock index CFDs for broader market exposure | Limited information on software index and licenses |

CXC offers a range of account types to cater to the diverse needs of traders. These accounts include the Micro Account, Zero Account, and Standard Account. Each account type has its own unique features and benefits.

MICRO ACCOUNT:

The Micro account offered by CXC is designed for traders who prefer smaller trading volumes. With a maximum leverage of 1:500, traders can amplify their trading positions. The minimum deposit required for this account is 10,000 JPY, and the minimum spread starts from 1.3 pips. Traders can trade various products, particularly focusing on currency trading. The minimum position size is 0.01 lots, and the account supports the use of Expert Advisors (EAs). CXC provides deposit and withdrawal methods for this account type, although specific methods are not mentioned. No commission is charged for trades executed in the Micro account.

ZERO ACCOUNT:

With a maximum leverage of 1:500, traders can have increased trading power. The minimum deposit required for this account is 100 USD, and the minimum spread starts from 0 pips. Similar to the Micro account, traders can access a wide range of products, mainly focusing on currency trading. The minimum position size is 0.01 lots, and Expert Advisors (EAs) are supported. Traders using the Zero account will be charged a commission of 8 USD per trade.

STANDARD ACCOUNT:

The Standard account offered by CXC caters to traders looking for a more flexible trading experience. With a maximum leverage of 1:500, traders can enhance their trading potential. The minimum deposit required for this account is 100 USD, and the minimum spread starts from 1.3 pips. Traders can access a variety of products, particularly focusing on currency trading. The minimum position size is 0.01 lots, and the account supports the use of Expert Advisors (EAs). No commission is charged for trades executed in the Standard account.

| Pros | Cons |

| No commission charged in Micro and Standard accounts | Lack of transparency on deposit and withdrawal methods |

| Access to a wide range of trading products | Limited information on specific deposit/withdrawal methods |

| Support for Expert Advisors (EAs) | Commission charged for trades in Zero account |

Leverage refers to the borrowing of funds to increase the potential return on an investment. CXC Markets offers a maximum leverage of 1:1000 for forex trading, which provides traders with the opportunity to control larger positions with a smaller initial investment. This high leverage allows traders to potentially magnify their profits.

CXC offers varying spreads and commission structures across its account types. The Micro Account has a minimum spread of 1.3 pips with no commission, while the Zero Account provides spreads starting from 0 pips but charges a commission of 8 USD per trade. The Standard Account also has a minimum spread of 1.3 pips but does not charge any commission. Traders can choose the account type that aligns with their trading preferences and cost considerations.

The Trading Platform offered by CXC provides an accessible and user-friendly interface for traders. It caters to various account types, with the minimum deposit set at $100 for the Micro account. The platform ensures that traders can engage in their preferred trading activities. Additionally, different account tiers are available, requiring deposits of $500, $1,000, and $10,000, respectively, offering a range of options to suit individual trading preferences.

Deposit and withdrawal options at CXC Markets are straightforward but limited. Traders can fund their accounts using two main methods: bank cards and Bitwallet, which includes cryptocurrencies such as Bitcoin, Litecoin, and Ripple. While these options provide a means of transferring funds, it is important to note that using cryptocurrencies for funding comes with inherent risks. Unlike traditional payment methods, such as bank cards, there is no possibility of initiating a chargeback in case of an issue or error. Therefore, caution should be exercised when choosing to use cryptocurrencies for depositing and withdrawing funds from CXC Markets.

| Pros | Cons |

| Supports Bit wallet for cryptocurrency transfers | Limited deposit and withdrawal options |

| Availability of bank card payments | Using cryptocurrencies for funding carries inherent risks |

| No possibility of initiating a chargeback with cryptocurrency transactions |

CXC Markets offers a range of trading platforms to meet the diverse needs of its users.

META TRADER 4 PLATFORM: CXC Markets provides access to the MetaTrader 4 trading platform, a highly regarded and widely used platform in the brokerage industry. This platform offers numerous trading tools and instruments that enhance the trading experience. Some notable features include a financial calendar, virtual private server (VPS) capabilities, trading signals (available for a subscription fee), a code base with customizable scripts, and a demo account for practice.

WEB TRADER: In addition to MetaTrader 4, CXC Markets also offers a web trader platform. This web-based platform allows traders to access their accounts and execute trades directly through a web browser. It provides an option for traders who prefer not to download and install trading software on their devices. The web trader platform offers similar functionality to the MetaTrader 4 platform, allowing for seamless trading experiences.

Pros and Cons

| Pros | Cons |

| MetaTrader 4 platform, widely used in the brokerage industry | No mention of specific innovative features or advanced tools |

| Web trader platform for browser-based trading | Lack of information on additional platform functionalities |

| Demo account for practice and testing | No mention of integrated educational resources or tutorials |

| Virtual private server (VPS) capabilities for enhanced trading | Limited information on platform customization options |

CXC Markets provides customer support through various channels to cater to the needs of their clients. Their online support is available 24/7, 365 days a year, and can be accessed in multiple languages such as Japanese, English, French, Chinese, and Korean. Clients can reach out to them via email at support@cxcmarkets.com. However, they do not provide a telephone number for customer inquiries. This approach ensures that clients can easily communicate with CXC Markets and receive assistance promptly.

Based on the reviews on WikiFX, there are mixed opinions about CXC. One user expressed satisfaction with the various trading conditions provided by CXC, such as a wide variety of trading products, high leverage of up to 1:1000. They were eager to open a demo account and potentially invest in instruments offered by the broker. However, another user had a negative experience, mentioning server issues that resulted in missed profits. They suspected intentional server shutdowns or problems with payment orders. It is important to note that these reviews reflect individual experiences and should be considered alongside other factors when evaluating a broker.

In conclusion, CXC is a trading platform that offers various market instruments such as forex currency pairs, precious metals, cryptocurrencies, and stock index CFDs. However, it is important to note that CXC is not regulated by any financial regulatory authority, which means there is no government oversight or customer protection. This lack of regulation increases the risk of fraud or financial losses for traders. While CXC provides different account types with features like leverage and low spreads, the limited deposit and withdrawal options and mixed user reviews raise concerns about the reliability and quality of their services. Traders should carefully consider these factors and exercise caution when dealing with CXC.

Q: Is CXC a regulated broker?

A: No, CXC is not regulated by any financial regulatory authority, which increases the risk of trading with them.

Q: What market instruments are available on CXC?

A: CXC offers trading in forex currency pairs, precious metals, cryptocurrencies, and stock index CFDs.

Q: What are the account types offered by CXC?

A: CXC offers Micro, Zero, and Standard accounts, each with its own features and benefits.

Q: What is the maximum leverage offered by CXC?

A: CXC provides a maximum leverage of 1:1000 for forex trading.

Q: What are the deposit and withdrawal methods supported by CXC?

A: CXC supports deposits through bank cards and Bitwallet, including cryptocurrencies like Bitcoin, Litecoin, and Ripple.

Q: What trading platforms are available on CXC?

A: CXC offers the MetaTrader 4 platform and a web trader platform.

Q: How can I contact CXC's customer support?

A: You can contact CXC's customer support through email at support@cxcmarkets.com.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive ig and cxc-markets are, we first considered common fees for standard accounts. On ig, the average spread for the EUR/USD currency pair is EURUSD 0.6 Gold 0.3 pips, while on cxc-markets the spread is 1.3~.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

ig is regulated by ASIC,FCA,FSA,NFA,AMF,FMA,MAS,DFSA. cxc-markets is regulated by --.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

ig provides trading platform including Standard account,DMA account and trading variety including Foreign exchange, precious metals, CFD. cxc-markets provides trading platform including Micro account,Zero Account,Standard Account and trading variety including --.