No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between FOREX.com and MSC GROUP ?

In the table below, you can compare the features of FOREX.com , MSC GROUP side by side to determine the best fit for your needs.

Long: -0.73

Short: 0.12

Long: -4.25

Short: 2.12

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of forex-com, msc-group lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

Forex.com is a major player in forex trading, providing various options including currencies, commodities, indices, and cryptocurrencies. Their platforms, like the popular MetaTrader 4, are available worldwide to meet different trader preferences. Backed by robust regulation and a strong focus on security, Forex.com is a favored choice for professionals looking for an all-encompassing trading experience. Now, let's delve deeper to verify if Forex.com lives up to its reputation.

| Quick Forex.com Review in 10 Key Points | |

| Registered in | USA |

| Regulated by | FCA (UK), IIROC (Canada), NFA(USA), ASIC (Australia), and CySEC (Cyprus), MAS ( Singapore), CIMA ( Cayman Islands) |

| Year(s) of incorporation | More than 20 years |

| Market instruments | currency pairs, precious metals, energies, indices, bonds, cryptocurrencies and equities |

| Minimum initial deposit | $100 |

| Maximum leverage | Variant |

| Minimum spread | Floating |

| Trading platform | Forex.com and MT5 |

| Deposit and withdrawal methods | credit card (Visa, Mastercard, Maestro), bank wire transfer, Skrill and Neteller |

| Customer Service | E-mail address/live chat |

It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

Forex.com is one of the most respected and trusted forex brokers in the foreign exchange trading industry. Founded in 2001, Forex.com is a global company licensed and regulated by several reputable regulatory authorities, including ASIC in Australia, FCA in the United Kingdom, FSA in Japan, NFA in the United States, IIROC in Canada, CIMA in the Cayman Islands and MAS in Singapore. These regulators are known for their strict compliance and oversight requirements, which means that Forex.com is required to meet high ethical and operational standards to protect its clients and ensure the safety of their funds.

In the following article, we will analyze the characteristics of this broker in all its dimensions, offering you easy and well-organized information. If you are interested, read on.

| Pros | Cons |

| Offers tighter spreads | Acts as counterparty in the operations of its customers |

| Guarantees the execution of operations under normal market conditions. | There may be conflicts of interest |

| Can offer a greater amount of liquidity and depth in the marketplace | Traders do not have direct access to the interbank market. |

| Offers an easy to use and customizable trading platform | Traders may prefer ECN or STP brokers. |

Forex.com is a worldwide forex broker offering online trading services in multiple markets, including forex, indices, commodities, cryptocurrencies and stocks.

Forex.com is a Market Maker broker, which means that it acts as a counterparty to its clients' trades, rather than sending trades to the interbank market. As such, Forex.com can offer tighter spreads and guarantee execution of trades under normal market conditions. However, some traders may prefer ECN or STP brokers, which send trades directly to the interbank market and do not act as a counterparty to their clients.

Yes, Forex.com operates legally. Forex.com, a globally recognized broker, is part of an international holding company regulated by reputable authorities worldwide, including the FCA (UK), IIROC (Canada), NFA(USA), ASIC (Australia), and CySEC (Cyprus), MAS ( Singapore), CIMA ( Cayman Islands).

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number |

|

ASIC | STONEX FINANCIAL PTY LTD | Market Making(MM) | 345646 |

|

FCA | Gain Capital UK Limited | Market Making(MM) | 113942 |

|

FSA | GAIN Capital Japan Co., Ltd | Retail Forex License | 関東財務局長(金商)第291号 |

|

NFA | GAIN CAPITAL GROUP LLC | Market Making(MM) | 0339826 |

|

IIROC | GAIN Capital - FOREX.com Canada Ltd. | Market Making(MM) | Unreleased |

|

CIMA | GAIN Global Markets, Inc | Market Making(MM) | 25033 |

|

MAS | STONEX FINANCIAL PTE. LTD. | Retail Forex License | Unreleased |

Forex.com's Australian entity, STONEX FINANCIAL PTY LTD, regulated by the ASIC in Asutralia under regulatory number 345646, holding a license for Market Making(MM).

Forex.com's UK entity, Gain Capital UK Limited, regulated by tier-one regulatory FCA under regulatory number 113942, holding a license for Market Making(MM).

The entity based in Japan, GAIN Capital Japan Co., Ltd, regulated by FCA under regulatory number 関東財務局長(金商)第291号, holding a license for Retail Forex License.

GAIN CAPITAL GROUP LLC, the US entity, regulated by the NFA under regulatory number0339826, holding a license for Market Making(MM).

Candian entity, GAIN Capital - FOREX.com Canada Ltd., is regulated by the IIROC, holding a license for Market Making (MM), with license unreleased.

GAIN Global Markets, Inc, another entity in the Cayman Islands, regulated by CIMA under regulatory number 25033, holding a license for Market Making (MM).

STONEX FINANCIAL PTE. LTD., the entity in Singapore, regulated by the MAS in Singapore, holding a license for retail forex.

| Pros | Cons |

| It offers a wide variety of trading instruments, allowing traders to find opportunities in different markets. | Offering a wide variety of trading instruments, it can be overwhelming for traders who are new to the market and do not have experience in all available markets. |

| Diversification of trading instruments can help traders manage the risk of their portfolios. | Some trading instruments may have higher costs in terms of spreads or commissions, which may reduce the profitability of trades. |

| Forex.com offers a variety of market analysis and education tools to help traders make informed decisions about trading instruments. | Traders may find that the variety of trading instruments may be too wide, making it difficult to identify profitable trading opportunities. |

Forex.com offers a wide variety of trading instruments, including currency pairs, precious metals, indices, futures and options, stocks. Traders have a wide range of options to choose from and can find opportunities in a variety of markets.

The minimum deposit amount required to register a Forex.com Standard live trading account is $100 USD, which is quite friendly to most investors.

Here is the table showing the comparison of Forex.com minimum deposit with other brokers:

| Broker | Minimum Deposit |

|

$100 |

|

$10 |

|

$5 |

|

$200 |

| Pros | Cons |

| Demo account available for risk-free practice | No Islamic account offered for traders who follow Shariah law |

| Offers two account types to suit different trading needs | The standard account has wider spreads compared to the MT5 account. |

| The standard account is ideal for traders looking for a wide variety of advanced charting tools and a wide selection of markets. | MT5 account can be more complex for beginner traders |

| Both accounts offer access to Forex.com's award-winning, technologically advanced and easy-to-use trading platform. | The MT5 account has a more limited selection of markets to trade compared to the standard account. |

| Customers can switch between the two accounts at any time to meet their business needs. | The standard account does not offer multi-asset class trading, like the MT5 account. |

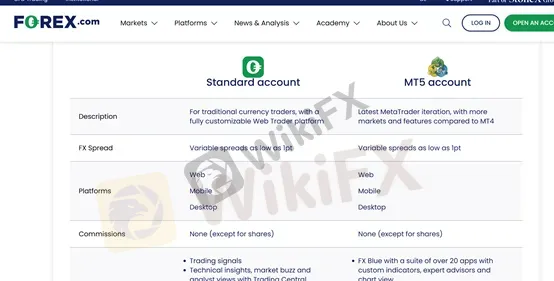

Forex.com offers its clients two types of trading accounts: the standard account and the MT5 account. The standard account is ideal for traders looking for a wide range of advanced charting tools with more than 80 technical indicators and a wide selection of markets to trade with competitive spreads starting from 0.8 pips on the EUR/USD currency pair. In addition, this account does not charge commissions on over 300 markets. On the other hand, the MT5 account is ideal for traders looking for up-to-date tools and analysis, multi-asset class trading, expert advisors and custom indicators. Both accounts offer access to Forex.com's award-winning, technologically advanced and easy-to-use trading platform. In addition, clients can switch between the two accounts at any time to suit their trading needs.

Forex.com provides beginners with demo accounts, allowing them to practice in a real trading setting without any financial risks. Demo accounts come with $50,000 in virtual funds and are active for 30 days from the time of registration. Please be aware that once this period ends, you won't be able to access the demo account with the same login details. Notably, each email address can only be used to open one demo account for each type, whether it's on FOREX.com platforms or MetaTrader.

With Forex.com demo accounts, you can enjoy the following features:

$50,000 virtual funds

Demo accounts active for 30 days

Access to 80+ tradable FX pairs, plus gold and silver

Using customizable charts

Here is the simple demo account sign-up process for you to follow:

Step 1: click the “Free Demo Account” button on the “Account” Navigation section;

Step 2: Fill in your full name, email and phone number in the form, and then click “ I'm not a robot” for verification.

Step 3: After a simple registration, you can use the demo account and start trading.

| Pros | Cons |

| Low spreads on a wide range of instruments | Spreads can be variable and can widen during periods of high volatility. |

| Low commissions for stock trading | Forex.com is a Market Maker broker, which means that there may be a conflict of interest. |

| Average speed of fast execution | It does not offer trading accounts with variable spreads. |

| Very low spreads on the EUR/USD currency pair | Some traders may prefer ECN or STP brokers that send trades directly to the market. |

| Low spreads for spot oil trading | |

| Low spreads for gold trading |

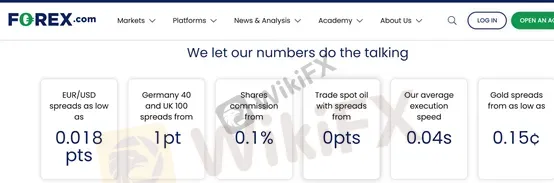

Forex.com offers competitive spreads and low commissions on a wide range of trading instruments. Spreads for the EUR/USD currency pair start from as low as 0.018 pips, which is very low compared to other brokers. In addition, spreads for the Germany 40 and UK 100 indices start from 1 pip, and commissions for trading stocks start from 0.1%. Traders can also trade spot oil with spreads starting from 0 pips, which can be very attractive for those interested in commodity trading. In addition, the average trade execution speed on Forex.com is 0.04 seconds, which means that traders can expect fast execution of their trades. Finally, spreads for gold start as low as 0.15 cents, which can be very attractive for traders looking to trade the precious metals markets.

| Pros | Cons |

| Forex.com's MT5 platform is fast and offers a wide range of technical analysis tools and resources. | Some traders may prefer other popular platforms such as MetaTrader 4. |

| The MT5 platform can be customized to each trader's preferences. | Traders who prefer a simpler platform may find the Forex.com platform a bit overwhelming. |

| The Forex.com platform is easy to use and designed to provide an intuitive trading experience. | The Forex.com platform is not as advanced as MT5 and may not be suitable for more experienced traders looking for more advanced tools. |

Forex.com offers its clients the MT5 trading platform, one of the most popular and advanced trading platforms on the market. MT5 is known for its fast order execution and wide range of technical analysis tools and resources. In addition, traders can customize the platform according to their needs and preferences.

In addition to MT5, Forex.com also offers its own trading platform, the Forex.com platform. This platform is easy to use and is designed to provide an intuitive and customizable trading experience. The Forex.com platform features advanced trading tools, real-time charting and a wide range of technical indicators, making it a good choice for traders of all experience levels.

Margin on Forex.com is a financial requirement that traders must meet in order to maintain their open positions. The margin requirement varies by platform (FOREX.com or MetaTrader), market, asset class and position size. Each instrument on Forex.com has its own margin information that can be found on the market information sheet on the FOREX.com platforms. To calculate the margin required to open a position, simply multiply the total nominal value of the trade (quantity x instrument price) by the margin factor. Traders can use the platform's margin calculator to find out the margin required before opening a position. In addition, Forex.com allows monitoring the margin requirements of each position individually and reviewing the total margin requirement of the account through the Margin Indicator. It is important to remember that the margin requirement may change over time as market prices fluctuate.

Forex.com offers negative balance protection on all of its trading accounts. This means that clients cannot lose more money than they have in their account, providing an additional layer of security and peace of mind in trading. In the event that an extreme market situation occurs and a position moves against the client, Forex.com will automatically close the position before the account balance falls below zero. This protection helps limit risk for clients and is an important feature to consider when choosing a forex broker.

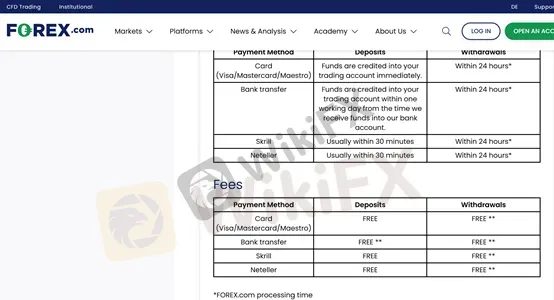

Forex.com offers several payment methods for depositing and withdrawing funds, such as credit card (Visa, Mastercard, Maestro), wire transfer, Skrill and Neteller. Deposits are processed within 24 hours, which means traders can start trading quickly. Withdrawals are also fast, usually taking 1-2 business days to process. It is important to note that Forex.com does not charge any additional fees for deposits or withdrawals, but payment service providers may impose their own fees.

Forex.com offers a wide variety of tools and resources to help traders make informed decisions, including technical analysis, economic calendars, real-time news, free webinars and seminars, and a free demo account to practice and improve trading skills.

Forex.com offers exceptional customer service, with 24-hour support in multiple languages via live chat, email and address. In addition, the broker has an extensive online help center covering topics from account opening to trade execution and risk management. It also offers a news and analysis section, which includes an economic calendar and real-time market news, allowing clients to stay informed and make informed decisions. Overall, Forex.com demonstrates a strong commitment to customer satisfaction and provides all the tools necessary for traders to succeed in their trading experience.

E-mail: support@forex.com

Address: 30 Independence Blvd, Suite 300 (3rd floor), Warren, NJ 07059, USA

In summary, Forex.com is a well-regulated and respected broker with a wide variety of trading instruments and easy-to-use trading platforms. With its solid reputation in the industry and its focus on security and protection of client funds, Forex.com is an attractive option for traders looking for a reliable and secure broker.

Q: Does Forex.com offer a demo account for practice?

A: Yes, Forex.com offers a free demo account for traders who want to practice before trading with real money. The demo account offers full access to the trading platforms and market analysis tools for a limited period of time.

Q: What is the minimum deposit to open an account at Forex.com?

A: The minimum deposit to open a Forex.com account varies depending on the type of account the trader chooses and the trader's location. In some cases, it can be as low as 10 0 dollars.

Q: Does Forex.com charge commissions for trades?

A: Forex.com charges commissions for some trades, such as stock trading. However, it does not charge commissions in most markets. Instead, Forex.com earns profits through the spread between the bid and ask prices of assets.

Q: Does Forex.com have any kind of training or education program for traders?

A: Yes, Forex.com offers a wide variety of educational resources for traders of all levels, including live webinars, seminars, trading guides, articles and educational videos.

Q: What payment methods does Forex.com accept?

A: Forex.com accepts various payment methods, including credit and debit cards, bank transfers, as well as electronic payment systems such as Skrill and Neteller. Processing times and deposit and withdrawal limits may vary depending on the method chosen and the trader's location.

| Aspect | Information |

| Company Name | MSC Group Inc |

| Registered Country/Area | United Kingdom |

| Founded Year | 2-5 years |

| Regulation | Currently lacks valid regulation |

| Minimum Deposit | N/A |

| Maximum Leverage | Up to 1:500 |

| Spreads | N/A |

| Trading Platforms | MetaTrader4 (MT4) |

| Tradable Assets | Currencies, indices, metals, commodities, stocks |

| Account Types | N/A |

| Demo Account | N/A |

| Customer Support | Email: support@mscgroupglobal.com Online chat available |

| Deposit & Withdrawal | Range of payment methods available, specific details not provided |

| Educational Resources | N/A |

Based in Delaware, USA, MSC Group Inc is an online broker offering a diversified range of trading products, including currencies, indices, metals, and commodities. They provide up to 1:500 leverage and utilize the popular MetaTrader4 (MT4) trading platform. However, it is important to note that MSC Group currently lacks valid regulation, which should be considered when evaluating the potential risks involved in trading with an unregulated broker. While they offer multilingual customer support and a variety of payment methods, educational resources are not currently provided. Traders are advised to seek alternative sources for educational materials and prioritize regulated brokers for enhanced protection of their funds and trading activities.

It has been verified that MSC Group currently lacks valid regulation. It is essential to be cautious and aware of the associated risks. The broker's regulatory status is abnormal, with an official designation of “Unauthorized.” Please exercise caution and consider the potential risks involved in trading with an unregulated broker.

MSC Group offers a diversified range of tradable instruments and competitive leverage of up to 1:500, along with the availability of the MetaTrader4 (MT4) platform. The broker also provides multilingual customer support and convenient deposit and withdrawal options. However, it is important to note that MSC Group currently lacks valid regulation, and specific details about spreads and commissions, educational resources, and payment methods are not provided.

| Pros | Cons |

| Diversified range of tradable instruments | Lack of valid regulation |

| Competitive leverage of up to 1:500 | No specific details about spreads and commissions |

| Availability of MetaTrader4 (MT4) platform | Limited educational resources provided |

| Multilingual customer support | Specific details about payment methods not provided |

| Convenient deposit and withdrawal options |

On the MSC Group platform, you can trade the following financial instruments:

1. Currencies: MSC Group provides access to a wide range of currency pairs, including major, minor, and exotic pairs. These currency pairs allow traders to participate in the forex market and take advantage of fluctuations in exchange rates.

2. Indices: MSC Group offers trading opportunities in various global stock market indices. Popular indices such as the S&P 500, Dow Jones Industrial Average, FTSE 100, and Nikkei 225 are among the options available. Trading indices allows traders to speculate on the overall performance of specific markets or sectors.

3. Metals: Precious metals like gold, silver, platinum, and palladium are available for trading on the MSC Group platform. These metals are known for their value and are often considered as safe-haven assets during times of economic uncertainty.

4. Commodities: Traders can also access a range of commodities on the MSC Group platform, including energy commodities like crude oil and natural gas, agricultural commodities like corn and wheat, and soft commodities like coffee and sugar. Trading commodities allows traders to speculate on the price movements of these essential resources.

5. Stocks: MSC Group provides access to a selection of stocks from global markets. These stocks represent shares of publicly traded companies across various sectors, including technology, finance, healthcare, and more. Trading stocks allows investors to participate in the performance of specific companies and benefit from their price fluctuations.

MSC Group offers a diversified range of tradable instruments with varying trading leverage. For Forex instruments, the leverage can go up to 1:500, while for indices and commodities, it can reach up to 1:100. Trading leverage can be advantageous as it allows traders to amplify their potential profits with a smaller initial investment. However, it is important to understand that higher leverage also increases the risk of potential losses, as losses are magnified in proportion to the leverage used. Traders should exercise caution and employ risk management strategies when utilizing high leverage to mitigate potential risks.

Cedar FX offers a low minimum deposit requirement of $10 to open a trading account, which is in line with what legitimate brokers typically require for a micro account. While this may seem attractive, it is important to note that Cedar FX is currently an unregulated broker. Due to the lack of regulatory oversight, traders are advised to exercise caution and consider the potential risks associated with trading with an unregulated broker. It is recommended to choose regulated brokers that provide additional safeguards and protections for clients' funds and trading activities.

MSC Group offers the widely acclaimed MetaTrader4 (MT4) trading platform, known for its powerful features and extensive capabilities. With MT4, traders can enjoy convenient access to the platform through various channels, ensuring flexibility and ease of use. The user-friendly interface of MT4 makes it accessible to traders of all experience levels, including novice traders. One of the standout features of MT4 is its advanced charting capabilities, allowing traders to analyze market trends and make informed trading decisions. Furthermore, MT4 is designed to support multiple markets, enabling traders to access a wide range of financial instruments. The platform also includes an embedded expert advisor system, allowing traders to automate certain aspects of their trading strategies. By choosing to trade with MSC Group, traders can leverage the benefits of MT4 for their trading needs, providing them with every possible advantage for achieving financial success.

MSC Group offers a range of payment methods for depositing and withdrawing funds, ensuring convenient and secure transactions for its clients. While specific details about the payment methods are not provided, clients can expect to have access to popular options such as bank transfers, credit/debit cards, and electronic payment systems. The availability of payment methods may vary depending on the client's country of residence. It is recommended to visit the MSC Group website or contact their customer support to obtain detailed information about the payment methods supported and any associated fees or processing times.

The MSC Group prioritizes effective communication and provides multilingual customer support to cater to the diverse needs of its clients. You can reach their customer support team through email at support@mscgroupglobal.com. Additionally, an online chat feature is available for real-time assistance and prompt resolution of queries or concerns. Whether you have questions about their services, need technical support, or require general assistance, the MSC Group's customer support is dedicated to providing helpful and timely responses to ensure a positive trading experience for their clients.Educational Resources

The MSC Group recognizes the importance of educational resources for traders, especially for those who are new to the market. However, it is important to note that the availability of educational materials or resources may vary among different brokers. While the MSC Group may not currently provide specific educational resources such as webinars or daily Forex news, traders can explore alternative sources to enhance their knowledge and understanding of the market. There are numerous reputable websites, online forums, and educational platforms that offer comprehensive educational content, tutorials, market analysis, and news updates. Traders are encouraged to leverage these external resources to supplement their trading education and stay informed about market trends and developments.

In conclusion, MSC Group Inc is an online broker based in Delaware, USA, offering a diverse range of trading products through the MetaTrader4 (MT4) platform. The broker provides access to various financial instruments, offers competitive leverage ratios, and supports micro trade sizes, making it beginner-friendly. However, it is important to note that MSC Group lacks valid regulation, and its regulatory status is designated as “Unauthorized.” This lack of regulation poses risks to traders, and caution is advised when considering trading with an unregulated broker. While MSC Group offers multilingual customer support and convenient deposit and withdrawal options, it does not currently provide specific educational resources. Traders are encouraged to seek alternative sources for educational materials to enhance their trading knowledge. It is recommended to prioritize regulated brokers that offer additional safeguards and protections for clients' funds and trading activities.

Q: Is MSC Group regulated?

A: Currently, MSC Group lacks valid regulation, and its regulatory status is classified as “Unauthorized.”

Q: What financial instruments can I trade with MSC Group?

A: MSC Group offers a variety of tradable instruments, including currencies, indices, metals, commodities, and stocks.

Q: What leverage does MSC Group offer?

A: The leverage offered by MSC Group varies depending on the specific instrument. For Forex instruments, leverage can go up to 1:500, while for indices and commodities, it can reach up to 1:100.

Q: What is the minimum trade size with MSC Group?

A: MSC Group allows a micro trade size of 0.01 lots.

Q: Does MSC Group charge spreads or commissions?

A: Specific details about spreads and commissions are not provided.

Q: What trading platform is available with MSC Group?

A: MSC Group offers the MetaTrader4 (MT4) trading platform, known for its powerful features, user-friendly interface, advanced charting capabilities, and support for multiple markets.

Q: What are the deposit and withdrawal methods supported by MSC Group?

A: MSC Group offers a range of payment methods for depositing and withdrawing funds, including bank transfers, credit/debit cards, and electronic payment systems.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive forex-com and msc-group are, we first considered common fees for standard accounts. On forex-com, the average spread for the EUR/USD currency pair is -- pips, while on msc-group the spread is 0 pip onwards.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

forex-com is regulated by ASIC,FCA,FSA,NFA,CIRO,MAS. msc-group is regulated by NFA,ASIC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

forex-com provides trading platform including STP PRO,COMMISSION,Standard and trading variety including 60 currency pairs Gold & silver. msc-group provides trading platform including ECN,SWAP FREE,STANDARD and trading variety including Forex, CFD’s, Commodities.