No data

Do you want to know which is the better broker between FBS and FXPRIMUS ?

In the table below, you can compare the features of FBS , FXPRIMUS side by side to determine the best fit for your needs.

EURUSD: 0.2

XAUUSD: 0.6

Long: -5.46

Short: 0.61

Long: -29.9

Short: 6.05

EURUSD: 0.2

XAUUSD: --

Long: -7.54

Short: 1.42

Long: -38.62

Short: 17.36

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of fbs, fxprimus lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| FBS | Basic Information |

| Registered Country/Area | Cyprus |

| Founded in | 2009 |

| Company Name | Tradestone Limited |

| Regulatory Authority | CySEC, FSC (Offshore) |

| Minimum Deposit | $1 |

| Maximum Leverage | 1:30 (retail), 1:500 (professional) |

| Spreads | Spreads from 0.0 pips |

| Trading Platforms | MetaTrader 4, MetaTrader 5, FBS Trader (proprietary) |

| Tradable Assests | Forex, CFDs, Stocks, Cryptocurrencies, Metals, Energies |

| Account Types | Cent, Micro, Standard, Zero Spread, ECN, Crypto |

| Demo Account | Yes |

| Customer Support | 24/7 Live Chat, Phone, Email, Telegram, Viber, WhatsApp |

| Deposit/Withdrawal Methods | Credit/debit cards, Bank wire transfer, Electronic wallets |

| Educational Tools | Articles, Video Tutorials, Webinars, Courses, Glossary |

FBS is a forex and CFD broker established in 2009. With its headquarters situated in Cyprus, the company maintains a global presence through offices in various countries such as China, Indonesia, Malaysia, and Thailand.

Catering to a diverse clientele, FBS offers an array of account types suitable for traders of varying experience levels and preferences. Whether you're a novice or a seasoned trader, FBS provides tailored account options to align with your requirements. The broker boasts an extensive selection of trading instruments encompassing over 40 currency pairs, precious metals, CFDs on stocks, and cryptocurrencies.

FBS equips its clients with the widely acclaimed MetaTrader 4 and MetaTrader 5 trading platforms, recognized as industry benchmarks. These platforms are accessible across desktop, web, and mobile devices, empowering traders to manage their accounts and execute trades on the move. Additionally, FBS introduces its proprietary mobile trading app, FBS Trader, catering to both iOS and Android users.

Ensuring top-notch client assistance, FBS is committed to delivering round-the-clock multilingual support via phone, email, and live chat. Complementing its support system, the broker extends an array of educational resources encompassing trading courses, video tutorials, webinars, and market analysis.

No, FBS is not a fraudulent entity. FBS is authorized and regulated by the Cyprus Securities and Exchange Commission(CySEC) in Cyprus under regulatory license number: 331/17.

This FBS is operated by FBS Markets Inc., and it is authorized and offshore regulated by the Financial Services Commission (FSC) in Belize under regulatory license number: IFSC/60/230/TS/17.

FBS offers a wide range of trading instruments, including Forex currency pairs, stocks, commodities, indices, and cryptocurrencies. Forex traders can access a total of 40 currency pairs, including major, minor, and exotic pairs.

In addition to currency pairs, traders can also access CFDs on various global stocks such as Amazon, Apple, and Facebook, as well as commodities like gold, silver, and oil. Furthermore, FBS offers CFDs on several popular indices, including the S&P 500, NASDAQ, and the FTSE 100. Finally, traders can also access cryptocurrency CFDs on Bitcoin, Ethereum, Litecoin, and Ripple.

Overall, FBS offers a diverse range of trading instruments for traders to choose from.

FBS offers a range of account types to cater to the different needs and trading styles of its clients.

The Standard account is the most popular choice, offering competitive spreads and no commission fees. It's ideal for both new and experienced traders who want to trade with a relatively low initial deposit and enjoy the benefits of FBS's trading conditions.

For those who prefer to trade with smaller amounts, the Cent account is a good option. It allows traders to trade with cents instead of dollars, so they can better manage their risks and test different trading strategies. The Cent account has the same features as the Standard account, but with smaller contract sizes.

FBS also offers a Pro account, which allows traders to trade with cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and Ripple. This account type is suitable for those who want to take advantage of the volatility of the cryptocurrency market and speculate on their price movements.

Each account type has its pros and cons. The Standard account offers more trading instruments and requires a higher minimum deposit, but it has competitive spreads and no commission fees. The Cent account is ideal for those who want to start trading in smaller amounts, but it has wider spreads and fewer trading instruments. The Crypto account has a lower minimum deposit yet wider spreads.

FBS provides demo trading accounts, enabling traders to refine their skills and acquaint themselves with the broker's trading platforms without financial risk. These demo accounts are complimentary and feature virtual funds, allowing users to replicate actual market conditions.

A key benefit of FBS's demo trading accounts lies in their ability to offer insight into the broker's trading conditions and execution speeds. They also facilitate the testing of various trading strategies and techniques. This feature proves particularly advantageous for novice traders who are still mastering the intricacies of trading and desire increased self-assurance prior to committing real capital.

Furthermore, FBS's demo trading accounts offer the advantage of global accessibility, requiring only an internet connection. This convenience is especially beneficial for traders without access to a physical trading station or those who prefer the flexibility of trading on the move.

Registering an account with FBS is a straightforward process that ensures a hassle-free start to your trading journey. Here's a step-by-step overview:

Visit FBS Website: Begin by visiting the FBS website.

Open an Account: Locate and click on the “Open an account” button on the website. This initiates the registration process.

Provide Personal Information: You will be prompted to enter some essential personal details, including your name, address, and email. This information helps establish your identity.

Financial Information: Additionally, FBS will require some financial information. You'll be asked about your trading experience and investment goals. This helps tailor your trading experience to your needs and objectives.

Application Submission: Once you've completed the necessary steps and filled in the required information, submit your application. FBS will receive your application and review it meticulously.

Identity Verification: FBS will verify your identity, a standard procedure to ensure the security of your account. This verification process typically takes a few business days.

Funding Your Account: After your application has been successfully processed and your identity verified, you can proceed to fund your trading account. FBS offers a range of convenient deposit methods, including credit/debit cards, bank transfers, and e-wallets.

In summary, FBS offers a user-friendly and secure registration process that ensures traders can quickly get started with their preferred trading account. Whether you're looking to trade with real funds or practice in a risk-free environment, FBS caters to your needs.

The maximum leverage offered to retail clients with FBS is 1:30. This is in compliance with the regulations set forth by regulatory bodies like CySEC and the European Securities and Markets Authority (ESMA) to protect traders from the risks associated with high leverage.

However, professional clients with FBS have access to higher leverage up to 1:500, which can be beneficial for those who have a deeper understanding of the markets and are comfortable with taking on more risks.

It's important to have a solid understanding of leverage and risk management before engaging in high-leverage trading.

FBS offers a wide range of trading opportunities with their motto, “Narrow spreads – wide trading opportunities.” They provide traders with the advantage of incredibly tight spreads, starting from 0 pips.

When it comes to choosing a spread that suits their trading strategy, FBS offers flexibility. Traders can select from various spread types, including floating spreads starting from as low as 0.2 pips, fixed spreads starting from 3 pips, and even the option to trade without any spread (fixed spread of 0 pips). The choice of spread type and its associated value is determined by the specific account type a trader uses.

To enhance precision and accuracy in trading, FBS provides up to 5-digit quotes on all account types. This high level of precision is especially crucial for traders who engage in short-term orders. With this precision, traders can confidently select and execute their trading strategies, ensuring they have the most accurate information about the market to make the most of their trading endeavors.

Here is a table comparing the spreads on EUR/USD, Gold, and Indices by FBS, eToro, Exness, and IC Markets:

| Broker | EUR/USD Spread | Gold Spread | Indices Spread |

| FBS | 0.5 pips | From 0.3 pips | From 0.3 pips |

| eToro | 1 pip | From 45 pips | From 75 pips |

| Exness | 0.1 pips | From 25 cents | From 0.8 pips |

| IC Markets | 0.1 pips | From 20 cents | From 0.5 pips |

Apart from trading fees, there may be other charges that traders should be aware of when using FBS. Here are some non-trading fees to consider:

Deposit and Withdrawal Fees: FBS offers various payment methods for deposits and withdrawals, including credit cards, e-wallets, and bank transfers. While most of these methods are free, some may incur fees depending on the payment provider and currency used.

Inactivity Fee: FBS charges an inactivity fee of $10 per month if the trading account has been inactive for 180 days or more. This fee is taken from the account balance and continues until the account becomes active again.

Conversion Fees: If a trader deposits funds in a currency different from their trading account currency, FBS may charge a conversion fee to convert the funds to the trading account currency. The conversion fee varies depending on the payment method and currency.

VPS Hosting Fees: FBS offers VPS hosting services for traders who want to use automated trading strategies. The fee for VPS hosting varies depending on the plan chosen and the billing cycle.

FBS offers its clients a variety of trading platforms to choose from, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. Both platforms are widely used by traders all around the world, and they offer a range of advanced tools and features to help traders analyze the markets and execute trades.

MT4 is a widely-used trading platform that is known for its reliability and ease of use. It offers a range of advanced charting tools, customizable indicators, and the ability to use expert advisors (EAs) to automate trading strategies. MT4 is available in both desktop and mobile versions, making it accessible to traders on-the-go.

MT5 is an upgraded version of MT4 and offers even more advanced features and tools. It has a more advanced charting package, as well as more timeframes and order types available. MT5 also allows traders to trade on the exchange markets, in addition to Forex.

In addition to these two popular platforms, FBS also offers a proprietary trading platform called FBS Trader, which is designed for mobile trading.

The platform is available for both Android and iOS devices and offers traders access to over 50 markets, including Forex, stocks, and commodities.

FBS offers a variety of deposit and withdrawal methods, including:

As for withdrawals, there are also no fees charged by FBS, but certain payment methods may have their own fees, such as bank wire transfer. The processing time for withdrawals may vary depending on the payment method chosen, but FBS aims to process withdrawals as quickly as possible.

FBS offers customer support through various channels, including email, phone, live chat, and social media. Their website is also available in multiple languages, making it more accessible to traders worldwide. The broker's customer support team is available 24/7, and they have received positive reviews from traders for their quick and helpful responses.

FBS offers a range of educational resources for traders of all skill levels. These resources include:

Trading courses: FBS provides free educational courses on various trading topics, including technical analysis, fundamental analysis, and risk management.

Webinars: The broker regularly hosts webinars on different aspects of trading. These webinars are conducted by experts in the field and cover a wide range of topics.

Video tutorials: FBS offers a collection of video tutorials that cover various aspects of trading. These tutorials are designed to help traders learn the basics of trading as well as advanced strategies.

Economic calendar: FBS provides an economic calendar that includes all major economic events that can impact financial markets. This helps traders stay informed about upcoming events and make informed trading decisions.

Trading tools: FBS offers a range of trading tools, including an economic news feed, a currency converter, and a trading calculator. These tools can help traders make better trading decisions.

Market analysis: FBS provides daily market analysis that covers major currency pairs, commodities, and indices. The analysis includes technical and fundamental analysis as well as trading recommendations.

FBS is a well-established online forex and CFD broker that offers a wide range of trading instruments, account types, and educational resources. The broker is regulated by reputable authorities and provides excellent customer support services to its clients. FBS also offers various trading platforms, including the popular MetaTrader 4 and 5, as well as a proprietary mobile application, FBS Trader.

While FBS has several advantages, such as a diverse range of trading instruments and low minimum deposit requirements, it also has some drawbacks, such as higher spreads and commissions than some of its competitors, as well as some limitations on the availability of certain account types in specific regions.

Q: Is FBS a regulated broker?

A: Yes, FBS is a regulated broker. It is licensed by the Cyprus Securities and Exchange Commission (CySEC) and offshore regulated by the Financial Services Commission (FSC) in Belize.

Q: What trading instruments are available on FBS?

A: FBS offers a variety of trading instruments, including forex currency pairs, metals, energies, stocks, and cryptocurrencies.

Q: What are the account types available on FBS?

A: FBS offers three main account types - Standard, Cent, and Zero Spread. There is also an ECN account type available for professional traders.

Q: What is the minimum deposit required to open an account with FBS?

A: The minimum deposit required to open a Standard or Cent account with FBS is $1.

Q: What leverage does FBS offer?

A: FBS offers flexible leverage options, up to 1:500 for professional traders, 1:30 for retail clients.

Q: What trading platforms are available on FBS?

A: FBS offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, as well as a proprietary mobile trading app called FBS Trader.

Q: What are the deposit and withdrawal methods available on FBS?

A: FBS offers a variety of deposit and withdrawal methods, including bank wire transfer, credit/debit cards, electronic payment systems such as Skrill, Neteller, and Perfect Money, and local payment methods.

Q: Does FBS offer any educational resources for traders?

A: Yes, FBS offers a range of educational resources, including video tutorials, webinars, e-books, market analysis, and a comprehensive FAQ section on their website.

Q: What are the customer support options available on FBS?

A: FBS offers customer support via live chat, phone, email, and social media channels. The support team is available 24/7 to assist traders with any questions or issues they may have.

Q: Is FBS a good broker for beginners?

A: FBS can be a good option for beginners due to its low minimum deposit requirement, flexible leverage options, and educational resources. However, traders should always do their own research and due diligence before choosing a broker.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| FXPRIMUS Review Summary in 10 Points | |

| Founded | 2009 |

| Registered Country/Region | Cyprus |

| Regulation | CySEC |

| Market Instruments | Forex, Metals, Energies, Equities, Indices, Futures and CFD Cryptocurrencies |

| Demo Account | Available |

| Leverage | 1:1000 |

| EUR/USD Spread | From 0 pips |

| Trading Platforms | MT4, MT5, cTrader, WebTrader |

| Minimum deposit | $15 |

| Customer Support | 24/5 live chat, email |

FXPRIMUS is a CySEC-regulated retail forex and CFD broker, founded in 2009 and headquartered in Cyprus. FXPRIMUS offers trading on a range of financial instruments including Forex, Metals, Energies, Equities, and Indices, different account types with varying minimum deposits and leverages, and multiple trading platform choices of MT4, MT5, cTrader, and WebTrader.

| Pros | Cons |

| • Regulated by CYSEC | • Clients from Australia, Belgium, Iran, Japan, North Korea and USA are not accepted |

| • High-level protection measures for clients | • Higher minimum deposit for certain account types |

| • Wide range of market instruments | • Limited copy trading availability |

| • Low minimum deposit | |

| • No deposit or withdrawal fees | |

| • Competitive spreads and commissions | |

| • Various deposit and withdrawal methods | |

| • Strong customer service support | |

| • Comprehensive trading tools and educational resources |

Overall, FXPRIMUS appears to be a legitimate and reliable broker with strong regulatory oversight and high-level protection measures. They offer a wide range of trading instruments and account types, as well as various trading platforms and educational resources.

There are many alternative brokers to FXPRIMUS depending on the specific needs and preferences of the trader. Some popular options include:

FXCM - a well-established broker with a good reputation and comprehensive trading tools;

FxPro - offers competitive pricing and advanced trading platforms;

Exness - has a user-friendly platform and low minimum deposits.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

FXPRIMUS is a legitimate online broker that is regulated by the Cyprus Securities and Exchange Commission (CySEC). It is also a member of the Investor Compensation Fund (ICF) in Cyprus, which provides protection to clients in the event of the company's insolvency. Overall, FXPRIMUS appears to be a reputable broker.

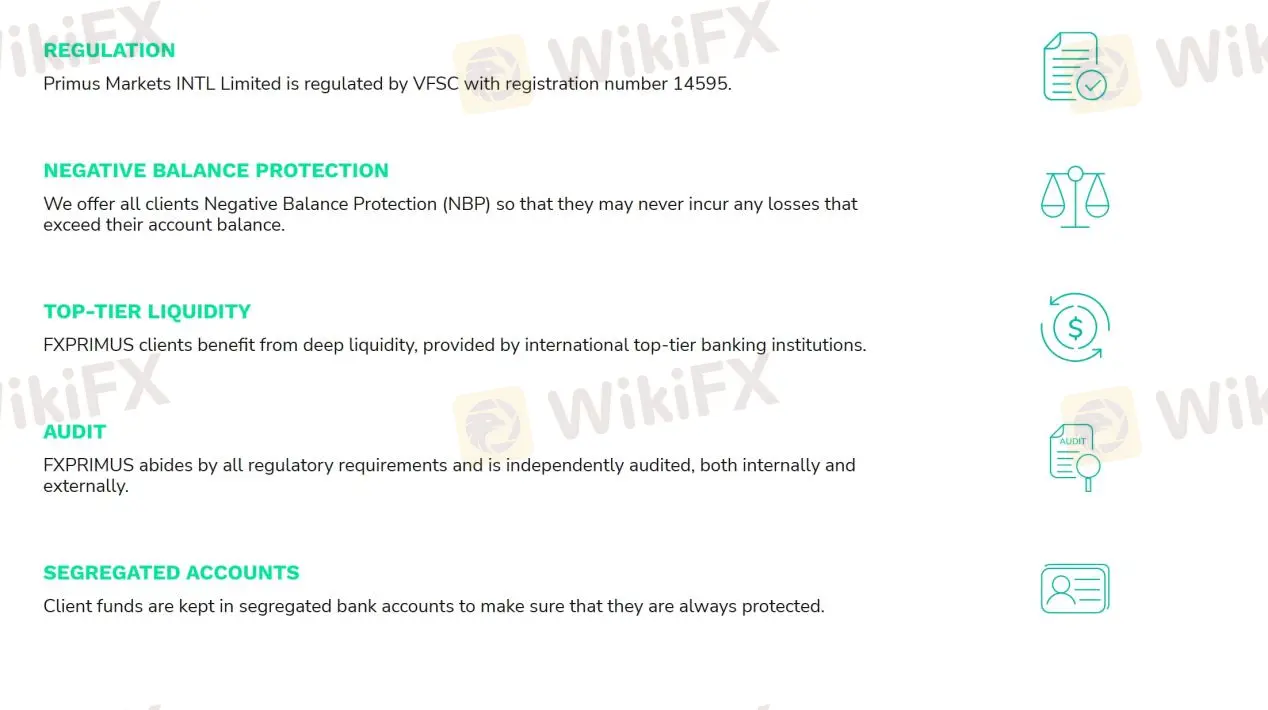

FXPRIMUS places a strong emphasis on client protection measures. It offers Negative Balance Protection, which means that clients will never lose more than their account balance. Additionally, FXPRIMUS uses top-tier liquidity providers, ensuring fast and reliable execution of trades. The broker's funds are audited by a third-party auditor to ensure transparency, and client funds are held in segregated accounts, separate from the broker's operating funds. These measures help to ensure that FXPRIMUS clients are protected from financial fraud and malpractice.

Based on the information provided, FXPRIMUS appears to have strong protection measures in place for their clients, including regulation by CYSEC, negative balance protection, top-tier liquidity, and audit and segregated accounts. These measures provide a level of assurance that FXPRIMUS is committed to the security of its clients' funds. Therefore, it can be concluded that FXPRIMUS is a trustworthy broker for traders.

FXPRIMUS offers a diverse range of market instruments for its clients to trade. In addition to forex pairs, clients can also trade metals such as gold and silver, as well as energies such as oil and natural gas. The broker also offers equities, indices, futures, and CFD cryptocurrencies. With such a wide range of market instruments available, clients can diversify their trading portfolios and take advantage of different market opportunities.

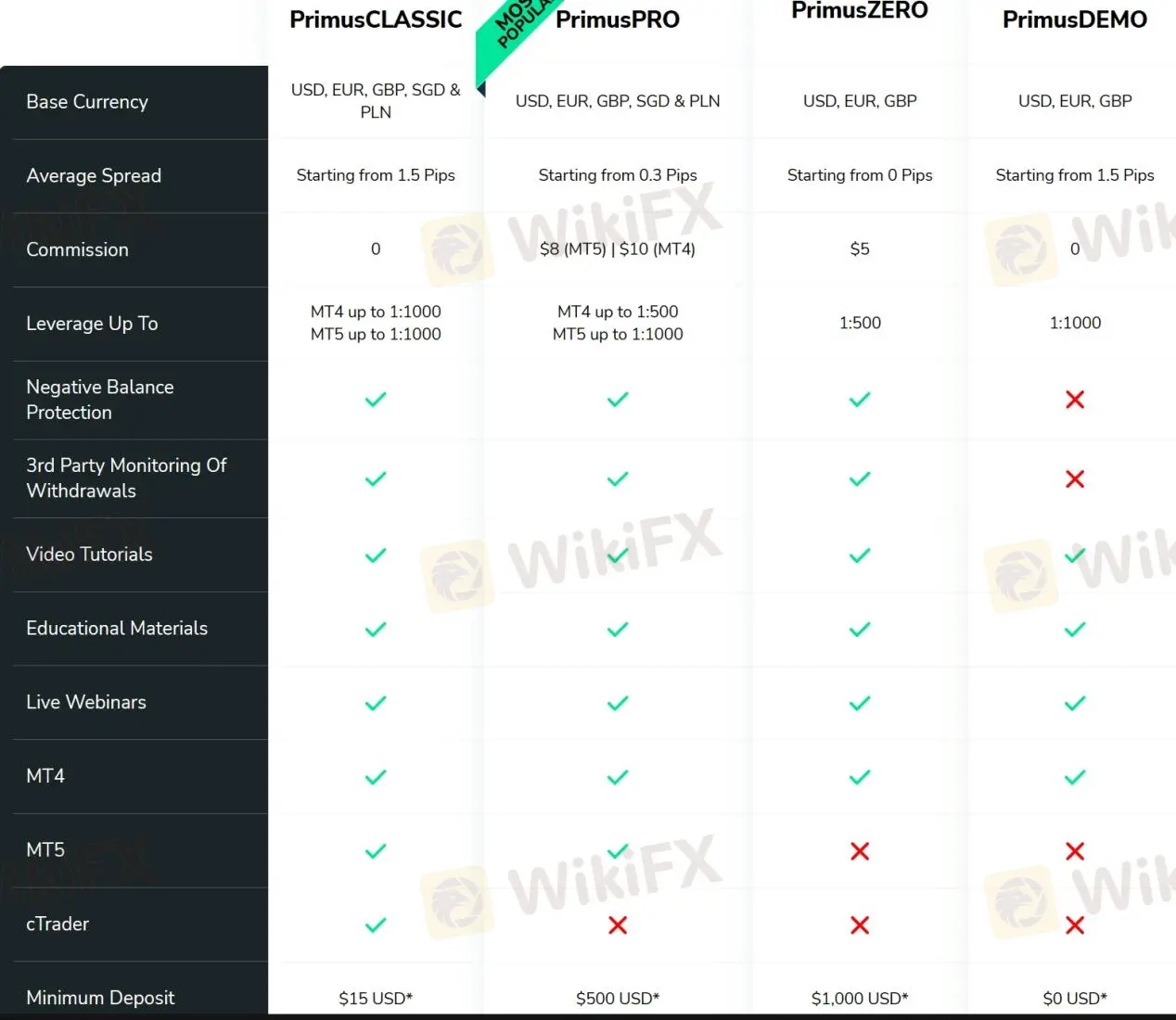

FXPRIMUS offers three account types, Primus Classic, Primus Pro, and Primus Zero, with minimum deposits ranging from $15 to $1,000. Primus Classic accounts are the most accessible with a low minimum deposit requirement of $15, while Primus Pro and Primus Zero accounts require higher minimum deposits of $500 and $1,000, respectively. Copy trading is only available for Primus Classic accounts. FXPRIMUS also offers demo accounts for traders to practice their strategies before committing to a live account.

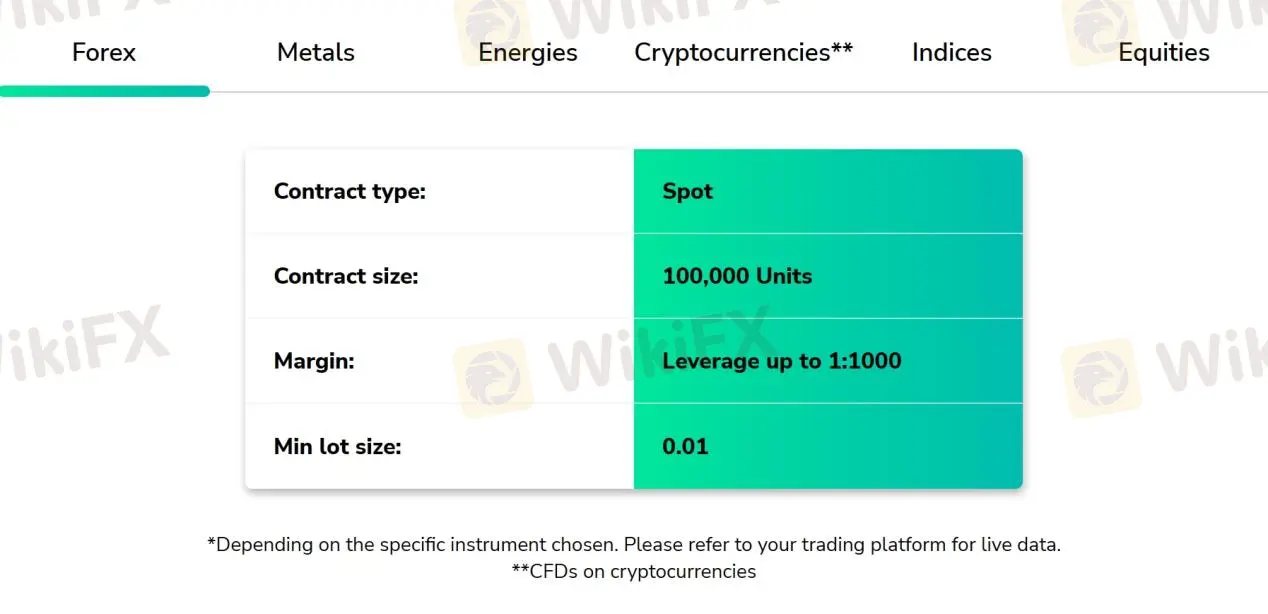

FXPRIMUS provides varying leverage options depending on the account type and trading platform. For instance, for the Primus Classic account, clients can enjoy up to 1:1000 leverage. On the other hand, for the Primus Pro account, leverage is up to 1:500 on the MT4 platform and up to 1:1000 on the MT5 platform. For the Primus Zero account, the maximum leverage offered is up to 1:500. It is essential to note that high leverage levels carry a higher risk of potential losses, and traders should exercise caution when using high leverage levels.

FXPRIMUS offers competitive spreads and commissions across its account types. The spreads for the Primus Classic account start from 1.5 pips with no commission, which is suitable for beginners who are looking for a commission-free trading experience. For the Primus Pro account, the spreads are variable and start from as low as 0.3 pips, but the commissions are higher at $8 on the MT5 and $10 on the MT4. For experienced traders who prefer tighter spreads, the Primus Zero account offers spread from 0 pips with a commission of $5, making it suitable for high-frequency trading strategies.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| FXPRIMUS | From 0.0 pips | No commission on Primus Classic |

| FXCM | From 0.2 pips | No commission on Standard |

| FxPro | From 0.0 pips | From $4.5 on cTrader |

| Exness | From 0.3 pips | No commission on Standard |

Note: Spreads can vary depending on market conditions and volatility.

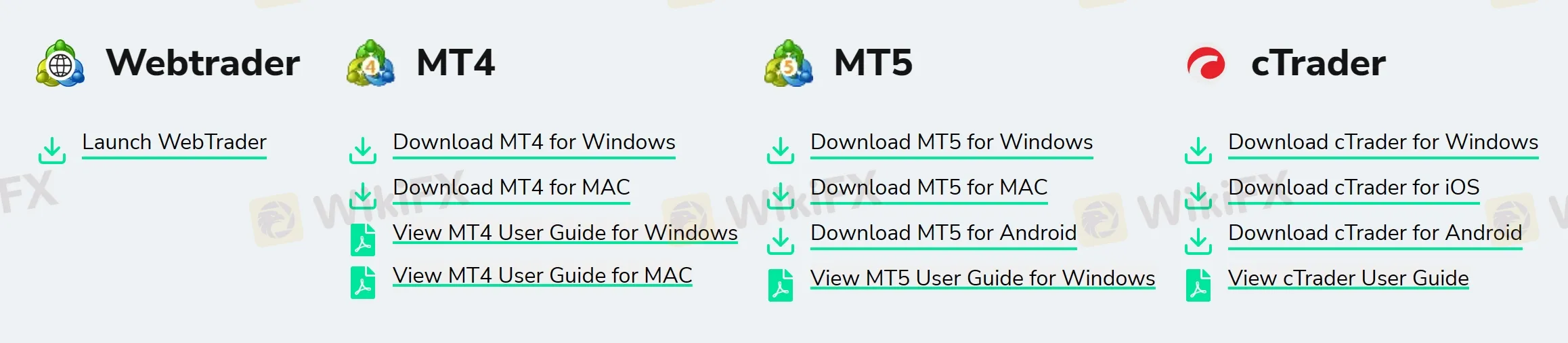

FXPRIMUS offers a range of popular trading platforms to cater to the needs of different types of traders. The platform options include the widely used MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and WebTrader.

The MT4 and MT5 platforms are popular among traders due to their user-friendly interface, advanced charting capabilities, and customizable indicators.

The cTrader platform is preferred by traders who seek a more transparent trading environment with direct market access (DMA) and Level II pricing.

The WebTrader platform is a web-based platform that allows traders to access their accounts from any device with an internet connection, without the need to download or install any software.

Overall, FXPRIMUS' trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders. See the trading platform comparison table below:

| Broker | Trading Platforms |

| FXPRIMUS | MT4, MT5, cTrader, WebTrader |

| FXCM | Trading Station, MT4 |

| FxPro | MT4, MT5, cTrader |

| Exness | MT4, MT5, WebTerminal |

Trading tools

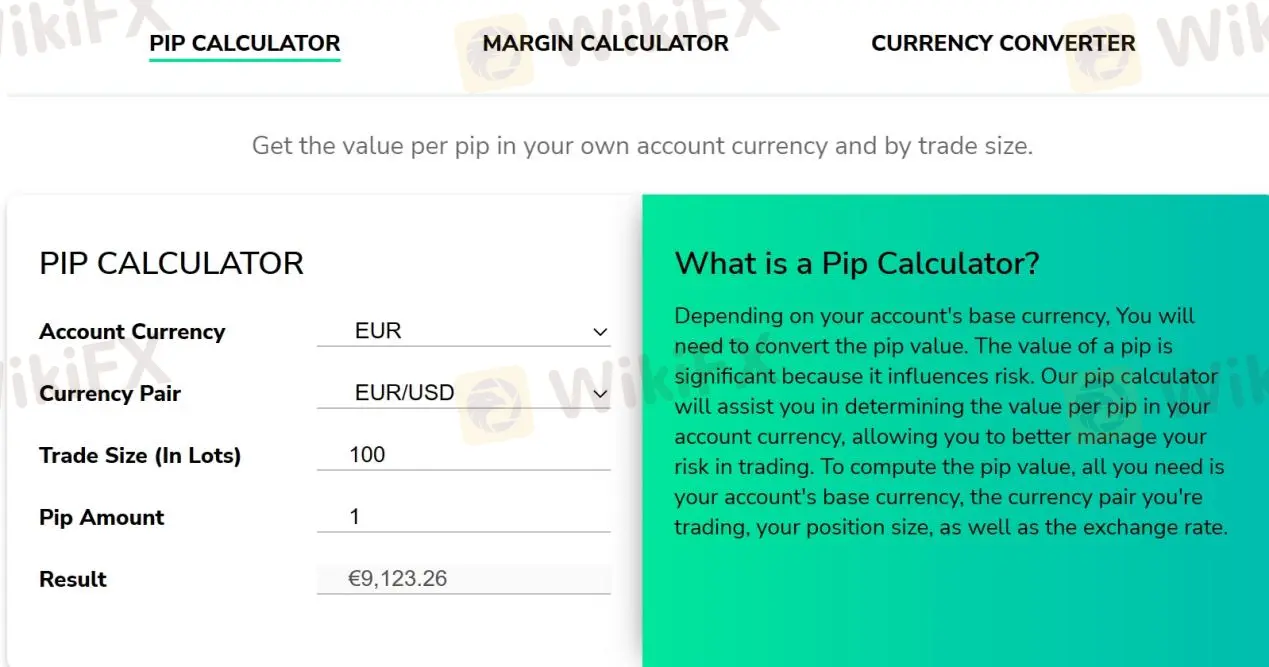

FXPRIMUS offers a variety of trading tools to assist its clients. The pip calculator helps traders calculate the value of a pip for a given currency pair and position size. The margin calculator allows traders to calculate the margin required to open and hold a position. The currency converter helps traders convert one currency to another at current exchange rates.

In addition, FXPRIMUS provides a market calendar that shows the schedule of economic events and their expected impact on the market, which can help traders make informed trading decisions. These tools can be accessed through the FXPRIMUS website or the trading platforms.

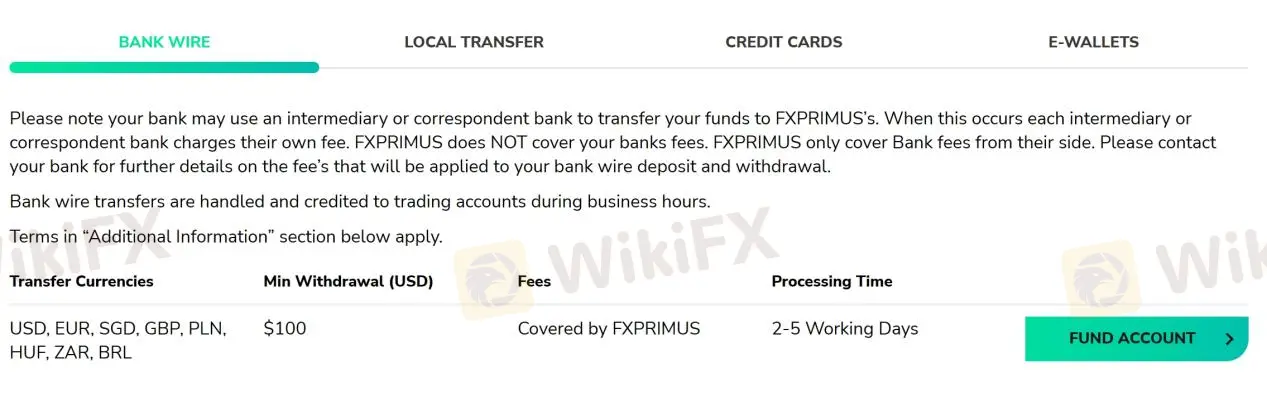

FXPRIMUS offers various deposit and withdrawal methods, including Bank Wire, Local Transfer, Credit Cards, and e-Wallets.

The minimum deposit is relatively low at $15. There are no deposit or withdrawal fees charged by FXPRIMUS, but your payment provider may charge a fee. However, it is worth noting that the minimum withdrawal amount is $100, which may be higher than some traders would prefer.

| FXPRIMUS | Most other | |

| Minimum Deposit | $15 | $100 |

The processing time for withdrawals varies depending on the payment method chosen, with Bank Wire taking 2-5 working days, Local Transfer taking 1-5 working days, and Credit Cards and e-Wallets taking up to 5 minutes.

To withdraw funds from FXPRIMUS, you can follow these steps:

Step 1: Log in to your FXPRIMUS account and click on the “Withdrawals” option in the main menu.

Step 2: Select the payment method you want to use for the withdrawal.

Step 3: Enter the amount you want to withdraw and click on the “Submit” button.

Step 4: Follow the instructions provided by the payment method you selected to complete the withdrawal process.

FXPRIMUS does not charge any deposit or withdrawal fees; however, payment provider fees may apply.

The broker charges an inactivity fee of $10 per month for accounts that have been inactive for 180 days or more. This fee is charged to cover the costs of maintaining the account and providing access to trading services, educational resources, and customer support. However, the inactivity fee can be avoided by simply logging into the trading account at least once every 180 days. It's important to note that the inactivity fee is only charged on the balance of the account and not on the deposited amount.

It also charges swap fees for holding positions overnight, and these fees vary depending on the instrument being traded.

See the fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| FXPRIMUS | Free | Free | $10 per month after 180 consecutive days of inactivity |

| FXCM | Free | Free | $50 per year after 12 months of inactivity |

| FxPro | Free | Free | $0 after 12 months of inactivity |

| Exness | Free | Varies by payment method | No |

It is important to note that fees and charges are subject to change, and clients should refer to the brokers websites for up-to-date information.

FXPRIMUS customer service offers various channels for clients to reach out for support. Clients can access 24/5 live chat, email, and online messaging to get in touch with customer support representatives. In addition, the broker provides support via messaging apps such as Messenger, WhatsApp, WeChat, Zalo, Line, and Telegram. This allows clients to contact customer support representatives in a convenient and accessible way.

Furthermore, FXPRIMUS has a presence on social media platforms such as Twitter, Facebook, Instagram, YouTube, and LinkedIn. This enables clients to stay up-to-date with the latest news and updates from the broker.

| Pros | Cons |

| • 24/5 live chat | • No phone support |

| • Multiple language support for live chat and email | • No support on Weekends |

| • Active on social media channels for customer engagement | • Live chat can be slow to respond during busy periods |

Note: These pros and cons are subjective and may vary depending on the individual's experience with FXPRIMUS' customer service.

FXPRIMUS offers a variety of educational resources for traders of all levels. These resources include video tutorials, educational materials, live webinars, and articles.

The video tutorials cover a range of topics, from basic concepts such as trading terminology and chart analysis to more advanced topics such as risk management and trading strategies.

The educational materials include e-books, trading guides, and other resources to help traders improve their skills and knowledge.

The live webinars are led by experienced traders and cover a variety of topics, including market analysis, trading psychology, and risk management.

The articles on FXPRIMUS' website cover current market news and analysis, trading strategies, and other relevant topics.

In conclusion, FXPRIMUS is a regulated and reliable broker that offers a range of account types with competitive spreads and commissions. The broker provides a variety of trading platforms and trading tools to enhance clients' trading experience. Additionally, the broker offers excellent customer service and educational resources to support traders.

| Q 1: | Is FXPRIMUS regulated? |

| A 1: | Yes. It is regulated by Cyprus Securities and Exchange Commission (CYSEC). |

| Q 2: | At FXPRIMUS, are there any regional restrictions for traders? |

| A 2: | Yes. FXPRIMUS does not offer its services to residents of certain countries/jurisdictions including, but not limited to, Australia, Belgium, Iran, Japan, North Korea and USA. |

| Q 3: | Does FXPRIMUS offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does FXPRIMUS offer the industry-standard MT4 & MT5? |

| A 4: | Yes. It supports MT4, MT5, cTrader, and WebTrader. |

| Q 5: | What is the minimum deposit for FXPRIMUS? |

| A 5: | The minimum initial deposit to open an account is $15. |

| Q 6: | Is FXPRIMUS a good broker for beginners? |

| A 6: | Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 and MT5 platforms. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive fbs and fxprimus are, we first considered common fees for standard accounts. On fbs, the average spread for the EUR/USD currency pair is from 0.5 pips, while on fxprimus the spread is from 0 Pips.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

fbs is regulated by ASIC,CYSEC,FSC. fxprimus is regulated by CYSEC,FSCA,VFSC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

fbs provides trading platform including Pro Account,Cent account,Standard account and trading variety including 36 Forex pairs, 8 metals, 3 energies, 11 indices, 127 stocks, 5 crypto pairs. fxprimus provides trading platform including PrimusZERO,PrimusCLASSIC,PrimusCENT,PrimusPRO and trading variety including --.