No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between AGEA and FX Corp ?

In the table below, you can compare the features of AGEA , FX Corp side by side to determine the best fit for your needs.

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of agea, fx-corp lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

Note: This company has been voluntarily dissolved.

| Aspect | Information |

| Company Name | AGEA |

| Registered Country/Area | Montenegro |

| Years | 5-10 years |

| Regulation | Unregulated |

| Market Instruments | CFD |

| Account Types | Standard and Cent |

| Minimum Deposit | USD 100 |

| Maximum Leverage | 1:100 |

| Trading Platforms | Streamster and MetaTrader 4 |

| Customer Support | Live Support, Phone: +382 (20)664-320 and +382(20)664-320, and Email: support@agea.com |

| Deposit & Withdrawal | Bank Wire Transfer, Credit/Debit Cards, E-wallets, and Local Payment Methods (Sofort Banking (Germany) and iDEAL (Netherlands)) |

| Educational Resources | Latest News |

AGEA, a financial services company, has been operating in the trading industry for 5-10 years. Based in Montenegro, the company provides trading opportunities primarily through Contracts for Difference (CFDs). Despite its years in the industry, AGEA operates in an unregulated environment, meaning it may not be subject to oversight by financial regulatory authorities.

Traders can choose between two types of trading accounts: Standard and Cent. With a minimum deposit requirement of USD 100. The company offers a maximum leverage of 1:100.

AGEA provides traders with two trading platforms: Streamster and MetaTrader 4. Additionally, traders can access live support for real-time assistance with any inquiries or issues they may encounter.

In terms of funding options, AGEA supports various deposit and withdrawal methods, including bank wire transfer, credit/debit cards, e-wallets, and local payment methods such as Sofort Banking (Germany) and iDEAL (Netherlands).

For educational resources, AGEA provides the latest news to keep traders informed about market developments and trends.

AGEA operates as an unregulated trading platform. Unregulated financial institutions are not bound by the rules and regulations designed to protect consumers' interests. This leaves customers vulnerable to various risks such as fraud, mismanagement of funds, and unfair treatment.

| Pros | Cons |

| Experienced Institution | Unregulated |

| Account Variety | Limited Educational Resources |

| Low Minimum Deposit | Higher Risk |

| Multiple Trading Platforms | Potential for Longer Dispute Resolution |

| Different Deposit/Withdrawal Options | Limited Market Instruments |

Pros:

Experienced Institution: With 5-10 years of industry experience, AGEA brings a solid foundation and understanding of the trading landscape.

Account Variety: AGEA offers a variety of account types, including Standard and Cent accounts.

Low Minimum Deposit: The minimum deposit requirement of USD 100 makes trading accessible to individuals with varying capital sizes.

Multiple Trading Platforms: AGEA provides traders with a choice of trading platforms, including Streamster and MetaTrader 4.

Different Deposit/Withdrawal Options: AGEA supports various deposit and withdrawal methods, including Bank Wire Transfer, Credit/Debit Cards, E-wallets, and Local Payment Methods, providing flexibility and convenience to traders.

Cons:

Unregulated: One significant drawback of AGEA is its unregulated status, consumer protection and the security of funds may be concerning.

Limited Educational Resources: AGEA may lack comprehensive educational resources to help traders improve their skills and knowledge, potentially hindering traders' ability to make informed decisions.

Higher Risk: The unregulated nature of AGEA introduces a higher level of risk for traders, as there may be fewer safeguards in place to ensure the stability and security of the financial institution.

Potential for Longer Dispute Resolution: Resolving disputes with AGEA may be more challenging and time-consuming due to the lack of regulatory oversight, leading to delays and frustrations for traders seeking resolution.

Limited Market Instruments: While AGEA offers CFD trading across various asset classes, it may have fewer market instruments compared to some other brokers, limiting trading opportunities for certain traders.

AGEA offers Contract for Difference (CFD) instruments as part of its market offerings. CFDs are derivative financial products that allow traders to speculate on the price movements of various underlying assets, without actually owning the assets themselves.

With CFDs, traders can take positions on a wide range of financial instruments, including currencies, indices, commodities, and cryptocurrencies. This flexibility enables traders to diversify their portfolios and capitalize on market opportunities across different asset classes.

AGEA offers two distinct account types: Standard and Cent.

For the Standard account, the minimum balance requirement is set at USD 100, ensuring accessibility for traders with varying capital levels. On the other hand, the Cent account presents a lower entry point with balances ranging from USD 6 to 5,000, ideal for those starting with smaller amounts.

Both account types share identical leverage options, ranging from 1:1 to 1:100, initially set at 1:100. This flexibility allows traders to adjust their positions relative to their capital, amplifying their potential gains or losses accordingly.

Neither account type imposes commissions, providing traders with a cost-effective trading environment. Additionally, trade sizes are consistent across both accounts, ranging from 1,000 to 100,000 units, enabling traders to execute trades according to their strategies and risk preferences.

| Account Type | Standard | Cent |

| Balance Limits | Minimum USD 100 | USD 6 - 5,000 |

| Leverage | 1:1 - 1:100 (initially 1:100) | 1:1 - 1:100 (initially 1:100) |

| Commissions | None | None |

| Trade Sizes | 1,000 - 100,000 | 1,000 - 100,000 |

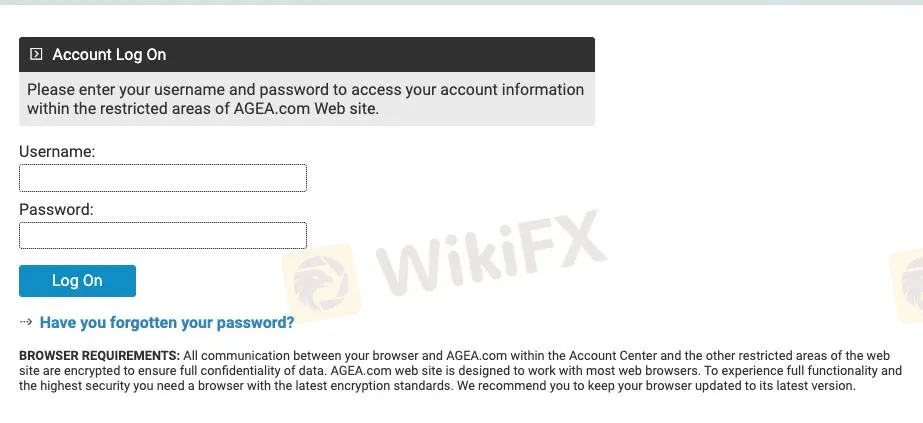

Opening an account with AGEA is a straightforward process that can be completed online in a matter of minutes. Here's a breakdown of the steps involved:

Visit the AGEA website and click “Open Account.”

Fill out the online application form: The form will request your personal information Be sure to have your identification documents (passport or ID card) and proof of address handy for uploading.

Fund your account: AGEA offers various deposit methods, including bank transfers, credit/debit cards, and e-wallets. Choose your preferred method and follow the instructions to complete the deposit.

Verify your account: Once your account is funded, you'll need to verify your identity and address. This typically involves submitting scanned copies of your ID documents and proof of address.

Start trading: Once your account is verified, you're ready to explore the AGEA trading platform and start making trades.

Withdrawal by Wire Fee - $10.00: This fee is applicable when you make a withdrawal transaction through bank wire transfer. We charge $10.00 for each withdrawal processed via wire transfer.

Withdrawal by Electronic Money Fee - $7.00: For withdrawals processed through non-wire processors, such as electronic money services, we charge a fee of $7.00 per transaction.

Inactivity Fee (SUSPENDED) - $30.00 per Month: Please note that the Inactivity Fee of $30.00 per month, which applies for each 1-month period without account activity, is currently suspended. We'll notify you in advance if there are any changes to this policy.

Streamster: Streamster is a user-friendly trading platform suitable for traders of all levels. Streamster stands out with its unique international multi-channel chat, allowing traders to discuss market trends and receive real-time customer support. It also seamlessly integrates live and virtual trading desks within a single account, ensuring consistency between demo and live trading experiences. With no balance limits or commissions, Streamster covers Crypto, Currency, Index, and Commodity CFDs, operating from Sunday 22:15 to Friday 21:00 GMT, and offers leverage ranging from 1:10 to 1:100.

MetaTrader 4 (MT4): MetaTrader 4 (MT4) is a customizable trading platform designed for proficient traders. It provides tools for price analysis, trade execution, and automated trading through Expert Advisors (EAs). MT4 offers various chart timeframes and built-in indicators for technical analysis. With its proprietary programming language, MQL4, traders can develop custom EAs tailored to their strategies. Supporting currency, index, and commodity CFDs, MT4 operates within the same trading hours as Streamster. Margin interest, execution types, and position limits vary between standard and cent accounts on MT4, providing flexibility for traders with different risk levels. Additionally, MT4 supports multiple account currencies, enhancing accessibility for global traders.

AGEA offers a range of deposit and withdrawal options including Bank Wire Transfer, Credit/Debit Cards, E-wallets, and Local Payment Methods such as Sofort Banking (Germany) and iDEAL (Netherlands).

Bank Wire Transfer: Traders can securely transfer funds to and from their AGEA accounts using bank wire transfers, providing a traditional and reliable method for depositing and withdrawing funds.

Credit/Debit Cards: AGEA accepts major credit and debit cards, offering a convenient and widely used method for instant deposits and withdrawals, facilitating seamless transactions for traders.

E-wallets: Traders can utilize various e-wallet services to deposit and withdraw funds from their AGEA accounts, providing a fast, secure, and convenient payment solution for managing their trading accounts.

Local Payment Methods (Sofort Banking and iDEAL): AGEA supports local payment methods such as Sofort Banking (Germany) and iDEAL (Netherlands).

Customer support at AGEA is comprehensive and easily accessible, ensuring traders receive assistance whenever needed.

Live Support: Traders can engage with AGEA's support team in real-time through the Live Support feature, allowing for immediate assistance with any inquiries or issues.

Phone Support: AGEA provides phone support through two contact numbers: +382 (20)664-320 and +382(20)664-320. Traders can directly reach out to speak with a representative for personalized assistance.

Email Support: For non-urgent inquiries or detailed requests, traders can contact AGEA's support team via email at support@agea.com. This allows for thorough communication and resolution of queries.

AGEA offers valuable educational resources through its Latest News section, keeping traders informed about important developments and events. This section provides updates on various company announcements and actions, including notices to shareholders, invitations to general meetings, updates on voluntary dissolution procedures, and more.

By staying updated with the Latest News, traders can gain insights into the company's operations, corporate decisions, and regulatory compliance. This information can help traders make informed decisions and stay ahead of market trends.

Here are some examples of educational resources provided by AGEA through its Latest News section:

Notice to Shareholders on the Payment of Dividends: Traders can learn about dividend payments and their impact on the company's financial performance.

Invitation to General Meetings: Traders can stay informed about upcoming general meetings and participate in discussions regarding company matters.

Update on Voluntary Dissolution: Traders can understand the implications of voluntary dissolution procedures and how they may affect the company's future operations.

In conclusion, AGEA has its ups and downs:

On the positive side, AGEA has solid experience in trading, offering various account types and a low minimum deposit of USD 100, making it accessible to traders.

But there are drawbacks to consider. AGEA operates without regulation, which might worry some traders about the safety of their funds. Plus, their educational resources are limited, which could affect traders' success. The lack of regulation also means there's more risk involved, and resolving disputes may take longer.

Question: What documents do I need to provide to verify my account?

Answer: To verify your account, you'll need to provide a copy of your identification document (such as a passport or driver's license) and proof of address (such as a utility bill or bank statement).

Question: What trading platforms does AGEA offer?

Answer: AGEA offers two main trading platforms: Streamster and MetaTrader 4 (MT4). Streamster is user-friendly and suitable for traders of all levels, while MT4 is more advanced and customizable, ideal for experienced traders.

Question: How can I deposit funds into my AGEA account?

Answer: You can deposit funds into your AGEA account using various methods, including bank wire transfer, credit/debit cards, e-wallets, and local payment methods such as Sofort Banking and iDEAL.

Question: What is the minimum deposit required to open an account?

Answer: The minimum deposit required to open an account with AGEA is USD 100. This ensures accessibility for traders with varying capital levels.

Question: Does AGEA offer educational resources for traders?

Answer: Yes, AGEA provides educational resources to help traders improve their skills and knowledge. These resources include articles, tutorials, webinars, and market analysis tools.

Question: How can I contact AGEA's customer support?

Answer: You can contact AGEA's customer support team through live chat, phone (+382 (20)664-320), or email (support@agea.com). Our support team is available to assist you with any inquiries or issues you may have.

| Aspect | Information |

| Registered Country/Area | Australia |

| Founded Year | 5-10 years ago |

| Company Name | FX Corp Pty Ltd |

| Regulation | Regulated in Australia by ASIC |

| Minimum Deposit | Not specified |

| Maximum Leverage | Not specified |

| Transaction Fees | Transaction fees vary based on the type of transfer and payment network used (e.g., $60 for SWIFT transfers) |

| Trading Platforms | No trading software available |

| Products | Spot contracts, Forward Exchange Contracts (FECs) |

| Account Types | Not specified |

| Customer Support | Phone support available, physical office in Sydney, Australia |

FX Corp is a regulated financial services provider offering a range of foreign exchange solutions to individuals and businesses. With its headquarters in Sydney, Australia, the company operates under the regulatory oversight of the Australia Securities & Investment Commission (ASIC).

For individuals, FX Corp facilitates international payment services for various purposes, including real estate transactions, luxury goods purchases, investments, inheritance management, overseas income handling, and mobile payments. Their goal is to provide efficient and secure solutions for conducting international transactions in these areas.

For businesses, FX Corp specializes in commercial foreign exchange services, catering to diverse industries. Whether it's a small online retailer or a growing global company, FX Corp aims to streamline payment processes and provide tailored solutions to meet their specific needs. The company's expert team works closely with businesses, enhancing their foreign exchange capabilities and offering valuable insights for successful expansion into new markets.

FX Corp offers a range of foreign exchange products to align with businesses' goals and requirements. These include spot contracts, which involve immediate purchase or sale of foreign exchange at prevailing rates, and forward exchange contracts (FECs), which allow businesses to lock in exchange rates for future dates to manage currency risk.

Customer support at FX Corp is available through phone communication, and their office in Sydney serves as a physical location for face-to-face interactions when needed.

While FX Corp is regulated and holds a license from ASIC, it's important for potential clients to consider the associated risk alert and conduct thorough research before engaging with the company.

FX Corp, a regulated financial services provider based in Australia, offers international payment services and foreign exchange solutions to individuals and businesses. While the company has certain advantages, it's essential to consider the associated risks and drawbacks. One of the pros of FX Corp is its legitimacy as a regulated entity under the Australia Securities & Investment Commission (ASIC), providing a level of trust and compliance with industry regulations. Additionally, the company offers competitive exchange rates, low transaction fees, and convenient international money transfer services. However, there are some cons to consider. Firstly, there is a risk alert associated with FX Corp, indicating potential risks and a negative field survey review. Moreover, the available information suggests a lack of functional trading software. Traders should exercise caution, conduct thorough research, and consider alternative options before engaging with this broker.

Here is a table summarizing the pros and cons of FX Corp:

| Pros | Cons |

| Regulated by the Australia Securities & Investment Commission (ASIC) | Risk alert associated with the broker |

| Offers international payment services and foreign exchange solutions | No information provided about trading software |

| Tailored payment processes |

FX Corp Pty Ltd, also known as FX Corp, is a regulated entity. It is regulated by the Australia Securities & Investment Commission (ASIC) in Australia. The company holds a full license under the authority of ASIC with the license number 459050. The license was granted to FX Corp Pty Ltd on October 30, 2014.

The regulatory status confirms that FX Corp Pty Ltd operates under the regulations and oversight of ASIC, ensuring compliance with the applicable rules and regulations in the financial industry.

However, it is important to note that there is a risk alert associated with this broker. The risk alert indicates that the broker has received one negative field survey review, which raises concerns about potential risks and the possibility of a scam. Additionally, the current information suggests that the broker does not have a trading software.

Traders should exercise caution and conduct thorough research before engaging with this broker. It is advisable to assess the risks involved and consider alternative options based on the available information and personal circumstances.

To open an account with FX Corp, follow these steps:

1. Visit the FX Corp website and locate the “OPEN ACCOUNT” button.

2. Click on the button to initiate the account opening process.

3. You will be directed to a form that needs to be completed.

4. Fill in your personal details, including your name (first name and last name), company (if applicable), website (if applicable), email address, and phone number.

5. Optionally, you may provide additional comments or information relevant to your account opening.

6. If you wish to receive updates and information from FX Corp, you can choose to subscribe to their mailing list.

7. Once you have entered all the required information, review the details for accuracy.

8. Click on the submit or send button to complete the form.

9. A Relationship Manager from FX Corp will be in touch with you shortly to guide you through the remaining steps of the account opening process.

FX Corp's international transfer service is available in 60 currencies for over 80 international/regional locations worldwide, with payments to most countries/regions taking 1-2 business days. There are two most common payment networks in the global payments arena, the SWIFT and the Automated Clearing House (ACH), with the former requiring a $60 transaction fee.

| Pros | Cons |

| Transfers to over 80 international and regional locations | Risk alert associated with the broker |

| Low transaction fees | Lack of functional trading software |

| Option to pay in local currency | Limited information about payment networks used |

| Secure payment processes | Transaction fees for SWIFT transfers |

FX Corp offers commercial foreign exchange solutions for businesses operating in various industries, ranging from small online retailers to fast-growing global companies. They understand the challenges faced by businesses expanding geographically and aim to provide tailored and modernized payment processes to meet their needs.

To support businesses in achieving their goals, FX Corp operates at the forefront of the foreign exchange services landscape. They have extensive experience working with businesses in different industries, similar to the ones they serve. By leveraging their expertise, FX Corp can enhance and improve the existing setup of businesses, helping them optimize their foreign exchange capabilities.

FX Corp's dedicated relationship managers play a crucial role. These managers keep businesses updated on the latest developments in foreign exchange and ensure that their FX capabilities remain adaptable to changing market conditions. They offer insights, advice, and support that are critical for the success of businesses' expansion plans into new markets.

FX Corp provides international payment services for individuals buying and selling real estate, buying and selling luxury goods, investments, inheritance, overseas income, mobile, etc. The personal services offered by FX Corp focus on providing international payment solutions for individuals. These services cater to various needs such as buying and selling real estate, buying and selling luxury goods, managing investments, handling inheritances, managing overseas income, and facilitating mobile payments. FX Corp aims to assist individuals in efficiently and securely conducting international transactions related to these areas.

FX Corp offers a range of foreign exchange products to align with businesses' specific goals and requirements. These products can be utilized simultaneously for different projects based on factors such as profit margin or time to completion. It is important for finance teams, who often face time constraints and pressure to meet reporting and accounting deadlines, to carefully consider FX transactions and products.

FX Corp specialists are available to assist finance teams in selecting suitable FX products while ensuring they can manage their other responsibilities effectively. By leveraging FX Corp's resources and experience, businesses can choose products that maximize their chances of success and minimize the impact of unfavorable currency movements.

Spot Contracts: One of the basic and commonly used FX products is the spot contract. Spot payments involve a binding obligation to buy or sell a specific amount of foreign exchange for fast delivery. These transactions are conducted at the prevailing live spot rate and typically settle within two business days.

Forward Exchange Contracts (FECs): FX Corp also offers forward foreign exchange contracts (FECs), which allow businesses to “lock in” an exchange rate for a specific date in the future. The forward rate for an FEC is calculated based on the current spot rate, time to maturity, and the interest rate differential between the two currencies involved. FECs provide businesses with greater certainty for forecasting costs or profits without the need to pre-purchase currency and deplete their cash flow. While a deposit may be required, the full payment of the contract amount is not necessary until the maturity date.

| Pros | Cons |

| Forward exchange contracts offer rate certainty | Lack of information on minimum deposit and leverage |

| Low transaction fees | No mention of specific account types or options |

| Spot contracts provide immediate delivery | No trading software mentioned |

FX Corp provides customer support through various channels. The primary contact method is through phone, and customers can reach their customer support team at the phone number 02 8076 9535. This phone support allows customers to directly communicate with FX Corp's representatives to address their inquiries, concerns, or seek assistance regarding their services.

Additionally, FX Corp has a physical office located in Sydney, Australia. The office is situated at Level 14, 1 Castlereagh Street, Sydney, NSW, 2000. Customers can visit the office in person if they prefer face-to-face interactions or have specific needs that require an in-person meeting.

In conclusion, FX Corp Pty Ltd offers international payment services and foreign exchange solutions to businesses and individuals. As a regulated entity, it operates under the oversight of the Australia Securities & Investment Commission (ASIC), providing a level of legitimacy. However, it is important to note the risk alert associated with this broker, indicating potential risks and a lack of functional trading software. While FX Corp offers competitive exchange rates, low transaction fees, and convenient international money transfer services, traders should exercise caution, conduct thorough research, and consider alternative options before engaging with this broker.

Q: Is FX Corp a legitimate broker?

A: Yes, FX Corp is a regulated entity and holds a full license from the Australia Securities & Investment Commission (ASIC).

Q: How can I open an account with FX Corp?

A: To open an account, visit the FX Corp website and click on the “OPEN ACCOUNT” button. Fill out the required form with your personal details, and a Relationship Manager will contact you to guide you through the rest of the process.

Q: What international money transfer services does FX Corp offer?

A: FX Corp provides international money transfer services in 60 currencies to over 80 international and regional locations. They offer competitive exchange rates, low transaction fees, and the option to pay in local currency.

Q: What products does FX Corp offer for businesses?

A: FX Corp offers spot contracts and forward exchange contracts (FECs) as foreign exchange products for businesses. Spot contracts involve fast delivery of foreign exchange at the prevailing spot rate, while FECs allow businesses to lock in an exchange rate for future transactions.

Q: What services does FX Corp offer for individuals?

A: FX Corp provides international payment solutions for individuals, including services for buying and selling real estate, luxury goods, investments, handling inheritances, managing overseas income, and facilitating mobile payments.

Q: How can I contact FX Corp for customer support?

A: You can reach FX Corp's customer support team by phone at 02 8076 9535. They also have a physical office located at Level 14, 1 Castlereagh Street, Sydney, NSW, 2000.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive agea and fx-corp are, we first considered common fees for standard accounts. On agea, the average spread for the EUR/USD currency pair is -- pips, while on fx-corp the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

agea is regulated by --. fx-corp is regulated by ASIC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

agea provides trading platform including -- and trading variety including --. fx-corp provides trading platform including -- and trading variety including --.