Australia House Prices Fall for Second Month as Shutdowns Bite

Abstract:Australian house prices fell for a second straight month in June, as the coronavirus shutdowns continue to weigh on the property market.

Australian house prices fell for a second straight month in June, as the coronavirus shutdowns continue to weigh on the property market.

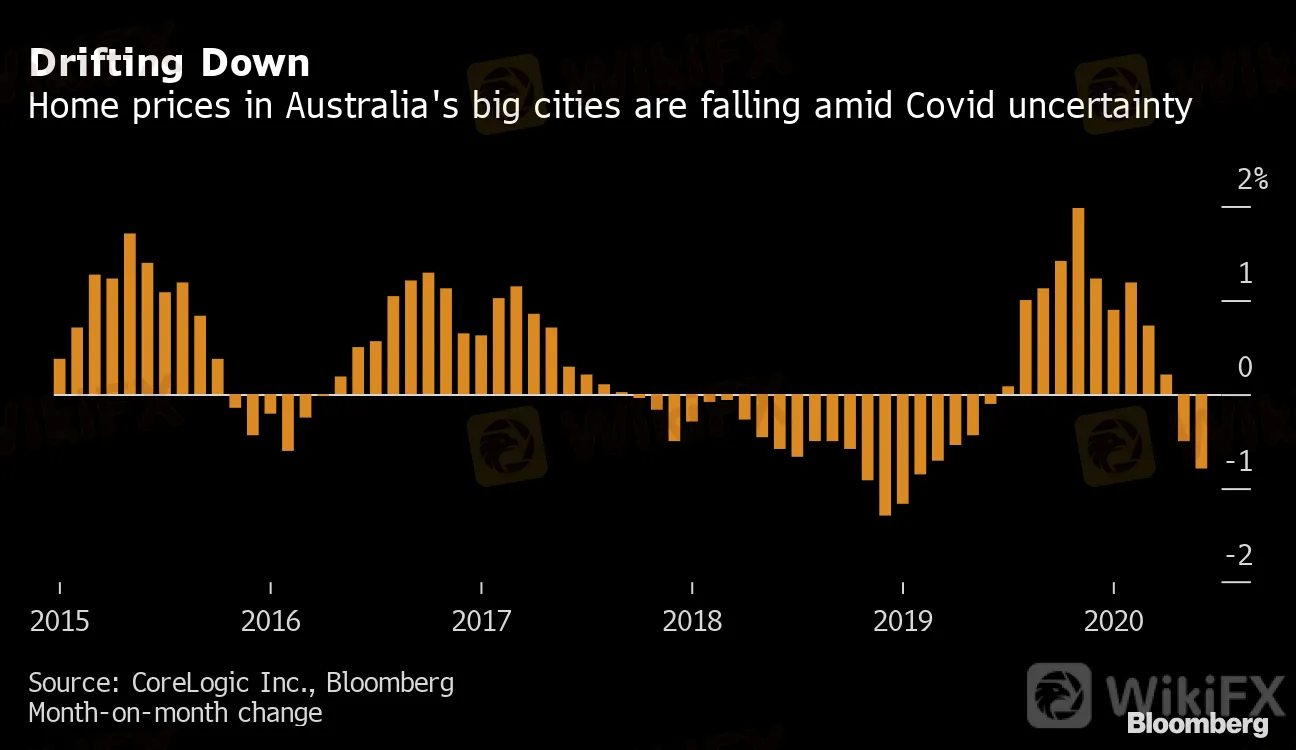

Home values in major cities fell 0.8% last month, accelerating from a 0.5% decline in May, according to CoreLogic Inc. data released Wednesday. The slide was led by Melbourne and Perth, where prices dropped 1.1%. In Sydney, prices fell 0.8%.

While the decline in property prices from the coronavirus outbreak has been milder than initially anticipated, “the downside risks remain significant,” said Tim Lawless, head of research at CoreLogic.

The real test for the housing market will come later this year when current extraordinary levels of government and bank assistance wind down. More than 485,000 mortgage borrowers are on payment holidays, amounting to about 11% of property loans at the major banks, according to Morgan Stanley analysts. About 3.5 million workers are on government wage subsidies.

Read more: Australia Housing Not the One-Way Road to Riches It Once Was

“Eventually the economy and borrowers will need to abide by market forces,” Lawless said. “This is when we could see a rise in mortgage arrears and the potential for a lift in urgent or forced sales.”

Drifting Down

Home prices in Australia's big cities are falling amid Covid uncertainty

Source: CoreLogic Inc., Bloomberg

Month-on-month change

While Australias success in containing the virus means the economy is reopening quicker than in many other countries, economists expect the after-effects to linger for years.

Treasurer Josh Frydenberg said last week the jobless rate is likely to climb to about 8% in the third quarter, while signaling he doesnt intend to take a “cold turkey” approach to ending fiscal support.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

PH SEC Warns Against TRADE 13.0 SERAX

U.S. Seeks 3-Year Sentence for Ex-Binance CEO Zhao

FCA exposed a clone firm

Crypto.com Faces Regulatory Issues with South Korea's Launch

Financial Watchdog FinCom Alerts Against Eplanet Brokers

Crypto Exchange CoinW Launches Prop Trading in Dubai

SEC Pursues Terraform Labs: $5.3B Verdict

Philippines SEC Takes Aim at Binance, App Store Ban

ALERT!! Two Firms Illegally Providing Services

Currency Calculator