In-Store Personalization Report: Retailer Personalization in 2020 - Business Insider

Abstract:In this report, Business Insider Intelligence analyzes how physical retail's personalization is being outperformed by e-commerce's, and examines the value personalization holds for brick-and-mortar in particular.

This is a preview of The In-Store Personalization Report from Business Insider Intelligence.Purchase this report.Business Insider Intelligence offers even more consumer coverage with Payments & Commerce Pro. Subscribe today to receive industry-changing payments and commerce news and analysis to your inbox.

Business Insider Intelligence

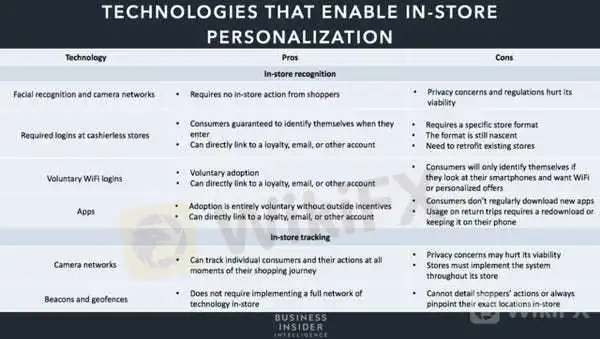

If we're living through a “retail apocalypse” that spells doom for brick-and-mortar retail, as many have suggested, why are e-commerce leaders like Amazon, Alibaba, and JD.com so focused on building their own brick-and-mortar networks?It's because they want to revitalize physical stores by introducing features associated with online shopping like personalization — and a whopping 65% of consumers said personalization and promotions are most important to their shopping experiences, according to a report from Oracle cited by Chain Store Age. What is personalization in retail?Brick-and-mortar retailers have the opportunity to reap the same benefits of hyper personalization that e-tailers do, like repeat visits and impulse purchases, but they need to invest in the right technologies and techniques to do so because they currently don't meet shoppers' expectations. For example, 41% of consumers expect sales associates to know about their previous purchases, but just 19% have experienced this, according to a report from Segment.In this report, Business Insider Intelligence analyzes how physical retail's personalization is being outperformed by e-commerce's, and examines the value personalization holds for brick-and-mortar in particular. We also look at what techniques and technologies are available to help retailers identify and track consumers in-store, and how they can be used to bolster their personalization capabilities. Finally, we examine the different channels through which retailers can reach consumers with their personalized offerings in-store.The companies mentioned in this report are: Amazon, Alibaba, JD.com, Intel, Mastercard, Target, Velocity Worldwide, RetailMeNot, b8ta, Nordstrom, Saks Fifth Avenue, Sitecore, Oak Labs, Calabrio, and Alegion.Here are some of the key takeaways from the report:Consumers say that a personalized shopping experience can inspire loyalty and increases in spending.But brick-and-mortar retailers aren't meeting consumers' in-store personalization expectations.The nature of online shopping gives e-commerce the upper hand when it comes to personalization. Physical retailers can close the gap in personalization by identifying consumers when they enter, tracking them throughout their journey, and then using that information to inform individualized offerings.To make the most of personalized offerings, retailers must consider how content is being presented to consumers in-store, and what the strengths of each channel are.If physical retailers fail to improve their in-store personalization, they risk losing sales and market share to e-commerce companies, both online and in-store.In full, the report:Identifies the values of personalization to physical retailers.Details the reasons e-tailers currently offer better personalization than brick-and-mortar stores.Outlines the technologies and processes that can bolster in-store personalization.Discusses how retailers can best present personalized offerings in-store.Interested in getting the full report? Here's how to get access:Purchase & download the full report from our research store. /> /> Purchase & Download NowJoin thousands of top companies worldwide who trust Business Insider Intelligence for their competitive research needs. /> /> Inquire About Our Enterprise MembershipsCurrent subscribers can read the report here.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

US personal savings rate increases due to lowered spending amid social distancing - Business Insider

The US personal savings rate increased from 8% in February to 13.1% in March due to lowered spending from social distancing.

Amazon's surge in Q1 revenue is spoiled by steep coronavirus costs - Business Insider

Amazon's Q1 earnings could give more insights into how exactly the coronavirus pandemic is affecting its business, and the broader e-commerce space.

Amazon's earnings report for Q1 2020 - Business Insider

Amazon's Q1 earnings could give more insights into how exactly the coronavirus pandemic is affecting its business, and the broader e-commerce space.

US Banking Digital Trust Study from Business Insider - Business Insider

The US banks with the highest levels of digital trust in 2020 are PNC, Chase, and Citibank, according to our inaugural Banking Digital Trust study.

WikiFX Broker

Latest News

Start Winning Now! Here's How You Build a Winning Trading System

BaFin Warns Against Unlicensed FX Brokers in April

Man Arrested for Rs 68L Fraud Using Bogus Trading App

FOREX TODAY: AS THE NEW WEEK BEGINS, THE MARKET IS FEELING BETTER

ON FOREX WINDOW, $1.7 BILLION WAS EXCHANGED IN A SINGLE WEEK.

Japan's FSA Alerts on Rising in Investment Cold Call Frauds

ED Freezes ₹5 Crore in Raids on Ponzi Scheme Mastermind

Clone entity – Stern

CONSOB Orders Blackout of Five Illegal Finance Sites

MyFlashFunding Suspended Over Denied Trader Payouts

Currency Calculator