Despite Decline, Oil Prices May Gain Strength from OPEC+ & U.S. Election

Abstract:Although WTI recently suffered a sharp loss to $39.57 amid the increase of oil production in Libya and the outbreaks in Europe and America, it may gain strength later from the deeper oil output cuts of OPEC+ and the U.S. presidential election.

WikiFX News (26 Oct.) -Although WTI recently suffered a sharp loss to $39.57 amid the increase of oil production in Libya and the outbreaks in Europe and America, it may gain strength later from the deeper oil output cuts of OPEC+ and the U.S. presidential election.

It is reported that Libya's oil production will rise above 1 million barrels a day in the next four weeks, and its crude exports will increase in the future. Besides, the second wave of the pandemic across Europe and America is worse than expected, which has further hindered the recovery in global oil demand. According to a report from the International Energy Agency (IEA), a full rebound in world energy demand will be delayed to 2025.

With that said, however, oil prices can hardly fall over the long run. OPEC+ sources show that OPEC+ compliance with agreed oil cuts in September was seen at 102%, indicating members' resolve to stabilize oil prices remains firm.

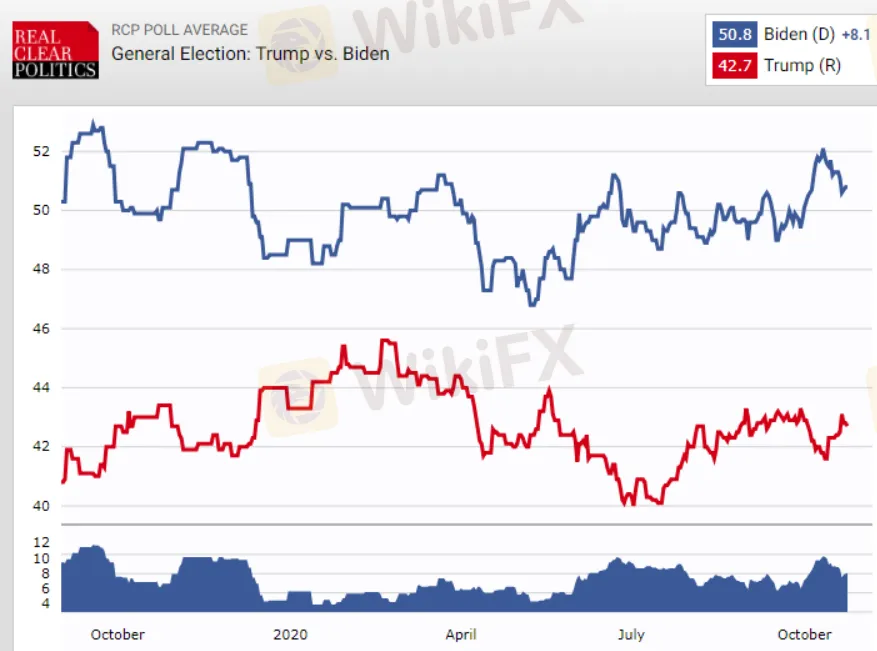

In addition, Biden said in the third debate that he would eliminate federal subsidies for the oil industry. With Election Day approaching, more U.S. oil producers will exit the market if that happened, which will boost oil prices.

All the above is provided by WikiFX, a platform world-renowned for foreign exchange information. For details, please download the WikiFX App: bit.ly/wikifxIN

Chart: Approval rating of Biden vs. Trump

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

US Asks Japan, South Korea, Others to Consider Tapping Oil Reserves

The Biden administration has asked some of the world's largest oil consuming nations to consider releasing some of their crude reserves in a coordinated effort to lower prices and stimulate the economic recovery, according to several people familiar with the matter.

Oil is bullish and continues

Oil is bullish and continues

Crude Oil Prices May Fall as US Retail Sales Data Shapes Fed Outlook

Crude Oil Prices May Fall as US Retail Sales Data Shapes Fed Outlook

Oil Price Forecast: WTI Crude Resumes Climb on Bullish Demand

Oil Price Forecast: WTI Crude Resumes Climb on Bullish Demand

WikiFX Broker

Latest News

Start Winning Now! Here's How You Build a Winning Trading System

BaFin Warns Against Unlicensed FX Brokers in April

PH SEC to Set Cryptocurrency Rules in 2024

Exploring Swing Trading vs Scalping: A Strategy Comparison

Oppenheimer & Co. Fined $500K for Supervision Lapses

Man Arrested for Rs 68L Fraud Using Bogus Trading App

Robinhood to Fight SEC Over Crypto Business in Court

Scope Markets Boosts UAE Offer with 23 New Dubai Stocks CFDs

ON FOREX WINDOW, $1.7 BILLION WAS EXCHANGED IN A SINGLE WEEK.

Japan's FSA Alerts on Rising in Investment Cold Call Frauds

Currency Calculator