Gold Has Been Propped Up by Risk Aversion

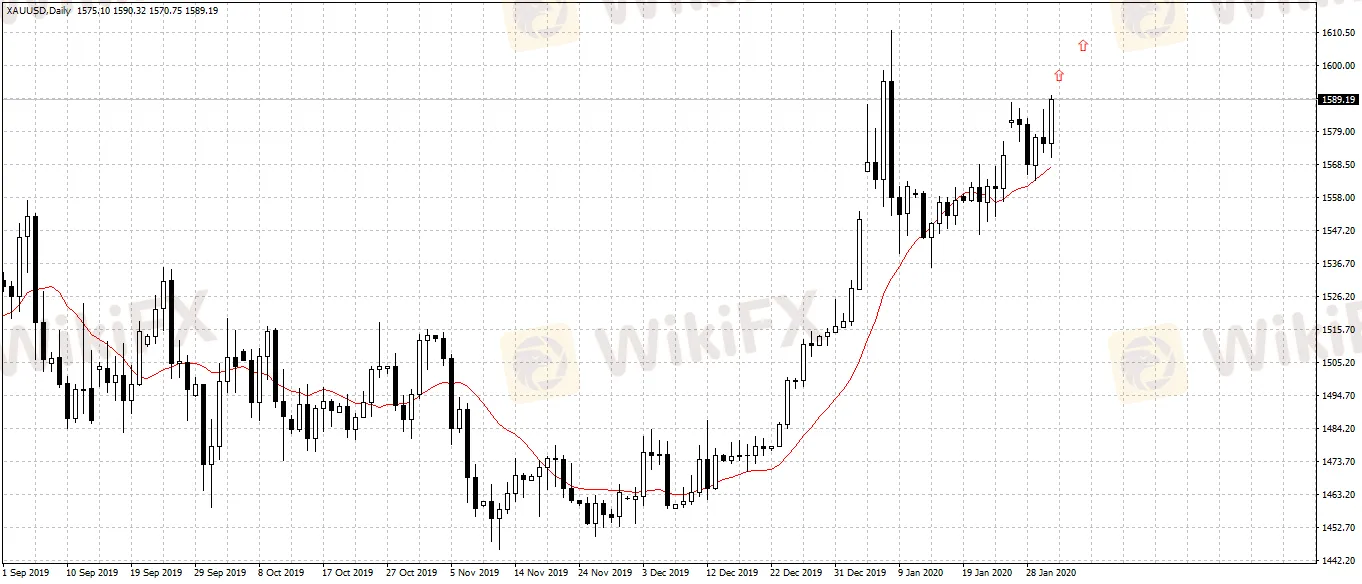

Abstract:The first month of 2020 had been a good start for gold. Escalating tensions between US and Iran, growing possibility for the Fed’s rate cut due to the country’s economic growth at a 3 year’s low, economic outlook dampened by public health emergency and bullish sentiment on the demand for physical gold, all these factors have fueled into gold’s surge.

The first month of 2020 had been a good start for gold. Escalating tensions between US and Iran, growing possibility for the Fed‘s rate cut due to the country’s economic growth at a 3 year‘s low, economic outlook dampened by public health emergency and bullish sentiment on the demand for physical gold, all these factors have fueled into gold’s surge.

Gold will maintain its uprising momentum this week as investors remain concerned about global economys outlook, which made them turn to gold, a traditional safe-haven asset that has gain even greater appeal, and shun high-risk assets including stocks. This week, Dow Jones Index fell by 2.5%, STP 500 dropped 2.1% and Nasdaq was down 1.8%, with Dow Jones and STP 500 witnessing the worst weekly performance since the beginning of last August.

Gold has been surging since last December, which has largely been due to major monetary stimulus of central banks around the world. As uncertainties in global economy still exist, central banks may eventually announce further rate cuts in 2020, which will further benefit gold‘s market trend. Gold has shown strong resilience when facing Asia’s public health emergency, while commodity currencies are the most vulnerable. Currencies such as AUD, NZD and NOK have particularly high risk exposure.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

PH SEC Warns Against TRADE 13.0 SERAX

U.S. Seeks 3-Year Sentence for Ex-Binance CEO Zhao

FCA exposed a clone firm

Crypto.com Faces Regulatory Issues with South Korea's Launch

Financial Watchdog FinCom Alerts Against Eplanet Brokers

Crypto Exchange CoinW Launches Prop Trading in Dubai

Clone of Morgan Financial Ltd.

SEC Pursues Terraform Labs: $5.3B Verdict

Philippines SEC Takes Aim at Binance, App Store Ban

Currency Calculator