简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

SOOLIKE Review 2026: Is this Forex Broker Legit or a Scam?

Abstract:SOOLIKE holds a South African FSCA license but has a dangerously low WikiFX score of 1.33 due to over 90 verified complaints about withdrawal refusals and profit deletions. Founded in 2023, this broker presents a severe risk to client funds despite its use of the MT5 platform.

TL;DR: SOOLIKE holds a WikiFX score of just 1.33 and is flagged with over 90 recent complaints regarding blocked withdrawals and account bans. Despite holding a South African license, the overwhelming volume of negative user feedback suggests extreme risk.

Before you find a broker for your trading journey, it is crucial to look beyond the surface. In this review, we analyze SOOLIKE, a relatively new entity (established in 2023) that has triggered a massive wave of trader alerts.

Question 1: SOOLIKE Regulation & Safety: Is my money safe?

SOOLIKE (SOOLIKE CAPITAL MARKETS (PTY) LTD) is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa (License No. 53244). While the FSCA is a respected regulator within Africa, valid regulation does not automatically guarantee safety if the broker's operational conduct is poor.

Why is the score so low?

Despite the license, the WikiFX score is penalized heavily due to recent behavior. A score of 1.33 usually indicates a platform that may be failing to meet its financial obligations.

Educational Moment: “Counterparty Risk” is the danger that the other party in a trade (the broker) defaults on their obligations. With Tier-2 regulators like the FSCA, protections such as compensation funds or strict segregated accounts may differ from Tier-1 standards (like the UK or Australia). When a broker faces 90+ complaints, the counterparty risk skyrockets.

Question 2: Are the trading fees and leverage fair?

SOOLIKE offers very high leverage, up to 1:500.

Is this good? It is a double-edged sword. While 1:500 leverage allows you to control large positions with a small deposit ($10,000 for ECN/Premium accounts), it also means a market move of just 0.2% against you could wipe out your entire equity.

Forex trading costs:

- Micro Account: Spreads start at 1.8 pips, which is expensive compared to industry averages.

- ECN Account: Spreads can be as low as 0, but usually involve commission fees.

- Standard Account: Requires a $70 deposit with spreads from 1.6.

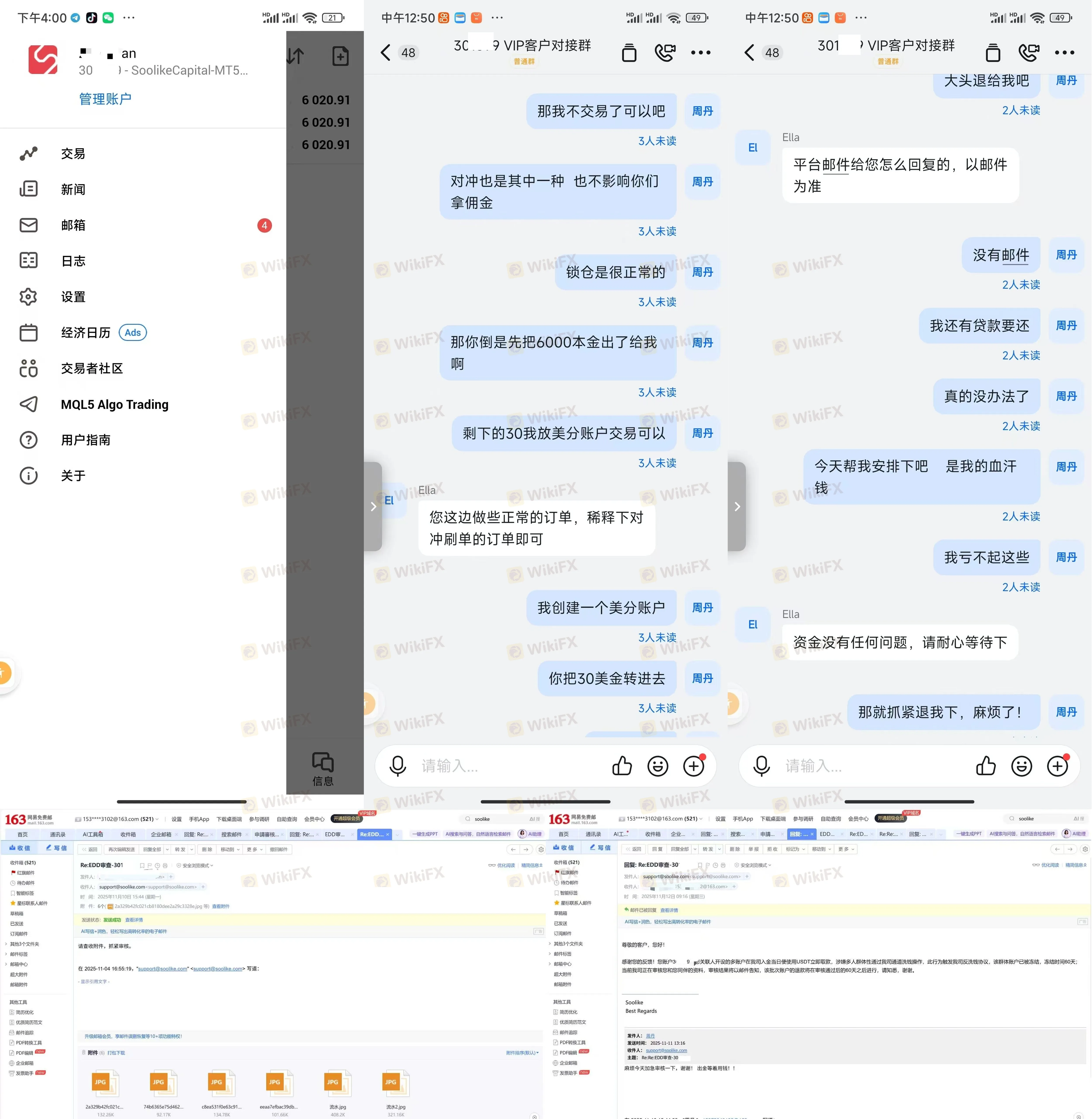

Question 3: What are real traders complaining about?

This is the most critical section. In just the last 3 months, WikiFX has received 90 complaints. The content of these cases is alarming:

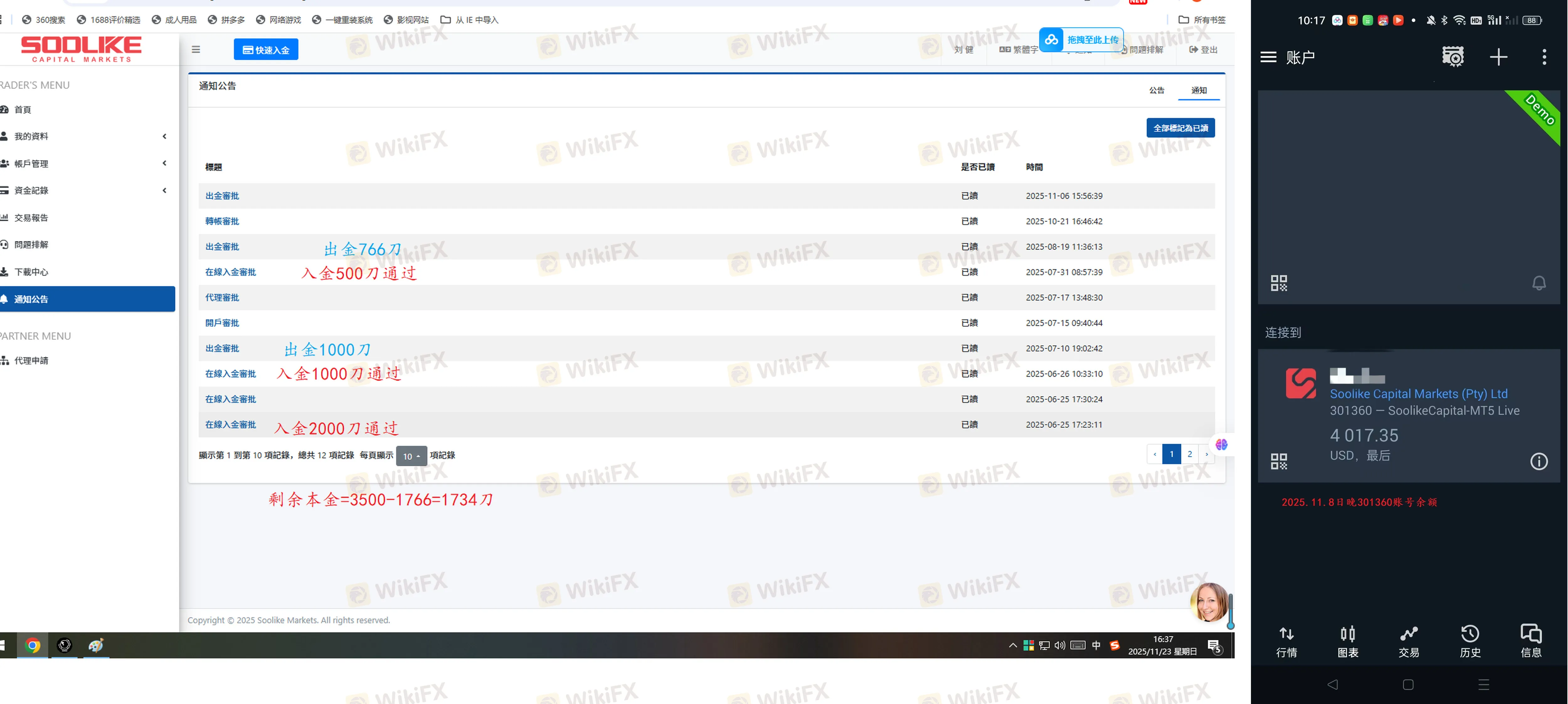

1. Withdrawal Denials: Ideally, withdrawing money should be as easy as depositing. However, dozens of users report their withdrawals are rejected with excuses like “system maintenance” or “AML audits,” or simply ignored for weeks. `<Danger Signal>`

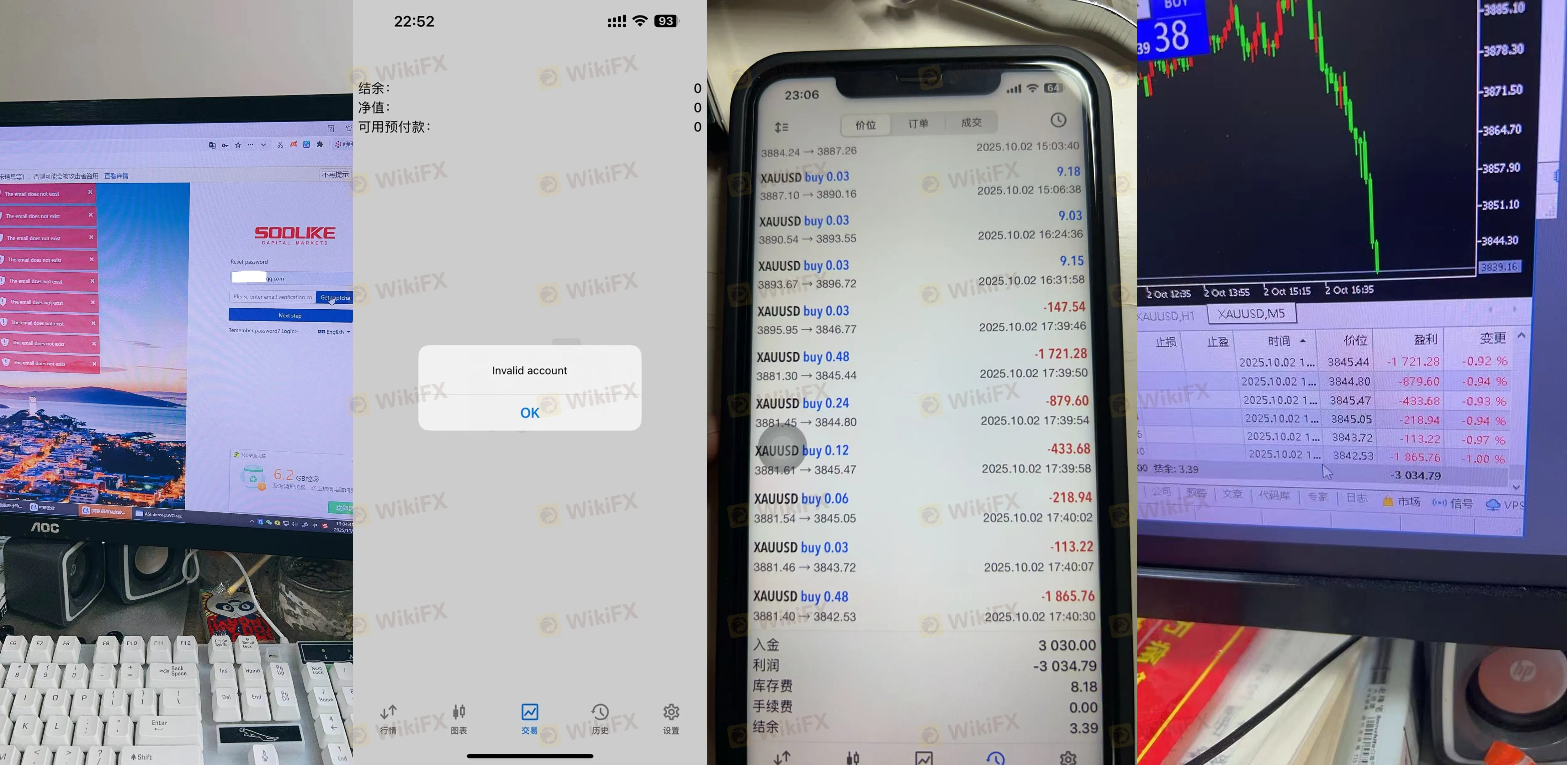

2. Profit Deletion: Traders who made profits (often using short-term strategies) reported their earnings were wiped out. The broker allegedly claimed they were “scalping” or “arbitraging” illegally, even if the terms weren't clear.

3. EA Malfunctions: Several users reported using “Managed Trading” or EAs (Expert Advisors) recommended by agents. These accounts suddenly opened massive positions or traded frequently to generate confusion, resulting in total loss of principal.

4. Coercion: Disturbingly, some traders mentioned being asked to sign “No Complaint” agreements or delete negative reviews in exchange for getting their principal back.

Pro Tip: If a broker deletes your legitimate trading profits citing vague “irregular trading” rules, they are likely a “B-Book” broker (a broker that pockets your losses). Legitimate STP/ECN brokers generally do not care if you profit because they make money on volume/commission, not your losses.

Question 4: What software will I use?

SOOLIKE uses the MetaTrader 5 (MT5) platform.

This is a standard, powerful platform used globally. However, the software is only as safe as the company managing the server.

Security Context:

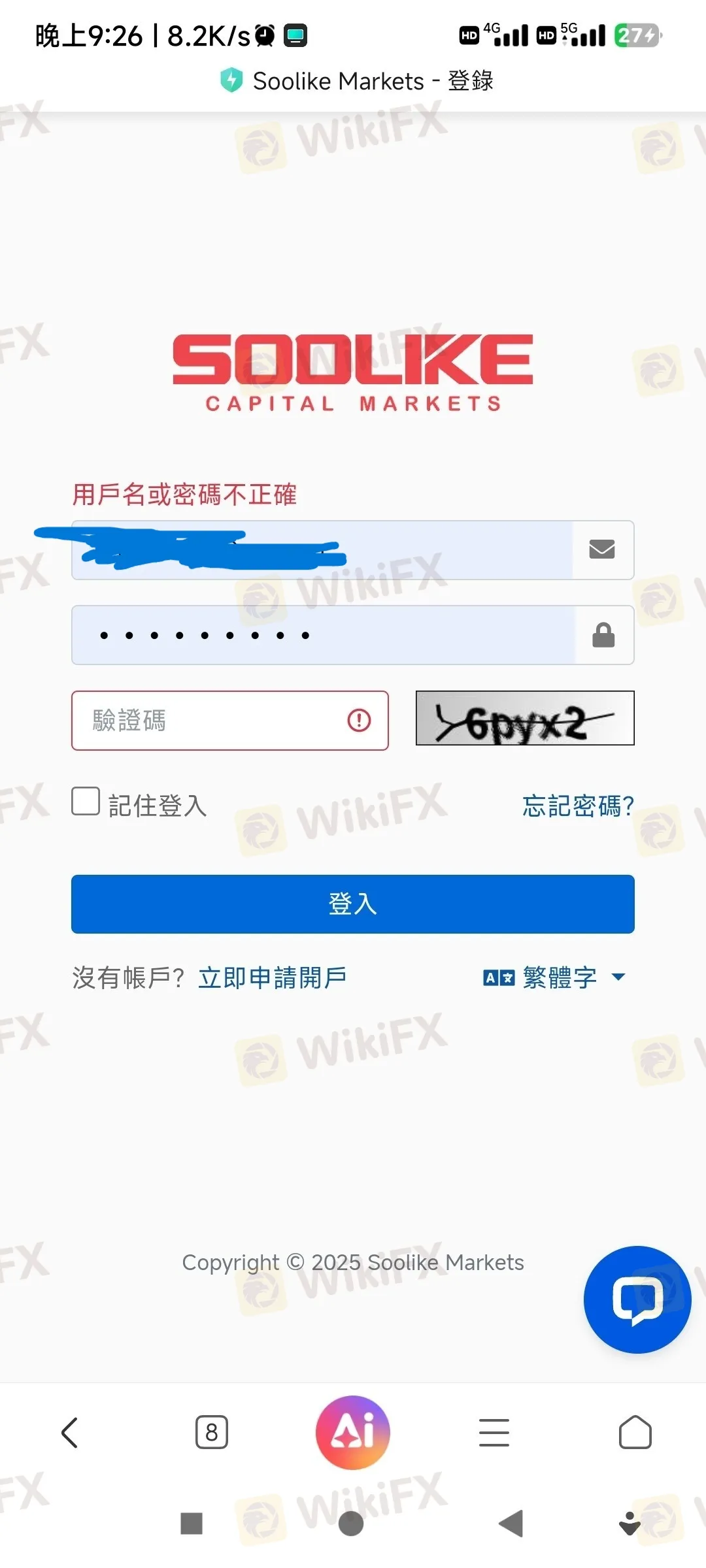

Always ensure you are on the official site before entering your login details to avoid phishing scams. Furthermore, be aware that `casesText` data indicates users faced “login authorization failures” precisely when they tried to close losing positions or withdraw funds. This suggests the issue isn't the software itself, but potentially backend access restrictions imposed by the broker.

Final Verdict: Should I open an account?

No. The risks significantly outweigh the benefits.

While SOOLIKE holds an FSCA license, the sheer volume of complaints (90 in 3 months) regarding unpaid withdrawals and deleted profits is a catastrophic warning sign. A WikiFX Score of 1.33 confirms this entity is currently unsafe for investment.

Status changes daily. Before depositing, check the WikiFX App for the latest real-time certificate.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

TradingPro: Regulation, Licences and WikiScore Analysis

Weltrade Review: Safety, Regulation & Forex Trading Details

Pepperstone Analysis Report

MultiBank Group Analysis Report

NEWTON GLOBAL Legitimacy Check (Addressing fears: Is This a Fake or a Legitimate Trading Partner?)

SPREADEX Review: Reliable Broker Check

U.S. trade deficit totaled $901 billion in 2025, barely budging despite Trump's tariffs

Copy-Paste Broker Scams: How Template Websites Are Used to Impersonate Regulated FX Firms

BP PRIME Review: Safe Broker or Risky Broker

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

Currency Calculator