简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold bears fight back control as US 10-year Treasury yields hit two-year highs.

Abstract:Gold Price Forecast: XAU/USD eyes $1,804 and $1,800 as US Treasury yields spike – Confluence Detector

Russia-Ukraine crisis, aggressive Fed rate hike bets triggered the yields spike.

Gold 2022 Outlook: Correlation with US T-bond yields to drive yellow metal.

The Fed policymakers have entered a blackout period ahead of next weeks FOMC decision. What is moving the US Treasury yields, dollar and gold then? With the return of full markets on Tuesday, investors brace for heightened tensions between Russia and Ukraine, causing the risk premium to explode and driving the benchmark US 10-year yields to a new two-year high of $1.85%. The US rates also jumped, sending the dollar higher, on speculation of aggressive Fed rate hike in March to the tune of 50bps.

Looking ahead, in absence of relevant US economic data due for release on Tuesday, the Fed sentiment and geopolitical tensions will continue to influence gold price. Higher yields tend to weigh on the non-interest-bearing gold price.

Read: Gold Price Forecast: XAU/USD weighed down by surging US bond yields, stronger USD

Gold Price: Key levels to watch

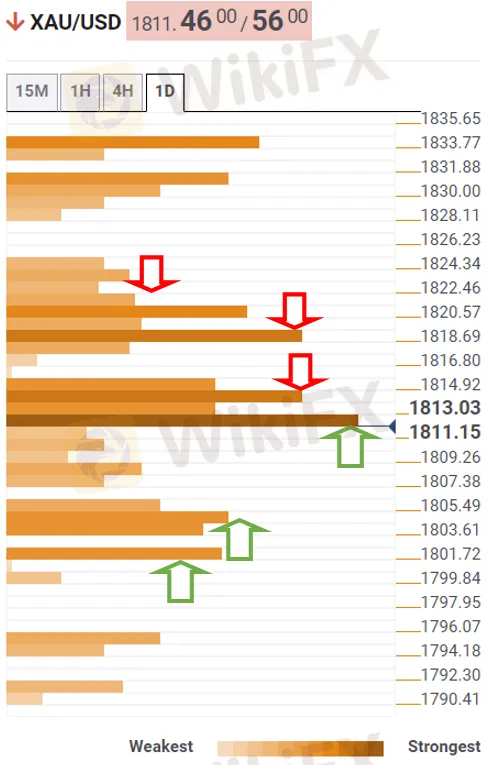

The Technical Confluences Detector shows that the gold price is testing the bullish commitments at $1,811, which is a powerful resistance of the SMA10 one-day and SMA100 four-hour.

The next support awaits at the 50-DMA of $1,808, below which a dense cluster of healthy cushions align at $1,804. At that point, the SMA200 one-day coincides with the Fibonacci 61.8% one-week and pivot point one-day S3.

The last line of defense for gold bulls is seen at $1,800, the Fibonacci 38.2% one-month.

On the flip side, the previous days low at $1,813 offers immediate resistance, followed by the intersection of the SMA5 and 10 four-hour.

Fibonacci 23.6% one-week at $1,820 will emerge as the next significant upside barrier.

Bulls will then challenge the previous days high at $1,823.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

HFM Review 2026: Is this Forex Broker Legit or a Scam?

ESMA Tightens Derivative Rules: Crypto 'Perpetuals' Face Strict CFD Leverage Caps

INFINOX Analysis Report

Dukascopy Triples MetaTrader 5 Asset Suite to Surpass 400 Instruments

Scope Prime Strengthens Institutional Liquidity Infrastructure with Ultency Integration

NAGA Earnings Signal Industry Stress Amid Low FX Volatility

Arena Capitals User Reputation: Looking at Real User Reviews and Common Problems

What Will US-Iran War Affect Stock Market: A Comprehensive Investor's Guide to 2026

Is FINOWIZ Safe or Scam? 2026 Deep Dive into Its Reputation and User Complaints

FX Deep Dive: Dollar King Returns as Energy Shock Splits G10 Currencies

Currency Calculator